serts

Brookfield Asset Management (NYSE:BAMR)(NYSE:BAM) and Blackstone (NYSE:BX) are arguably the best of breed among alternative asset managers. One need look no further than the vast empires of assets under management they have built and the tremendous long-term total return track records they have accumulated to make this case.

Meanwhile, both companies’ share prices are looking attractive after pulling back meaningfully this year, so in this article we are going to look at them side by side and offer our take on which is a more attractive buy at the moment.

Brookfield Asset Management Investment Thesis

BAM/BAMR has ~$725 billion in assets under management and over 100 years of experience owning and operating alternative assets. The company operates in over 30 countries across five continents, employs over 1,000 investment professionals along with over 150,000 operating employees to manage and drive exceptional returns from its over 2,000 individual investments.

It currently invests across five major platforms: renewable power, infrastructure, private equity, real estate, and credit and insurance solutions. Its renewable power business can be invested directly in via publicly traded Brookfield Renewable (BEP)(BEPC) and owns and operates primarily hydro, wind, and solar power generating assets. Its infrastructure business can be invested in directly via publicly traded Brookfield Infrastructure (BIP)(BIPC) and owns and operates primarily utility, port, railroad, toll road, midstream, and data center assets. Its private equity business can be invested in directly via publicly traded Brookfield Business (BBU)(BBUC) and owns and operates businesses that primarily service infrastructure, industrial, and healthcare businesses. Its real estate business used to partially trade publicly via Brookfield Property (BPY), but has since been privatized. It owns mostly world-class office and retail assets, but also invests in multifamily, hospitality, logistics, and other real estate asset classes.

Last, but not least, after acquiring Oaktree Capital (OAK) and bringing on board the legendary fixed income investor Howard Marks, BAM/BAMR also manages credit and insurance solutions assets, including performing credit, opportunistic credit, and direct lending. BAMR/BAM offers private investment funds which pursue various strategies across each of these platforms and has been able to drive very strong fundraising growth in recent years.

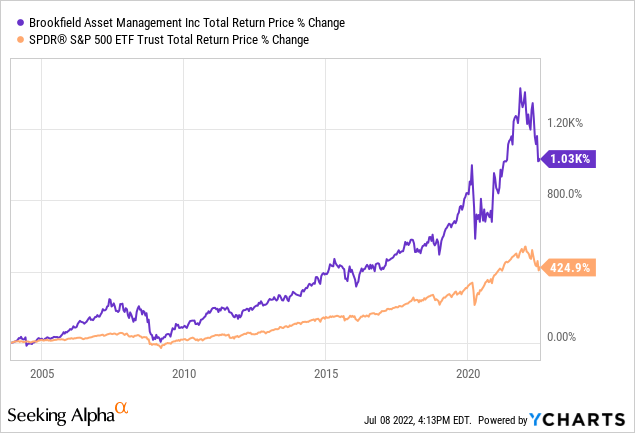

In addition, BAMR/BAM is unique among major alternative asset managers in that to date it has retained a large percentage of its earnings and reinvested it into its own products. Given that these investments have generated strong returns, this has turned out to be a prudent strategic decision, even if it has reduced returns on equity for the company. Still, when combined with its strong fundraising momentum, BAMR/BAM has been able to generate market-crushing total returns over the years:

BAMR/BAM is well-positioned to continue generating strong returns for shareholders for the following reasons:

- Its century-long track record of excellence in operating and investing in real assets gives it a deep knowledge base and expertise in maximizing the organic performance of its investments.

- Its sheer size and global scale gives it access to superior and generally exclusive deal flow, potentially leading to superior risk-adjusted returns and strong fundraising appeal.

- There is extremely strong ongoing fundraising momentum for the alternative asset industry in general as persistently negative real interest rates, heavy government indebtedness, and a severe global infrastructure deficit are driving strong demand for private sector real asset investments.

- It has a very large and established investor base that have proven to be quite sticky clients.

BAMR/BAM is well-positioned to weather the current economic uncertainty as its assets generally benefit from inflation, are generally mission-critical assets with long-dated cash flow visibility, and its A- credit rating reflects its focus on building up a massive liquidity war chest and concentrating debt at a non-recourse asset level.

As a result, if the economy manages to dodge a recession, BAMR/BAM’s investments are well positioned to continue thriving, and if the economy falls into a recession, BAMR/BAM’s massive war chest positions it to not only survive but play aggressive offense in order to emerge on the other side of the downturn in a much stronger position.

