jax10289/iStock Editorial via Getty Images

Those who read my books and SA articles know that my focus is on the strategies of technology-based companies, especially during technology disruptions. For long-term investors, technology disruptions can restructure major markets and provide historic investment opportunities. Buying Amazon (AMZN) at less than $0.70 per share (adjusted for splits) in 2001 (which I did) and Apple (AAPL) in the early 1990s are examples. Electric vehicles (“EVs”) are a historic disruption, which will create similar investment opportunities.

The primary point of this article is to explain how EVs are “crossing the chasm” from an early market stage to a mainstream market. When this happens, buyer characteristics change to favor some of the more traditional auto companies, like Ford Motor Company (NYSE:F). Ford has an aggressive, but sound, EV strategy. There are indications now that already point to its potential success, and by 2023, its EV success will be clear.

As I’ll explain, those who understand the importance of crossing the chasm and link this to Ford’s strategy may see it as one of those historic investment opportunities. With a market cap of $48 billion, a 3.32% dividend, and a P/E of just over 4X, there appears to be little downside to investing in Ford. And a depressed market can make that investment opportunity even larger. The upside potential can be significant if its EV strategy succeeds. We’ll try to estimate potential 2023 valuation ranges by looking at Ford as an EV company.

First, let’s look at the fundamental strategic concept of crossing the chasm and the implications when the customer base changes. Then we’ll outline Ford’s EV strategy.

