Editors’ Note: This is the transcript version of the podcast we posted on September 14. Please note that due to time and audio constraints, transcription may not be perfect. We encourage you to listen to the podcast embedded below, if you need any clarification. Enjoy!

Listen on the go! Subscribe to The Cannabis Investing Podcast on Apple Podcasts, Spotify, Sounder and Stitcher.

George Allen: I’ve always thought packaged pre rolls were a big part of the future. And in terms of brand ability and in terms of showcasing a brand and really bringing a brand forward. But the biggest challenge we had was during COVID, we just noticed that people were not sharing pre rolls like they used to. And that exacerbated a problem that we already had in pre-rolls, which was that they were more expensive than flower.

And if you know cannabis, which most people who buy cannabis do, they know that what goes into pre-rolls typically is lower quality input materials. That’s not the case for a Lowell, but that’s a headwind that we face all the time in terms of perception.

Rena Sherbill: Hi, again, everybody. Welcome back to the show. Super excited to have you listening along with us. For those of you following along, I’m in Chicago for the Benzinga Cannabis conference. Lot of great conversations being had both for the podcasts and conversations being had surrounding those interviews and kind of what’s also fueling those conversations is so many side conversations, lot of great insights that we’re going to be bringing to you that I’m going to be bringing to you in the next few weeks, really some great insights to be had.

Today, we are also graced with one of the attendees of the Benzinga Cannabis Conference, though I talked to him, back when I was on the West Coast. That’s George Allen, Chairman at Lowell Farms (OTCQX:LOWLF). George has been on this show a few times before, always great to talk to him. He shared with us his journey from Acreage to Indus to Lowell Farms. And now they are sharing with us a new product line that they’re launching at the end of the month, called 35s, which I would describe as looking like a lady’s slim cigarette. It’s a joint that looks elegant. That’s what somebody told me.

So George and his team were gracious enough to invite me to their Salinas operation, their grow, their facilities, where they’re creating this new product, and really thinking about what the future of cannabis consumption will be, how will that look like, what the products will look like the quality of the products. I got to meet so many different people on the team, from the person designing the grow to the growers to the people sifting through the buds. And it’s a really unbelievable thing to be able to see an operation, that scaling at that level.

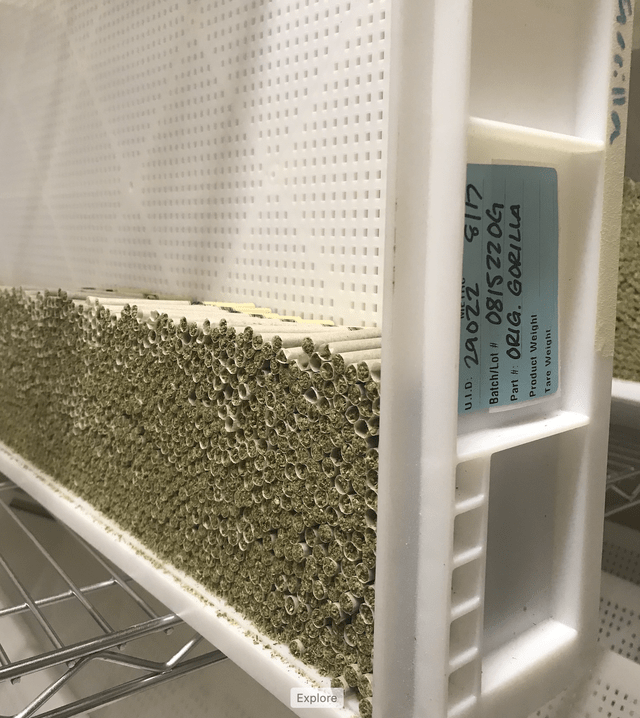

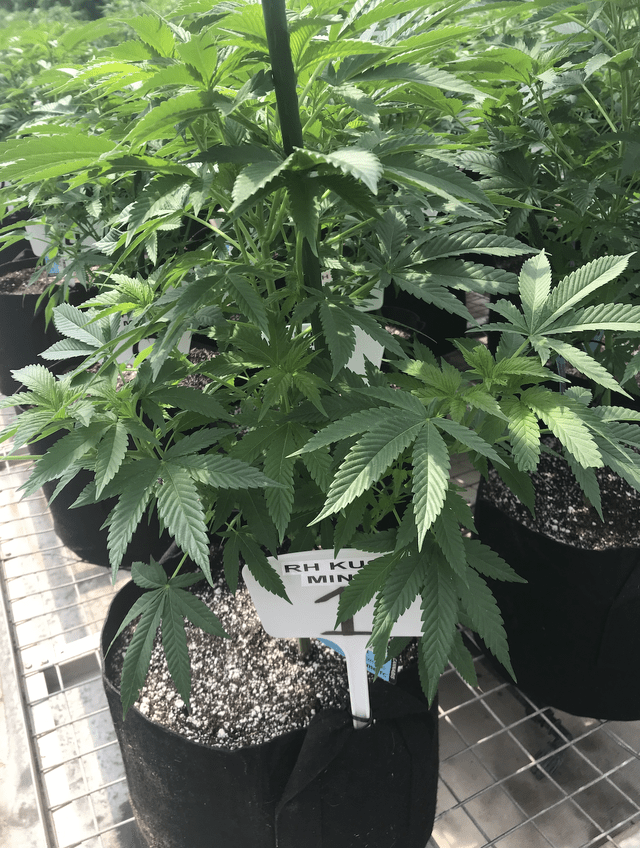

Lowell Farms Salinas facility (Rena Sherbill)

When you’re coming from the cannabis community, thinking about how cannabis was grown and packaged and sent out when I was growing up to how it is now it’s just astounding. George comes on the show today to discuss the retail picture launching a new product, pre-rolls, flower. How he is thinking about those things in California beyond Northeast Region, how we should be looking at the industry how we’re looking at the retail picture, a topic we’ve covered from a number of different angles.

