Kwarkot/iStock via Getty Images

The beautiful thing about the world of REITs is that you have a wide variety of options to choose from. Options can be based on geographical location, or on asset type or quality, or on other factors as well. To me, one of the more interesting segments of the REIT universe involves the ownership of industrial properties. One company that has been doing quite well in this space recently is First Industrial Realty Trust (NYSE:FR). Revenue and profitability continue to rise as management acquires additional assets and as occupancy rates at the properties that currently owns climbing as well. Long term, I suspect the company will do quite well for itself and its investors. On top of that, shares are gradually getting cheaper. But that doesn’t mean that the stock is a great opportunity to buy right now. In fact, given how pricey shares are at the moment, and considering that they are more or less fairly priced compared to similar firms, I would make the argument that its stock is more or less fairly valued right now as well, indicating, in effect, limited upside for investors for the foreseeable future. If shares fall further, this picture could change. But until that does happen, if it does at all, I have decided to keep my ‘hold’ rating on the enterprise.

Great results don’t make for a great buy

The last time I wrote an article about First Industrial Realty Trust was is in February of this year. At that time, I acknowledged that management was continuing to create attractive value for the company’s investors. I also said that the company was a quality firm that would likely do well moving forward. But given how expensive shares were at that time, I ended up keeping it as a ‘hold’, indicating my belief that it would likely perform along the lines of the broader market for the foreseeable future. So far, that call has not been too far off. While the S&P 500 has dropped by 2.9%, shares of First Industrial Realty Trust have generated a loss for investors of 4.6%.

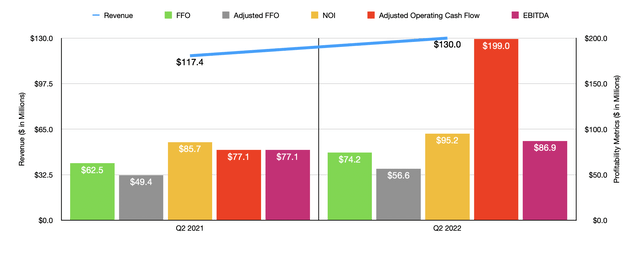

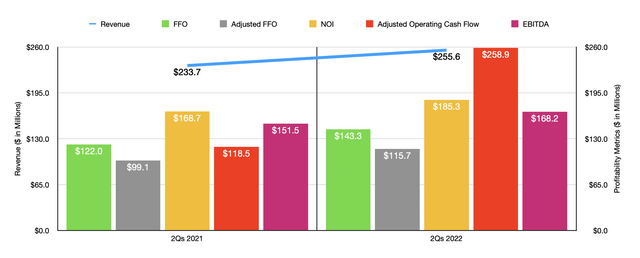

When you see a company post a share price decline that exceeds the decline of the broader market, your first thought might be that the fundamental condition of the company is worsening. But that is simply not the case with First Industrial Realty Trust. In fact, the company is currently stronger than it has ever been. To see what I mean, we need only look at recent financial performance. For the second quarter of the company’s 2022 fiscal year, revenue has come in strong at $130 million. That’s 10.7% higher than the $117.4 million generated just one year earlier. The company has benefited from two key contributors. First and foremost, this year alone, management has spent $182.7 million on acquiring seven different properties. That alone should help to push shares higher. And second, the occupancy rate of the company now stands at 98%. That compares to the 96.1% occupancy rate reported the same quarter last year. Naturally, these same contributors have also been instrumental in pushing revenue up for the first half of the year as a whole. Sales for this timeframe came in at $255.6 million. That’s up from the $233.7 million generated the same time last year. And over this time frame, the occupancy rate of its properties has grown from 95.6% to 97.7%.