EVs Are Crossing the Chasm

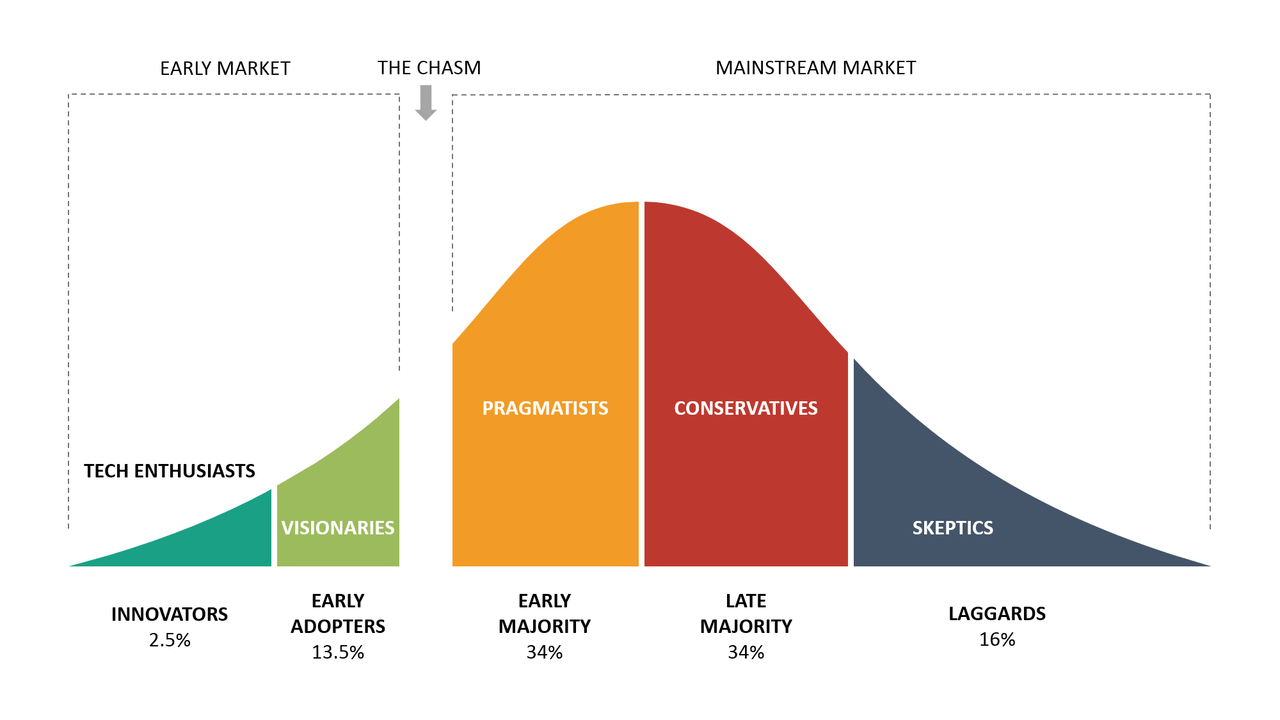

“Crossing the Chasm” is one of the most important strategic concepts for predicting the adoption of new technologies. Initially introduced by Geoffrey A. Moore, it explains the technology adoption life cycle, the different customer characteristics at each stage, and most importantly, the implications of crossing the chasm. It segments the development of a new market over time into Innovators, Early Adopters, Early Majority, Late Majority, and Laggards. Most importantly, there is a chasm between the early market stages (Innovators and Early Adopters) and the mainstream market. Although the power of this concept is understanding each of these stages, there is some overlap. The customers of one stage may still be growing as another stage starts to emerge. This strategic idea is fundamental to understanding the evolution of the EV market. Each stage in the EV market’s evolution has distinct characteristics.

The Early Market

Innovators and Early Adopters make up the early market for new technology.

Innovators are usually technology enthusiasts who aggressively pursue new products and technologies. Innovators are generally a small portion of the market. Moore used an estimate of typically 2.5%. They serve well as a test group because they are comfortable with emerging technologies. With EVs, they were willing to try the new technology even with lower battery mileage and higher costs. This group was the primary customer for the first half-million or so EVs, mostly Tesla’s (TSLA), sold in the U.S. from 2015-2018.

Early Adopters, like Innovators, are visionaries who are attracted to new products and technologies early in their lifecycle. They are interested in revolutionary breakthroughs but want to see some proof before they buy. With EVs, they most likely reached out to those who had Teslas for insights and test drives. I estimate that this stage began in approximately 2019. That’s when I bought my Tesla. From 2019 to 2021, almost 2 million EVs were sold in the U.S., mostly to Early Adopters, but mainstream buyers also started to buy EVs. One of the most important functions of Early Adopters is that they become avid references to the next, larger, market segment.

Crossing The Chasm (Geoffrey A. Moore)

The Mainstream Market

Crossing the chasm provides access to the mainstream market, which is what any new technology needs to be successful. More than 2 million EVs are projected to be sold in the U.S. in 2023, including 600,000 by Ford.

Jefferies analysts recently raised its EV penetration outlook to 11% and 14% in 2022 and 2023, respectively, up from 10% and 13%. This denotes crossing the chasm. It also issued a longer-term forecast for EV sales, saying it expects sales globally to reach 19 million in 2025 and 36 million in 2030.

There are three segments of the mainstream market.

The Early Majority is the first segment of the mainstream market. They may share some of the Early Adopters’ interest in technology; however, they are primarily driven by a stronger sense of practicality. They want well-established references before buying the new product. This early majority wants to see the benefits of buying EVs, and now there are many:

- Lower Fuel costs. An EV’s fuel cost is much lower than ICE vehicles, especially with increasing gas prices. The cost to fully charge a 60-kilowatt-hour (kWh) EV with more than 230 miles of range at home is less than $8. In comparison, at today’s gas prices, the cost of gas for 230 miles at 23 miles per gallon is more than $50. Over 15,000 miles per year, the savings would be more than $2,500 (650 gallons at $5 is $3,250, and the cost of electricity is $520).

- Fun to Drive. Electric cars are fun to drive, with quick acceleration and engaging performance. Unlike gas-powered cars, electric motors produce peak torque from a standstill, without the buildup gasoline engines require to reach maximum power.

- Lower Maintenance Costs. An EV has no internal combustion engine, drive train, carburetor, or need for oil changes. In general, it has 90% fewer moving parts. All of this leads to less maintenance.

- Better for The Environment. An EV is consistently better for the environment in terms of CO2 emissions than the average new gasoline vehicle. That margin could grow as electricity generation shifts more to cleaner sources. However, this benefit may only be a minor buying preference for mainstream buyers.

