Carl Court

Introduction

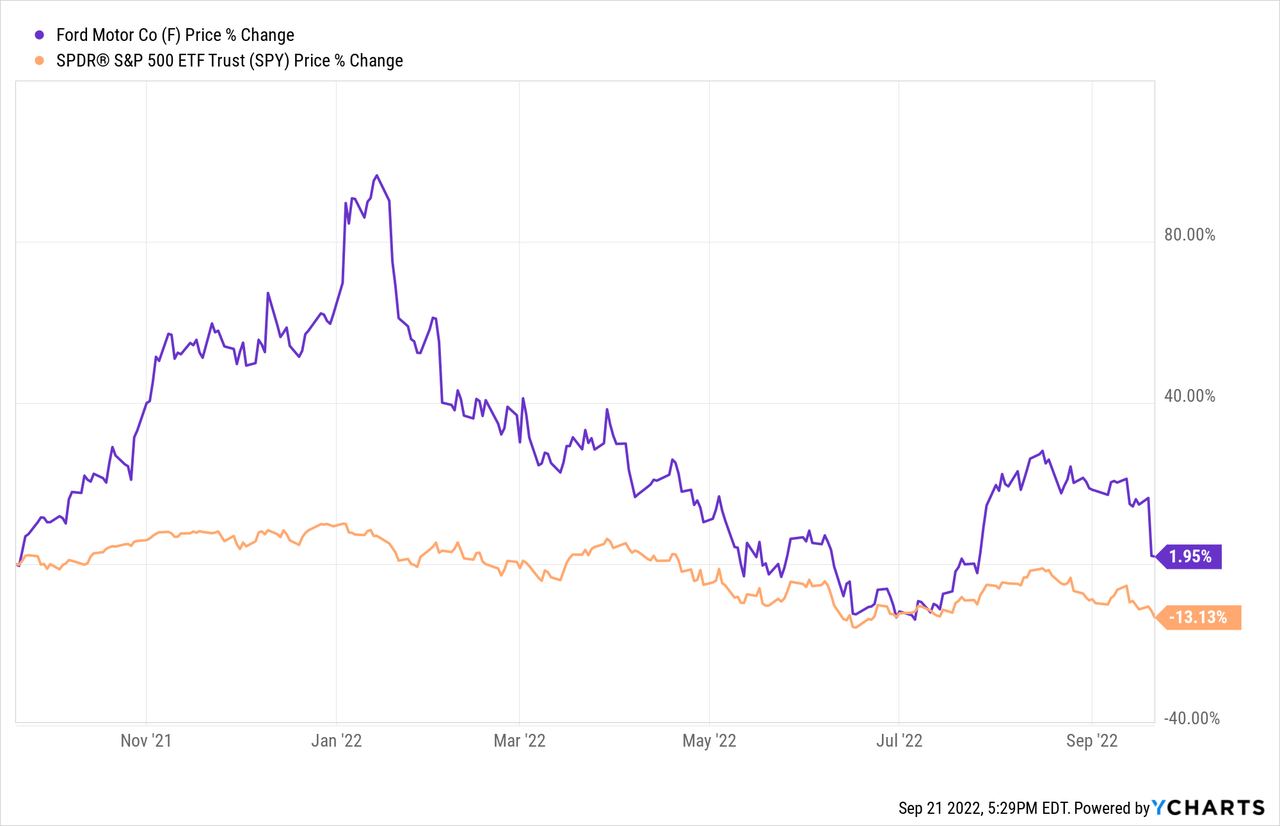

Ford Motor Company (NYSE:F) is an American automotive company that sells a variety of vehicles such as their Ford 150/250 trucks and electric cars in the Automobile Industry. Year-to-date, Ford’s stock price has slightly outperformed the market, gaining 1.95%, while the S&P 500 (SPY) declined as much as 13.13% in market value during the same time period.

Despite these performances, I still see potential in Ford stock as an attractive long-term investment. There are many bullish signals hinting at growth for the foreseeable future: healthy financial growth over the past 5+ years, continual focus on making Ford+ a reality, stable dividend recovery, and many more. Let’s start off with an in-depth company activity analysis of what has been going on so far.