This one I’m interested to cover from stalwart in the pre-roll industry and how they’re thinking about flower and packaging that flower and pre rolling that flower. And I’m looking forward to bringing you the conversations I’ve been having at the Benzinga conference. Super excited about that but really excited to bring you my conversation with George. Really appreciate all of his team up in Salinas, enjoy this one.

George, welcome back to the Cannabis Investing Podcast. Always a pleasure to have you on but especially since we got to meet in person recently, super psyched to have this follow up conversation. So thanks for coming on.

GA: Thanks for having me. I appreciate it. I always enjoy and I look forward to talking today.

RS: Yes, it’s mutual. And I came to visit the Lowell facilities in Salinas. I had a fantastic, fantastic day. A, from a personal standpoint, I am not a completely unbiased, robot doing these podcasts, like I also have personal interest. And I’m a consumer and I found it just super fascinating to see your facility to see your grow operation to speak to everybody, because I think that’s a salient part of any business is talking to the people and seeing what’s really going on.

Lowell Farms Salinas facility

So, A, I just want to publicly thank you for having me and hosting me it was super fascinating. And also, I think, really edifying in terms of how you can really scale an operation. So yes, it was it was really thrilling for me to see that.

GA: Well, I would say the same in return. We really enjoyed having you. I think that there’s a lot of folks on the team who listen to the podcast who are paying attention to what’s going on in the industry and there’s a fair amount of opacity in the industry, it’s hard to really understand what’s going on out there. And I think you’ve given a lot of depth for people that actually do know about cannabis, but don’t really know how their competitors are positioning themselves as well as long term strategy. And I think you’ve shed a lot of light on that.

So, having you come through the facility, it was a really special day for us. And we were great. We were grateful for it. So thank you.

RS: Yes, it was a special day for me. And just to kind of like set the tone a little bit, I was driving like, really early morning up to Salinas, from LA and passing all these farms and farm country. And really, I was starting to think about like, not just cannabis as a commodity, but cannabis as a crop and what we ingest in our bodies and how it’s grown and who’s growing it and how it’s been scaled and what they’re focusing on.

And I remember talking to you, as you came on board at Lowell, and talking about this flower and focusing on strong flower and not kind of shying away from that, because that’s a big part of the industry, right. And I remember talking about Lowell Smokes and kind of the branded — the brand that it has in that name. And now how you’re talking about kind of even doubling down on that. So I’d love to hear from you, kind of like where — how you’ve been thinking about where your focus is going to be at Lowell and how you’ve come to think about this new product launch?

Lowell Farms pre rolls

GA: Well, first of all, you’ve caught us at a really exciting moment. And I’m so glad to have you come see it, because the anticipation, the enthusiasm and excitement from the team is really palpable right now. And they’ve been leaning heavily into it. And there’s a little bit of scarcity right now in cannabis around positivity and enthusiasm, just because it has been so challenging for the last 18 months or so.

So, but for us, really the journey, and we talked about this when you’re out there, like the journey for us started during COVID. And we started paying attention to what was happening during COVID. I’ve always thought packaged pre-rolls were a big part of the future. And, and in terms of brand ability in terms of showcasing a brand and really bringing a brand forward.

But the biggest challenge we had was during COVID, we just noticed that people were not sharing pre-rolls like they used to. And that exacerbated a problem that we already had in pre-rolls, which was that they were more expensive than flower. And if you know cannabis, which most people who buy cannabis do, they know that what goes into pre-rolls typically is lower quality input materials. That’s not the case for Lowell. But that’s a headwind that we face all the time in terms of perception.

So what you have as the consumer has been asked for a long period of time to pay more for pre-rolls with lower quality input material than the flower that they would smoke in a jar. And the consumer for the most part has chosen nine times out of 10 to go with flower. So as we said there at the beginning of COVID, we knew that we had this challenge, we had a price point challenge, and we had a dose stability challenge. And the only chance we could solve both of those was to really re engineer the pre-roll.

And that led us down, what was a an 18 month two year journey around engineering fine finding vendors, and securing the design of the product that we felt would win eventual or that would give consumers what they were looking for. I would say the most, the heaviest piece of data that we relied on, in sort of coming to the product was this discovery, we made looking over some Brightfield data.

And when we looked at the data, it was really astounding to see that all the talk that we’re all the like lip service we give to the new entrants in cannabis and the soccer moms occasional users in cannabis, the education process that has to go on to dispensaries. 90% of cannabis is smoked by people and 90% by quantity is smoked by people who smoke at least one times a day. That’s an astounding statistic.

If you think about 10%, that means that 10% of cannabis is smoked by people who smoke less frequently than one times a day. And so that the uneducated, they are sort of on the fringe, the occasional user who’s coming back to cannabis, while they’re important to the growth and the normalization of what’s going on in cannabis.

