KeithBinns/E+ via Getty Images

Earnings of First Financial Bankshares, Inc. (NASDAQ:FFIN) will likely continue to grow through the end of 2023 on the back of decent loan growth. Further, moderate margin expansion will support earnings. Overall, I’m expecting First Financial to report earnings of $1.67 per share for 2022, up 5% year-over-year. For 2023, I’m expecting earnings to grow by 4% to $1.75 per share. Next year’s target price suggests a small downside from the current market price. Based on the total expected return, I’m adopting a hold rating on First Financial Bankshares.

Loan Growth to Slow Down to the 2019 Level

First Financial Bankshares’ loan growth so far this year has been stronger than in previous years. The portfolio grew by 16% in the first nine months of the year. This loan growth appears unsustainable as it is out of the ordinary. Further, the high interest-rate environment is bound to temper credit demand.

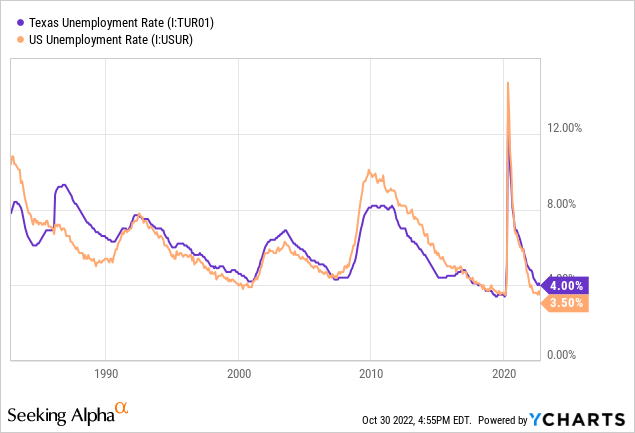

On the plus side, other economic factors will support loan growth. First Financial operates in Texas, which currently has a higher unemployment rate than the national average. Nevertheless, the state’s job market is quite strong from a historical perspective.

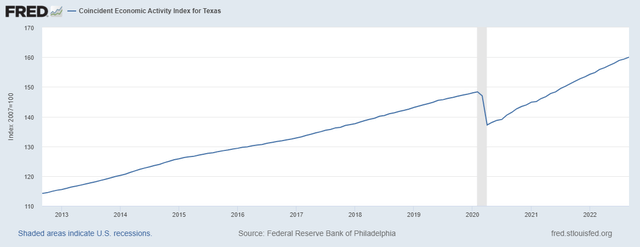

Further, the trend of economic activity is steeper now than it was before the pandemic.

The Federal Reserve Bank of Philadelphia

Overall, I’m expecting loan growth to slow down to the 2019 level. I’m expecting the portfolio to grow by 1.5% in the last quarter of 2022, leading to full-year loan growth of 17.8%. For 2023, I’m expecting the loan portfolio to grow by 6%.

Investment Securities, Fixed-Rate Loans to Restrict Margin Expansion

First Financial Bankshares’ net interest margin will benefit from the rising rate environment going forward. I’m expecting a further 150 basis points hike in interest rates till the mid of 2023; therefore, the average earning-asset yield will rise in the coming quarters.

However, the large balance of investment securities will restrict the rise in the earning asset yield. As most of these securities are based on fixed rates, they will hold back the average earning-asset yield as market interest rates rise. As mentioned in the second quarter’s 10-Q filing, only around 18.15% of total securities will mature up till the mid of 2023.

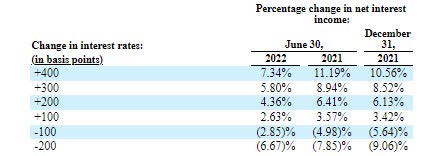

Further, around 42% of loans are based on fixed rates. The results of the management’s interest-rate sensitivity analysis given in the 10-Q filing show that a 200-basis points hike in rates can boost the net interest income by 4.36% over twelve months.

2Q 2022 10-Q Filing

Considering these factors, I’m expecting the margin to grow by 15 basis points in the last quarter of 2022 and eight basis points in 2023.

Provisioning Normalization to Limit Earnings Growth

Due to a significant fall in non-performing loans, the allowance coverage has improved tremendously over the past year. The allowances-to-nonperforming-loans ratios surged to 301.02% by the end of September 2022 from 232.71% at the end of September 2021. Considering the allowance coverage, the high inflation environment, and the threats of a recession, I’m expecting the provision-expense-to-total-loan ratio to remain at the same level as the average for the last five years.

The anticipated loan growth and margin expansion discussed above will counter the effect of provision normalization. Overall, I’m expecting First Financial to report earnings of $1.67 per share for 2022, up 5% year-over-year. For 2023, I’m expecting the company to report earnings of $1.75 per share, up 4% year-over-year. The following table shows my income statement estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |||||

| Income Statement | ||||||||||

| Net interest income | 273 | 289 | 350 | 370 | 405 | 448 | ||||

| Provision for loan losses | 6 | 3 | 20 | (1) | 16 | 10 | ||||

| Non-interest income | 102 | 108 | 140 | 142 | 134 | 126 | ||||

| Non-interest expense | 191 | 197 | 228 | 242 | 237 | 267 | ||||

| Net income – Common Sh. | 151 | 165 | 202 | 228 | 239 | 250 | ||||

| EPS – Diluted ($) | 1.11 | 1.21 | 1.42 | 1.59 | 1.67 | 1.75 | ||||

|

Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million unless otherwise specified) |

||||||||||

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, a stronger or longer-than-anticipated recession can increase the provisioning for expected loan losses beyond my estimates.

