Khanchit Khirisutchalual/iStock via Getty Images

Written by Nick Ackerman. This article was originally published to members of Cash Builder Opportunities on June 18th, 2022.

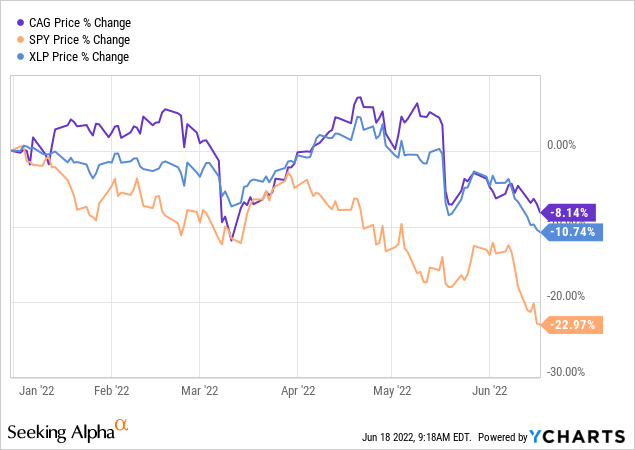

The latest options expiration has come and gone. The final day of trading heading into the June 17th options expiration had the major averages swinging between gains and losses. This made the finish in our Ford (F), and Conagra (CAG) trades quite interesting.

After weeks of significant downside pressure on the broader indexes, these two names had been dragged down along with this broader trend. That put the prices right near the expirations that we had selected. They, too, were swinging in and out of the money on the final day of trading.

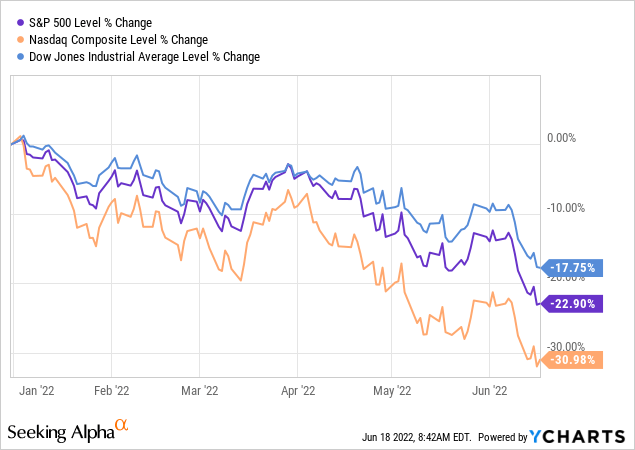

These latest declines have pushed the S&P 500 back into bear territory. This time we’ve been staying below that 20% level for more than just a brief period. The Dow Jones Industrial Average has, so far, remained above the technical bear market level. The Nasdaq Composite has only sunk further into its already deep losses.

Ycharts

Ultimately, for the puts that we had written, the F contracts expired worthless while CAG shares were assigned.

Ford Trade

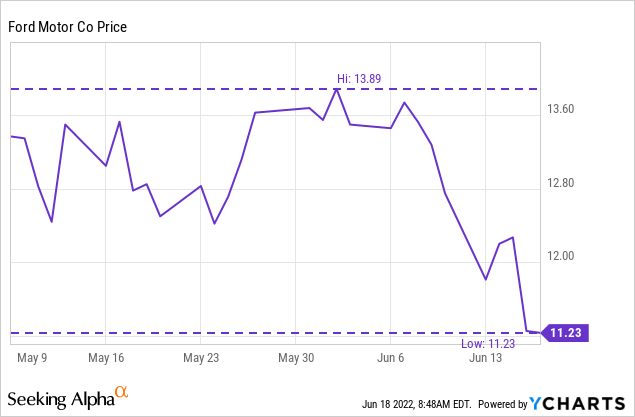

We entered into this trade on May 9th, 2022. This is a position in our Satellite Income Builder Portfolio as we had previously taken assignment of shares through writing puts. The main rationale for this trade was to potentially increase our position overall and average down from the higher strikes.

This trade collected a premium of $0.15 at a strike price of $11. At the time, this provided a significant cushion. Since it was over 39 days, the annualized return would still be quite attractive at 12.76% – despite the actual premium being a small absolute amount. This works out to 1.5x equivalent of the current $0.10 quarterly dividend as well over a shorter time frame than a quarter.