Rena Sherbill

And if you want to build a brand, they want to build a product, that’s right. They actually should focus on the use case out there. That’s for the heavy users, the 90% users. And that was really where we came to. It was very hard. I knew that in our core product or low pack, which I think has done wonders for the brand, and really marched to sort of cannabis into a more open perspective.

But that pack was not getting into the 90% of daily user smokers at least without with any significant frequency. And the reason for that it was just priced too expensive. We have great flower. And — we worked really hard to put — to build the best flower pre-roll in the market. But I still think that it was priced out of out of market, and especially with the collapsing flower prices, our material costs were going down, but our labor costs were not necessarily going down. And so what you ended up with is, are as prices for flower were falling in California and elsewhere.

The price discrepancy between our core pack was getting high in the margin, the premium you’re paying for the core pack, over the core flower was widening out, and we knew that was going to happen. And that’s why we spent all this time, on this long journey, much of which we kept sort of opaque from the public standpoint, there’s a long journey to sort of reengineer the pre-roll. And I’m really proud of where we ended up.

RS: How much time did you spend like at when you first came on board at Lowell thinking about what you want it to be kind of your first mission, I guess?

GA: Yes, so I mean, we’re all just hoping when we first got here, we all spent time just staring at headset data. Because first of all, we couldn’t really go outside we couldn’t really meet with dispensary owners, it was very hard to have dialogue in the early days, most dispensary owners were too busy to even get on a zoom call because they were still trying to figure out how they were going to reengineer the business.

But so when we first got into it, we spent a lot of time saying, we have to find what we’re going to be good at. Because cannabis is not going to be a marketplace where you can afford to do a lot of things okay. That seems like a very 1.0 kind of business model. It’s just let’s just create everything we can under the sun, try to make it all pretty good. And convince the consumers that you know that price wins.

I think for a brief moment in time that strategy seemed like it was going to make sense. But what you’ve really seen in California is the majority share gains had been made by companies that show focus and a specific strategy. So that was pretty informing to us. We also saw we also saw flower usage. When I came from acreage, I sort of had this perspective, probably sort of errantly so actually definitely errantly so in hindsight, but it came from acreage, and in this this view that I think we kind of all had originally, which was that flower was going to eventually a trip to zero.

And that consumption patterns around more efficient or more effective ways to take the product would evolve, I certainly thought there was a lot of potential. In beverages, we saw an enormous amount of trend towards vapes and edibles. So I think there was this view that that was happening.

But when you actually looked at data in California, flower consumption was rising. And where the Alpha user spends most of their dollars in cannabis is usually in flower, and then to a lesser extent in concentrates. And so that sort of pointed us towards this idea that we would have to kind of put our focus into flower and that was we talked about it when I first joined, we wanted to establish our flower brand, not necessarily as sort of like the best value, we wanted to establish it as sort of a premium-ish brand that was accessible to the mass consumer market.

Lowell Farms cannabis flower

But we’ve worked really hard on bringing genetic diversity in there and making the selection really quality. And the journey was always going to be and still remains to take consumers from their perception of quality in the jar and take them into the journey that says okay, now you know what’s inside. But here’s a more convenient form factor for you. That is priced really competitively and frankly, I’m super proud that we’re putting the same inject input materials into our pre-rolls that we’re launching the under the 35s is brand, but we’re launching it at a lower price point than our flower.

RS: So how does that work in terms of dispensaries like, do you have a talk with them? Do you meet with the dispensaries and explain to them like the new pre rolls? And what’s coming? Are you looking to expand into more dispensaries with this product? How are you in terms of the retail space? How are you working with this with these new pre-rolls?

GA: I would generally say for most of what we’ve learned about launching products we’ve learned by watching others, and some of done a really nice job, as well as by our own mistakes. And — so I think there’s a lot of learnings from negative space as well as from folks who’ve done it really well.

And the formula in California for a product launch, believe it or not, the more complicated you make it, the worse you make your life because it’s actually pretty basic, your retailers control the channel, you have to become partners with your retailers, you have to get them interested in it, they have to promote the product, both at the counter as well as within their trade collateral. And they have to be bought in and so one of the things that we did, coming into the 35 launch was I scheduled calls at this at the executive level with all the tops 30 stores, and I just said, here’s what we’re doing, here’s why it’s going to work, I mean going get your product sample shortly.

But here’s what we think we’re going to be in terms of price point, here’s where we think we’re going to be in terms of potency. And here’s where I think this is going to make a lot of sense on your shelves. And we even asked, some of our retailers to make some concessions on us that we’re going to help consumers find the product.

And I was only looking for a small handful of stores to launch. There’s a young guy in our team who is just a workhorse with data and analytics. And one of the things he preaches constantly to us in the Salesforce is to focus specifically on shelf velocity on stores, where you have a presence. Because if you’re not winning the accelerating shell philosophy game, it doesn’t make a ton of sense to continue to expand your breath, breath is operating expense heavy, it costs a lot of money to support breath, if you can figure out how to get more shelf velocity out of the stores that you’re in, it means that the product has found an audience with consumers that’s compelling. And makes sense and that this store is also making an attractive profit selling your product.

So that’s, that was really the key gate for us. That learning took us into this logic of, okay, let’s limit the number of stores that we’re going to launch with. And try to make it a really positive experience there, we’ve had almost half a million, Instagram light ups on the product launch that we put out there, which I’m super excited about. So I think there’s this tremendous amount of anticipation for the product. And we’re going to point that to I think something close to somewhere around 15 stores.

