ArtistGNDphotography/E+ via Getty Images

Fluor Corp. (NYSE:FLR) is a holding company providing oil & gas and Industrial and Infrastructure services, as well as focusing on power services. Fluor is the largest Engineering & Construction company in the Fortune 500 and has a history going back nearly 115 years.

In this article, we’ll establish a solid foundational thesis for Fluor, and look at where the company might go from here on out.

Let’s see what we can expect from Fluor.

What does the company do?

The company is at its heart a holding company that owns subsidiaries as well as JVs, and through these, it’s one of the larger professional service firms around, providing EPC, fabrication, and modularization services as well as project management on a global basis. The primary areas of the company’s operations are the end markets of fuels, chemicals, LNG, nuclear services, infrastructure, advanced technologies, life sciences, mining and metals.

Fluor is also a partner to the US government, as well as foreign governments.

The company is barely BBB-rated anymore following a COVID-19 earnings collapse and currently has no dividend yield, even if forecasts call for the company dividend to resume.

Company operations are now split into four segments:

- Energy Solutions

- Urban Solutions

- Mission Solutions

- Other

The company also has Fluor Constructors International, which is organized and operates separately from the rest of the businesses, and provides unionized management and construction services across North America for Fluor-specific projects.

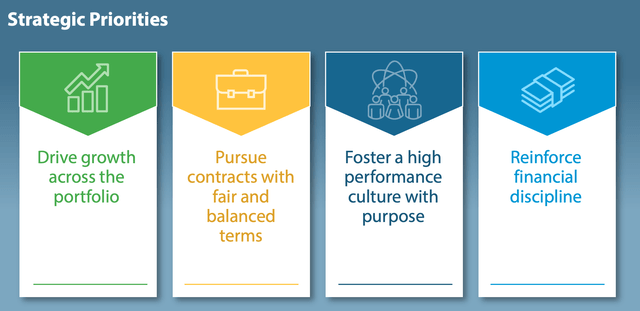

Like many construction companies, Fluor has re-focused on procurement/contract quality as opposed on volume. Emphasis is now on balanced commercial terms and risk-adjusted agreements that reward Fluor for its value.

There have been several portfolio divestments over the past year as a result of the company’s organizational shift, including the construction equipment business AMECO.

Little does this explain, however, what the company actually does. So let’s dig deeper.

It does engineering such as piping, electrical, control systems, civil, structural, and architectural design with specialized engineering solutions. It does the processing, simulation, automation, and interactive 3d-modeling. It also constructs these projects on a subcontractor basis, usually in difficult locations and circumstances, as well as project management for its operations.

It does procurement, which includes entire supply chain solutions set to increase product quality and performance, while also reducing cost and schedule. Clients draw upon company’s global sourcing and supply expertise, global purchasing power, technical knowledge, processes, systems, and experienced global resources

The company also fabricates and modularizes production, as well as offers operations and maintenance services to extend client facility lifetime.

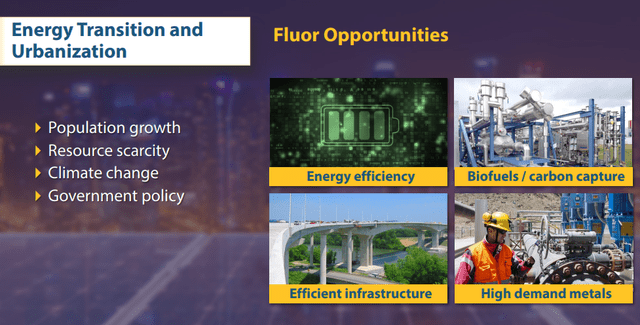

Overall, there are plenty of fundamental upsides for the company that can be considered. With Technical and medical innovation, connectivity and IoT, AI and automation and data-driven processes, this company is a major beneficiary of all of these trends – at least provided they manage to capture business. The same is true for the trends in urbanization and the energy transition.

Fluor Upside (Fluor IR)

The company’s expertise and world-class experience across multiple fields sees it having massive advantages. The overall global post-pandemic recovery is not unlikely to have the company reverse its negative earnings trend. This is a necessity following the trends during 2020-2021, which saw EPS drop to actual negative levels.

The company also cut the dividend as a result of this.