Company Activity

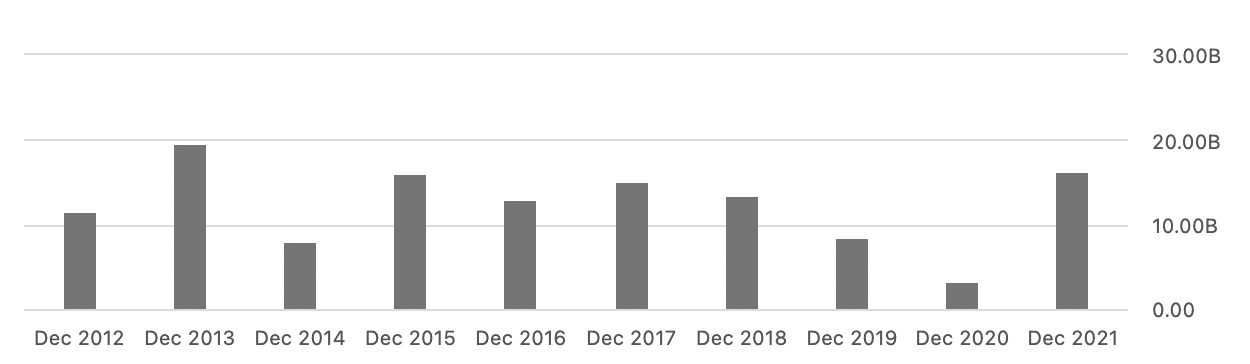

After Q2 2022, Ford’s primary business focus is to continue raising funds and maintaining a strong balance sheet to further proceed on implementing their new Ford+ business growth strategy while maintaining a strong and successful shareholder return program. To recap on the strong financial performances in recent years, I decided to look into the history of Ford’s TTM financial metrics such as free cash flow (“FCF”), EPS, and EBITDA from data provided by Seeking Alpha’s Financials section.

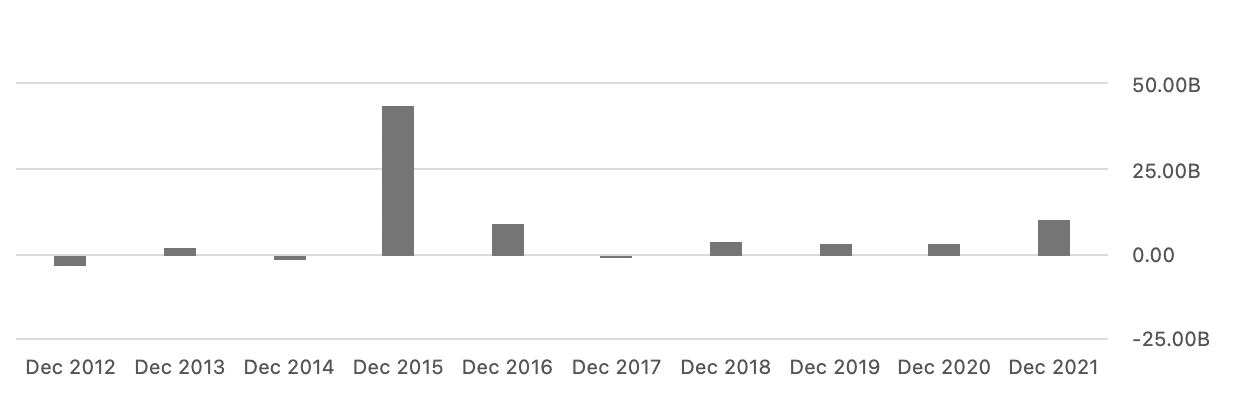

As you may know, Ford’s more focused and revamped business model has been yielding strong operational and financial results over the past 2 years. I strongly believe that the true potential of the business has not been met as the reflected earnings and levered cash flow below only provides a very brief snapshot of the progress Ford has made since changing its business strategy. Nevertheless, Ford has been growing its levered FCF metrics at a strong 3 year 44.75% CAGR (calculations December 2019 to December 2021).

