jetcityimage/iStock Editorial via Getty Images

What happened?

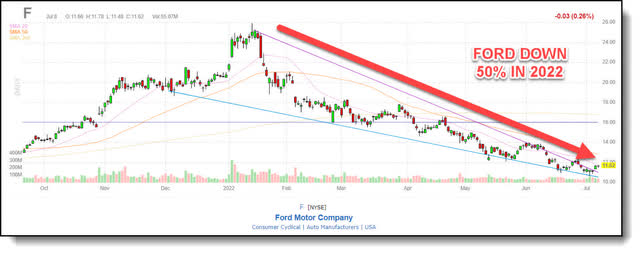

Ford’s (NYSE:F) stock price has plummeted 50% over the past 6 months.

Ford Performance (Finviz)

There was little to no upside breakouts along the way.

Even so, the stock is up 4% for the week and just recently broke out above the top of the downtrend channel.

Recent Breakout (Finviz)

The recent upside push in the stock has actually occurred in the face of some negative news breaking as well. As reported by Seeking Alpha news:

“During the second quarter, Ford sold a mere 120,000 vehicles in Greater China marking a ~22% year-over-year decline led by rising COVID cases and ongoing global supply chain problems. The sales indicated the worst since Q1 of 2020 (89K units) when government COVID restrictions halted the production in the country.”

Even so, a selloff based on macro factors, such as COVID breakouts and supply chain issues, often creates an opportunity to buy stock in a solid company with sound prospects. I submit this is the case we have with Ford. The stock presents an excellent long-term growth buying opportunity at present. Let me explain.

Ford well positioned for growth

The Ford F-150 Lightning is now officially in production. I have done my research on the truck and it is awesome. Ford CEO Jim Farley stated:

“The company is not joking around by saying the electric F-150 lightning could be as big a product for the automaker as the Model T back in 1908.”

Ford plans to scale production of the F-150 Lightning even faster than competitors, with plans to boost manufacturing of the Lightning at a plant in Dearborn to 150,000 units in the next year, up from an initial target of 40,000 vehicles.

What’s more, Ford has secured the lithium-ion batteries needed to meet its expected level of production of 150,000 units next year. Moreover, the company plans to prioritize supplies of semiconductor chips toward the F-150 Lightning.

Markets can stay irrational longer than most can stay solvent. Especially in times such as these where inflation is running rampant and the Fed “put” has been effectively removed. As a grizzled veteran investor who has successfully navigated the 2000, and 2008 bubbles and subsequent crashes, I have developed a disciplined strategy for building new positions. Here is how.

Investing in turbulent times

I started out my adult life as a Winter Warrior in the US Army’s famed 10th Mountain Division to earn the money for college. As the largest “Winter Warrior” in the unit, I was given one of the larger weapons to hump. My weapon was the M249 Squad Automatic Weapon, or SAW, an individually portable light machine gun. You must only fire the weapon in short 6-8 round bursts so it doesn’t overheat. You should build new positions in the same manner. Let me explain.

Winter Warfare Training Ft. Drum, New York (10th Mountain)

A mistake I made many times in my younger days was to plunk down the entire allocation for a new position in one buy. I felt so confident the stock had seen the low, I wanted to be sure and maximize my upside. This was a huge mistake. I have learned to be patient over the years when building a new position. You must layer in to new positions over time. Moreover, the higher the level of macro market volatility, the greater the number of tranches you should use to create a position. Always layer in to new positions over time to reduce risk. What’s more, have a plan for building the position. Let me explain.

Have a plan for creating a new position

I have found one way to improve my performance over the years is to set up a plan for any new positions I create. I set predetermined buy limit orders at lower prices that will significantly improve my basis for a series of tranches. After each tranche executes, I take some time and, reassess, and set up new buy limit orders according to my new targets. Another reason I am picking up shares now is the fact I believe if we aren’t at the low, we are darn close and Recession fears have gotten out of control.