So only 15 shelves in the state are going to have the product. So we’re going to point all the velocity at those stores. And we’ll expand that over time. But it really comes down to make sure that they have a good experience, make sure consumers don’t walk in, it’s out of stock, they thought it was going to be here, it’s going to be out of stock.

And so the team is working really hard on that launch plan that we had an all hands meeting last Thursday with the Salesforce and our PA team and just there’s just so much excitement around this. But there’s — the list of things that we’ve got to get done right before we launch is enormous. So it’s a really exciting time right now.

RS: So what does that look like? Exactly, like really honing in on the relationship with a dispensary really making sure they’re informed on what the product is, as you said, making sure that it’s in stock, and it’s not going to go out of stock, like all of those types of things just make it [multiple speakers].

GA: So it starts with an educated budtender, I mean that’s the biggest one. It’s like, we’ve got a — and obviously fingers crossed for how the launch goes. So I don’t know yet. But leaving the budtender behind is tragic mistake in new product launches. If you buy a billboard, but you haven’t given free product to bud tenders, in this industry, you haven’t been around very long because that strategy just doesn’t work.

Lowell Farms cannabis flower

So I think — our dialogue with retailers was, okay, if you want to be in the launch, we’re excited to have you. And we obviously picked the retailers that we felt had like a good starting position and we felt like they had a good relationship with the brand Lowell, had been supportive of ours.

But in addition to that, we want to make sure that they’re going to use their social footprint, their email lists, their store frontage, all of which to sort of be supportive of the brand launch. Not necessarily taking over the store. But as close as we can get to making the consumer aware of the product when they walk in.

And then the second part of that dialogue, is making sure that everybody in the product has tried the product, everybody in the store has tried the product. And that we’ve gotten, we’ve solicited for their feedback, they feel heard about their feedback, and they get an opportunity to sort of iterate with us on the product.

And I think that’s really, that’s where we are now, we give away a lot of product to bud tenders, it’s a good thing to be budtender in the industry when there’s a new product launch and now we’re certainly not shying away from it. They have to — budtender speak with authenticity when they can speak firsthand knowledge of a product. If they don’t speak with that authenticity, the client is likely just it doesn’t it doesn’t really resonate. It’s like having a restaurant where the waitress says that they don’t eat the food, and it doesn’t make any sense.

RS: Has there been feedback from that group of people that you’ve kind of taken into the product and change some things?

GA: Yes, 100%. I would generally say the feedback so far, has been lights out. I mean, it is — the feedbacks so far has been really electric. And I can’t wait for it to get in the hands of consumers. But, I would say, the commentary that we’ve received so far, it’s just been really positive.

The form factor is really freeing for the consumer, it allows them to, to hold more cannabis in their pocket, it’s a more effective way to carry around and ate the weed. It’s a really easy, convenient form factor to light up when there’s an opportunity to light up, there’s no rolling of the product, it keeps it fresh, but then the dosage is also a big part of it, it’s 350 milligrams, which for a lot of consumers isn’t enough, but there’s the ability to have multiple sticks behind it.

And what we were really trying to eliminate was this amount of wasted weed that happens with these massive ice cream cones that people smoke and sometimes they’ll just let it go out and then relight it later which, which in my opinion is about as sacrilegious as you can be with a cannabis product, because if you let weed burn and then and then rest for 24 hours, it really makes it quite an unappealing project — product.

So that we found all that feedback and what consumers were saying to us. There has been some collective feedback that we solicited, we wanted it on the packaging and in some of the design aspects. And I think that’s been really helpful to us. And we’re taking all that momentum and pushing it into the launch.

RS: When is the launch scheduled for is that settled yet?

GA: It — so what we’re telling people is it’s the third week of September, right now, we don’t have a date certain we should be getting product samples out to all stores this week, all stores in the launch and working through some inventory digestion periods with our launch partners to make sure that they can get it on shelves in a coordinated fashion. So third week of September is target right now. Exactly the day, we’re not quite sure.

RS: So something we’ve been talking about. And you know this is the California cannabis market this summer, I’ve been spending time there. And also I just think it’s really edifying to speak about the largest market, the most mature market and kind of see how that lends itself to thinking about the broader states and even broader global picture.

And something that I always think about, one of the differences between the illicit and the legal market is, that the weed has been — the cannabis has been looked after it’s their certificates, there’s tests done, there’s all these things that you don’t want in your cannabis that shouldn’t be there and perform.

But then there’s this other thing that I think we’re talking about now, which is the legal market is able to really hone its products according to what the consumer wants. And I was talking to you before we had record about how I — you guys generously gave me some pre-rolls and I’ve been sharing them in Colorado I’ve been going to shows and everything you’re saying has been kind of the experience that I’ve experienced with it.

And it’s interesting to see and I’ve been with a lot of legacy smokers let’s call them. And they know their cannabis. They know their form factors. A lot of people work in the industry. And talking about how these little things like, oh, yes, that’s so nice to not have to waste like half of a joint, because it’s not an ice cream cone and it’s smokeable in one session. And these things, I think, are part of the ways that the legal, the smart, I think legal companies are learning their consumer learning the ecosystem, and not just about getting even the best weed, which is also great, or the most price effective weed, which is also great.

But really like, what do people really want? And I, to me, it seems like, that’s one great way to make inroads to the people that are still consuming from the illicit market because of price because of have it, because of whatever. Do you think that’s something like listening to the consumer and really building it like taking like an apple approach to what consumers really are looking for? Do you think that’s the most important part of kind of scaling as a legal company to make inroads against the illicit? Or how do you how do you think about that or look at it?

