Morsa Images

Fiverr International Ltd. (NYSE:FVRR) was one of the big pandemic winners in 2021, but things have gotten pretty ugly over the last year.

FVRR shares traded as high as $325 in 2021, but now are down nearly 90% to around $35 at the moment.

I missed the Fiverr train when pandemic lockdowns forced professionals to take on additional freelancing work to keep the lights on.

However, now many companies are forcing employees to return to the office or else.

Right now, work-from-home stocks aren’t very popular, but that’s exactly when investors should get greedy.

In this article, I’ll talk about Fiverr’s recent performance and why I think it’s an excellent buy and hold for the next 10 years.

Fiverr Business Update

A lot has changed about Fiverr since I published my previous FVRR article in March 2021.

Investors are betting against Fiverr because growth has slowed down and due to an overall bearish market outlook.

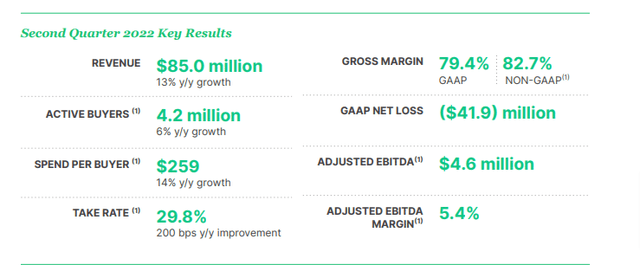

In Q2 2022, Fiverr hit $85 million in revenue (Up 13% YoY) and suffered net losses of -$2.9 million.

Fiverr Q2 results (fiverr.com)

The good news is that active buyers increased to 4.2 million (Up 6% YoY) and active buyer spend reached $259 (Up 14% YoY).

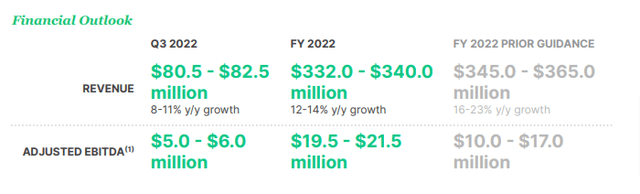

Fiverr reduced its FY 2022 guidance to adjust for slowing revenue growth.

Fiverr FY 2022 Guidance (fiverr.com)

It looks like Fiverr needs to focus on increasing average spend per buyer, because I don’t think it’s easy to grow overall active buyers during these difficult economic times.

Fiverr Q 2022 Spend Per Buyer (fiverr.com)

The company finished Q2 2022 with $417 million in cash and marketable securities on its balance sheet along with $462 million in long term debt.

