piranka

Introduction

We believe that Five9, Inc. (NASDAQ:FIVN) is a strong business that can deliver consistent growth for investors in the cloud/SaaS segment. Five9 is likely to be a continued beneficiary of the digitization of global enterprises and increased business spending, and we believe the company is well protected against adverse macroeconomic conditions due to its high customer retention rates and strong financials.

Five9 Overview

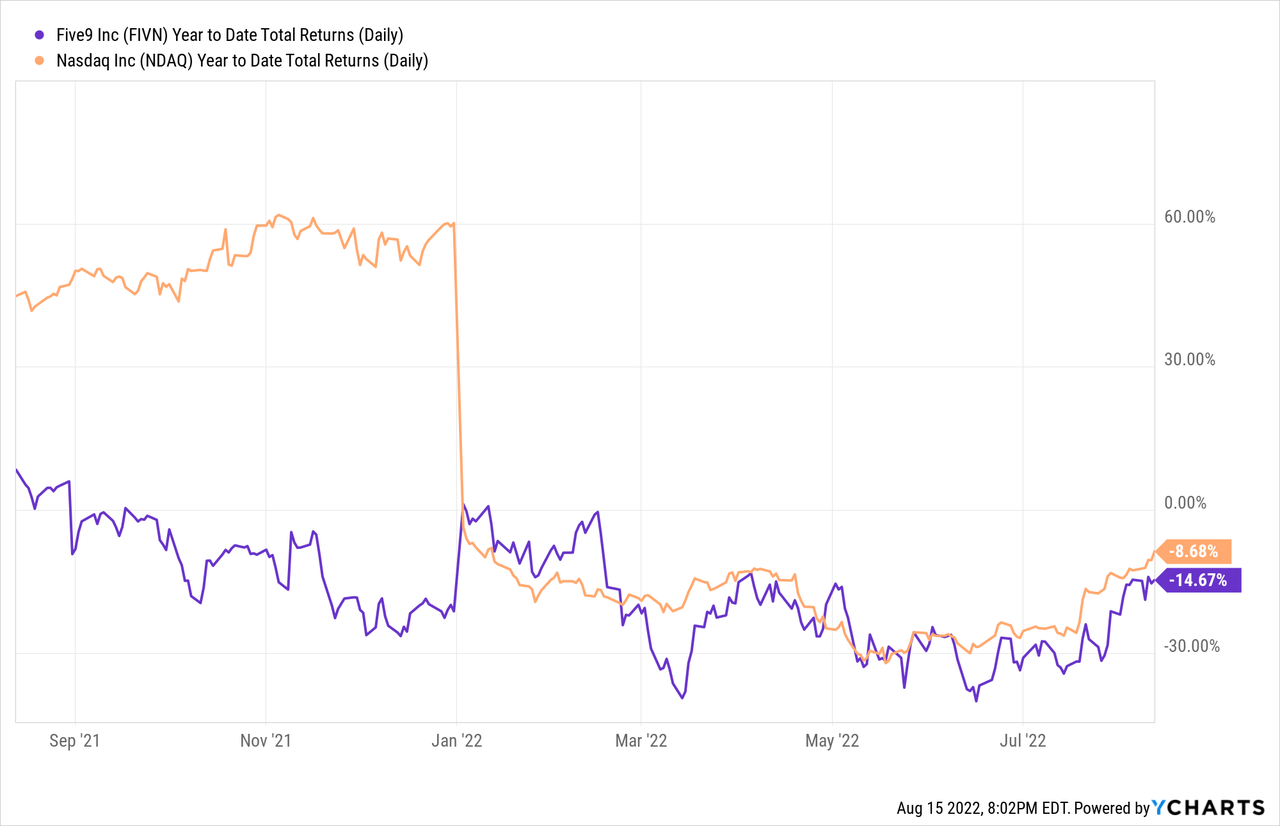

Five9 is a cloud contact center software enterprise company that offers B2B services that enhance call centers/customer service departments for various businesses. Five9 has largely tracked the performance of the NASDAQ Index since the beginning of the year and is down 14.67% Year-to-Date (YTD). The company has recently reported outstanding results, and we believe that now is the right time to initiate a position on this stock given its strong business outlook, and based on our DCF valuation model.

Strong Q2 2022 Earnings Results From Five9

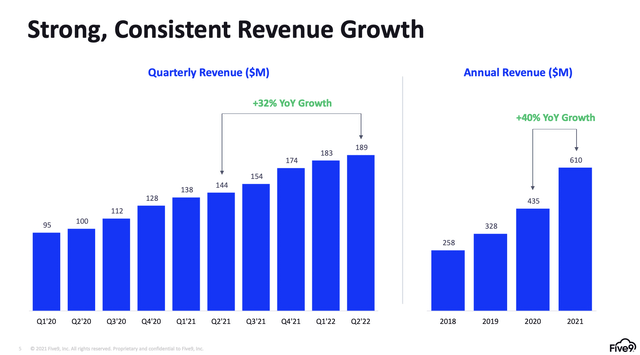

Five9, Inc. reported its Q2 2022 quarterly earnings in late July, and investors saw stellar financial results despite the difficult macroeconomic backdrop. Five9 beat both EPS and revenue estimates, and provided a higher FY guidance than analysts expected. Management reported a 32% YoY Growth in quarterly revenue and guided a range of $1.38 to $1.40 in EPS on revenue of $780.5 million to $782.5 million. As one can see in the chart below, Five9 has delivered consistent top-line growth, and even shows an acceleration in revenue growth from 2020 to 2021.

