Marina113

Thesis

Ford Motor Company’s (NYSE:F) Q2 release was well received by the market, as F continued its remarkable pre-earnings run toward its recent August highs. As a reminder, we highlighted in early July that F has likely bottomed out convincingly as we prepared to add exposure. Accordingly, F has significantly outperformed the market since our update, as bearish investors were taken out decisively.

Notwithstanding, F’s remarkable run has stalled in August, given its rapid recovery over the past month. We also noted that F’s valuations are more well-balanced now, and its current price structure also lacks a convincing buy trigger.

Therefore, we urge investors to be more cautious in adding new positions now. Instead, they should consider waiting for the near-term momentum to be digested first before adding new positions.

Still, we are confident that Ford’s EV transformation journey remains on track, despite the near-term uncertainties. Coupled with Ford’s confidence to reinstate its dividends to pre-COVID levels, the auto OEM leader is confident of its ability to sustain its free cash flows. Therefore, F investors should be assured of its long-term operating model as Ford ramps towards its 2M EV production run rate by 2026.

Accordingly, we revise our rating on F from Buy to Hold for now.

The Market Had De-risked Ford’s Near-Term Uncertainties

Investors should recall that F collapsed nearly 60% from its January 2022 highs to its lows in July 2022. Therefore, we are confident that the market had de-risked the intensifying headwinds on Ford’s H2’22 ahead of time. Automakers have continued to come under increasing pressure due to the worsening macroeconomic challenges. The market was concerned about whether the leading automakers like Ford could face near-term profitability headwinds, despite their pricing power.

Therefore, Ford’s ability to maintain its FY22 overall adjusted EBIT guidance of between $11.5B to $12.5B highlights the resilience of its operating model. Furthermore, the company’s decision to increase its dividend payout to $0.15/share per quarter accentuates its confidence in sustaining its free cash flow (FCF) profitability. Ford also highlighted that its ex-US operations should return to positive FCF in 2022, as CFO John Lawler articulated:

Our business is very different than what it was in the past. Our ICE product, clearly, our lineup is more profitable as we’ve exited unprofitable vehicles. But we’ve de-risked the overall business. We restructured our markets overseas. And I think a great proof point for that is the fact that between ’18 and ’21, we burned through $9 billion of free cash flow overseas. And we do expect this year, we’re projecting that our overseas markets will be free cash flow positive. So we’re just in a completely different position. (Ford FQ2’22 earnings call)

Ford’s Valuation Is More Well-Balanced Now

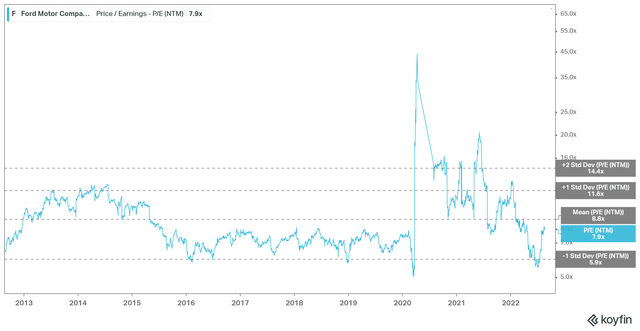

F NTM normalized P/E valuation trend (koyfin)

As seen above, F’s NTM normalized P/E has recovered remarkably from its July lows. At 7.91x NTM earnings, F last traded close to its 10Y mean of 8.8x. Note that F has consistently found robust support whenever its P/E fell to the one standard deviation zone below its 10Y mean over the past ten years. Therefore, we were confident in early July that F should find robust buying support.

F’s Stock Price Action Does Not Have A Convincing Buy Trigger Now

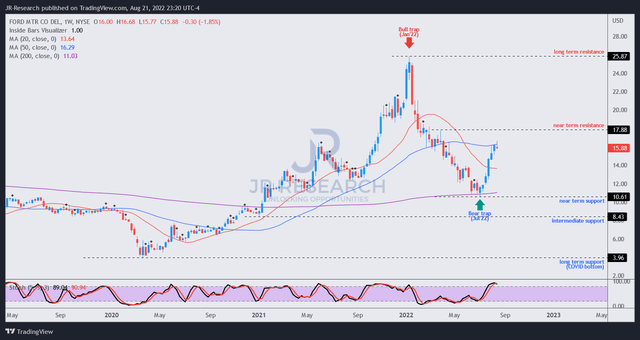

F price chart (weekly) (TradingView)

As seen above, F has surged tremendously from its July bear trap (indicating the market denied further selling downside decisively) that we highlighted in our previous article.

However, the momentum and pace of the current surge are likely unsustainable. Furthermore, F’s buying momentum also seems to have stalled last week, indicating potential near-term downside volatility moving ahead.

While we remain optimistic about Ford’s medium-term prospects, we will not be buyers at the current levels, as we don’t observe any convincing buy trigger.

Is F Stock A Buy, Sell, Or Hold?

We revise our rating on F from Buy to Hold.

Ford’s medium- and long-term transformation journey remains on track. Still, we urge investors to be patient, as the recent surge has been too rapid. Therefore, investors should expect a near-term consolidation that could see downside volatility moving forward, giving them more opportunities to add on weakness.

Be the first to comment