Seeking Alpha (Levered FCF)

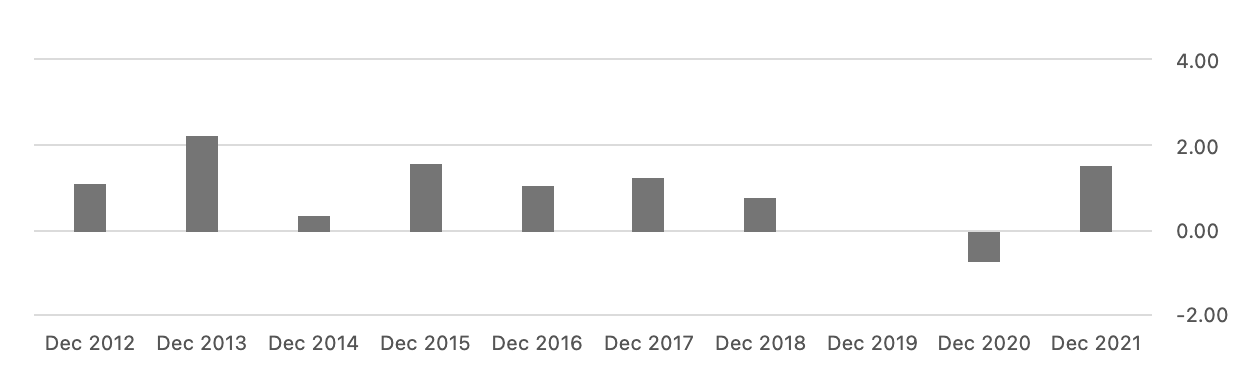

Next, primary earning metrics such as EPS and EBITDA also saw stabilized growth following the successes with the revamped business model. I decided to calculate the 5-year CAGR on Ford’s Normalized Basic EPS from December 2017 to 2021 to get the most recent results, giving me a steadfast 4.26%. I also calculated their EBITDA’s 10-year CAGR growth from December 2021 to December 2021, resulting in an attractive 3.51%. Ford continually is having solid momentum in earnings growth over the past few years, and it is my view that we can expect the same growth trend for EPS and EBITDA in the coming years.