But beyond this recent 2-year trend, the reversal has a lot of appealing trends for the company. Governmental focus is expected to shift to sustainable infrastructure and the energy transition as well as commodities, which directly ties into the company’s operations and ambitions. There are strong pricing trends and signals throughout the commodities space, indicating massive upside for chemicals, mining, and other areas.

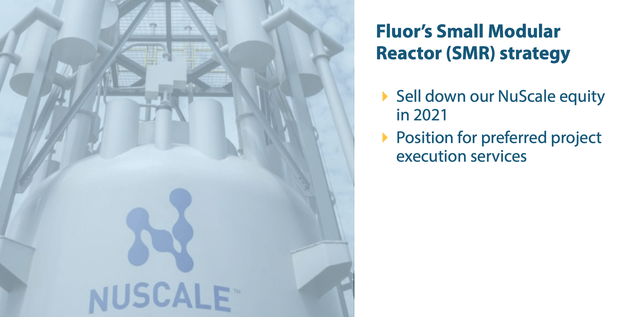

Furthermore, Fluor builds and works a lot with data centers and storage – this is yet another area that Fluor is active in. The company is also active in interesting areas with future potential, such as the construction of small, modular reactors.

Fluor Reactors (Fluor IR)

In short, the company has a lot to turn around after a number of absolutely disastrous years in terms of EPS. It’s not something that Fluor necessarily could have changed all that much given the pandemic backdrop and macro. Still, the company has set new goals, and is targeting some new strategies.

Fluor Strategic Goals (Fluor IR)

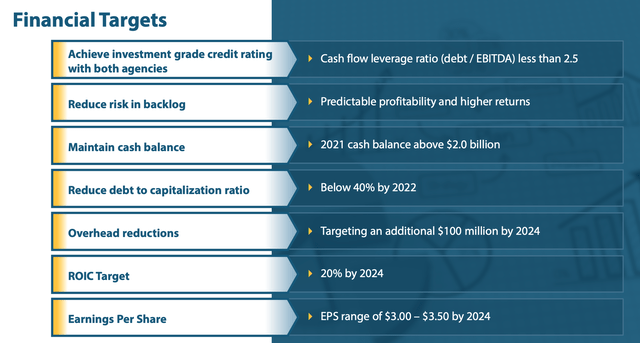

The strategic shift also marks a shift from the company’s legacy business, away from Oil & Gas to a 70%+ revenue from Non-Oil/Gas business by 2023 and onward. The company also has specific goals for better contracts, making the backlog 75%+ reimbursable by 2024 and onward. These new goals also include a substantially lower debt, at 20-40% to cap, overhead reductions, ROI improvements, and an increased overall EPS range.

What we’re seeing in Fluor is some of the same things we’re seeing in a lot of construction businesses – only in EU, most of the businesses went through these changes before the pandemic. Once this is done, in my experience investing in some Scandinavian peers, the return numbers will look excellent – especially given Fluor’s market position.

The company’s financial targets give us something to shoot for.

Fluor Financial Targets (Fluor IR)

Overall, this is a very interesting company. It has a significant upside in the case of reversal, which I would argue has already begun. Fluor is, at heart, a volatile business like most construction/engineering businesses. What is required is buying these companies at an appealing sort of valuation. If this is done, the RoR can be well over 100% over the course of several years.

My experience in this is like investing in construction businesses such as Skanska (OTCPK:SKSBF) and HOCHTIEF (OTC:HOCFF) which share some similarities to this business, though they don’t share all of this company’s business areas and specifics.

Let’s take a closer look at company valuation and see what this might lead to if you invest at this specific time.

The company’s valuation

Fluor is, without a doubt, a bit of a high-risk investment. Not because the company is in a threatened position in terms of survival, but because of the relative historical volatility this business sees.

It is better explained by showing the company’s historical trends.

