Marti157900

A few months ago, I launched coverage of FirstCash Holdings Inc. (NASDAQ:FCFS) with a bullish article. My main bullish thesis is that the countercyclical pawn business is primed to outperform during the current economic tough times.

While I continue to like FirstCash’s countercyclical pawn business, I am increasingly worried about a pending recession and its impact on the cyclical POS LTO business. After a quick 20% gain on my bullish call, I am recommending investors take profits and look for opportunities elsewhere.

Brief Company Overview

For those not familiar with FirstCash Holdings Inc., the company is the largest operator of pawn stores in the U.S. and Latin America, with over 2,800 retail locations. FirstCash also operates a retail point-of-sale (“POS”) payments solution that provide lease-to-own (“LTO”) loans to credit constrained consumers.

Unlike other forms of consumer lending such as payday loans, the credit risk with pawn loans are very low, as the loan receivables are fully collateralized at a fraction of the collateral’s market value.

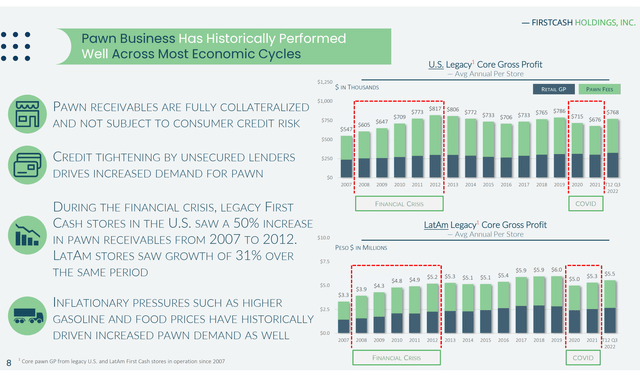

Historically, utilization of pawn services tend to be countercyclical, as financially stretched consumers increase their use of alternative credit solutions like pawn loans during tough economic conditions. In fact, U.S. FirstCash stores saw a 50% increase in pawn receivables during the 2008 financial crisis (Figure 1).

Figure 1 – Pawn stores are countercyclical (FCFS Investor Presentation)

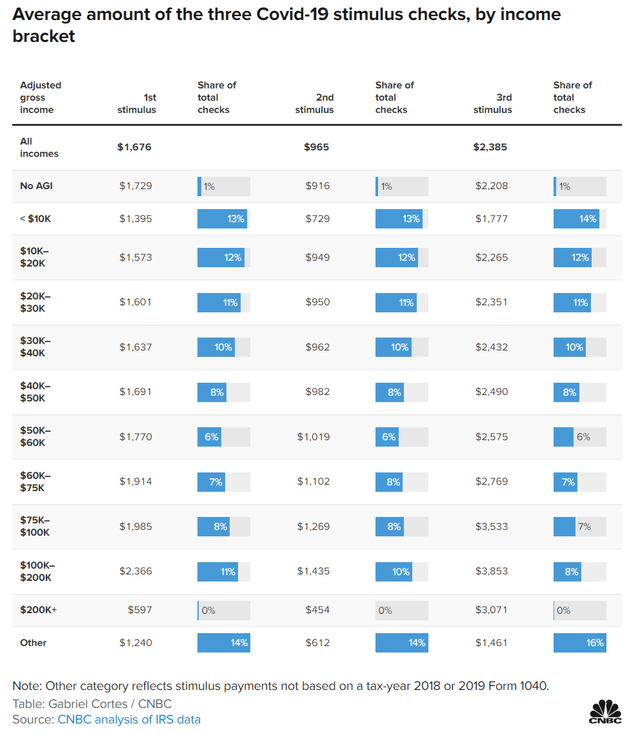

The 2020 COVID-pandemic was an unusual economic downturn as pawn receivables actually declined for FirstCash. This was likely because government stimulus checks were issued to help financially stretched consumers, often in excess of their monthly incomes. For example, according to a recent CNBC article reviewing lessons from the COVID stimulus, we can see that those earning less than $10,000 in adjusted gross income received over $3,900 from the 3 rounds of COVID stimulus, or more than 39% of their gross income. Similarly, those earning $10-20k received almost $4,800 in COVID-stimulus (Figure 2).

Figure 2 – COVID stimulus checks (CNBC)

However, with government stimulus mostly ended and inflation eating into stretched household budgets, pawn store utilization has been ratcheting higher in the past few quarters.

Excellent Q3 Results Confirm Thesis

Figures reported by FirstCash in their latest quarterly results have certainly confirmed my bullish thesis on the pawn business. Consolidated revenues in Q3/2022 grew 68% YoY to $672 million and adj. EPS grew 55% YoY to $1.30, handily beating Wall Street estimates of $1.17 / share.

