LordHenriVoton/E+ via Getty Images

The U.S and Canada were once among the world’s largest agricultural suppliers. These countries lost their positions as globalization became more pervasive and food supply chains became more extended. Nonetheless, these two countries still produce sufficient food to meet their own requirements, although the Ukrainian conflict has revealed the dependency of many on geopolitically sensitive regions of the world for their wheat and soybeans.

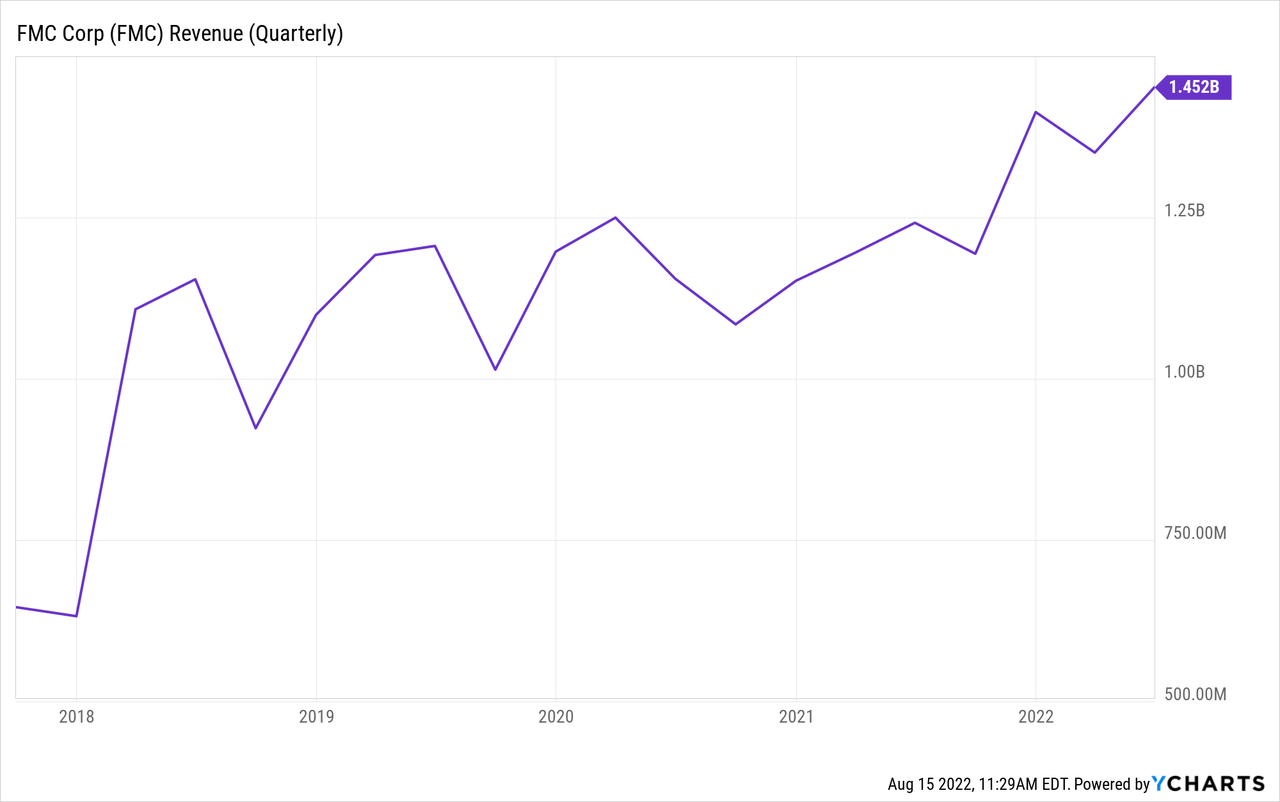

Therefore, in an effort to boost capacity in a world where uncertainties are now becoming the norm rather than exceptions, there has been a pickup in agricultural activities in North and Latin America in turn benefiting crop protection companies like FMC Corporation (NYSE:FMC) whose second quarter of 2022 (Q2) revenues were up by 21% compared to the same period last year.

The company trades around $112.5 after flirting with the $140 level in April, but also pays dividends at a rate of 1.84% (trailing). This is not an enticing yield, but it is dividend growth that really matters. Thus, my aim with this thesis is to assess whether FMC can deliver on profitability and cash flow to pave the way for more distributions to shareholders in an agricultural commodity market that has proved to be unpredictable since March.

I first start by providing insights as to FMC’s role in the food ecosystem.

