Petmal

Energy storage demand will likely rise big in the coming years as the U.S. and Europe seek to harness renewable power. Firms that can position themselves well stand to make big profits in the years ahead. Moreover, using AI and the latest software can further bring down costs, increasing demand for energy storage.

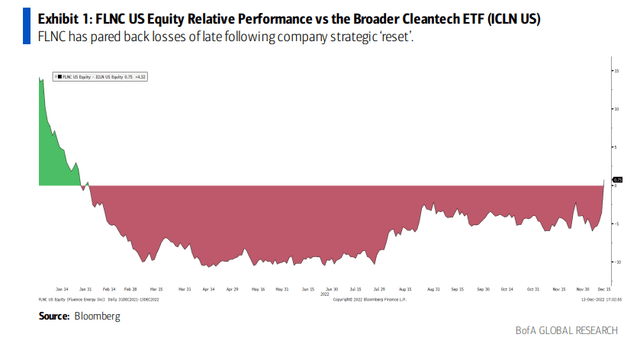

One firm has recently turned positive on a relative performance basis compared to the cleantech industry, and I spot a bullish breakout on the chart of Fluence Energy, Inc. (NASDAQ:FLNC).

FLNC Rallying Vs Its Industry

According to Bank of America Global Research, Fluence Energy was launched in January 2018 by Siemens and AES as a joint venture dedicated to innovating modern electric infrastructure. Fluence delivers energy storage products, services, and digital application packages, as well as an artificial intelligence-enabled IQ platform to optimize renewable and third-party storage assets.

The Virgina-based $3.8 billion market cap Electrical Equipment industry company within the Industrial sector has negative trailing 12-month GAAP earnings and does not pay a dividend, according to The Wall Street Journal. Earlier this week, the company issued a small earnings miss, but beat top-line estimates. Net sales notched a fresh record high, which was music to the bulls’ ears. Shares soared after the results crossed the wires. In September, Goldman Sachs upgraded the stock’s price target from $15 to $19. It’s all about energy storage with Fluence, and the market is positive, but tailwinds from the Build Back Better plan are subsiding. FLNC has its work cut out for it if the firm is to effectively expand its footprint.

Upside potential stems from demand strength following government programs and if the management team can execute on its software offering. Downside risks include a slower-than-expected margin expansion and an ongoing fire investigation that could lead to damages.

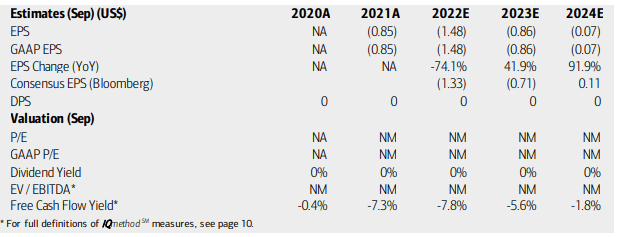

On valuation, analysts at BofA see earnings getting closer to the flat line by 2024, but per-share losses are expected through next year at the very least. The Bloomberg consensus forecast is a bit more sanguine, though. Without earnings, there is no P/E, but we can look to the stock price-to-sales ratio which is high at 3.5, but not excessive given the company’s position in a scarce market. Overall, I don’t like negative profits, and free cash flow is weak, but I see this as a technical play. Read on.

Fluence: Earnings, Valuation, Free Cash Flow Forecasts

BofA Global Research

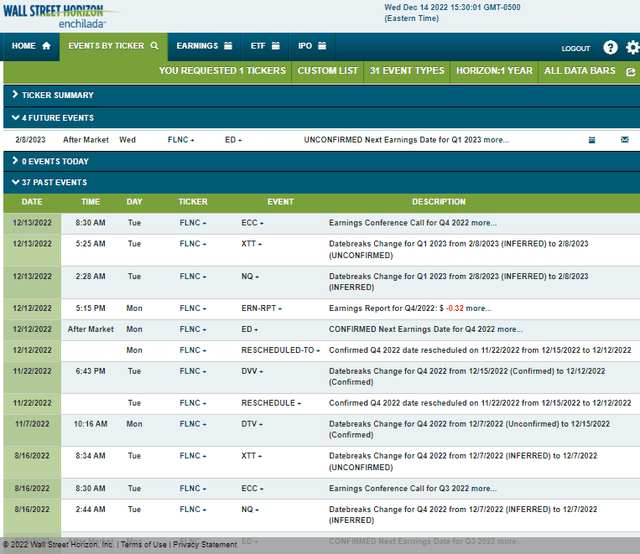

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q1 2023 earnings date of Wednesday, February 8. The calendar is light aside from that earnings date.

Corporate Event Calendar

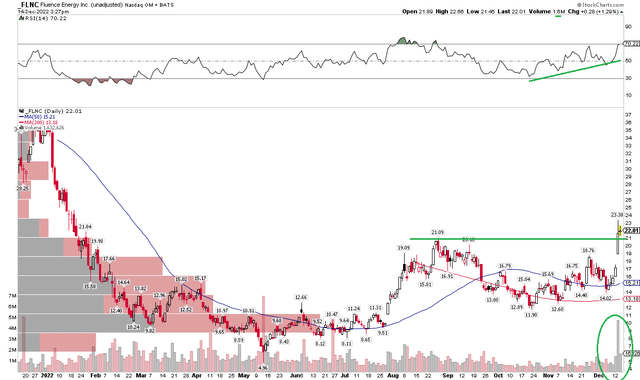

The Technical Take

Here’s where things get interesting with Fluence. The stock has rallied above its August peak near $21 with plenty of open space above where shares trade right now. Also, notice how there was a big volume spike on this move. While the Industrial sector wavers somewhat, FLNC is up six sessions in a row. If we were to pull back the chart to November 2021, we’d see a low after the stock began trading on the market near $28 – I see resistance there and traders should target that spot to take profits.

The technical situation is also interesting in that both the 50-day and 200-day moving averages are now positively sloped, which cannot be said for many cyclical stocks currently. On the downside, I spot a gap near $17 that could be a risk. Overall, though, the stock is a technical buy above $21.

FLNC: Shares Breakout On Big Volume

The Bottom Line

Traders should like what they see with FLNC. While the firm is not yet profitable, earnings could turn positive in 2024 and free cash flow appears to be in the black by then too. With relative strength and a bullish technical move, I think the stock can continue toward $28.

Be the first to comment