Seeking Alpha

Seeking Alpha

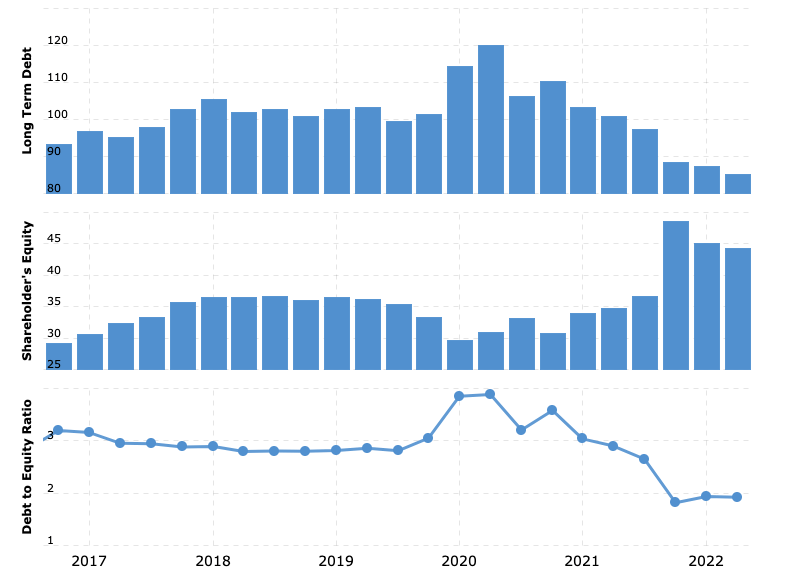

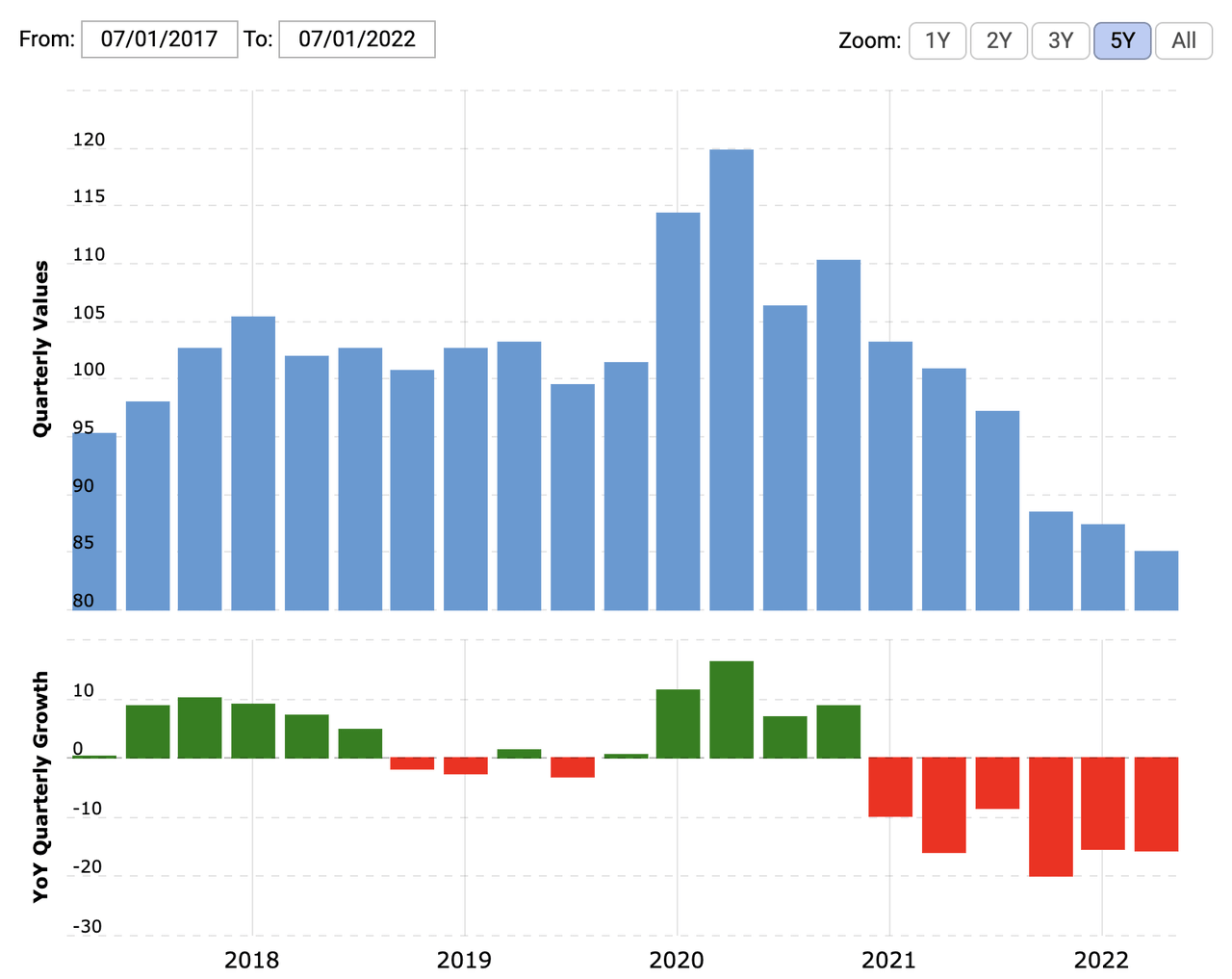

Finally, I concluded that Ford has a very strong balance sheet. I decided to analyze the company’s long term debt to equity ratio over the past 5+ years to 1) assess the potential financial risk and 2) check if Ford is financing operations and investments effectively without borrowing money. We can see that their debt to equity ratio has been hovering near its lowest so far at 1.92% in years, likely suggesting that its capital structure is performing incredibly well, which is great news for future prospects.

