gchapel

It’s been a rough 18-month stretch for the Silver Miners Index (SIL), and especially First Majestic (NYSE:AG), which has seen a 70% drawdown from its 2021 highs. The magnitude of this drawdown should not surprise investors, given that the stock never belonged above $15.00 in the first place, let alone above $20.00 during its one-day spike. Normally, a pullback of this magnitude would leave the valuation near distressed levels, but First Majestic continues to trade at a significant premium to net asset value, making it un-investable at current levels.

Fortunately, First Majestic didn’t sit on its hands with a rising share price. In fact, it used its expensive currency to complete a major acquisition and diversify into the #1 ranked mining jurisdiction – Nevada. To date, its bet hasn’t paid off due to being in the investment phase and being impacted by weaker gold prices. Still, Jerritt Canyon has the infrastructure and scale from a property-wide exploration standpoint to thrive in a $1,900/oz+ gold price environment if the company grows high-grade reserves. Let’s take a closer look at its recent results below:

Jerritt Canyon Operations (Company Presentation)

Q3 Production

First Majestic Silver released its Q3 production results last week, reporting quarterly production of ~2.74 million ounces of silver and ~67,100 ounces of gold, or ~8.8 million silver-equivalent ounces [SEOs]. This translated to a 17% decline in silver production, offset by a 23% increase in gold production. The company saw lower silver production due to lower grades at La Encantada and a shift to a more gold-weighted operation at Santa Elena: Ermitano. Unfortunately, the increase in gold production at Ermitano from its extremely high gold grades (6.61 grams per tonne gold) was partially offset by a weaker quarter at Jerritt Canyon, impacted by two weeks of annual scheduled maintenance for its dual roasters, which similarly impacted the Q3 2021 results.

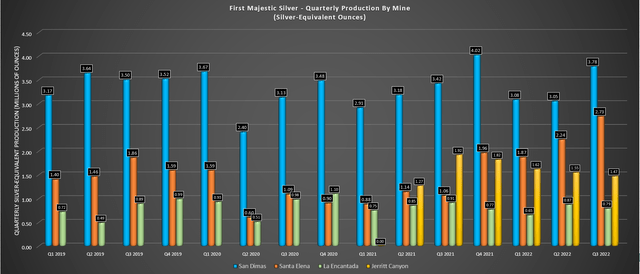

First Majestic Silver – Quarterly Production by Mine (Company Filings, Author’s Chart)

As the chart above shows, we can see that the stand-out performer in the quarter was clearly Santa Elena, where production hit a new record of ~2.73 million SEOs, up over 150% year-over-year and 22% on a sequential basis. Meanwhile, San Dimas also had a solid quarter, with higher gold grades offsetting the lower throughput vs. Q3 2021 levels (~185,100 vs. ~214,200). Finally, La Encantada saw lower throughput and lower grades, but this didn’t move the needle much due to this being First Majestic’s smallest operation by a wide margin. Meanwhile, Jerritt Canyon produced ~16,300 ounces at its US operations, down 37% year-over-year.

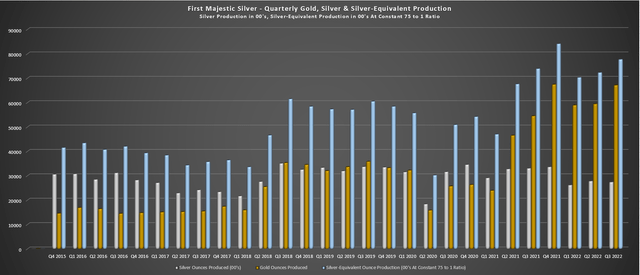

First Majestic – Gold & Silver Production & Constant Ratio SEO Production (Company Filings, Author’s Chart)

First Majestic noted in its prepared remarks that this was a record quarter from an SEO standpoint (~8,800 SEOs), but this was due to the favorable movement of the gold/silver ratio in the period. The chart above shows the company’s SEO production on a constant 75 to 1 gold/silver ratio basis. As we can see, SEO production did not hit record levels on this metric, but it was still a very solid quarter. That said, the company likely would have come very close to a new record on a constant ratio basis if not for the two-week maintenance at Jerritt Canyon. As it stands, First Majestic is tracking slightly behind its FY2022 guidance mid-point, having produced ~23.7 million SEOs vs. a ~33.6 million SEO mid-point.