GA: I think about it all the time, do we have the formula? I don’t know, we’ll find out. I mean, we put a lot into and we’ve bet millions of millions of dollars on a form factor that was really unproven and untested. And I think a lot of it came, a lot of it did come from data, I think I trust data a little bit more than I trust sort of like individual feedback, there’s certainly people that are in our network that we go to for feedback. I think a lot of a lot of people would tell you that are hardcore flower smokers, they’ll tell you they’ll never go to a pre-rolls. They’ll say that all day long, the pre-rolls just don’t make any sense. It’s too expensive, I enjoy the process of rolling my own.

And so I think a lot of respects, if you were just listening to consumer feedback, you probably wouldn’t do. And I think a lot of consumer feedback would also tell you that a pre-roll that looks like a cigarette might be offensive. And there’s the pre-roll is distinct enough to so that doesn’t exactly look like a cigarette, but it’s closer to a cigarette then, as we say, the short stubby cones.

So I would say a lot of data, we spent a lot of time looking at data. And I’m trying to understand, when the consumer has choice at a pre-roll that’s attractively priced relative to the quality of flower, what choice do they make, and looking into that decision and seeing, okay, you don’t have it’s not just 90% of your consumers buy this product all the time they move around, that there’s cannabis is really interested in the consumer journey isn’t like liquor where you find the liquor that works for you, that cocktail that works for you. And you sort of are loyal to it.

The consumers in cannabis it really being a cannabis consumers about the journey. You want to try new terpenes you want to try new flavor profiles, you enjoy the experience, sort of similar to like a foodie, or a vino file where there’s just you’re constantly evaluating? And so what we’re trying to figure out is okay, how do we, that consumers isn’t closed to new products and to new form factors. But you’ve got to you got to find your way your wedge to get in there. And one thing that we found was really price, price and convenience are aren’t obvious wedge to get in there.

I think more broadly, California is really struggling with an illicit market problem. You can call it a problem, you can call it, just a fact of life. But the reality is, we’re struggling, we’re struggling in California, I see it pretty basic.

What you have in California is retailers are crushed by 280E. And by a pretty expensive regulatory framework. As a result of that, they’re trying to grab as much margin as they can, they charge probably more margin than they should, on the underlying product, leaving too much of an opportunity for non-taxed, non-regulated illicit market players to sort of come on in under them in price. And it only takes those Alpha consumers, it only takes a couple of them to start shifting over and go into trap shops, which is the nickname we give to illicit market stores.

Going to trap shops and once that happens, they get followed by sort of the rest of the community. And that’s happened and when — then we’ve got a vicious cycle in California where retailers are watching their traffic decline. And they’re watching the traffic decline because the traffic is going to the illicit stores and they’re turning around, and they’re saying well, I’ve got to make up for that gap. And so they’re raising their effective markup on the products, usually by squeezing their vendors.

So they squeeze their vendors down, make more margin on the product. The problem is that same product that they’re squeezing their vendors down on, is also scooting out into the illicit market. And so you’ve just got this excess price problem that you’re not going to get away from in California.

And there’s a couple really intrepid retailers in California that I really admire that have looked at the retailing model and said, the main on main retail dispensary with 15 to 20 parking lots, parking spaces in the parking lot. That’s not the future, what they’re moving towards is these much more sort of large volume retail stores with a lot more parking, a lot more fresh inventory, and a lower markup model where the consumers sort of says, wait a minute, this is a compelling alternative to going into the illicit market.

And there’s a couple of operators, very few, but there’s a couple of operators in California that are taking some significant share. Ultimately, I think that’s a promising seed crystal of success. I do think ultimately, like, what are the secrets to, I don’t know, defeating the illicit market or making the illicit market less relevant. I think there’s really three possible vectors we can go down, one of which is purely academic, and that is enforcement. I just don’t see an enforcement paradigm really changing in California cannabis, and probably for good reason. I mean, nobody wants to see people walking away in handcuffs in cannabis.

So enforcement is a definitely a vector that could improve the prospects of the illegal market, I just don’t think it’s highly likely. The second is price competition, can you create price competition with the illicit market, and that’s really, if you want to look at where that’s worked out really well, that’s worked out really well, in Canada, Canada, they basically all but eliminated the illicit market with price competition. And they don’t have the burden of this excess tax levy called 280E in Canada, which is helped. But retailers in Canada, they actually, they will generally retail their product for around 25 or 20 to 25 points of margin, which is way different than what we’re seeing in California, which is 60 points in market margin.

So you’re seeing consumers, they see a really good price option for them there. And I think that’s one way we could do it. The problem is nobody has a lot of margin to give up, there isn’t a lot of margin in the food chain to give up and, and if there are efficiencies to go get there, sort of on the margin, they’re not wholesale changes to efficiency. So we’re really hamstrung there.

The third, and I daresay, now we’re going give it our best shot. The third has come out with a product that the illicit market doesn’t have. That is like if you can create a product that the illicit market doesn’t have. And it’s not asking consumers to break the bank, in terms of pricing. Can you win some share there from the illicit market?

That’s the conversation that we’ve been having with our retailers, which is, hey, look, if you want to bring in an audience that you’re not already seeing, let’s try with this product. And let’s try this product at this price point, to see to see what happens. And I don’t know, we’ll find out. It’s one of those things where I could be talking to in a year about all the miscalculations we made, or I could be talking to you about how that was the beginning of something really huge and exciting.