There are also some disadvantages to EVs, although these will likely be reduced over time. EVs can be more expensive because of high battery costs, but the cost of batteries is declining as technology improves and manufacturing volumes increase. Initially, EV manufacturers focus more on the premium price market, so the price is less of an issue. There are also potential government subsidies to reduce costs. EVs can have a limited range, but as ranges approach more than 300 miles, it becomes less of a restriction for many. Charging can be a concern, but many people can plug in their EV overnight. Investments to build out charging station infrastructure that will reduce this concern.

The Early Majority have different buying preferences than Early Adopters. Most will strongly prefer buying their first EV from a dealer that they have trusted for many years. They will be uncomfortable ordering an EV on the internet, waiting for a truck to deliver it, and not knowing how it will be serviced. They may prefer to buy an EV version of a vehicle they have used for many years, such as the Ford F-150 Lightning. The different buying characteristics of the early majority give traditional auto manufacturers significant advantages.

Breaking into this segment is crossing the chasm. It will be the primary market segment for EVs for the next five years. Moore estimates the Early Majority market stage to be approximately 34%, and it would be reasonable that EVs will grow to be roughly a third of the market for new vehicles in the next five years or so. Experts estimate EVs to be half of all new car sales by 2030.

The next mainstream market stage is the Late Majority. This group is more conservative. They believe more in tradition than in progress. Customers of the Late Majority may wait until EVs have become a more established standard. They will also require that EVs are less expensive than similar ICE versions. They will want longer driving range and more available charging. They will become EV customers closer to 2030 when limited new ICE vehicles are available, and many others already have EVs. At this point, most all new cars will be EVs. Although there will still be a large market for used ICE vehicles.

Laggards are skeptics. They don’t want anything to do with new technology. This is a small percentage of the market, and they may prefer to buy used ICE vehicles for many years.

Ford’s Initial EV Product Launch Strategy

Ford’s EV strategy is intriguing. It decided to go all-in by building EV versions of its three most popular vehicles. This leverages brand popularity and plays to the buying preferences of the mainstream market. Ford is investing $50 billion in EV development and manufacturing facilities and has created a separate business unit, Ford Model e. Ford plans to follow its first three EV models with a continuous stream of new EVs. It has publicly stated bold sales projections of 600,000 EVs next year and 2 million in 2026. Ford is all in with EVs.

Let’s look at the first three Ford EVs.

Mustang Mach-E

The Mustang Mach-E is an electric cross-over version of one of the most popular cars of all time. It has a range of 314 miles and 0-60 acceleration in 3.5 seconds.

Ford Mustang Mach-E (Ford)

It includes many new technology features. It automatically adjusts for driver personalization. Your smartphone will function as a key. You can lock/unlock and start your car remotely. It has a 15.5-inch touchscreen with cloud-based connectivity and over-the-air updates. It has Ford Co-Pilot360 with active parking assist and BlueCruise Hands-Free highway driving.

So far this year, Ford has produced more than 10,000 Mach-Es. The 2022 version is no longer available for order, and the 2023 model will be available later this year. The Mustang Mach-E competes against the Tesla Model Y. Ford plans to aggressively increase production of Mach-E and expects to reach 200,000 units per year for North America and Europe next year.

F-150 Lightning

The F-150 Lightning recently started shipping to customers. It is an impressive vehicle. It has a range of 320 miles, 563 horsepower, 4 seconds 0-60 mph acceleration, a 2,000 lb payload, and 10,000 lbs towing capacity.

In addition, it has some handy features unique to a workhorse EV. It has 11 electrical outlets (two 120 V outlets in the cab, four in the truck bed, four in the Mega Power Frunk, and a 240 V outlet in the bed) with 9.6 kW of power. Those who use their trucks for outside work no longer need to find an electrical power source or use a generator.

F-150 Lightning (Ford)

The truck includes additional advanced technology typical of modern EVs. It has a 15.5-inch touchscreen, the largest in any truck. It has remote features like start/stop, lock/unlock, and locate the vehicle. It also has Ford Bluecruise hands-free driving on more than 130,000 highway miles.

Ford makes it easy to install a charging station in your home, and the Ford charging station enables the truck to reverse charge and power an average home for three days.