Recession fears overblown

After doing due diligence on past recessionary cycles and the respective effects on the markets in general, I surmise the potential coming recession will be a short and shallow one, even with a hard landing, for several reasons. Firstly, the average drop in the S&P 500 during the past 12 recessions since World War ll was 30%. We’re currently down 20% already, so about two thirds of the recession’s potential downside effect on the market is already priced in by historical standards. And Ford is down more than that at 50%. So, I employing Sir John Templeton’s strategy of “Invest at the point of maximum pessimism.”

Invest at the point of maximum pessimism

One of my favorite quotes from investing icon Sir John Templeton is the following:

“Invest at the point of maximum pessimism.”

Templeton is known as a contrarian investor. He referred to his investment philosophy as “bargain hunting.” Templeton’s guiding principle was:

“Search for companies that offered low prices and an excellent long-term outlook.”

I feel this statement perfectly illustrates where Ford’s stock lies right now. The reward far outweighs the risk at this time with the stock down 50% on factors that are bound to improve over time. The stock is under-owned and oversold presently. In the following sections I make my case. This only works if you have courage in your convictions and can sleep well at night. I can with Ford.

Bear markets throughout history

Can anyone guess how many times the market has bounced back after a steep sell off such as the one happening now? The answer is every time. Right now, bearish sentiment at record highs. This exactly the time to strike. Here is why.

Are you playing chess or checkers?

I see those selling out now as classic cases of first-level thinking. A first level thinker sells stocks as they fall and buys stocks when things are going well. The fact of the matter is in order to be truly successful; you have to do the exact opposite. Think of first-level thinking as checkers, second-level thinking as chess. Warren Buffett’s quote “Be fearful when others are greedy and greedy when others are fearful” is a classic example of second level thinking.

The contrarian’s code

Times of market turmoil often present the best buying opportunities for savvy investors. Contrarians find their best investment opportunities during times of market duress while others are panic selling. Nonetheless, the underlying stock needs to have a solid growth story and strong fundamentals. Ford fits the bill of the baby being thrown out with the bathwater. I see Ford doubling within the next couple of years. Here is why.

Ford’s solid fundamentals

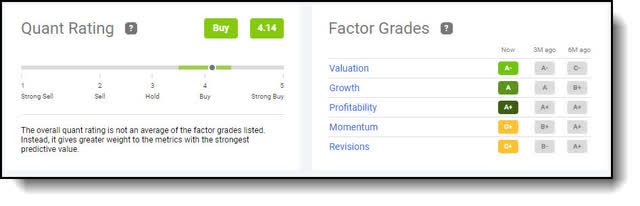

First of all, Ford is basically trading for a song at the present valuation. Ford’s forward P/E of 5.41 is approximately a third of the current S&P 500 forward P/E of 16. The stock is incredibly trading for book value with $10 in cash per share on the balance sheet, talk about margin of safety. Moreover Seeking Alpha’s Quant analysis rates Ford a Buy with A scores for valuation, growth, and profitability.

Ford Quant Analysis (Seeking Alpha)

If ever there was a bargain basement buying opportunity in Ford, this is it. Nevertheless, there are always downside risks to any thesis or investment. Please review the following.

Potential Downside Risks

It would be remiss of me not to include the positional downside risks as no investment comes without risk. Even so, the higher the risk the higher the reward. The following is a list of downside risks as I see them.

- A decline in Ford’s market share.

- Lower-than-anticipated market acceptance of Ford’s new or existing products.

- Further issues with chip supply.

- China’s economy not coming back online.

- Fluctuations in foreign currency exchange rates, commodity prices, and interest rates.

- Inflation continuing to rise causing a recession leading to a further selloff.

The Bottom Line

Our innate instincts encourage us to depart a sinking ship. This survival tactic impacts the way we invest. The herd running for the door is what creates the opportunity to buy a fundamentally solid company like Ford with sound prospects at a discount. Hopefully, you have some dry powder and a long-term time horizon and take advantage. Moreover, after years of diligent work, the company has obtained a fortress balance sheet and solid cash flow. Those are my thoughts on the matter I look forward to reading yours.

Your input is required!

The true value of my articles is provided by the prescient remarks from Seeking Alpha members in the comments section below. Do you think Ford is a Buy at current levels? Why or why not? Thank you in advance for your participation.

Be the first to comment