RS: Yes, I think it’s really interesting, because to me, that’s the most important — not the most important, but the most interesting kind of lane to think about, because the 280E, I mean, maybe you have more pull than I do, but it seems that not many people have so much pull in terms of eradicating the nonsense. And so it’s interesting to me, like how does the legal market — how do they uniquely make it accessible and attractive to the consumer? Because the price is really difficult to do. It’s really hard to out price the illicit market?

GA: The taxes are bit — without tax relief and structural regulatory relief, which I think is an important but less discussed vector for improving cost relief. But if you can’t get taxes down, which I think was the entire intent of the cultivation tax relief, I mean, you could argue that the cultivation tax relief was designed to help cultivators, but the reality is, it’s an oversupplied market so those savings will almost always get passed on to the consumer because their consumer has more leverage than cultivators do in an oversupplied market.

But the idea was, well, if we get a lower effective price out there to consumers, will there be a demand response in will we shift demand from the illicit market into legal market? The journey is not in and it’s too soon. I will say prices are plummeting in California retail we’re watching, if margins are still excessively high, so we haven’t seen any from the majors, any margin compression. But vendors are coming in with product that’s continuously priced lower and lower and lower and lower. And whether or not that’s sustainable. I have no idea. But that’s where it is today. And I think we are going to see at some point at demand response.

RS: I’m curious just about the retail picture a little bit. I’m just curious your opinion, you talked about the future of retail, and what it’s going to look like and how you can make it more successful on the legal side. What are your thoughts about consumption lounges? I mean, especially in California, to me, that’s also something that the legal market can offer. What do you think about that?

GA: Yes, I don’t know. I mean, obviously, Lowell’s got a history of consumption lounges. I wasn’t affiliated with it, then. And we’ve looked a lot of consumption lounges, like what is really exciting what’s happening in LA. That said, I think there’s just a cardinal sin fundamental flaw in consumption lounges, which is you can’t drink. And I hate to say it, but like, if, unless you’re with a group of friends, that chooses to socialize entirely by smoking cannabis, a consumption Lounge is a really kind of shitty experience unless there’s a way to get to the [multiple speakers].

RS: What about cannabis beverages?

GA: I think there’s a chance. The problem with cannabis beverages is, if you want to get high.

RS: They take a while.

GA: It’s got — you do have the time delay issue. But if you want to get high, it’s also just like, I think it’s like I think cannabis beverages today are a product that’s focused on that 10%, we were talking about that sort of non-frequent sort of cannabis consumer. And so you’re just talking about too small, the pie to defray all your costs for the marketing, and then in the support of the product like that.

So then the product ends up being a lot more expensive than the alternative. And when it’s a lot more expensive, the alternative, the people who could bring you volume don’t. And then without that base load of volume, you really are struggling to make money, where we’ve seen cannabis beverages kind of take, like, and it’s a little a little scary, where we’ve seen cannabis beverage kind of take hold, the high dose beverages in California certainly are having more traction, I believe.

But in the high dose beverage category, which I think you’re getting closer to price parity an edible or a joint in those high dosage like 100 milligram serving size, you’re in a really tricky regulatory environment, because the regulatory environment technically calls that a tincture. So but we both know, it’s not a tincture.

I mean it so I think — so I think beverages — I think beverages will get there. But 100% they will get there. And there’ll be really exciting. And there’s some real fun crossover to get there. But my view my view of what a consumption lounges, if you go into New York City, every single bar in New York City is exactly the consumption lounge that I always wanted when I lived in New York for years and years and years, which is you can drink inside, and you step outside and you can grab a smoke, and that’s what New York City is.

California doesn’t allow that now. I think I doubt there’s a ton of enforcement there. But by statute, you can smoke outside of a bar in New York City. And that, in my opinion, is all the consumption lounge I ever wanted and I don’t necessarily see. I don’t see, I don’t I don’t see where it goes from there. We’ll see.

I mean, it’s going to be really interesting to watch. I’m watching I really do like what he’s watching how the success they’ve been there and what he’s just kind of got an interesting blend of migrating between alcohol and cannabis. So there is a way, it’s just cumbersome and a bit messy. It’s not quite as simple as the New York City Bar, we just step outside and grab a joint.

RS: So speaking of it’s a good segue to talk about kind of what’s happening in the broader U.S. marketplace, because something that we are noticing in New York, for instance, is as it’s rolling out its legal thing as it’s becoming legal. There’s a lot of California cannabis out there until that market gets solidified as legal.

There’s a lot of illegal cannabis coming through. How are you thinking about that, like, first of all, there’s many companies that are playing both sides of it? And there’s — it’s almost impossible to succeed without it, but at the same time, it’s also really damaging, I think, the legal rollout there, how are you thinking about that both as like a part of the cannabis ecosystem, but also as head of Lowell?

GA: So I think that, I think New York is generally where I would say, I would not be a predictor of the future in New York, because the change, or the variety of outcomes that we could see in New York is enormous. And let’s put it in context. If you live in New York, and have been living in New York for a long time, and you smoke weed, right now, you’re going through one of the most bountiful periods of freedom and choice that you’ve ever had in the city, and that’s slowly going to get taken away as they migrate to this new taxed paradigm and try to kick out all this, otherwise non taxed product.