This strength on the top line has also been instrumental in improving the company’s profitability. In the second quarter alone, for instance, operating cash flow came in strong at $199 million. By comparison, the same time last year, it stood at just $77.1 million. If we look at the full half of the 2022 fiscal year, that picture does even out some, with the metro climbing from $118.5 million to $258.9 million. Of course, there are other profitability metrics for us to pay attention to. First and foremost, we have the FFO, or funds from operations, of the business. In the latest quarter, this came in at $74.2 million. That compares favorably to the $62.5 million generated one year earlier. On an adjusted basis, this metric rose from $49.4 million to $56.6 million. Another metric to pay attention to is NOI, or net operating income. According to management, this came in at $95.2 million in the second quarter of this year. The same time last year, it was $85.7 million. Meanwhile, the EBITDA of the firm rose from $77.1 million to $86.9 million. Naturally, as the chart below illustrates, these strong results in the second quarter were instrumental in helping the company to generate similarly strong results for the first half of the year as a whole.

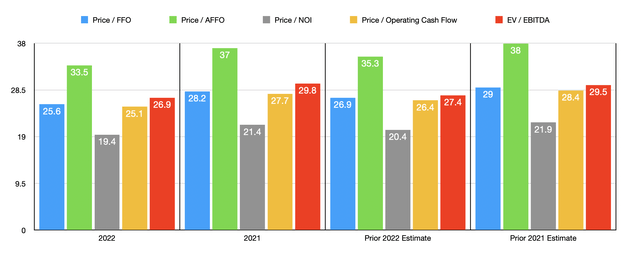

Moving forward, management has high expectations for the firm. They currently anticipate FFO per share this year of between $2.15 and $2.23. At the midpoint, this will translate to a reading of $289.2 million. That’s slightly above the $261.8 million the company generated during its 2021 fiscal year. If we apply that same year-over-year growth rate to other profitability metrics, the results are promising. Adjusted FFO, for starters, would come in at $215.1 million. Net operating income would be $371.6 million, while operating cash flow would come in at $287.5 million. And finally, we arrive at EBITDA. Based on the estimates, this should be roughly $334.1 million this year.

If we apply these metrics to the market capitalization and enterprise value of the firm, it should be fairly easy to understand where the stock is from a pricing perspective. Using our 2022 estimates, we can see that the firm is trading at a price to FFO multiple of 25.6. On an adjusted basis, this rises slightly to 33.5. The price to NOI, meanwhile, should be 19.4, while the price to operating cash flow multiple should come in at 25.1. Finally, the EV to EBITDA multiple of the company should be roughly 26.9. As you can see in the chart above, all of these metrics are lower than what they would be if we used 2021 results. They are also, interestingly, slightly below where the company was valued when I last wrote about it. But that makes sense when you consider the modest share price decline. As for the rest of the analysis, I did compare the company to five similar firms. In three of these cases, the price to operating cash flow approach, the price to FFO approach, and the EV to EBITDA approach, I found that three of the five companies were cheaper than First Industrial Realty Trust. The fourth method, the adjusted price to FFO approach, would result in four of the five companies being cheaper than our target.

| Company | Price / Operating Cash Flow | Price / FFO | Price / AFFO | EV / EBITDA |

| First Industrial Realty Trust | 27.7 | 28.2 | 37.0 | 29.8 |

| Innovative Industrial Properties (IIPR) | 12.9 | 14.2 | 13.2 | 14.8 |

| STAG Industrial (STAG) | 16.6 | 15.8 | 18.1 | 19.2 |

| LXP Industrial Trust (LXP) | 14.9 | 18.2 | 15.8 | 20.4 |

| Prologis (PLD) | 31.3 | 29.8 | 30.8 | 32.6 |

| Rexford Industrial Realty (REXR) | 39.0 | 42.6 | 36.1 | 40.9 |

Takeaway

As far as industrial REITs go, First Industrial Realty Trust strikes me as a quality operator that continues to expand at a respectable pace. On top of that, the underlying fundamentals of the firm are improving and shares are getting cheaper from an investment perspective. Having said that, I do not think that the stock has gotten quite cheap enough yet. Yes, it is likely that the very long-term horizon will prove beneficial for shareholders. Even so, that doesn’t mean that shares are great to buy into at this time. On an absolute basis, the stock does still work rather lofty. And it is more or less fairly valued, or may be only slightly overvalued, relative to some similar firms. What all that tells me is that there might be something more affordable out there at this moment. All things considered, I do not yet think the company makes for a compelling prospect. But given how shares are priced today, I do think that a ‘hold’ rating would be more appropriate at this time.

Be the first to comment