Since the trade, shares had been hanging well above the strike price, with little ‘risk’ of taking assignment. That was until the last week or so of the trade when the price declined rapidly as the market broke down. Intraday on Friday, shares actually fell below the $11 strike price.

Ycharts

Since the trade ultimately ended up expiring worthless, we were able to lock in the premium and have the capital to potentially go back in at a lower strike price.

What’s Going On With Ford?

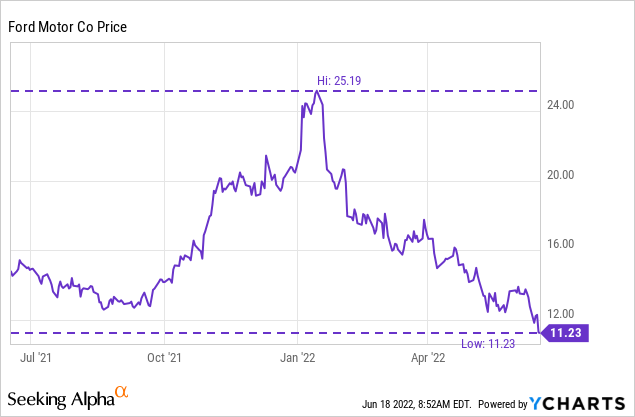

This has been a sharp decline for Ford since the highs that it reached at the beginning of the year. A decline of over 55% from its 52-week high.

Ycharts

The main culprit seems to be that it is simply a cyclical stock. The nature of the auto industry is that they go through the boom and bust cycles of the economy. If we are in a recession, they will have a much more limited number of buyers who can purchase their vehicles.

On top of the simple economic cycle risks, they continue to have supply chain issues with chips, and inflation is eating away at their profitability. The CFO announced the other day that the Mustang Mach-E profits were erased by inflation. Though, he noted that “the company isn’t yet seeing consumer demand for new vehicles drop off…”

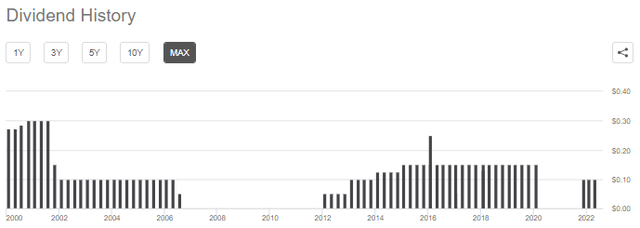

That puts into focus the dividend. With a cyclical business such as Ford, the dividend is never safe. It has generally been the case that during any major recession, it is suspended or reduced. This is to conserve cash just to survive.

Ford Dividend History (Seeking Alpha)

That puts Ford on watch heading into next year potentially when economists believe that we will be in a recession. If it is mild enough, then no cut would seem necessary. Analysts expect EPS for 2022 to come in at $1.93; for 2023, they still expect EPS of $2.14. That would be more than enough to cover their $0.40 annual dividend.

They reported EPS of $0.38 in Q1, and the outlook they provided is still expecting growth for 2022 over 2021.

Ford Outlook (Ford)

Conagra Trade

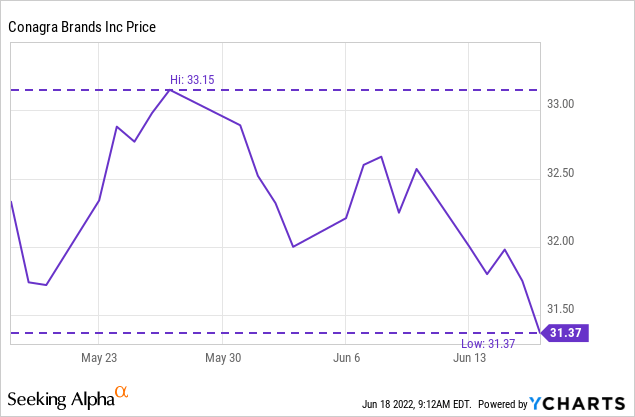

CAG has been a name we’ve also made several trades on. The previous two had expired worthless. This is a position that I was looking to add to the Core Income Builder Portfolio, so doing so via selling puts is a way to do just that. With this latest trade, the shares finally dropped below our strike and now have taken assignment of shares.