On the valuation front, BAM/BAMR looks very attractively priced at the moment, with a P/AFFO ratio of 11.13x compared to its five-year average of 15.78x. It also trades at a P/FFO ratio of 15.36x compared to its five-year average of 17.39x. Meanwhile, it trades at ~15x distributable cash flow which is quite attractive given that it is expected to grow its distributable cash flow per share at a 12% CAGR over the next several years on top of paying out a 1.2% dividend yield.

Analysts expect BAMR/BAM’s FFO per share to reach $5.63 in 2026. Even without achieving any multiple expansion over that period of time, BAMR/BAM should generate a total return CAGR of 16.25% over that time span when including the ~$3 in dividends per share expected to be paid out between now and then.

Blackstone Investment Thesis

BX also has a very impressive track record, business model, and forward outlook. Whereas BAMR/BAM is primarily known as an infrastructure and real estate investor, BX is known for its private equity and real estate investments.

It is the largest alternative asset manager in the world with $915 billion in assets under management with $298 billion of that in real estate, $268 billion invested in private equity, $266 billion invested in credit and insurance, and $83 billion in hedge fund solutions.

Its private equity business is spread across well over 100 companies that include sectors ranging from infrastructure to life sciences. Its real estate business is spread across three sectors: opportunistic funds, core+ funds, and real estate debt, including assets like a massive apartment community in Manhattan and a large European logistics portfolio. Its credit business includes direct lending, high yield and investment grade bonds, systematic strategies, CLO investing, mezzanine debt, opportunistic and distressed debt, and sustainable investing. Finally, its hedge fund solutions business includes registered funds, special situations, general partnership stakes and seeding, and customized portfolios of alternative investment strategies.

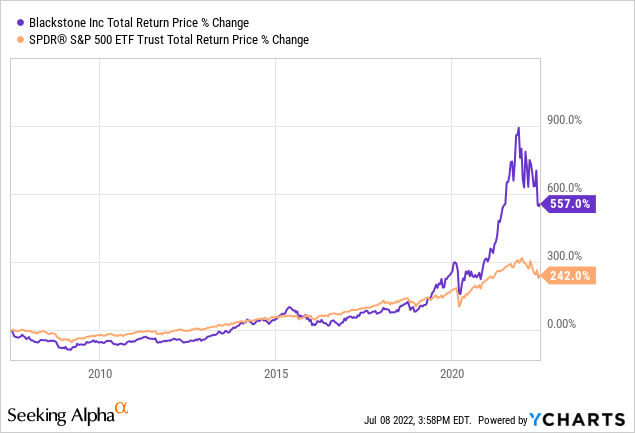

BX’s immense capital, global scale and breadth of investment opportunities have fueled very robust fundraising and its exceptional fund total return performance have combined to generate outstanding total returns for clients and shareholders alike in recent years:

It also enjoys a very strong forward growth outlook for essentially the very same reasons as we already mentioned for BAMR/BAM and its assets are similarly well positioned to weather economic headwinds, though its greater emphasis on private equity rather than renewable power and infrastructure assets means that it will likely suffer a little bit more during a recession. Additionally, it is a pure-play asset manager, so its cash flows are a bit more volatile than the more stable cash generating machines that BAM’s subsidiaries such as BEP and BIP are.

On the flip side, BX has an A+ credit rating, putting it in an even stronger position than BAM to weather rising interest rates and get access to attractively priced capital.

From a valuation perspective, BX currently trades at a discount to its five-year averages on a price to normalized earnings and price to free cash flow basis:

| Metric | Current | 5-Yr Avg |

| P/E | 17.14x | 18.24x |

| P/FCF | 8.35x | 10.14x |

In 2026 analysts expect BX to generate $8.71 in normalized earnings per share and have paid out a total of ~$27.75 in dividends per share. Assuming no multiple expansion over that period, BX is projected to generate a total return CAGR of 14.5% over that span.

Investor Takeaway

Both BX and BAMR/BAM are without a doubt world-class asset managers with leading competitive positions in their industry and a compelling set of tailwinds for future outperformance. That said, it appears we are all but certain to see a recession in the next year or two and both of these businesses will likely see their businesses take a hit as a result. Given that BAMR/BAM is more defensively positioned, has greater upside potential as per analyst consensus estimates, and has a potential additional catalyst through its planned spinoff of its asset management business from its large balance sheet of invested capital, we view it as the more attractive buy of the two right now.

Be the first to comment