martinrlee/iStock Editorial via Getty Images

With so many brands in the athletic and footwear industry competing for today’s limited customer budgets due to inflation concerns, Foot Locker (NYSE:FL) is one of the companies that could face a difficult year ahead.

In the midst of a return to normalcy and as US gas prices are cooling, the management provided a trimmed outlook in its FY22 outlook, on top of the upcoming holiday season. Sales began to slow this quarter, with negative catalysts such as FL experiencing lower digital penetration, which is exacerbated by its lower digital investment budget in FY22. This makes FL unappealing, especially given its declining margin, making it a good short play in the coming weeks.

Company background

Foot Locker is one of the world’s leading retailers of athletic footwear and apparel. It operates 2,799 stores in 28 countries across the world. The store closures trend seems to be continuing in the next few years as the company is in the progress to renovate its stores to improve customer experience and attract younger generations.

We plan to open approximately 100 new doors in 2022, including 40 community and Power stores while closing a total of 190 stores.

… Overall, our store count will be down approximately 3% in 2022, with square footage down less than 2%. Source: Q2 2022 Earnings Call Transcript

As quoted above, the management is serious about innovating their stores, which will undoubtedly benefit the company. Although, the increase in depreciation and amortization expense of $105 million YTD compared to $93 million in the same period last year is a bit surprising. This incremental expense adds to its existing margin issue, which overall hurts the company’s bottom line.

FL ended its Q2 2022 with a negative growth of -9.23% year over year of $2,065 million, a bit below the $2,175 million recorded in Q1 2022. This store’s optimization probably will make its comp sales better in the future, but one sure thing that is shown in FL’s performance this quarter is its inefficiency in its expenditures relative to its sales.

The company ended with a trailing total operating expense of $2,115 million this quarter, its highest figure since FY2018. Its total operating expense ratio boosted to 24.12%, its highest figure as well, leaving FL with an operating margin of 9.20%, down from 11.24% recorded in FY2021.

Declining Sales Conversion

For the quarter, our global fleet was open 99% of available days versus approximately 90% last year.

Comparable sales in our stores fell 6% with store traffic in our global fleet up low double digits and conversion down approximately 10%. Source: Q2 2022 Earnings Call Transcript

As quoted above, Foot Locker is well prepared for a return of demand. However, despite improvements in store traffic as a result of ongoing store renovations and new stores opening, sales conversion is still down 10%. This could be due to limited budgets of consumers at this time.

Slower Digital Penetration

According to the management, they are also experiencing a slower digital penetration this quarter:

Our digital penetration was 16.9% in the second quarter this year, down from 20.1% last year, but above the 14.3% from 2019. Source: Q2 2022 Earnings Call Transcript

The management allocated an $85 million budget in FY22 for its digitalization and supply chain initiatives, which is down from its $115 million budget in FY21. In my opinion, this adds up to its slower digital penetration this quarter. As previously stated, inflation is understandable; however, lowering investment in digitalization seems a bit off to me, especially considering the growing e-commerce athletic footwear market.

Leading To Competition Risk

This ignites competition risk, especially considering its peers’ performance. NIKE (NYSE:NKE) recently announced that their Nike Brand Digital business grew 18% on a constant currency basis.

Another peer to mention is Shoe Carnival (NASDAQ:SCVL), a smaller peer with a market cap of $674.33 million that recently announced aggressive expansion as well, with a target of surpassing its 30 store opening by the end of FY23. Another interesting catalyst is SCVL’s improvement in digital sales; their e-commerce net sales increased 75.3% from Q2 2019 to Q2 2022.

On top of this, SCVL is somehow more efficient, as shown in its higher gross margin of 37.55% compared to FL’s 33.32%. Lastly, SCVL is currently trading at a cheaper multiple than FL. Looking at their trailing P/E, SCVL has a cheaper multiple of 5.29x than FL’s 7.65x. Additionally, SCVL has a better EV/EBITDA multiple of 4.70x and a P/CF multiple of 8.27x than FL’s 6.50x and 21.64x. As of this writing, I believe SCVL is a better company to consider than FL.