We had selected a strike price of $32 and entered the trade on May 18th, 2022. A total of 30 days of being in the trade and collecting $0.55 meant it worked out to a healthy annualized return of 20.91%. It also reduced our breakeven on the trade to $31.45. Friday’s close only put us slightly below that level.

Through the course of this trade, there were several occasions where the shares fell below the strike price. Being a volatile period and selecting a strike that was only ~4% away from the then-current price had contributed to that result.

Ycharts

What’s Going On With Conagra?

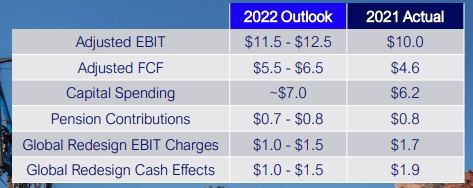

CAG is dealing with the main issue that is happening to companies around the world. High inflation is eating away at consumers’ cash and making the input costs rise for these companies.

A big difference here is that CAG isn’t a cyclical business. Being in the packaged food business can be competitive, but people generally eat no matter the economic conditions. That puts CAG in an area where they have some pricing power but also have to be conscious of consumers trading down to private label brands.

This pricing power due to inelastic demand is a good reason why the consumer staples sector, and subsequently CAG, are outperforming the broader market as a whole.

Ycharts

A UK supermarket, Tesco, has recently reported that they “see early signs of shoppers trading down in products…” They noted that shoppers are also making more frequent trips, but that is because they are reducing what they are buying at one time.

Inflation staying elevated continues to put pressure on CAG, which is something to watch closely. This is why they had reduced their EPS guidance when they reported their Q3 results earlier in April. They expect approximately $2.35 compared to the $2.50 originally.

They’ve already finished their fiscal year in May. So the next expected earnings report will be in mid-July, which will let us know if they achieved their target or not. They tend to beat analyst expectations, which come in at the same $2.35 for 2022. They’ve also reported $1.72 in the previous three quarters, we are looking for EPS of $0.63 to hit their target.

All this being said, I believe even during a recession and the immense pressures of inflation, CAG can operate successfully. I believe their dividend to be safe, even if they miss their targets and come in with lower earnings. The current annual dividend rate is $1.25.

What’s Next?

With these trades finishing up, the next move here would be to look to write more puts on both F and CAG. Since this last trade expired worthless, I still wouldn’t say that I have a full position in F. I had also left room to add to CAG lower instead of going all in. It seems in this volatile market. A dollar-cost averaging approach is worthwhile to take.

Ford

With the continued pressure of recession risk, we can look at the single-digit area for writing more puts on F. That is hard to imagine considering where the shares were trading just earlier this year.

One trade that looks like it could have some potential is at the $9.50 strike on the July 22, 2022 expiration. Given the last trade closed at $0.21, that works out to a potential annualized return of 23.73%. The breakeven would be $9.29. All this depends on where we open up after the three-day weekend off from the market.

If assigned at $9.50, the cost basis for the position would go down to $16.17. That would include the shares assigned at $23 and those assigned at $16. The adjusted breakeven of the trade, when including the premiums received, would go down to $15.82. This includes the $0.62 (from a strangle trade combining the call and put premium collected) that resulted in the shares being assigned at $16. Then the original assignment price of $23 was adjusted for the $0.22 collected.

Conagra

For CAG, we could look at writing some puts at lower strike prices. The main benefit to this would be lowering our cost basis if assigned. The worst case is that we take the premium, and the trade expires worthless.

I think there are two potentially interesting trades, both at the $30 strike price. One is on the July 15, 2022 expiration. One could collect $0.50 for a potential annualized return of 22.53%.

Going out a week later to the July 22, 2022 expiration, the same strike price could net $0.55. That works out to a potential annualized return of 19.68%. This is a weekly options expiration, so the trading volume here is significantly lighter.

I would consider writing covered calls on CAG if it jumped meaningfully higher. I’m not in a rush to possibly exit the position, though, so that isn’t the main concern in this case.

Be the first to comment