MacroTrends

Ford Pro’s E-Transit Custom Potential

Ford is taking great leaps in the electric vehicle (“EV”) industry. Not too long ago, on September 8th, Ford launched their E-Transit Custom to hone in on consumer experience and small businesses, providing value and solutions all across Europe. The E-Transit Custom boasts new digital solutions during the day for multi-drop deliveries to maximize productivity and a new EV powertrain to aid consumers relying on diesel on switching towards electric. Here’s CEO Ford Pro, Ted Cannis from the news report on the impact overall to Ford’s European consumer base:

Powered by the Ford Pro digital ecosystem, E-Transit Custom offers a genuinely revolutionary proposition to European van customers… These vital businesses contribute €786 billion to Europe’s economy, and E-Transit Custom will give them a much-needed productivity boost as they transition to EVs.

Furthermore, Ford’s new battery technology delivers a targeted range of 380 km and a 125 kW fast charging ability with a maximum towing capacity of 2,000 kg. To put this in perspective, Tesla’s V1 and V2 supercharging stations can provide up to 150 kW of power to cars, showing Ford’s ability to match against the industry giants. The E-Transit Custom also adds onto Ford Pro’s 4 new electric commercial vehicles projected to launch into Europe by 2024. To further global expansion, E-Transit Custom production in Turkey starts autumn 2023 built by Ford Otosan in Kocaeli, Turkey. This is all fantastic news and I believe that analysts are overlooking this launch as Ford is moving in strong and impactful ways in the EV Industry.

Here’s a quote from General manager of Ford Pro Europe, Hans Schep summing it up:

Transit Custom is a hard act to follow – Europe’s top-selling van and last year’s best-selling vehicle overall in the UK – but the all-new E-Transit Custom is a huge leap forward for our customers… E-Transit Custom’s ground up new design, unmatched connected ecosystem and innovative customer experiences will redefine productivity for our customers in the electric, connected era.