FMC in the food supply chain

First, perfectly aligned with the need to produce more crops is the fact that everyone needs to eat. This is the reason why most food producers like Mondelez International (MDLZ) or Nestlé S.A. (OTCPK:NSRGF, OTCPK:NSRGY) are classified as consumer staples, in turn signifying that demand for their products is not impacted by the woes of the broader economy.

As for FMC, it is not a food producer, but more of an agricultural sciences company that provides crop protection, plant health, and professional pest control products. In other words, it develops and supplies products like insecticides, herbicides, and fungicides to farmers.

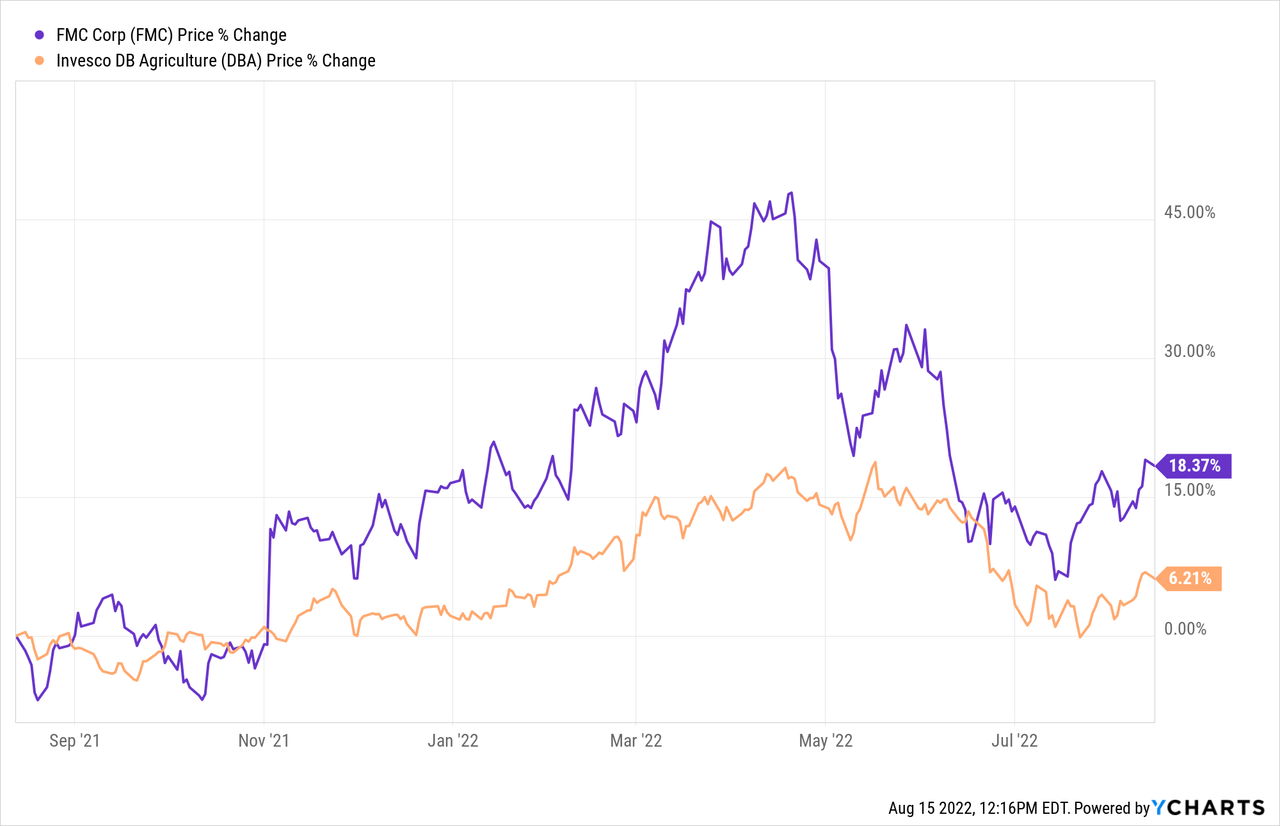

Thus, despite not producing food, FMC’s products are essential in supporting crop nutrition and quality against insects or weeds, in order to enhance crop yield, thereby making modern-day agriculture commercially viable. This is the reason why its shares as shown in the blue chart below were less impacted when commodities such as wheat, soybeans, and corn pulled back in July after having reached an all-time high in April. This was due mainly to the Ukrainian conflict adversely impacting supplies while demand was sustained. For this purpose, I have compared FMC’s performance with the Invesco DB Agriculture Fund (DBA) which holds the futures of soybean, corn, wheat, and other agricultural products.