Has the F-150 Lightning made the shift to the mainstream? Some early reviews believe this, as exemplified by the recent review in Motortrend by Scott Evans (emphasis added):

No joke: The Lightning is one of the most important pickup trucks—vehicles, really—in history. Forget early adopters, environmentalists, and technophiles. This truck has to convince construction workers, farmers, ranchers, surveyors, and everyday truck fans that electric pickups aren’t just viable but also desirable. That an EV truck not only can do the work but also do it better. Mission accomplished.

The F-150 has been the best-selling pick-up for many years and one of the best-selling vehicles of all time. Sales have ranged from 750,00 – 850,000 annually over the last decade. How many of these will shift to the EV Lightning version? Probably 10% initially, increasing to more than 50% in the next five years. There are probably more than 10 million F-150s in use today. How many of these will want to upgrade to the EV Lightning? This points to more demand for Lightning than Ford could fill in the next few years.

It’s expected that this EV truck isn’t for everyone. Some user requirements such as long drives hauling heavy loads may be inconvenient. These customers will naturally fall into the Late Majority category. But, there is more than enough opportunity in the Early Majority segment for the next few years with expected production constraints.

Ford had more than 200,000 reservations for the F-150 Lightning when it closed reservations, which didn’t include fleet sales. While these reservations aren’t binding, it indicates sufficient demand for the next few years.

Ford keeps increasing its forecasts for production of the F-150 Lightning. The latest estimates are approximately 80,000 in 2023, possibly higher, with a mid-year run rate of 150,000. 2024 production could be more than 200,000.

E-Transit

The Transit was marketed initially in Western Europe and Australia. As of 2015, 8 million Transit vans were sold across four primary platform generations (debuting in 1965, 1986, 2000, and 2013 respectively). Upon its introduction in North America in 2015, the Transit quickly became the best-selling van of any type in the United States, minivan sales included. Ford has sold more than one million transit vans since then. You see them all the time used by contractors and service businesses.

The E-Transit is the electric version of the Transit van. Like the Transit, it is available in regular, long, and extended-length versions and three roof heights.

E-Transit (Ford)

The E-Transit only has a 126-mile range, but the average daily range for commercial vans is only 74 miles, but its range is expected to increase over time. It’s easy to recharge them overnight. It can use depot, home, or public charging at Ford’s BlueOval charging network.

The E-Transit can be further customized by adding vocational bodies (on chassis cab and cutaway) and equipment like ladder racks and interior bulkhead and storage solutions. Other built-for-business features on E-Transit include the optional Pro Power Onboard, which provides up to 2.4 kilowatts of power for customers to transform the vehicle into a mobile generator that charges and powers tools and equipment on job sites and on the go. The E-Transit also brings SYNC® 4 communications and entertainment technology to commercial vehicles, featuring a standard 12-inch touchscreen that’s easy to use, enhanced voice recognition, and built-in navigation.

With Ford Power-Up Software Updates, E-Transit software, and SYNC features, it can stay up-to-date without a trip to the dealership. E-Transit also features additional standard Ford Co-Pilot360 technologies, including Lane-Keeping System and Pre-Collision Assist with Automatic Emergency Braking. Available features include Blind Spot Assist 1.0, a 360-degree camera with Split-View, and Reverse Brake Assist. These features can help maintain fleet driving standards and help improve driver confidence.

So far this year, Ford has sold more than 1,500 E-Transits. That’s about 6% of all Ford Transit sold this year, but an even more interesting statistic is that the E-Transit is now the best-selling electric van in the U.S. Currently, there is very little competition for the E-Transit. Walmart has ordered E-Transits for home deliveries.

Ford has not released production projections for the E-Transit, but with its expected popularity, it will be production constrained for the next few years.

Ford’s EV Valuation vs. Tesla

So if EVs cross the chasm and Ford succeeds with its EV strategy, how will this increase its valuation. The best way to do this is by making some comparisons to Tesla – at the risk of being bombarded by Tesla fans.