And there, it could work that could get the genie back in the bottle. It could work in a way that nobody has to do a perp walk. And it’s completely, effective and fair, I think that that’s not that likely. I think it’s — I think, unfortunately, there’s going to be a fair amount of carnage in New York, trying to figure out how to incorporate the two markets.

And some of our peers, I’ll dare say some of our peers have made the intentional decision to put their product on the streets in New York. I don’t know how much of that is sort of stuff that they would admit to, but you can’t go into New York and see all the products in stores there, and then say that they had no knowledge of it. I mean, that’d be crazy. And it’s been going on for so long, that’s super obvious as to how — are super obvious as to the fact that it’s happening.

But it might be the right play, like you look at that brain just think about in the long term context of I’m trying to build a brand, I want to identify with New York consumers. And I don’t want to wait around for Albany to figure out where the punctuation marks go into the code. Nobody’s getting in trouble. So let’s just let our product go through this network of murky distributors, where it ends up in into California.

And I think a lot of our competitors have frankly, made that decision, and are watching their brand, prosper and proliferate in New York, while many of our other competitors who haven’t made that decision. And would generally say, like, we’re going to find out, and it’s going be really interesting to watch how the New York market sort of breaks because let’s be clear, it’s not a market, it is the largest market in the world. New York City is the largest single market for cannabis in the world. So the table stakes there are just enormous.

And I think there’s so much that has been cemented into consumer behavior, and into the sort of working ecosystem as to how a product is getting in there, that it’s going to just take an enormous amount, and it’s going to be very hard to convince the consumer that they should just settle for 100 a whole bunch of really great Hudson Valley weed. I don’t know, maybe it works, maybe that works.

And I’m not trying to take like the Uber snobbish approach of California. Look it’s good be — I mean California makes good weed with lower capital investment required than any other place. And I think it’d be really hard for a bunch of hemp growers to sort of catch up on that, but maybe they will. I mean, I’ve seen some products in California and in New York, that from local growers, it’s actually surprisingly good. So, I think it’s really one of those moments where you’re like, predicting the future is far less interesting than just grabbing a bag of popcorn and watching.

RS: So how are you thinking about, vis-a-vis Lowell, as the states expand as the country opens up? How are you thinking about that in terms of scaling Lowell?

GA: Evolving, it’s definitely evolving, and I’m going to watch, I mean men right now I would generally say, we’ve had the brand out there and we our legacy pack is available now in two states, and hopefully by the end of the quarter will be available in Colorado, and New Mexico. And we’ve got a number of states lined up behind that we’re keenly focused on Arizona and Michigan is two more markets. I’ve heard great things about a couple other markets that we’re in early discussions.

But that’s our legacy pack, which is our basically is a walking billboard for our brand. It has always been like the product that makes a thud when you put it on the table that grabs consumer attention. I think will never ever stop selling that product. But we don’t have the 35s launching in those markets, I can’t get to the same. The unit economics and the cost dynamics don’t really make as much sense in a place where I have to, we have to buy weed for $4,000 a pound. So we’re watching it carefully.

There’s a part of me that thinks that let’s just focus on the new product and making it work in California get our supply chain, right, get the consumer response, right. And 50 odd million people or so visit California every single summer. And let’s just let them take us — let them pull us into other markets as time moves on.

We’re ordering enough equipment to build the manufacturer, close to a quarter million sticks a year. And I think that that’s going to allow us to serve a tremendously wide audiences as the business grows, whether or not we do that with localized operations in each market or whether or not we do that with a centralized cost effective strategy based out of California.

Largely, I know the end state, we know the end state, it’s a long ways away. We know the end state is some combination of male based fulfillment, and brands and brand conversations with consumers. What happens in between and how we get to that end state, I think it’s just really murky right now.

RS: Yes, yes. Which is kind of where I wanted to leave it with this question. And I think this might be — this definitely is murky waters to look at. But I’m curious, as an investing podcast, and as investors looking at share prices, and all the negative news out of cannabis companies for sure, this past year, maybe it’s starting to get a little bit better. But how do you look at it as a catalyst coming?

That’s going to help like maybe eradication of 280E, maybe more friendly regulations? What do you think, or do you think it’s going to be one catalyst or just a series of catalysts that help the companies over this, kind of nasty hump that investors are suffering from? How do you how do you see that kind of falling out? How do you see it improving?

GA: Well, I mean, I hate to be the Grinch that stole Christmas, I will generally say, I think we have shifted into — we’ve shifted from the sort of early perception that cannabis has so much margin and opportunity and demand, that there’s just going to be a large degree of wealth generated everywhere.

We’re shifting to the sort of the unfortunate reality that, yes, taxes are a problem. Yes, the illicit market is a problem. But also, the unfortunate problem is the other people in the room are also a problem, we have excess supply. And that kind of sucks, it kind of sucks to go into that because you realize that like, wait a minute, you’re kind of looking around and saying like, if I want to matriculate into the pantheon of brands that survive and businesses that survived this, I’ve got to outlast outgun our product going to win.

That is a really hard emotional place for all of our employees to get to it’s a hard emotional place for us to get to because cannabis is like, it’s a product that we think is has changed people’s lives to the positive. It certainly made the world a better place and in my opinion of the social costs, are far outweighed by social benefit.