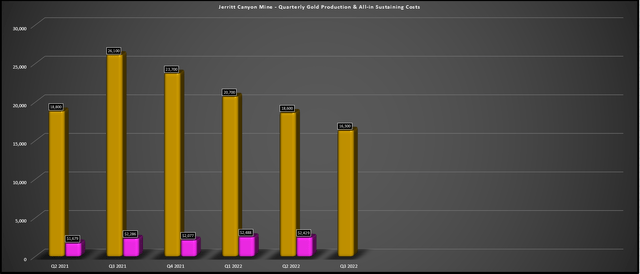

Jerritt Canyon Mine – Production & Costs (Company Filings, Author’s Chart)

Looking at Jerritt Canyon in closer detail, we can see that the operation saw its fourth consecutive decline in production, and production is sitting nearly 40% lower than Q3 2021 levels. This is related to grades and much lower throughput in the period, with ~181,100 tonnes processed at 3.41 grams per tonne of gold, down from ~230,400 tonnes at 4.19 grams per tonne of gold in the year-ago period. However, First Majestic noted that it expects much higher throughput going forward, benefiting from increased mine production at Saval II, West Generator, and Smith Zone 10. Notably, Smith Zone 10 will also provide higher grades.

However, even if throughput increases to 3,100+ tonnes per day over the next year (~2,000 tonnes per day in Q3 2022), the asset still has a significant excess capacity with a total capacity of 4,000 tonnes per day. So, if First Majestic can find a way to fill capacity or get closer to the 3,500 tonnes per day mark, I expect a dramatic unit cost improvement. That said, with the benefit of lower sustaining capital in 2023 (expenditures were elevated in 2021/2022) and higher throughput, we should see more respectable costs at the asset starting in Q4.

Recent Developments

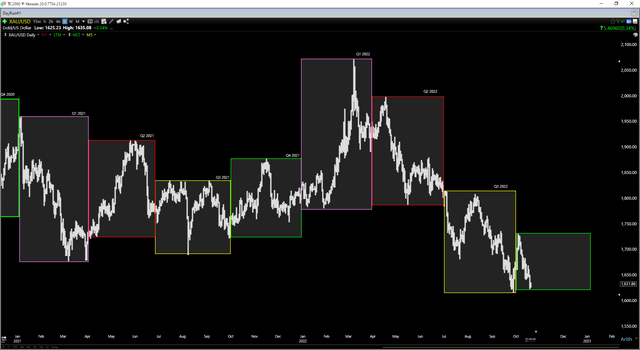

Unfortunately, any expected margin improvements at Jerritt Canyon have been mostly offset by weaker gold prices, and the company’s silver segment has seen its margins pinched by weaker silver prices. This is certainly not ideal, and even if Jerritt Canyon can get its costs below $1,600/oz in 2023, this isn’t doing much to help the company when the gold price is hanging out below $1,700/oz. While this obviously isn’t in the company’s control, and I remain long-term bullish on the gold price, the softness in the metal has dampened the outlook for Jerritt Canyon in FY2022 and FY2023. So, investors in First Majestic should be rooting for gold prices just as much as silver prices, given the higher gold production from Ermitano and the ramp-up at Jerritt Canyon.

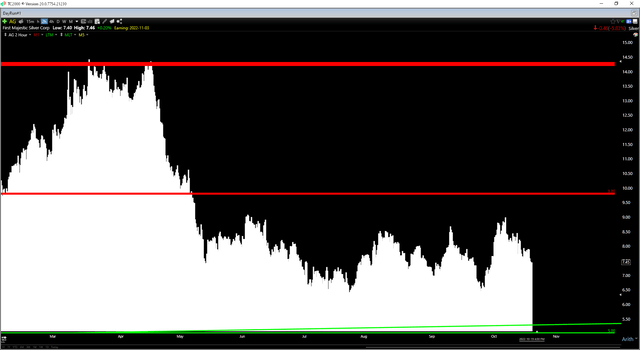

Gold Futures Price (TC2000.com)

The one positive development was that First Majestic hit solid grades in the area between the SSX and Smith mines at Jerritt Canyon, with aggressive drilling following up on these intercepts. Highlight holes from the Smith 10 Zone include:

- 17.6 meters at 6.98 grams per tonne of gold

- 12.8 meters at 8.61 grams per tonne of gold

- 24.4 meters at 8.61 grams per tonne of gold

- 13.2 meters at 14.6 grams per tonne of gold

The above highlight intercepts, while not representative of the average hit, are well above Jerritt Canyon’s reserve grades and should help lift average head grades when fed to the plant. Meanwhile, First Majestic hit solid grades from the SSX/Smith Mine Connection drift, intersecting 23.2 meters at 19.35 grams per tonne of gold and 14.7 meters at 10.27 grams per tonne of gold and 13.7 meters at 9.53 grams per tonne of gold. While true widths are unknown as of the release date, these intercepts are encouraging. Growing reserves at 6.5+ grams per tonne would certainly improve this asset’s long-term outlook, especially when combined with the benefit of economies of scale from higher throughput, supporting a ~200,000-ounce per annum operation. Let’s look at the valuation:

Valuation

Based on ~276 million fully diluted shares and a share price of US$7.40, First Majestic trades at a market cap of ~$2.04 billion. While this might seem like a low valuation for a company with four operations in two countries, First Majestic remains one of the most richly-valued companies in the precious metals space. This is based on the fact that it trades at more than 24x FY2023 earnings estimates ($0.30) and over 2.0x P/NAV, with an estimated net asset value of $980 million. For comparison, Agnico Eagle (AEM) at ~19x FY2023 earnings estimates and ~1.0x P/NAV with 11 mines in more favorable jurisdictions and much stronger operating margins (~29.0% vs. 8.0% in FY2021 for Agnico vs. First Majestic).

Given this significant valuation discrepancy between First Majestic and larger-scale and lower-risk producers in the sector, I don’t see any investment case for First Majestic from a valuation standpoint. This is especially true given that First Majestic has reserve deletion risk if metals prices continue to drop, while most gold producers are using much lower assumptions, meaning they should be able to grow reserves even at a $1,500/oz gold price assumption. So, even after the nearly 70% decline in the share price, I don’t see First Majestic as investable. Importantly, this is not due to lack of quality but simply because there is no investing without valuation, and one can’t hope to make money long-term in a precious metals stock by paying 2.0x P/NAV.

Technical Picture

Fortunately, when it comes to the technical picture, it is improving, and First Majestic benefits from extreme torque in periods of rising silver prices. This was evidenced by a 680% return off its 2016 lows in a period of fewer than eight months, translating to a 5,000% annualized return. So, while the stock may not make for an ideal investment, it is a solid swing-trading vehicle if bought correctly. The key to getting the right price is buying near multi-year support levels or at a minimum reward/risk ratio of 6.0 to 1.0, given AG’s volatility.

In AG’s case, the stock’s next strong support level comes in at $5.00 – $5.30, and the stock has overhead resistance at $9.80. From a current share price of $7.40 and using the mid-point of support ($5.15), the stock currently has a 1.07 to 1.0 reward/risk ratio based on $2.40 in potential upside to resistance and $2.25 in potential downside to support. So, for this reward/risk ratio to move into a buy zone, the stock would need to decline below $5.80 at a bare minimum. A correction of this magnitude may not materialize, but with no attractive valuation setup here, it makes sense to get the best technical setup or pass entirely.

Summary

First Majestic should have a better year ahead as production steadily increases at Jerritt Canyon, with costs likely improving from lower sustaining capital expenditures and economies of scale. That said, the lower gold price has partially offset any margin improvement at the asset. Plus, while Ermitano continues to put up phenomenal results, First Majestic’s margins have also pinched in its silver business. Normally, after a 70% decline, the valuation would suggest that negativity was priced in, but in AG’s case, the stock never belonged above $15.00 per share, let alone $20.00. Hence, the valuation still remains rich.

That said, the stock can be one of the best performers in a bull market for precious metals and easily double in a period of 9 months or less when sentiment returns to the sector. So, for investors looking for a liquid silver miner from solely a swing-trading standpoint, AG would become interesting below $5.80. However, for investors preferring to buy value in the sector, I see names like i-80 Gold (IAUX) or Agnico Eagle as far more attractive opportunities, with both enjoying production and reserve growth per share and having top-10 exploration stories with high-grade assets in Tier-1 jurisdictions.

Be the first to comment