Five9, Inc. Earnings Presentation

Outstanding Customer Retention

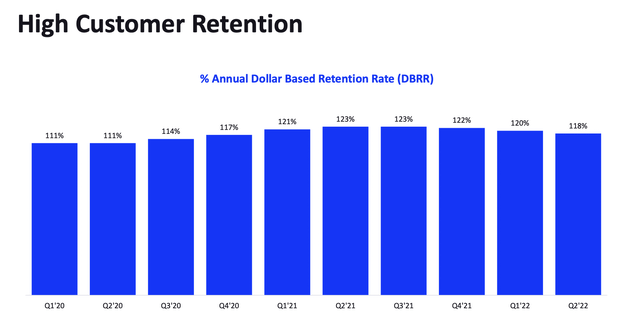

In addition to strong financial results, Five9 has been able to consistently retain its customers at a high level, which shows the immense value proposition of its business. The high retention also lends support to the notion that the company’s products and services are valued by customers, and this should in theory mean the company should have high pricing power. As seen below, the company has reported a high Annual Dollar Based Retention Rate with minimal variance. In addition, the company reports that 91% of its quarterly revenue is recurring as a % of Total Revenue, and this number has stayed largely the same since the beginning of 2020. The high percentage of its revenue coming as recurring revenue should be good news to investors, as it provides a floor for financial performance and provides a concrete baseline for the company’s bottom line.

Five9, Inc. Earnings Presentation

Secular Growth Tailwinds

Five9, Inc. has been a beneficiary of the increased digitization of the economy and strong adoption by businesses to invest in their customer service networks. This digitization will continue to propel the business forward, and as companies look for ways to increase their competitive advantage, they will naturally look to leverage services offered by Five9 to increase customer satisfaction and improve customer service operations. For example, a recent report has found that 9 out of 10 call centers are seeking to improve the agent/employee experience and that a large percentage are looking to find technical solutions for these problems.

AI technologies are now part of the overall contact center arsenal, providing assistance to agents, customers, and contact center operations… By embracing collaborative intelligence, where AI and agents work together to enhance each other’s strengths, organizations can improve both customer and agent satisfaction, leading to better business outcomes” – Scott Kolman, Senior Vice President of Marketing at Five9, Inc.

FIVN Stock Valuation

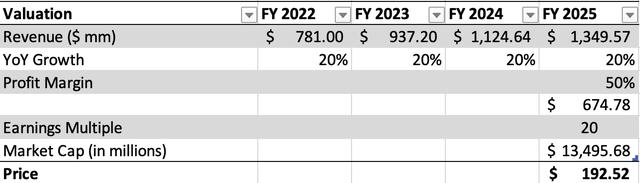

We use the company’s strong top-line growth as the basis for our valuation exercise. As mentioned before, the company has reported strong YoY revenue growth to the tune of ~32%. We believe that this trend is likely to continue as businesses continue to adapt to the changes brought about by the pandemic and invest in technologies to equip their customer service environment. We believe that using a conservative ~20% revenue growth estimation for the next 3 years, and a reasonable net profit margin of 50% (Five9’s gross margin stands at 63.5% and SaaS gross margin is ~80%), we see that the stock will trade around at a $192.52 per share. This valuation assumes DSO (Daily Shares Outstanding) to be constant and for the stock to trade at around ~20x P/E multiple. This presents a ~66% upside, and we believe that the stock can go even higher over time as profit margin expands with scale and revenue continue to grow.

Five9, Inc. Valuation Model

Risks to Thesis

We believe the main risk to the thesis is if the macroeconomic environment were to worsen as a result of higher-than-expected inflation and a higher interest rate environment. We would like to note that such a circumstance would likely drive the valuation lower and affect the company’s financial capacity by tightening its access to liquidity and ability to raise capital. However, the company has roughly $558.8 million in cash, which is more than double the equity value of the company. Given that the company has a lot of cash on hand and is highly profitable (~64% adjusted gross margin), we believe that the company is well positioned to endure any further deterioration in the macroeconomic environment.

Conclusion

Five9, Inc. is a unique investment proposition for investors who want to buy a growth name that can consistently grow its top line and is well protected against macroeconomic risks. Five9 is an investment that can deliver consistent revenue growth that is also stable given the high customer retention rate and its strong recurring revenue model. Based on our assumptions, we find that the company can grow its earnings and be valued at $192.52 per share in a matter of 3 years. We believe that investors will be rewarded in a medium-term timeframe.

Be the first to comment