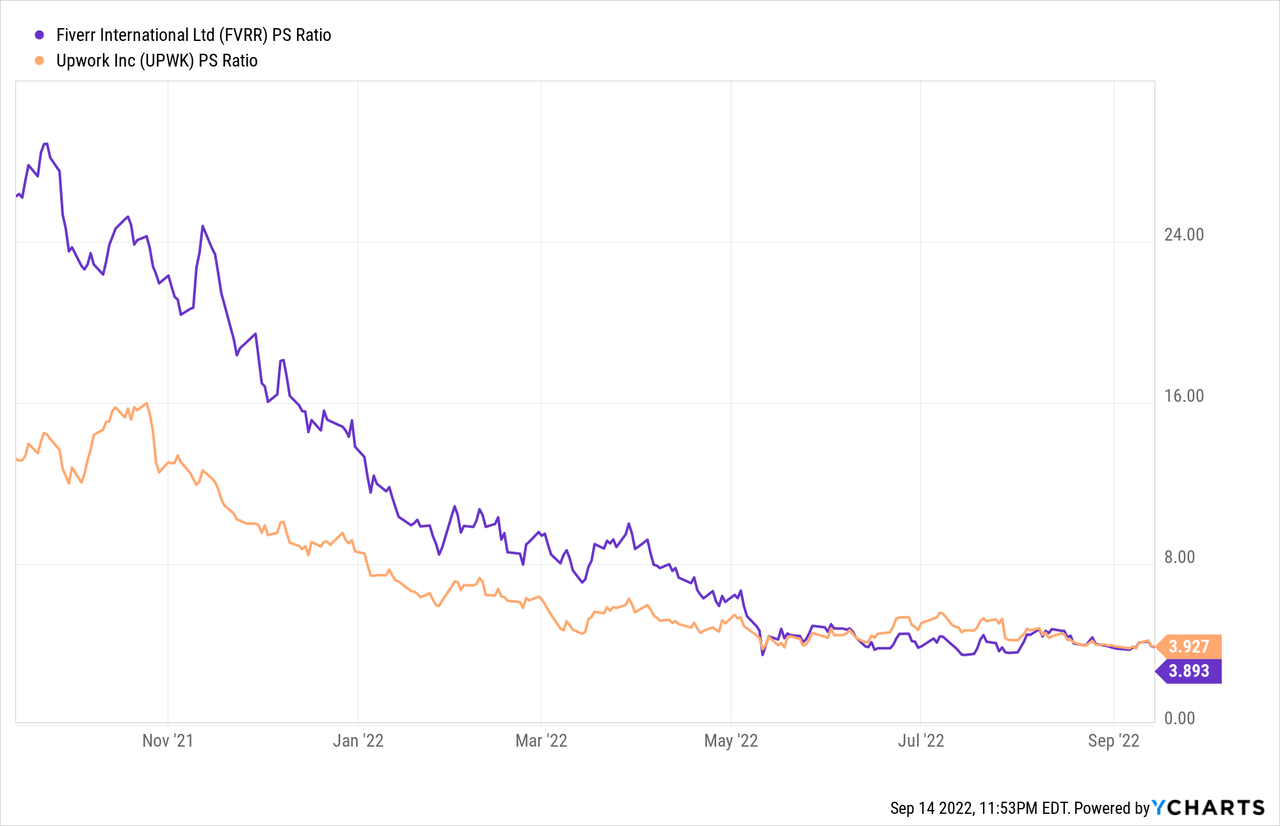

Fiverr and its biggest competitor, Upwork (UPWK), both trade at a P/S ratio of just under 4.

What will happen to Fiverr stock next? I’m bullish on the overall freelance economy, which is a great sign for Fiverr longs.

The Gig Economy Will Continue to Grow

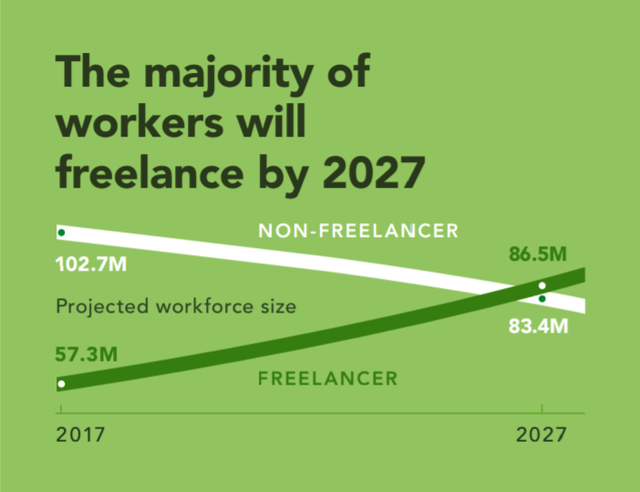

According to Flexiple, the global freelance economy is expected to reach $455 billion in 2023. By 2027, freelancers could make up the majority of the U.S. workforce.

US Workforce Freelancing Statistics by 2027 (weforum.org)

Freelancing is a great option for both small businesses and large corporations to find capable talent on a flexible schedule.

Fiverr is well-positioned in a growing market, plus earns a lot of trust by being one of the few publicly traded freelancing companies along with Upwork.

My Opinion on FVRR Stock

I personally use Fiverr as a buyer and seller for my web publishing business. You can find excellent writers and designers for great prices on the platform.

This is a great example of investing something you know because many online publishers use Fiverr for a ton of Internet tasks.

But how much will the freelance gig economy grow moving forward?

The pandemic boom is mostly over as people remove their masks and return to the office.

Is the party over for Fiverr? I wouldn’t expect a huge runup in FVRR stock anytime soon, but FVRR could be a wonderful buy and hold stock for the next 10 years.

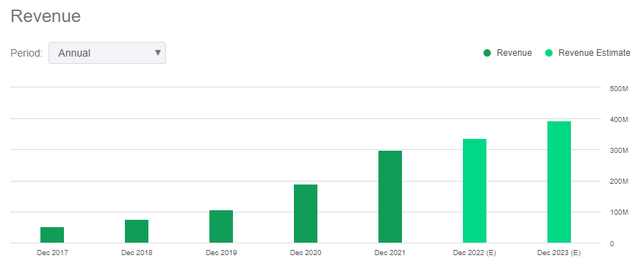

Fiverr’s revenue growth remains steady YoY and could reach $393 million by 2023.

Fiverr Annual Revenue Projections (seekingalpha.com)

If we use a conservative 20% revenue growth rate for the next 10 years, then Fiverr could hit $1.8 billion in annual revenue by 2032.

That’s more than Fiverr’s current market cap of $1.3 billion at the moment.

FVRR won’t soar to the moon in the short run like some of the more exciting tech stocks, but it’s a wonderful slow-and-steady buy and hold stock for the next 10 years in my opinion.

Risk Factors

Fiverr’s biggest competitor is Upwork, and I know many companies that source 100% of their talent from Upwork’s large pool of working professionals.

Fiverr must address several risk factors moving forward, including:

- Loss of top talent to Upwork’s freelancing platform

- Higher net losses moving forward if active buyer growth stalls out

- Failure to attract the top professionals to its platform in the future

- The slowing of the freelance gig economy if employees choose a stable monthly wage over the variable freelancing salary

- Short sellers are betting against the stock and the current 16% short interest could grow larger and send FVRR much lower in price.

Conclusion

Fiverr is good buy and hold stock for long term investors. The company is one of the best in the freelance gig economy and trades under a $2 billion market cap.

If you can hold FVRR for around 10 years or so, then investors can make some huge gains before the rest of the market takes notice.

FVRR isn’t the most exciting stock to own, but sometimes boring is better for your portfolio.

Be the first to comment