Another noteworthy point is that FMC’s share price has remained high despite the dollar only weakening slightly. For investors, a higher-priced greenback generally weighs on agriculture-related commodities like pesticides as these are priced in dollars. Thus they become more expensive for farming companies located in other countries which have to pay more of their local currencies for the same shipment. Conversely, this brings fewer dollars to the United States for Philadelphia-based FMC.

In this respect, the company’s operations in Asia and the Europe Middle East (EMEA) regions have particularly been affected as depicted in the figure below.

Revenue growth drivers (www.seekingalpha.com)

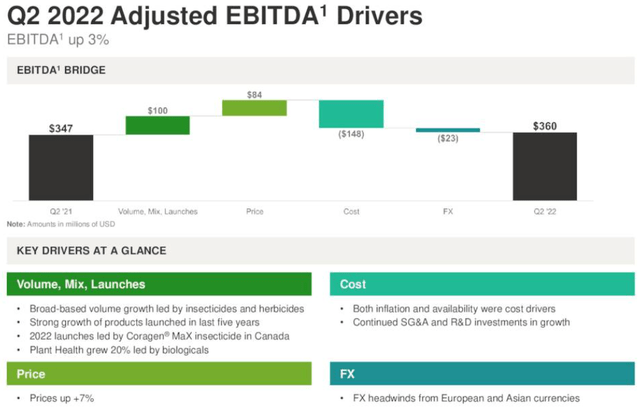

However, since overall revenues increased sharply in Q2, it means that the gains made in the American continent were able to more than offset the losses. In this respect, FMC was able to increase pricing (by 7%) to offset the effects of FX headwinds and cost inflation. Looking at profitability, the EBITDA increased by 9% signifying that the higher sales had not been achieved at the expense of margins.

Consequently, far from suffering from a fall in demand, the company saw volume gains and better pricing amid a globally robust market, and the management expects this to continue in 2023. However, market optimism and elevated commodity prices (versus their historical averages) can tempt investors to overlook the risks of investing in materials companies.

The risks and their Mitigation

First, the ability to fetch higher prices for items like wheat, corn, and soy prompts farmers to increase demand for crop protection. As a result, expect some volatility in case there is any de-escalation in the Ukrainian conflict which would basically imply an increase in supply and a fall in agricultural commodity prices. However, this appears highly improbable at this juncture.

Exploring further, FMC can mitigate the impact of a fall in commodity pricing as it benefits from advanced orders for its products well into 2023. In this respect, more favorable prices (after the July drop) have motivated some customers in Latin America to order beforehand, with 70% of this year’s orders already clinched compared to 50% normally.

On the other hand, there is also the problem of cost inflation when FMC sources raw materials from secondary and even tertiary suppliers in case the preferred ones are out of stock. Also, there is a lag (of six months) between procurement and impact on the company’s P&L.

To illustrate these risks, an example is the $200 million of raw materials being purchased from German companies whose costs of production are rising due to higher fuel prices from Russia. In case of these rises further, FMC will have to seek alternative sources from other parts of the world and pay higher prices on a temporary basis. However, talking mitigation, German sources only represent only about 7% of total purchases.

Along the same lines, FMC itself has been impacted by higher natural gas prices, namely for its major European-based Romlund manufacturing facility, but it has been able to mitigate rising energy costs by switching to diesel.

Therefore, FMC does have some leeway in passing in costs to customers, but, the ability to source from the preferred supplier together with the timing of the increase in its raw material costs (including fuel) may imply a temporary impact on profitability as the inventory exercise is carried out twice a year.

Still, as per the EBITDA drivers diagram below for Q2, the higher volumes produced together with better pricing have more than offset cost inflation and forex headwinds. This is expected throughout 2023 with strength in Latin and North America more than offsetting weakness in Asia and EMEA as I mentioned above.

EBITDA drivers (www.seekingalpha.com)

Moreover, as illustrated above by “biologicals,” the company is diversified into sustainable crop protection.

