Elena Perova/iStock via Getty Images

A Quick Take On First Watch Restaurant Group

First Watch Restaurant Group, Inc. (NASDAQ:FWRG) went public in September 2021, raising approximately $170 million in gross proceeds from an IPO that was priced at $18.00 per share.

The firm operates a network of breakfast and lunch restaurants in the United States.

While FWRG’s recent performance and forward guidance increase have been encouraging, the effects of continued cost rises coupled with a weakening economy make me cautious on the stock.

I’m therefore on Hold for FWRG in the near term.

First Watch Overview

Bradenton, Florida-based First Watch Restaurant Group was founded to develop corporate-owned and franchised restaurants aimed at casual diners for breakfast, brunch and lunch meals.

Management is headed by President and CEO, Christopher Tomasso, who has been with the firm since 2006 and has served the company in a variety of functions.

The firm sources customers through its 449 retail locations, drive-by traffic and through online and offline media advertising and promotion.

It also has a small but growing number of franchise-owned locations.

First Watch’s Market & Competition

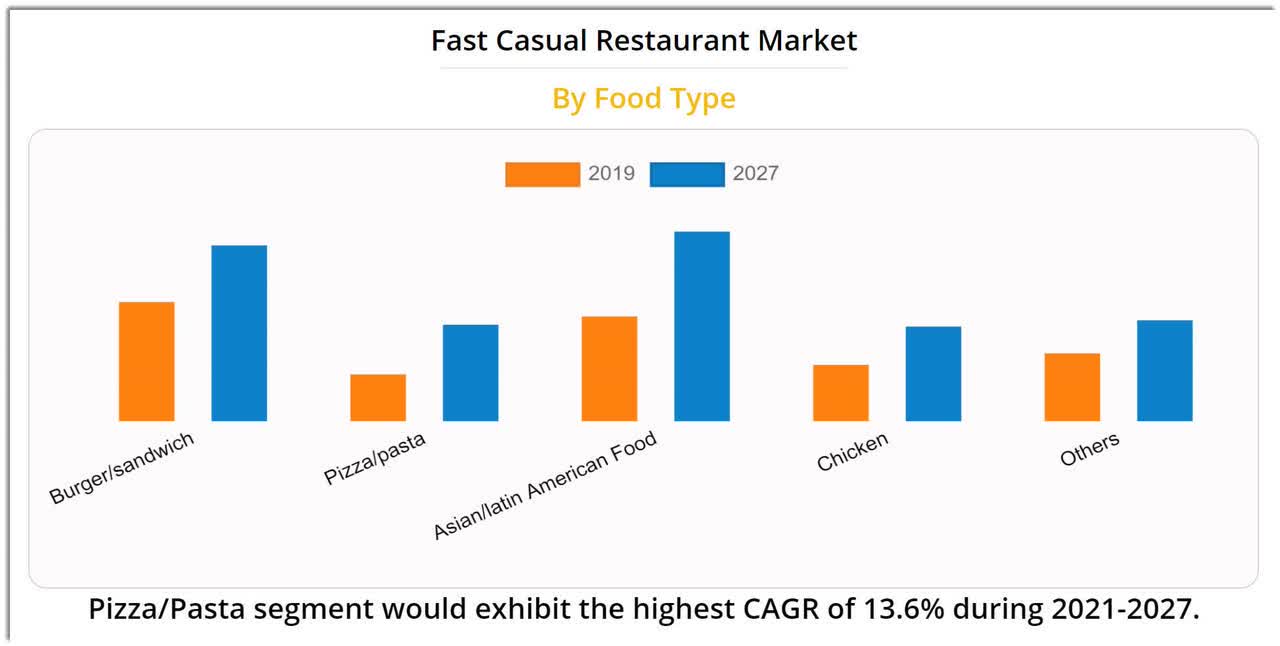

According to a 2020 market research report by Allied Market Research, the global fast-casual restaurant market was an estimated $125.6 billion in 2019 and is forecast to exceed $209 billion by 2027.

This represents a forecast CAGR of 10.6% from 2021 to 2027. Obviously, the COVID-19 pandemic has negatively affected this growth trajectory as many restaurants have been forced to close their dining rooms and only offer takeout service, reducing their operations accordingly.