In my opinion, the highlight of the quarterly release was management’s outlook for 2022 and beyond with respect to the pawn business. In management’s own words:

Cash fundings to customers (new pawns and direct purchases of merchandise from customers) in both the U.S. and Latin America remain exceptionally robust, with October fundings above comparative pre-pandemic levels in 2019 and continued double-digit growth in same-store pawn receivables over last year.

– FirstCash Q3/2022 Press Release

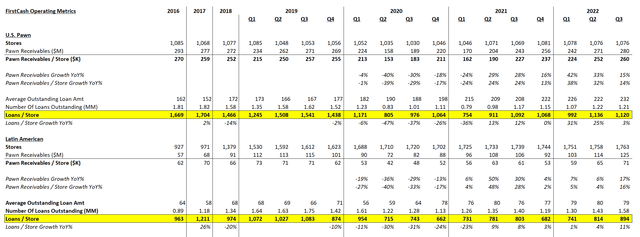

Looking at the details, we can see that U.S. pawn loan receivables grew 15% YoY to $280 million, surpassing the level in Q3/2019. Similarly, within the Latin American segment, pawn receivables grew 17% YoY to a record $125 million (Figure 3).

Figure 3 – FirstCash pawn operating metrics (Author created with data from company press releases)

Importantly, I believe there is still a lot of scope for growth in pawn loan receivables in the coming quarters, as the volume of loans is still low compared to historical figures.

For example, in the U.S. segment, if we look at additional operating metrics the company provides in its press releases, we can see the average loan amount in Q3/2022 was $232, vs. $167 in Q3/2019. This means that the total number of loans outstanding in Q3/2022 was 1.2 million ($280 million in receivables divided by $232), a decrease of 25% vs. 1.6 million loans in Q3/2019.

On a per store basis, the average store only had 1,120 loans outstanding in Q3/2022 vs. over 1,500 loans in Q3/2019 and over 1,700 loans at the peak in 2017. Similarly, in the Latin American segment, per store number of loans was 894 in Q3/2022 vs. 1,083 in Q3/2019 and over 1,200 at the peak in 2017. Therefore, there is still a lot of room for FirstCash to make more pawn loans, provided it has the balance sheet capacity to extend them.

Amended Revolving Credit Facility Supports Additional Growth

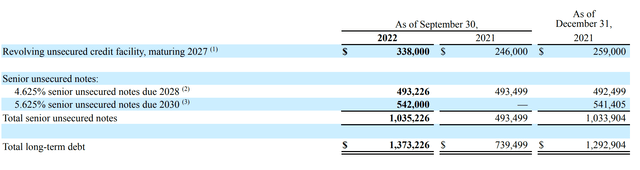

To address balance sheet capacity, FirstCash amended its revolving credit facility in late August, increasing the size from $500 million to $590 million with an additional $200 million accordion feature.

This new credit facility should give FirstCash more than enough runway to grow its loan receivables in the coming quarters, as only $338 million was used as of September 30, 2022 (Figure 4).

Figure 4 – FirstCash amended credit facility (FCFS Q3/2022 10Q Report)

POS LTO Profitable So Far…

One of the key risks I highlighted in my prior article was the America First Finance (“AFF”) POS LTO payments business that FirstCash acquired in December 2021 for $1.17 billion. So far, management’s commentary suggest the LTO business continues to perform well despite the economic headwinds.

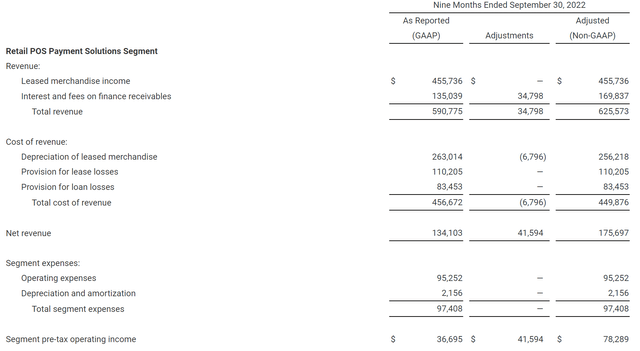

AFF continued to grow market share in the LTO space, with approximately 8,600 active retail and e-commerce merchant partners as of Q3/2022, a 40% YoY increase. Adj. operating income for the segment totaled $28 million in Q3/2022, and $78 million YTD.

Provision for loan and lease losses accounted for approximately 31% of adjusted revenues, highlighting just how risky the customers are (Figure 5).

Figure 5 – FirstCash AFF segmented financials (FCFS Q3/2022 Press Release)

… But Will It Continue To Be In A Recession?

While LTO and pawn both serve the same credit constrained customer, the two businesses have subtle but important differences in operations and credit management. As mentioned above, the pawn business tends to have very low credit losses, as loan receivables are fully collateralized and the pawn store only lends a fraction of the market value of the merchandise. The customer also brings the merchandise to the store, so operationally it is very efficient.