Diversification, Profitability, and Dividends

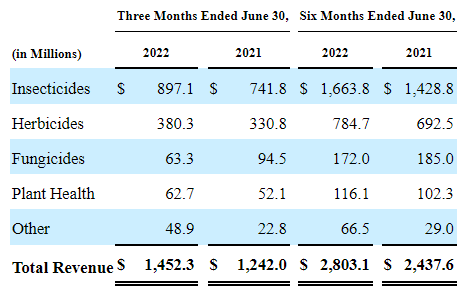

In addition to being diversified into non-agricultural markets namely through pest control products for turf management, the BioPhero acquisition which closed on July 19 should increase FMC’s ability to produce high volumes of organic pesticides. For this matter, BioPhero will operate as part of the global plant health segment which grew by 20% in Q2 on a year-over-year basis, from $52.1 million to $62.7 million as shown in the table below.

Segmental revenues (www.seekingalpha.com)

This is a small amount but is expected to rise to $1 billion by 2030 driven by BioPhero’s pheromones which FMC intends to expand the usage from specialty fruit and vegetables to large-rows crops. For investors, the agricultural pheromones market which was worth $2.9 billion in 2021 is expected to reach $6.1 billion in 2026, or expand at a CAGR of 16.1%.

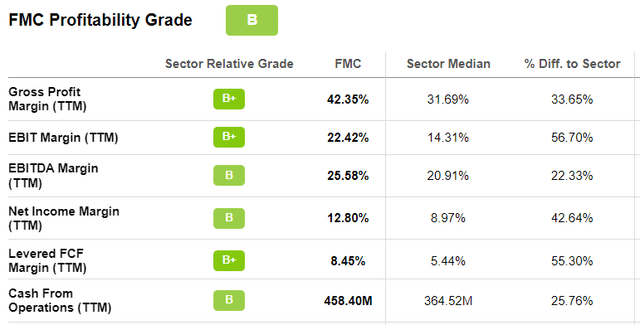

Now, one billion dollars represents one-fifth of the total revenues for 2021, but, more than the topline, BioPhero’s highly efficient pheromones manufacturing process comes at significantly reduced costs when compared to competitors’ chemical synthesis methods, signifying better profitability. In this case, the company’s ability to improve operating margins for the last five quarters has been rewarded with a higher profitability grade than the material sector median by SA.

Profitability grades (www.seekingalpha.com)

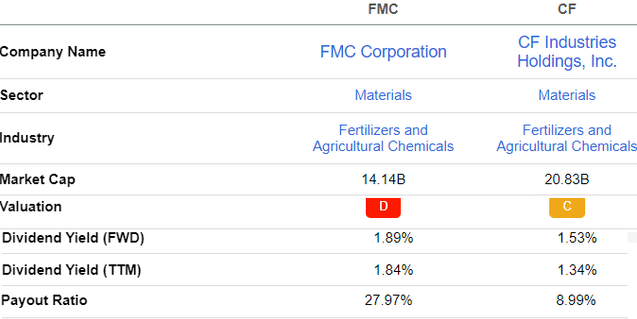

Looking further, levered free cash flow margins of 8.45% are higher than the sector median by a whopping 55% which allows the company to pay more dividends. For this purpose, the company pays better forward yields of 1.89% than CF Industries (CF) as per the table below, and it has grown dividends by 29.34% during the last five years.

Now, during H1-2022, the company paid $200 million for BioPhero and $134 million in dividends and restrained from doing any share buybacks. For the second half of 2022, FMC intends to pay $334 million as distributions to shareholders and up to $200 million in share repurchases. This shows a clear strategy to reward shareholders.

Valuations and Conclusion

Thus, FMC may not dominate the North American fertilizers market in the same way as CF or Nutrien Ltd. (NTR). Moreover, with unusually warm and dry summers in many parts of the world, bush fires spreading to farm fields are limiting arable land while other cultivable areas have been wiped out by flooding. Additionally, it may be hard for fertilizer and agricultural chemical companies to deliver on future guidance, especially after 2023. Also, commodity prices may drop next year as the wider application of crop protection results in bumper harvests thereby causing a supply glut.

In these circumstances, an investment in FMC with its clear path to increment profitability in the longer term through sustainable agriculture makes better sense compared to CF as per the comparison below. With a score of D, FMC’s valuation grades may not be favorable, but, considering momentum factors, with its share price dominating the 10-day and 50-day SMAs, the company could flirt with the $120 level. However, it is unlikely to retest the $139 level unless agricultural commodities revert back to their April high.

Comparison with a peer (www.seekingalpha.com)

Therefore, after considering the revenue growth, EBITDA drivers as well as risks, FMC is a buy. The company has a net debt-to-EBITDA ratio of 2.4x. Finally, with a forward yield of 1.89%, a payout ratio of only 28%, and management which is clearly pro-dividend, FMC is a buy for those who want to derive income from the crop protection business.

Be the first to comment