The main drivers for this expected growth in the future are expected to include improved operational efficiency and greater potential volume due to beefed-up online purchasing and delivery options necessitated by the pandemic.

Also, below is a chart showing the projected growth dynamics by food type:

Fast Casual Market (Allied Market Research)

The firm competes with all manner of restaurants, including other casual dining restaurants, fast food restaurants, independent dining establishments and cook-at-home.

First Watch’s Recent Financial Performance

-

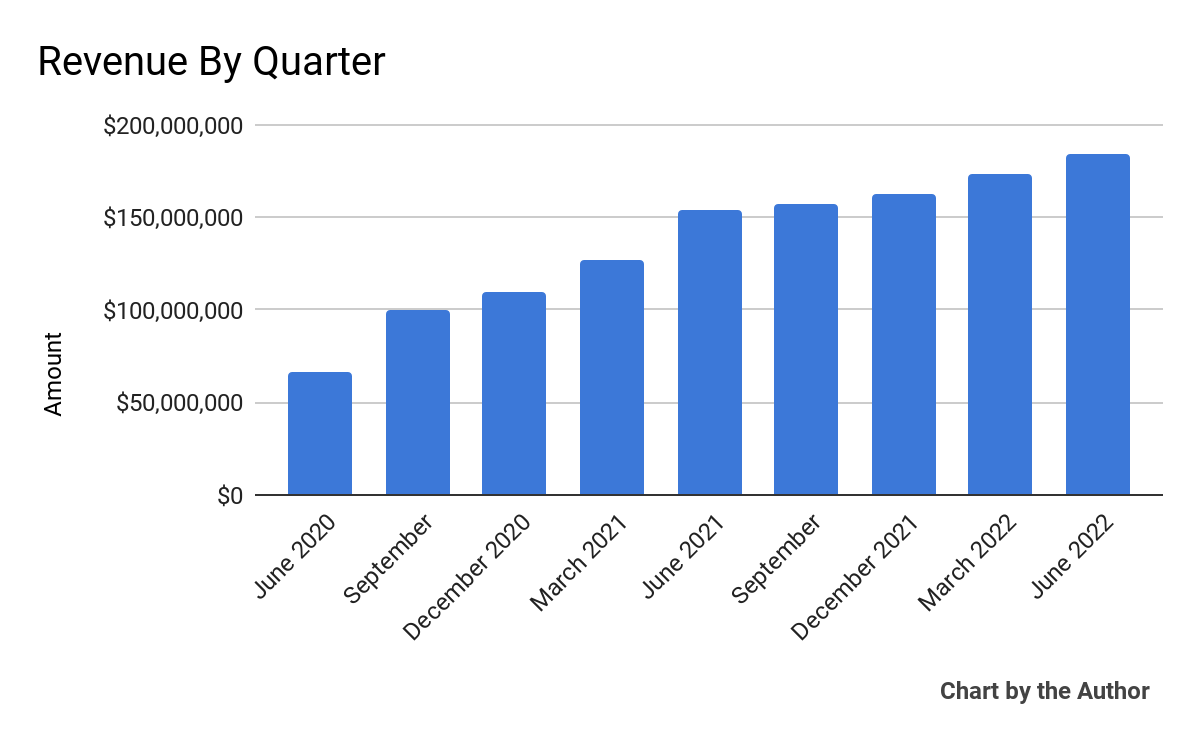

Total revenue by quarter has grown as follows:

9 Quarter Total Revenue (Seeking Alpha)

-

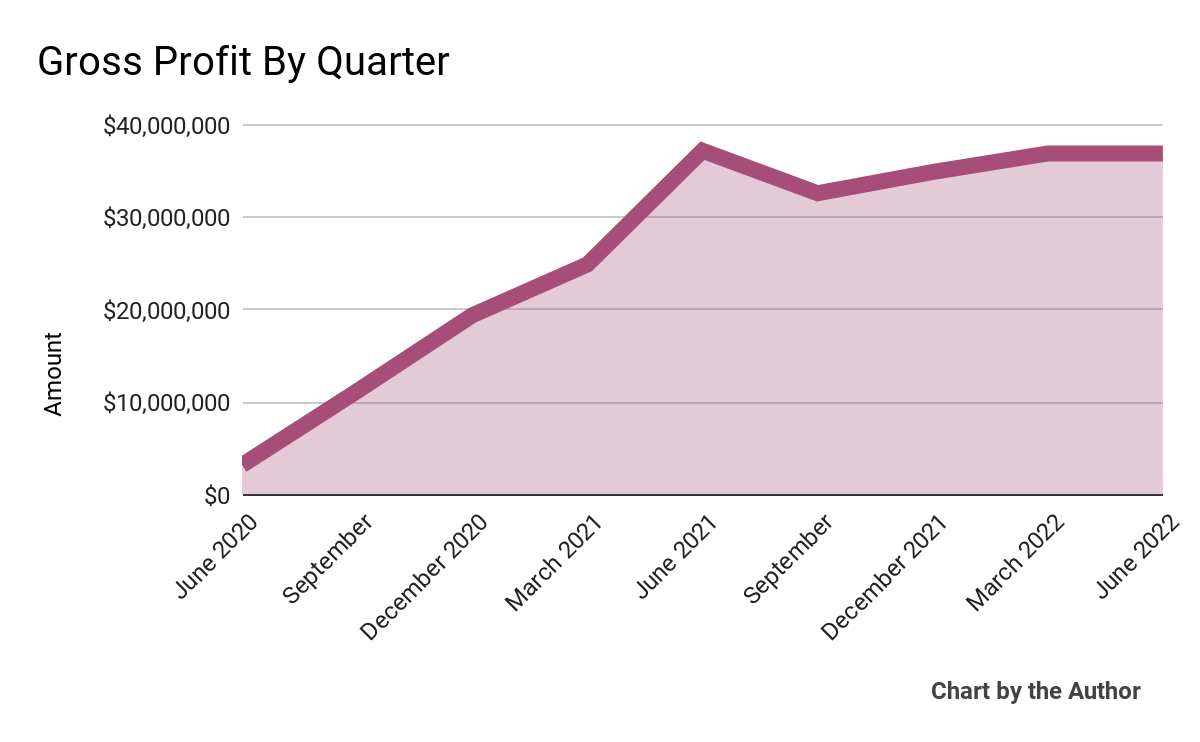

Gross profit by quarter has followed generally a similar trajectory as total revenue:

9 Quarter Gross Profit (Seeking Alpha)

-

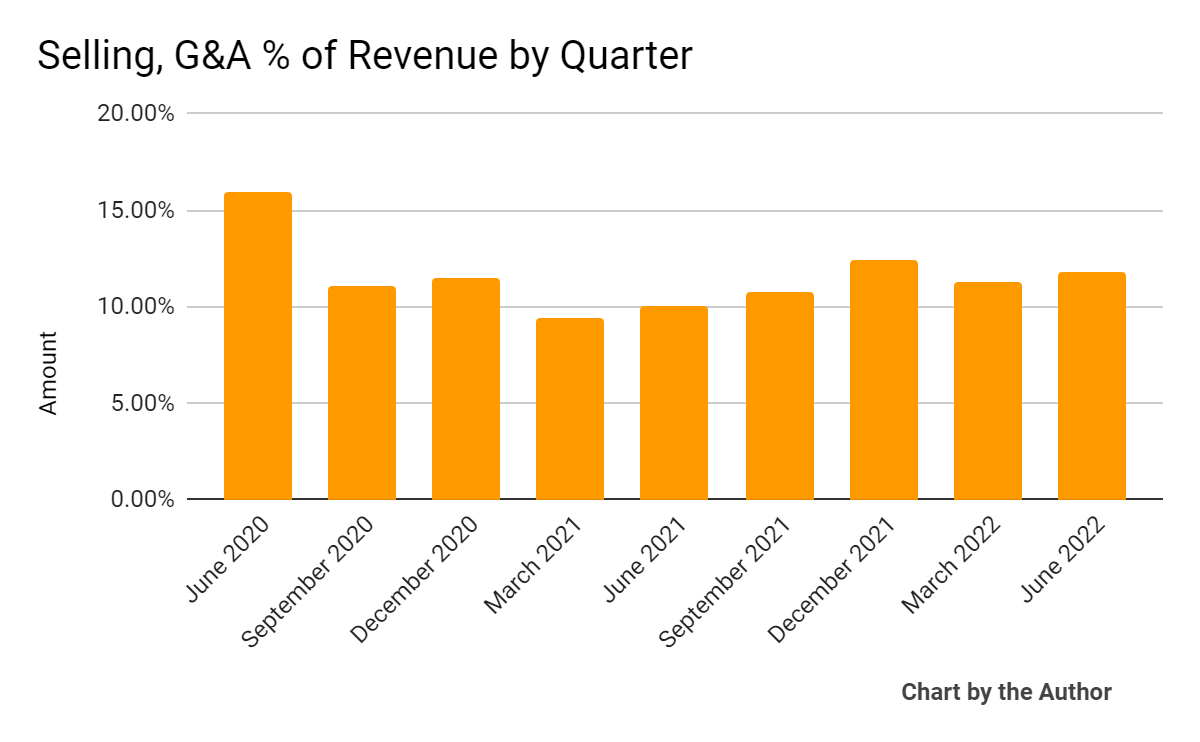

Selling, G&A expenses as a percentage of total revenue by quarter have risen in recent quarters:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

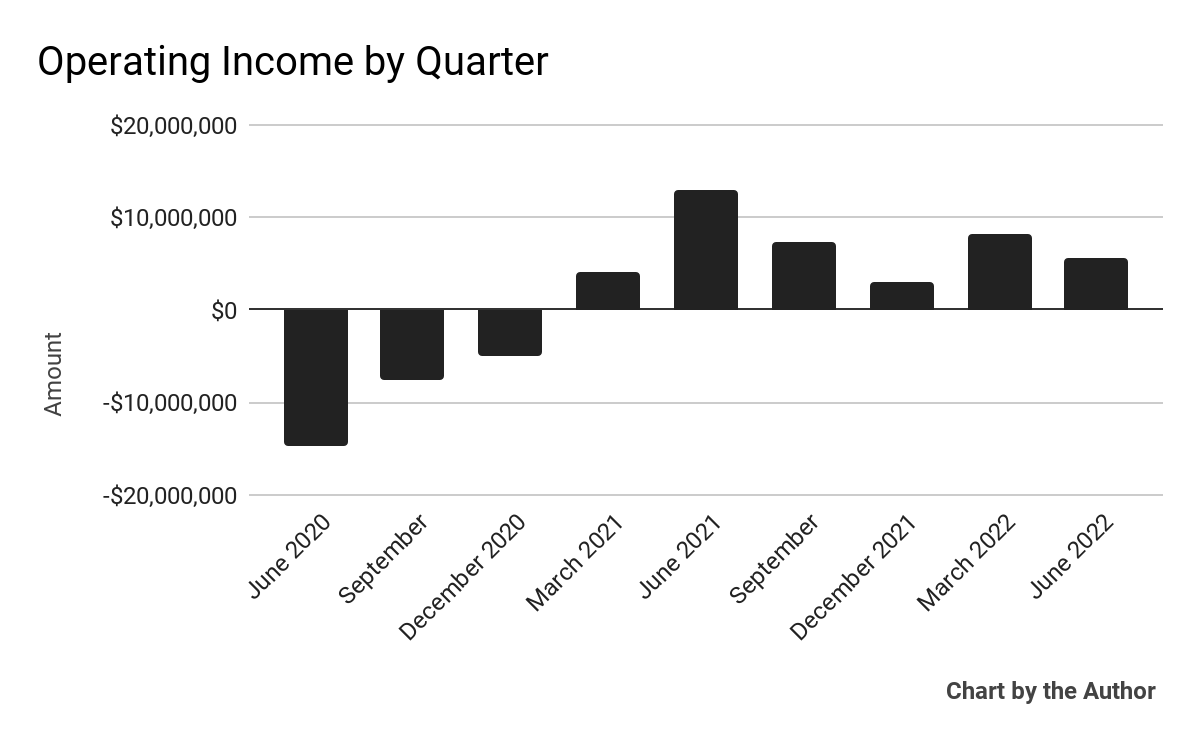

Operating income by quarter has remained positive in the last six quarters:

9 Quarter Operating Income (Seeking Alpha)

-

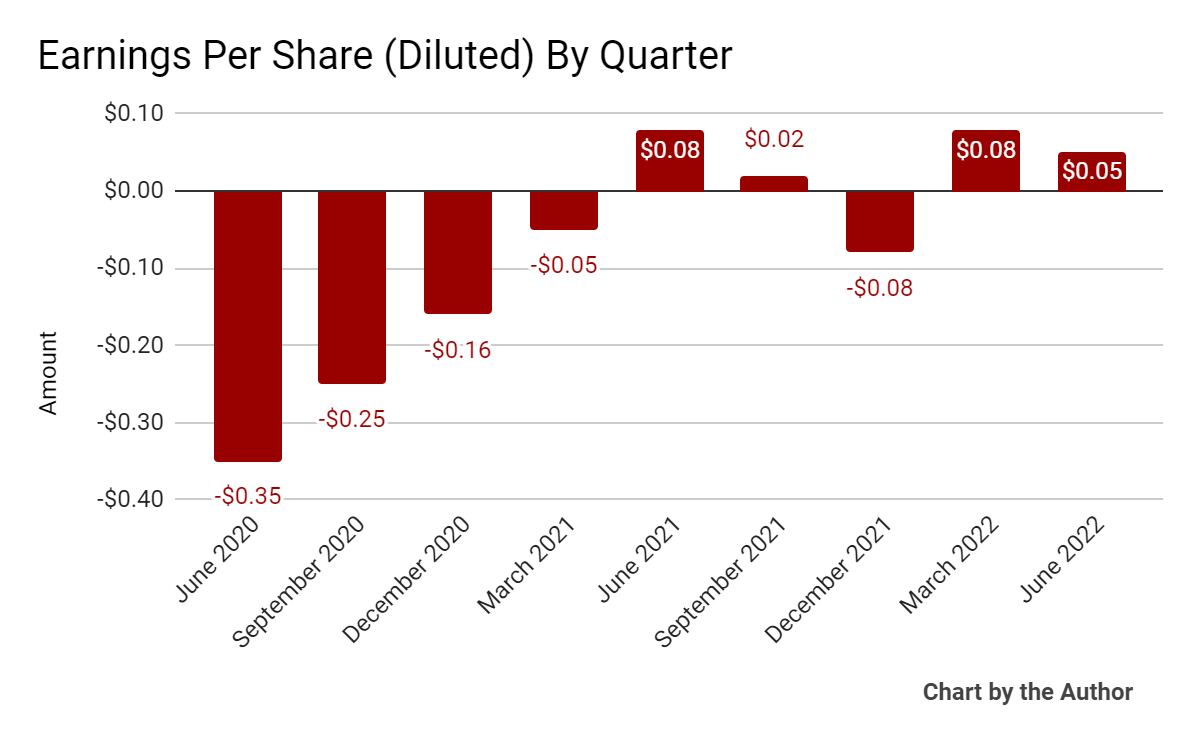

Earnings per share (Diluted) have been positive in four of the last five quarters:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP.)