Tesla will do well but not continue to dominate

I’m not going to predict Tesla’s demise, but I will anticipate that its market share may decline for three reasons. First, more competitors, like Ford, are entering the market with excellent EVs. Second, mainstream customers have different buying behaviors than those in the early market, and these behaviors don’t favor Tesla. And third is the impact of used cars. Many do not understand this important consideration, so let’s look at it more closely.

People buy both new and used cars. Until now, there haven’t been many used Tesla’s, so all Tesla sales were new. But now, the Tesla used car market is starting to compete with Tesla’s new car sales. Carvana has hundreds of Tesla’s listed, and they are selling fast. And leases are ending on thousands of Tesla’s (including mine). Used cars will start to be an increasing portion of Tesla’s purchased, eroding Tesla’s new car sales. So, for example, there could be a market for 2.5 million Teslas in 2026, but 1/2 million of them might be used cars not sold by Tesla.

The different characteristics of mainstream customers, rapidly increasing competition, and competition from its own used cars all lead to Tesla becoming more demand constrained than production constrained. You can already see its lead times shrinking. Most Tesla models are now available with 1-3 month lead times. It’s unclear how successful Tesla will be in creating demand since it has never had to do that before. There are so many differing forecasts for tesla unit sales that it’s difficult to predict.

Ford will rapidly grow its EV sales

Ford recently stated two EV sales goals: 600,000 in 2023 and 2 million in 2026. This ambitious goal has a 50% average growth rate from 2023 to 2026.

Ford’s strategy for achieving this appears sound. It has released three new EV versions of popular vehicles. Two of these don’t have much competition right now. It won’t have any competition from other used Ford EV sales for several years.

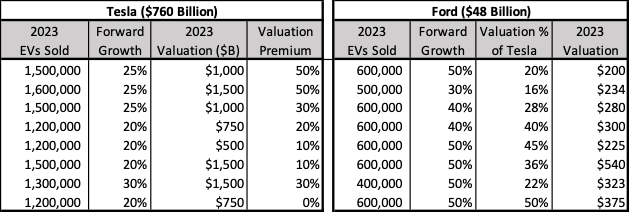

Comparative valuations

It’s reasonable to assume that eventually, the value of Ford’s EV business will be compared to Tesla’s. Still, there are not likely to be any agreements on what the relative valuations could be in 2023. So, let’s look at a variety of alternatives.

Tesla and Ford EV Comparative Valuations (Author)

This relative valuation model computes a valuation of Ford’s EV business based on Tesla’s valuation. It uses two different assumptions. The first is EV volume. The first alternative assumes that Tesla will sell 1.5 million EVs next year (which is higher than most estimates) and that Ford will sell its stated projection of 600,000. You can’t simply assume a proportional valuation since Tesla will likely continue to have a premium valuation. So, the relative valuation percentage for Ford is only 20%, not 40% (600/1,500), because the valuation premium reduces it by half. The forward growth assumptions are not used in the calculation but are only there to be a consideration for valuation premium.

Assumptions for Tesla’s valuation range from the current $750 billion to twice as much at $1.5 trillion, with one alternative of a lower valuation of $500 billion. The 2023 EVs sold and Tesla forward growth estimates are generally within the range of analyst estimates. The estimates from Ford are based on publicly disclosed Ford estimates.

Overall, this range of alternative valuations all points to a significant potential increase in valuation for Ford from its current $50 billion to more than $200 billion by 2023. And this is only the value of Ford’s EV business, not including its ICE business. All of this, of course, assumes that Ford’s EV strategy is successful.

Investment Thesis

Overall, at any of the alternatives considered, Ford looks like an excellent, potentially once-in-a-lifetime buying opportunity right now, if you assume that its EV business will succeed. And there is every indication that it will. Its current valuation, a 4X P/E, and a 3.32% dividend indicate very little downside. And this downturn in the stock market presents an even more unique buying opportunity for long-term investors looking to gain multiple times their investments by picking the right companies for a technology transformation.

In 2001, I wrote about Amazon’s market disruption in my book, Product Strategies for Technology-Based Companies. Later that year, when the stock market was down, I bought Amazon stock for $0.50-$0.70 (adjusted for the stock split). It turned into an excellent investment. Ford may be another one of these rare investment opportunities over the long term.

Be the first to comment