Dividend Safety Issues

FL is a dividend paying company with an impressive forward dividend yield of 3.73% and a low payout ratio of 22.22%. However, it began to generate a negative trailing free cash flow of -$116 million. Furthermore, FL has a concerning dividend coverage ratio based on cash flow from operations of 1.18x, especially when compared to its 5-year average of 7.06x.

Additionally, FL ended its Q2 2022 with an inventory buildup amounting to $1,644 million, its highest inventory level since 2013. This leaves FL with an improved current ratio of 1.46x compared to its 1.36x recorded in FY21, but it remains lower than its five-year average of 2.50x.

No Margin of Safety

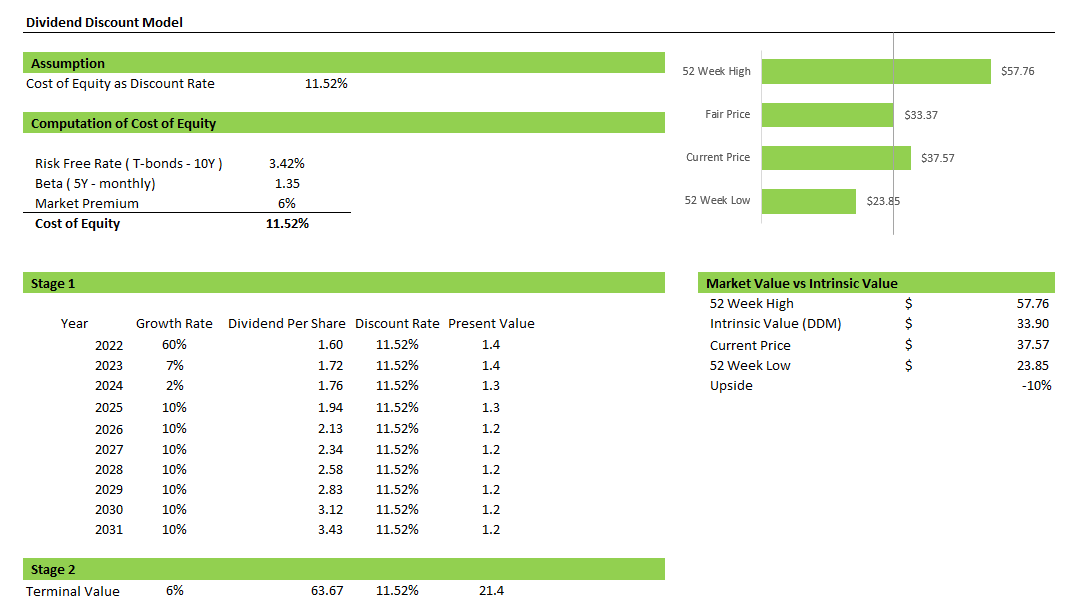

FL: Dividend Discount Model (Source: Data from Seeking Alpha and Yahoo! Finance, Prepared by InvestOhTrader)

Assuming FL manages to generate a positive cash flow from operations, which seems likely given the upcoming holiday season, and ends FY22 with a positive free cash flow, I believe there is reason to believe that it can still grow its dividend, starting with an analyst estimate of $1.60 seems reasonable, especially given the company’s low payout ratio. Using its 5-year dividend growth rate of 5.82% as the terminal growth rate, the model generates an intrinsic value of $34 and indicates that FL is trading at a premium at the time of writing.