On the other hand, the LTO business lends on the retail value of the merchandise. Although the LTO lease payments are priced to take into consideration high potential loan losses (over 30% according to AFF’s financials), the actual loss ratio is variable and can be influenced by the economy. Furthermore, customers tend to keep the merchandise in their homes (a major category for LTO is furniture and big box items like TVs), and repossessing the merchandise in the event of a default can be troublesome.

Traditional LTO players like Aaron’s (AAN) and Rent-A-Center (RCII) have extensive store networks such that when customers fail to pay, the merchandise can be repossessed and placed back into circulation quickly. While AFF allow customers to return merchandise to FirstCash’s pawn stores, it is unclear how successful this will be if economic conditions worsen and payment defaults spike. A small footprint pawn store is probably not designed to handle large pieces of furniture or appliances.

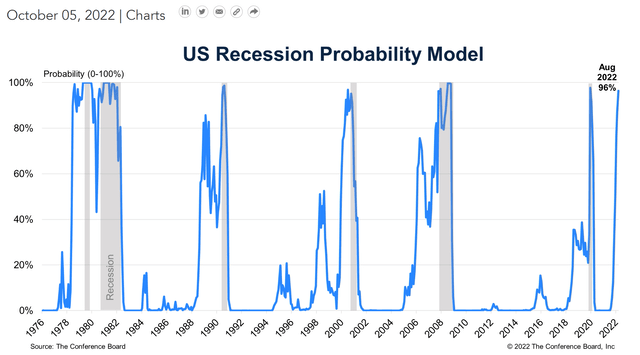

Finally, AFF was only started in 2013, so the business model of POS LTO has never been tested in a real recession. Unfortunately, according to the Conference Board and other economic forecasters, a U.S. recession is virtually a lock in the next 12 months (Figure 6).

Figure 6 – U.S. recession probability at 96% (Conference Board)

Technicals Suggest A Pause

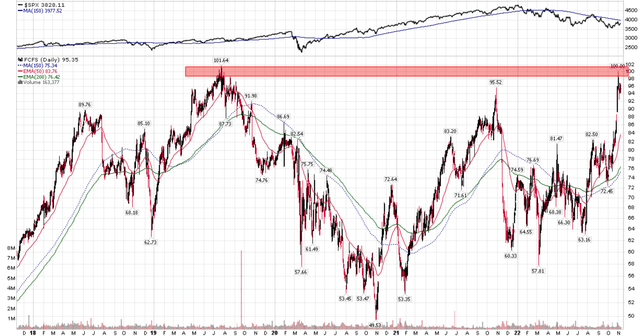

Technically, after rallying aggressively post the strong Q3/2022 earnings report, FirstCash has reached resistance near 2019 highs that will take time to overcome. I would not be surprised if the stock consolidates here for a few weeks at least (Figure 7).

Figure 7 – FCFS stalling at resistance (Author created with price chart from stockcharts.com)

The next important catalyst for FCFS is Q4/2022 earnings that is not expected until early 2023.

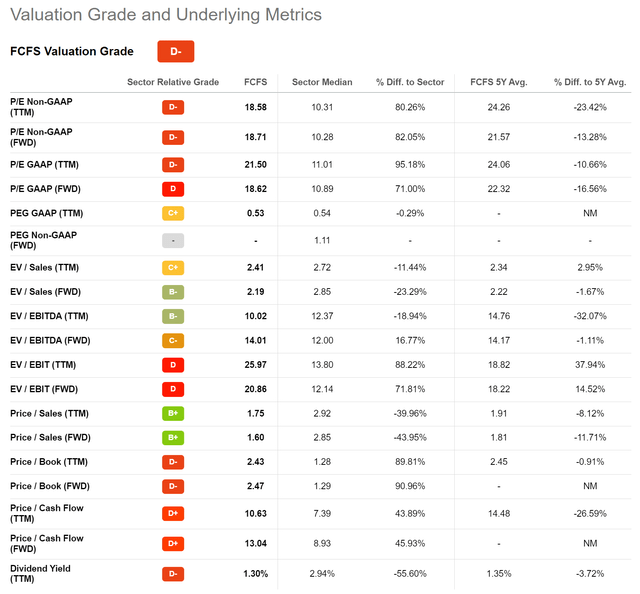

Valuations Even More Stretched

After the recent rally, FirstCash’s valuation has gotten even more extended relative to the financials sector. FCFS is now trading at 18.7x Fwd P/E vs. 10.3x for the sector. As a reminder, the valuation was only 16.1x when I wrote my initiation article a few months ago (Figure 8).

Figure 8 – FCFS valuation even more stretched (Seeking Alpha)

Conclusion

While I continue to like FirstCash’s countercyclical pawn business, I am increasingly worried about a pending recession and its impact on the cyclical POS LTO business. After a quick 20% gain on my bullish call, with valuations even more stretched, I am recommending investors take profits and look for opportunities elsewhere.

Be the first to comment