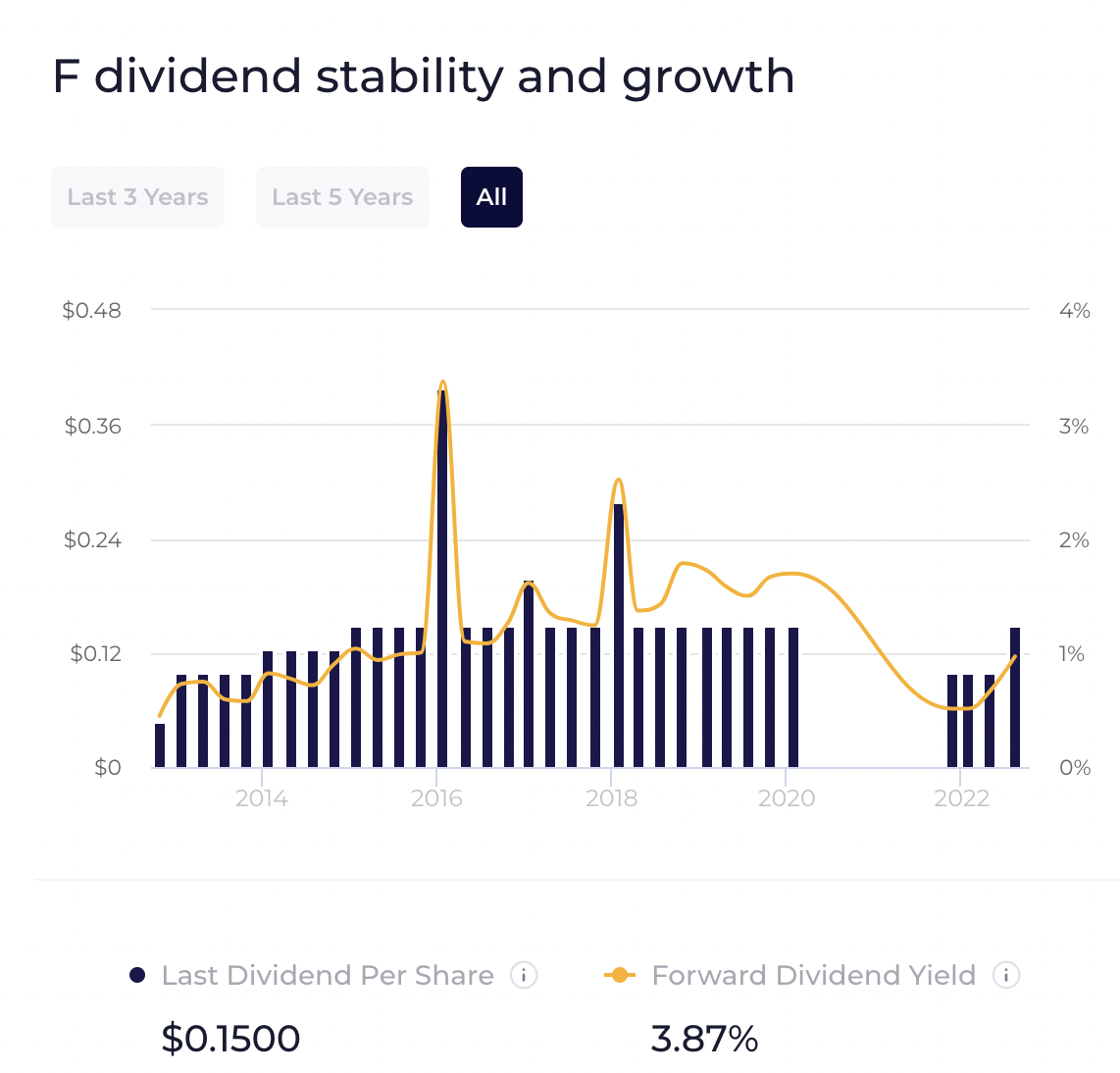

Strong Dividend Recovery

Ford’s dividends recently have seen ample recovery since the start of the pandemic when the company paused dividend payouts. Ever since the start of 2022 when the company re-began its dividend payment program, dividends actually grew 90.2% since their reinstatement and is now back at pre-pandemic levels. The quick dividend recovery should be good news to investors as it demonstrates management’s confidence in the company’s business prospects and shows their commitment to deriving shareholder value. In Ford’s Second Quarter Earnings Call, Chief Financial Officer John Lawler recaps their focused strategy and positive results. Mr. Lawler goes on to provide his thoughts on the dividend:

We are confident in the underlying strength of our business and our ability to fund all the calls of capital. All the calls that we have on capital, especially those fundamental to growth and value creation, we can achieve this while maintaining the financial flexibility to navigate external uncertainties. And as a result, we’re increasing our regular quarterly dividend to $0.15 a share beginning this quarter, this returns us to the pre-pandemic dividend levels.