Trading At Resistance

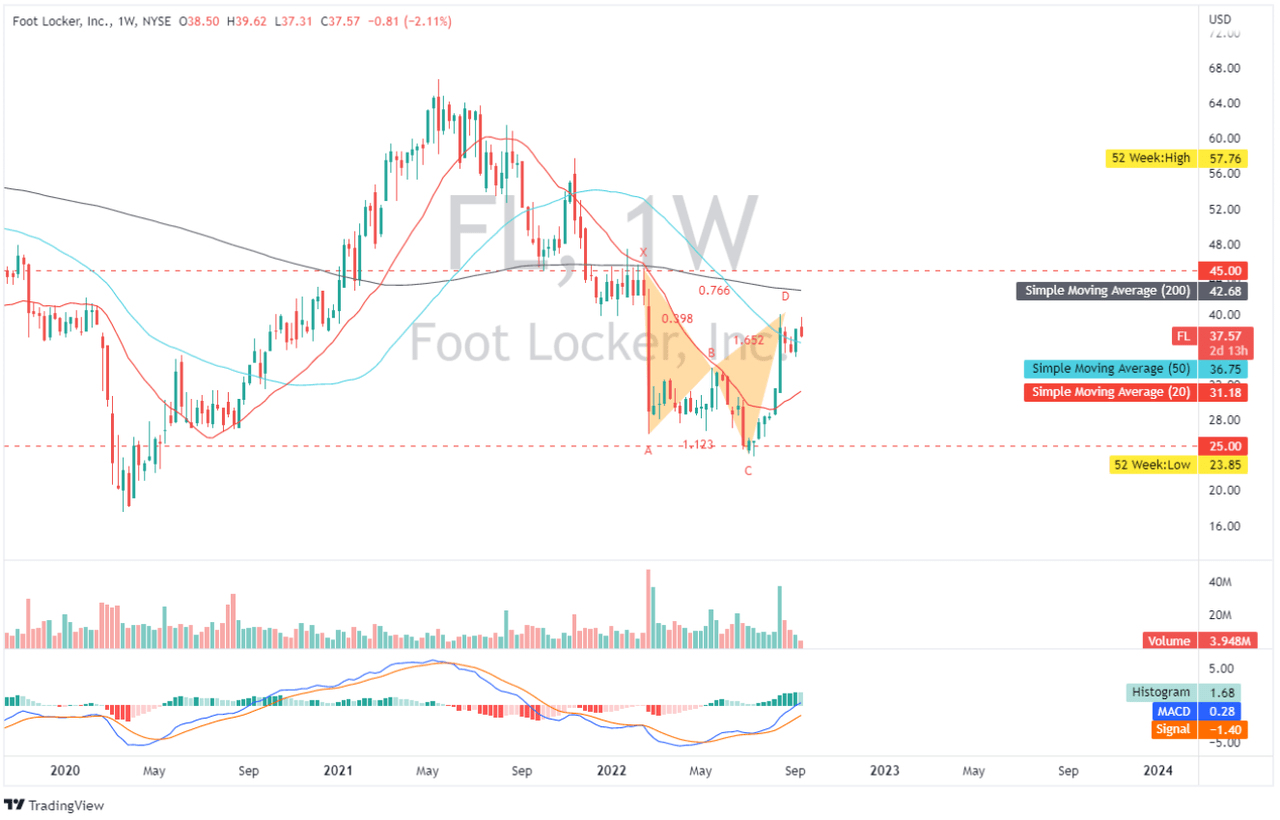

FL: Weekly Chart (TradingView)

FL appears to be completing a bearish cypher pattern, which is a type of harmonic pattern in which markets print new lows (see point C) and are expected to finish slightly lower than their point X. As shown in the chart above, FL appears to have some bullish pressure piercing both its 20- and 50-day simple moving averages. However, it may have difficulty challenging its 200-day simple moving average, especially given its previously mentioned short-term fundamental issue. Its MACD indicator indicates that bulls are still in control, allowing for a retest of its 200-day simple average. As of this writing, FL has a short interest of 9.56% and there are still 4.5 million shares ready to be shorted at a 0.25% browning cost.

Risk Note

On the bright side, management anticipates $200 million in cost savings as a result of their cost optimization plan, which will begin to bear fruit in the second half of this year. However, this catalyst appears to be challenged by its declining adjusted EPS forecast for this year, which is expected to be between $4.25 and $4.5, compared to its initial target of $4.25 to $4.60 in FY21. Either way, this figure is way below last year’s adjusted EPS of $7.77, making this stock unattractive.

Another risk to consider in shorting the stock is the unexpected growth from the metaverse, as the company is seeking opportunities in shoe NFT collectibles, which may complement the company’s physical operation. Here is an interesting article about the shoe NFT industry, which is expected to reach $42 billion by 2026, a huge gap from their initial estimate of $6.1 billion this year.

Conclusive Thoughts

As previously stated, FL has some profitability issues, particularly their declining digital penetration, which creates competition risk. Looking at its valuation, I believe FL has more room for the downside. To sum it up, I believe FL is a good short candidate at this time based on both technical and fundamental analysis.

Thank you for reading and good luck!

Be the first to comment