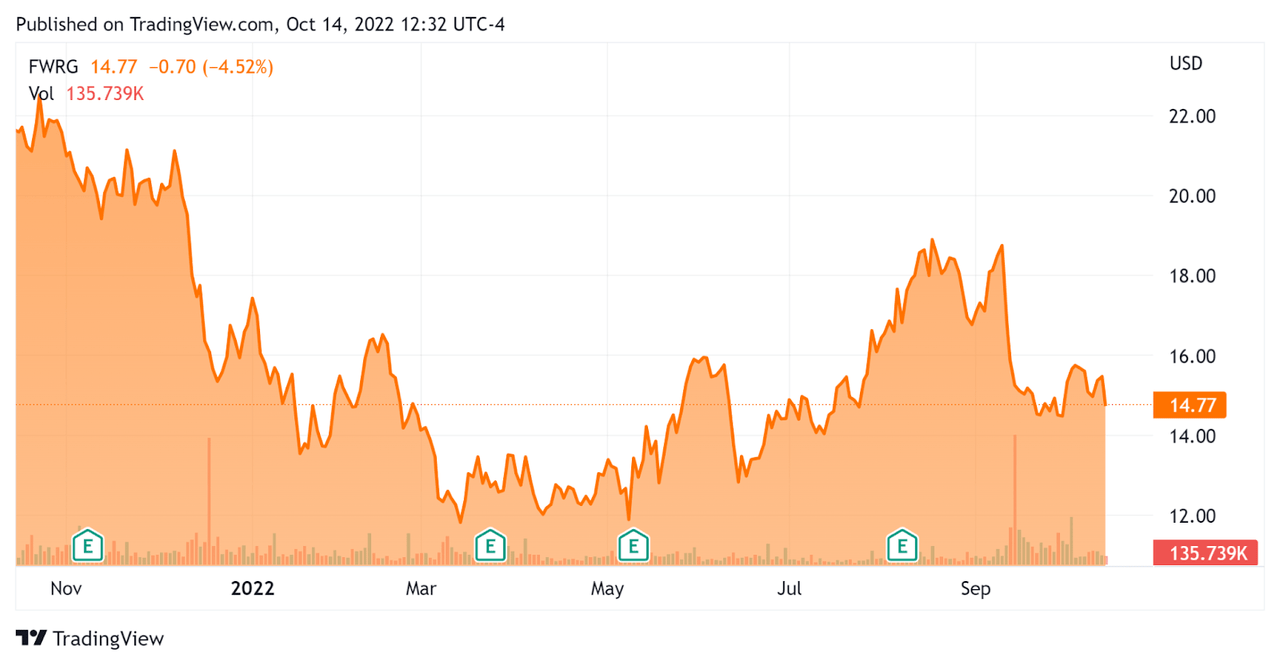

Since its IPO, FWRG’s stock price has fallen 30.9% vs. the U.S. S&P 500 Index’s drop of around 18.7%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For First Watch Restaurant Group

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure (TTM) |

Amount |

|

Enterprise Value/Sales |

1.95 |

|

Revenue Growth Rate |

38.2% |

|

Net Income Margin |

0.5% |

|

GAAP EBITDA % |

8.5% |

|

Market Capitalization |

$884,430,000 |

|

Enterprise Value |

$1,320,000,000 |

|

Operating Cash Flow |

$64,360,000 |

|

Earnings Per Share (Fully Diluted) |

$0.07 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Dine Brands Global, Inc. (DIN); shown below is a comparison of their primary valuation metrics:

|

Metric |

Dine Brands |

First Watch Rest. Group |

Variance |

|

Enterprise Value/Sales |

2.77 |

1.95 |

-29.6% |

|

Revenue Growth Rate |

14.3% |

38.2% |

166.8% |

|

Net Income Margin |

9.9% |

0.5% |

-94.8% |

|

Operating Cash Flow |

$119,700,000 |

$64,360,000 |

-46.2% |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

Commentary On First Watch

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted its 8.1% same-restaurant traffic growth.

While the company has seen food price inflation, leadership believes it has peaked and expects ‘costs to normalize moving forward.’

Notably, the company appears to have sufficient hourly and managerial staffing and has seen an ‘uptick in applications’ recently.

As to its financial results, revenue rose 19.8% year-over-year, with 13.4% same-restaurant sales growth not including the 46 new restaurants added to its network during the last year.

Franchise revenue remains small, at only $2.8 million for the quarter.

Cost of commodity inflation was a hefty 17.7%, with labor inflation at around 9% in line with expectations.

For the balance sheet, the firm ended the quarter with $53.6 million in cash and equivalents and $96.1 million in long-term debt.

Over the trailing twelve months, free cash flow was $21.7 million while the company spent $42.7 million on capital expenditures.

Looking ahead, management raised its same-restaurant sales growth from high-single-digit percentage to 14% at the midpoint of the new range, a positive signal.

Adjusted EBITDA expectations rose $2 million to $71 million at the midpoint. The firm paid stock-based compensation of $13.4 million in the past 12 months which is typically removed from “adjusted” figures, so non-adjusted EBITDA would likely be closer to $57.6 million.

Regarding valuation, the stock is currently being valued at a lower EV/Revenue multiple than partial competitor Dine Brands, despite growing at a much higher rate of growth. However, its net income margin is paltry in comparison to that of DIN.

That may be due to the recent pricing of a secondary offering of its stock by selling shareholders, with the stock dropping immediately prior to the pricing of the offering.

The primary risk to the company’s outlook is continued cost inflation and related consumer price increase fatigue, potentially coinciding with an economic slowdown and rising cost of capital environment with recent interest rate hikes in the U.S.

While FWRG’s recent performance and forward guidance increase have been encouraging, the effects of continued cost rises coupled with a weakening economy make me cautious on the stock.

I’m therefore on Hold for FWRG in the near term.

Be the first to comment