But, the reality is like if you’re going to be successful in cannabis, you better have a strategy and that strategy if it looks like all the other people around you, then you better know that you’re better at execution on that than anybody else. And that margin has to be pretty wide. And I don’t know that I look at this industry and saying, there’s a lot out there. And frankly our vectoring into this new product launch and into this direction, it was really an effort for us to say, okay, most of our competitors are stacking up on retail, they’re all going to try to look a lot like Trulieve, in California equivalent of Trulieve, and to control as much the supply chain.

And that I think that was that’s a strategy that on paper does definitely pencil out makes sense. But you’re left with this tremendous carnage, of trying to integrate these retail shops on a one by two by three bases into your portfolio and the bandwidth and the clock cycles that that takes from the core execution of building a brand is very hard to endure.

And so from my standpoint, like, we took a long look around the room of the board and said, if we’re going to be successful year and successful means, the top 1% of the top 1% and survive, we’re going to have to do something different and that we believe in. And so we took a bet misses it, really excited about it.

RS: And in terms of the investor, how do you see them looking at the space? Like what do you think that they should be focused on? Or looking at aside from trying to suss out, the most successful company? How should they be thinking about kind of the journey? Or who knows? Let’s all let’s all kind of grab a handful of popcorn.

GA: No, I think it’s also a really exciting place for investors. I mean, right now, unfortunately, like financial performance doesn’t necessarily beget stock price performance, and that sucks. That’s too bad. Because I think it’s, there’s one of the best information arbitrage does exist in cannabis, like if you want to do the work, and understand who’s doing well, who’s gaining share, there’s data out there that allows you to do that. And the research coverage in this industry is definitely less comprehensive than it is in other industries.

So the normalization of all information is occurs less in cannabis, and it does in most other information — most other industries. And that means that a well-educated — a well-informed investor, I should say, can make better decisions than the mass and that usually means outperformance. The problem is we witnessed just this huge fall off from the dream. And we’re all recovering from that. I think a couple outstanding operators with success in the rearview mirror who are showcasing, what it looks like to be operating a competitive market. I think that will turn it around. And I’m optimistic on Lowell, will be on the top of that.

RS: That’s what I was going to ask and I’ll leave it here unless you want to kind of add anything to listeners. But do you see it like is your goal for Lowell to be at the top of the chain as federal legalization gets closer? Like you? Or do you see it as well, it could be more of a consolidation and lower will have a place within maybe a bigger company? How do you see that?

GA: Well, I think that playing for sort of like a middling financial return exit is kind of — if you want to take the sap out of, sap the enthusiasm out of an employee base, talk to them about how you might be able to sell it into some MSO for 2x [multiple speakers], mark price like that. Nobody wants to, like, work over Labor Day weekend because of that.

So I think the reality is like, what I think the message we communicate is, look, I think the goal for Lowell is to make the law brand, a household name synonymous with the liberalization of cannabis. And I think that I always I use it as like a funny sort of indicator of success, but I said we’re not stopping until there’s a Lowell bullhead racing around on an IndyCar. That’s it, that’s when your brand has reached sort of that type of staple, consumer staple on the presence. And that’s I think, where the true north is for us.

And frankly, people talk about all the time. I do believe this. It’s a pain in the ass for us to raise money and we need to raise money because we haven’t shown self-sustainability thus far and I’m incredibly grateful to the people who are supportive of us. But the current state of the capital markets, they are exactly what you want as a backdrop to actually build a business. Because there’s no question that over capitalization of this industry will sap out every single ounce of opportunity to make money.

And so right now, as you’re trying to build a brand, yes, it’s fantastic that my competitors cannot pay for Instagram hits and influences. It’s fantastic that my competitors cannot be on Facebook, because if they did, then I would have to do it. And the amount of money that I’d have to raise to keep pace with them, and keep pace with Altria, or whoever else is going to come into the market would just be enormous. So if you want to build right now, the sandbox isn’t the worst environment to build. Albeit, we’ve got our challenges. But that’s, I think we should be more grateful for what we have.

RS: Yes, well said, Well, George, it’s always a pleasure. And again, I feel like this is a better conversation for having visited your facilities. And I appreciate you sharing that with me, and thus with our audience. Anything else you want to share with listeners before we go?

GA: No. The only last thing I’ll say is like, thank you. I think, I’m a big fan of your podcast, I spent a lot of time listening to it. I mean, there are some real, really smart people that have been on this podcast, and every time I listen to them, I wake up a little bit earlier than next morning think it’s time to get to work. So thank you for pushing us, thank you for the level set of information that you give and the objective views. It’s been a really helpful source of information for us at the company. So thank you.

RS: Well that really, really, really means a lot. I really appreciate you saying that. And I agree there’s so much to be found from this podcast from the datasets that you’ve also highlighted. There’s a lot of great information out there and we’re better off for having it in our heads.

So thanks for helping share and spread the message and really appreciate you coming on George.

Thanks so much for listening to the Cannabis Investing Podcast. Subscribe or follow us on Seeking Alpha, Libsyn, Apple Podcast, Spotify or Stitcher and we’d really appreciate it if you left us a review on Apple podcast, it helps other investors find our show and makes us feel fantastic. If you have feedback or questions, we’d love to hear from you at rena+canpod@seekingalpha.com.

Nothing on this podcast should be taken as investment advice of any sort. I’m long Trulieve Khiron, IsraCann Biosciences, The Parent Company, Ayr Wellness, and the ETF, MSOS. Subscribe to us on Libsyn, Apple Podcast, Spotify or Stitcher. Thanks so much for listening and see you next time.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment