Victoria Gnatiuk

Investment Thesis

Fiverr (NYSE:FVRR) is down more than 90% from its peak. Shareholders that backed the gig platform as a high-growth marketplace are likely to be reeling and more likely than not, not wanting anything further to do with the company.

Yet Fiverr isn’t alone. Nearly all the market darlings from the Covid period are today down 40%, 50%, and often down more than 70%.

The big question mark hanging over Fiverr is, will it be able to carve out a high enough profit margin to support its current valuation?

And while I’m inclined to believe that’s possible, I prefer to wait to have stronger evidence that this is indeed the case.

The Bear Market Will End

During the bear market, it’s not so much that investors cannot understand that something has value. It’s that investors’ expectations and capital have been mowed down so much through consistent bear market rallies that few investors have any hope left.

If two years ago, investors were all clamoring loudly that they were ”buy-and-hold forever” investors, today’s investors’ mood is ”ask first and invest later” (if at all).

Fiverr’s Near-Term Prospects

The problem for Fiverr is that its revenue growth rates have so significantly decelerated.

This time last year, when Fiverr reported its Q3 2021 results, its revenue growth rates were up 42% y/y. That’s the sort of growth rate that gets investors’ pulses positively tingling.

Today, investors are bracing themselves for around 10% CAGR for Q3 2022. That’s a huge difference in revenue growth rates, over a twelve-month period.

What’s more, I believe that investors are now questioning whether it’s likely that Fiverr’s revenue growth rate estimates will have to be further downwards revised in the coming months.

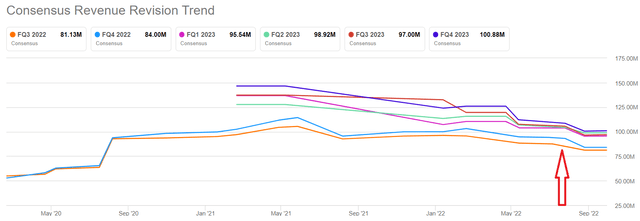

The red arrow points to when the macro environment started to substantially deteriorate.

And as you can see, analysts have not materially brought down Fiverr’s revenue estimates for the next few quarters. Even though we’ve had a lot of inputs from a wide range of companies, from AMD (AMD), Nike (NKE), and FedEx (FDX), as well as banks too. Today we are not in a favorable business environment.

Next, we’ll turn our focus to Fiverr’s profit margins.

Positive Cash Flows, But is it Enough?

There’s no question that businesses that are already cash flow positive will have a lot more options available to them, compared with other marketplaces that are still attempting to figure out how to make their businesses cash flow positive.

With that in mind, it’s clearly a positive consideration for Fiverr’s shareholders that Fiverr is already reporting a positive cash flow profile. But is breakeven cash flows enough?

And I don’t suspect it is. Today this is a buyer’s market. And investors can be very discerning over where they deploy capital into.

FVRR Stock Valuation – 3x Next Year’s Revenues

The biggest problem facing Fiverr is that its shareholder base has had to change. Investors that were previously invested in Fiverr were ”high growth” investors, and were positively entranced with this rapidly growing gig marketplace.

Today’s investors are likely bottom-fishing investors, looking to buy at the bottom, for a quick return, but by definition have little to no faith in the long-term viability of its business model.

So, it could be said that the stock presently finds itself in no man’s land, with it being too expensive for the value tribe, which wouldn’t pay more than 20x earnings for a business growing at 10% CAGR, and growing too slowly for the high growth crew.

The Bottom Line

As investors, we are all primed to understand with our heads that stocks go down as well as up. But the distance from our heads to our stomachs can feel very long at times, particularly during bear markets.

Fiverr was supposed to be a secular high-growth company. But as it transpires, Fiverr turned out to be a lot more cyclical than investors previously expected.

The only question that remains outstanding is can Fiverr’s business model carve out a path for high-profit margins to sustain its $1 billion market cap?

And while I’m hopeful that this is the case, I’m still opting to wait and see to be sure.

Be the first to comment