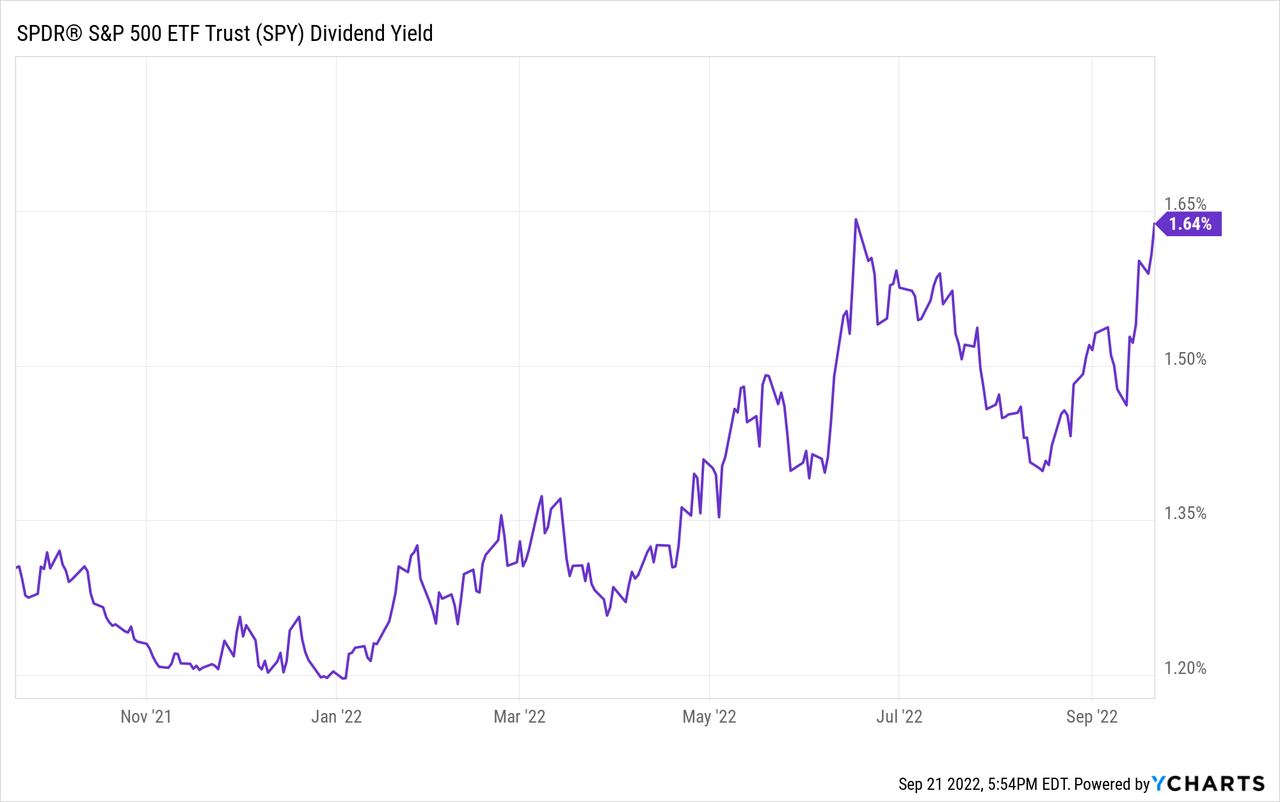

Currently, Ford has an annual dividend of $0.60 per share (derived from their recent quarterly dividend payout) which translates to a 2.97% annual yield and is much higher than S&P 500’s 1.64% annual yield (this also ranks the company well over the top 75% of US-listed companies). Furthermore, the company’s strong TTM EPS of $2.88 is more than enough to cover the annual dividend per share costs, leading to a sustainable payout ratio of 20.83%. The continued growth and momentum moving forward makes me believe that Ford is well-positioned to improve dividend metrics for the foreseeable future and provide returns to fulfill investors’ needs amidst these uncertain times.

WallStreetZen

Stock Valuation

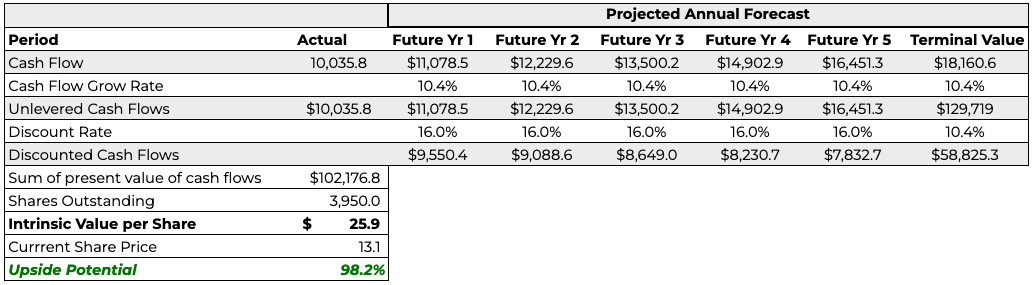

Since we know that Ford has a strong balance sheet and is operating with profitability, I decided to use the Discounted Cash Flow (DCF) method and employ conservative assumptions to derive a conservative intrinsic valuation. Ford’s Free Cash Flow (FCF) metric is volatile, so I based both of my models on an average FCF value to provide a more consistent FCF metric rather than using the TTM Free Cash Flow value. I based my first DCF model using a pre-pandemic 5 year FCF average from 2015-2019, which is $10.036 billion. With this conservative baseline FCF assumption, I then assumed a 2% terminal growth rate and a modest 10.39% FCF growth rate (derived from the 2012-2021 FCF CAGR) which I believe represents in-line growth with historical performance. These assumptions resulted in an intrinsic price of $25.90 and presented a 98.20% upside from its current market price.