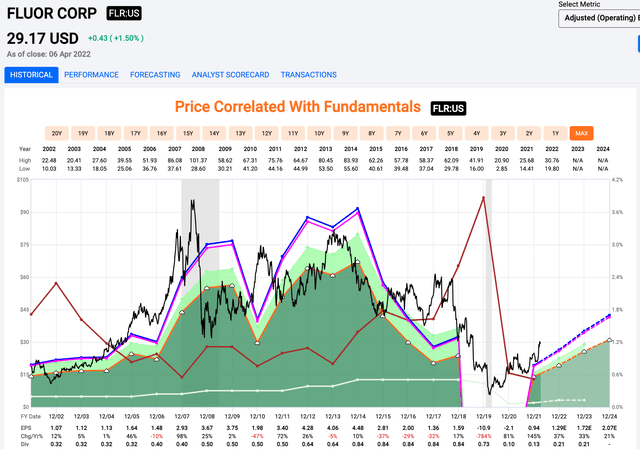

Fluor historical valuation (F.A.S.T. Graphs)

It wouldn’t be unfair or wrong to say that this company has already recovered to a level where, on a 2021-2022E EPS level, it has reached the valuation that it should be, based on historical multiples.

That doesn’t mean there isn’t an upside to the company if you were to invest today. Fluor is set to improve its results on a year-over-year basis as well as reinstate the company dividend once things completely normalize.

Still, there’s a massive amount of forecast uncertainty to the company when you look at the forecast success ratio – meaning it’s more than a 50% negative miss ratio for forecasting the company’s EPS. As you can see on the above graph, when Fluor works well, it really does perform well. When it does not, the resulting volatility can wipe out more than 70% of your portfolio value.

Investing in a business like this takes a very strong stomach and high conviction. I know these sorts of businesses as I’ve been investing in them for years.

I would say that today is a barely acceptable time to invest in Fluor, given that the company has already recovered quite a bit of the ground it lost during the pandemic.

The upside is between 20-30% here based on a forward P/E ratio of 27x, which is the company’s 5-7-year average. However, given that the company already trades at 27x today, the upside is based primarily on earnings growth. And given how low the accuracy ratio is for this, I don’t consider this a very strong case to make.

It’s possible, but the low EPS visibility and the current zero dividends make this a weak case in my book. Investing in a 27x P/E stock at this time, with this volatility, isn’t something I’d do.

S&P Global’s targets for the company are interesting – because they agree with this assessment. Usually, S&P Global targets are exuberant. In this case, they’re no higher than $25/share, which means the company is currently considered 13% overvalued. Only one out of 13 analysts have a “BUY” target on the company, with most others at “HOLD” or “Sell” recommendations.

Fluor as a company is an interesting business – and potentially a very appealing one. This is the case with most construction businesses because they provide very crucial overall services to societies, businesses, and governments as a whole. However, the share price history shows us just how up and down things can go for a company like Fluor.

Based on this company’s fundamentals and recent earnings trends, I would call Fluor a “HOLD” at a current share price of over $29/share. Despite the company’s 5-year average valuation multiple, I consider a 27x too high for comfort and given the volatility and lack of precision. I would go no higher than a 15-20x P/E multiple at the very highest. For the year 2022, a forecast EPS gives us at most a $25.9/share price target as a 20x P/E, which is where I will end up with my price target.

If the company drops below $25.90/share, then I would consider this company a “BUY” – but even then, it would only be a buy-in of what I would consider a “vacuum” – and the market isn’t in a vacuum. We always have investment options, and in this case, we have got options that are plenty more conservative and interesting.

At the current valuation, this isn’t an interesting prospect for me. That’s why I consider it a “HOLD”.

Thesis

Fluor has a similar problem to most construction and engineering companies. They’re great companies – and I do mean great companies to invest in during an upswing. The yields and RoR in these companies at this time have made me some great returns – over $30,000 in Skanska over less than 2 years, for instance.

However, when and if these companies go into the doldrums, they can stay there for several years, and once earnings crash, they can do so to negative levels and be there for several years as well. This is more or less what happened to some of those construction companies I invested in.

For now, I’m fairly tepid on this company – my PT is $25.9 and I’m at a “HOLD” here.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

This process has allowed me to triple my net worth in less than 7 years – and that is all I intend to continue doing (even if I don’t expect the same rates of return for the next few years).

If you’re interested in significantly higher returns, then I’m probably not for you. If you’re interested in 10% yields, I’m not for you either.

If you, however, want to grow your money conservatively, safely, and harvest well-covered dividends while doing so, and your timeframe is 5-30 years, then I might be for you.

Fluor is a “HOLD” here due to poor valuation.

Thank you for reading.

Be the first to comment