Google Sheets

Even when using a more conservative model based on Ford’s pre-pandemic 10 year FCF average from 2010-2019 of $7.750 billion, my model resulted in an intrinsic price of $20.00 per share which still represents a solid 53.70% upside. With these two models alone backed by historical data, this shows me that Ford stock is heavily undervalued by the market and presents itself as a great buy opportunity for investors.

Google Sheets

Risk Headwinds

The biggest risk that stands for Ford currently is the uncertain effects on the current macroeconomic environment. The rise in interest rates from the Federal Reserve’s monetary policy and the implications of the Russia-Ukraine war have had a significant impact on the EV industry as well as Ford. With all of these costs compounded together, Ford had to offset roughly $3 billion worth of other inflationary costs on top of funding their new Ford+ business model. Here’s Chief Financial Officer Jawn Lawler on where Ford is at right now from their Q2 2022 Earnings Call:

We’re working to offset those inflationary costs. You know, and that’s something that we need to continue to work through. We’re not all the way there, of course, but we’re working on it, and, you know, we do have the rest of the year to go, and it is a significant focus of our team as we’ve talked about, but, you know, the cost efforts are a significant focus of the team as we remake, you know, the company in Ford+. So that’s a really important part of what we’re doing

Moreover, I strongly side with Mr. Lawler on the fact that Ford will be resistant towards these inflationary pressures as my claim is supported by an historical analysis of Ford’s debt levels. If we take a look at the past 5 years of debt accumulated (especially at 2020 when debt levels were at an all-time high), management managed to taper down debt amounts to $85 Billion (the lowest debt has been since 2010) in 2 short years. This shows me that management is very nimble and well-off to adjust on tackling headwinds— a testament to Ford’s successes over the years.

MacroTrends

Competitor Comparisons

The last part of my thesis is formulated on Ford’s strong global competitive positioning within the Automobile Manufacturer Industry. To visualize this, I created a table below showing key automobile metrics from Ford and top competitors inside and outside of the U.S. such as Tesla (TSLA), Chang’an (SHE: 000625), and more that investors could seek out as an alternative investment.

From this, my table of EV car production targets and shareholder return metrics from Yahoo Finance yielded impressive results. Ford’s current recovering dividends with plenty of room to grow (discussed above) provides a yield that exceeds the bulk of the giants listed below, only to fall short of Hyundai by a mere 1.90% difference. With regard to Return on Equity, Ford supplies upper echelon returns but is not enough compared to Tesla beating them by a 0.50% difference. Though these difference margins are quite minor, I believe that Ford will easily make it up based on all of their strong momentum moving forward. I also found that Ford, as an American firm, is primarily eligible for the recent big climate and health care bill signed by President Biden, allowing for a $7,000 tax credit possibility. This bill has enormous potential for Ford because the majority of their products fall inside the maximum cost threshold. Ford still has a lot of room to expand, and for these reasons, I believe it can outperform the industry.

Conclusion

Ford is a strong contender in its industry and the stock is looking more and more as an attractive buy opportunity for investors. Their stable financials, strong dividend recovery being comparable among global peers, and new product potential to have an impact on the EV industry all are reasons for buying this stock. My two Discounted Cash Flow models stemming from an FCF based on pre-pandemic and normalized values resulted in a minimum intrinsic price of $20.00 or a 53.70% undervaluation by the market. Management has proven its excellence during these uncertain economic times as they have tapered down debt levels stemming from inflationary pressures to an all-time low. With all of these supporting reasons and more covered in my previous sections, I recommend a “Buy” on Ford.

Be the first to comment