Further Attrition of Equity Book Value Likely

First Financial Bankshares’ equity book value has plunged by 36% over the first nine months of this year mostly because of mark-to-market losses on the sizable available-for-sale (“AFS”) securities portfolio. As interest rates increased, the market value of this portfolio dropped, leading to unrealized losses that skipped the income statement and directly eroded the equity book value. The AFS securities portfolio made up a whopping 48% of total earning assets at the end of September 2022.

Further attrition of the equity book value is likely as I’m expecting the fed funds rate to increase by a further 150 basis points by the mid of 2023. This book value attrition will affect First Financial Bankshares’ market valuation as the price-to-book-value multiple is often used to value banks and bank-holding companies.

The following table shows my balance sheet estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |

| Financial Position | ||||||

| Net Loans | 3,902 | 4,142 | 5,104 | 5,326 | 6,274 | 6,659 |

| Growth of Net Loans | 13.5% | 6.2% | 23.2% | 4.3% | 17.8% | 6.1% |

| Other Earning Assets | 3,223 | 3,493 | 4,995 | 6,935 | 5,947 | 6,127 |

| Deposits | 6,180 | 6,604 | 8,676 | 10,566 | 11,281 | 11,856 |

| Borrowings and Sub-Debt | 469 | 381 | 430 | 671 | 775 | 778 |

| Common equity | 1,053 | 1,227 | 1,678 | 1,759 | 1,072 | 1,116 |

| Book Value Per Share ($) | 7.7 | 9.0 | 11.8 | 12.3 | 7.5 | 7.8 |

| Tangible BVPS ($) | 6.5 | 7.7 | 9.5 | 10.1 | 5.3 | 5.6 |

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

Adopting a Hold Rating

First Financial has a long-standing tradition of increasing its dividend every year. Given the earnings outlook, I’m expecting the company to increase its dividend by $0.02 per share to $0.19 per share in the second quarter of 2023. The earnings and dividend estimates suggest a payout ratio of 42% for 2023, which is close to the five-year average of 38%. Based on my dividend estimate, First Financial is offering a forward dividend yield of 1.9%.

Historically, First Financial has traded at very high multiples with large premiums over peers. The table below shows the company’s current multiples in comparison with the multiples of peers.

| HOMB | BPOP | UBSI | WTFC | ONB | Average | FFIN | |

| P/E GAAP (“fwd”) | 16.3 | 5.2 | 14.8 | 11.1 | 13.7 | 12.2 | 23.3 |

| P/E GAAP (“ttm”) | 17.8 | 5.2 | 16.1 | 12.7 | 17.4 | 13.8 | 23.5 |

| P/B (“ttm”) | 1.5 | 1.4 | 1.3 | 1.3 | NM | 1.4 | 4.8 |

| Source: Seeking Alpha | |||||||

As the premium has been maintained in previous years, I believe that it is long-lasting. Therefore, it’s best to value First Financial through historical multiples. The stock has traded at an average price-to-tangible book (“P/TB”) ratio of 4.05x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| T. Book Value per Share ($) | 6.5 | 7.7 | 9.5 | 10.1 | ||

| Average Market Price ($) | 27.1 | 31.6 | 30.4 | 47.7 | ||

| Historical P/TB | 4.19x | 4.09x | 3.19x | 4.74x | 4.05x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $5.6 gives a target price of $22.7 for the end of 2023. This price target implies a 40.5% downside from the October 28 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 3.85x | 3.95x | 4.05x | 4.15x | 4.25x |

| TBVPS – Dec 2023 ($) | 5.6 | 5.6 | 5.6 | 5.6 | 5.6 |

| Target Price ($) | 21.5 | 22.1 | 22.7 | 23.2 | 23.8 |

| Market Price ($) | 38.1 | 38.1 | 38.1 | 38.1 | 38.1 |

| Upside/(Downside) | (43.4)% | (42.0)% | (40.5)% | (39.0)% | (37.6)% |

| Source: Author’s Estimates |

The stock has traded at an average price-to-earnings (“P/E”) ratio of around 25.5x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| Earnings per Share ($) | 1.11 | 1.21 | 1.42 | 1.59 | ||

| Average Market Price ($) | 27.1 | 31.6 | 30.4 | 47.7 | ||

| Historical P/E | 24.4x | 26.2x | 21.5x | 30.0x | 25.5x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $1.75 gives a target price of $44.6 for the end of 2023. This price target implies a 17.1% upside from the October 28 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 23.5x | 24.5x | 25.5x | 26.5x | 27.5x |

| EPS 2023 ($) | 1.75 | 1.75 | 1.75 | 1.75 | 1.75 |

| Target Price ($) | 41.1 | 42.8 | 44.6 | 46.3 | 48.1 |

| Market Price ($) | 38.1 | 38.1 | 38.1 | 38.1 | 38.1 |

| Upside/(Downside) | 7.9% | 12.5% | 17.1% | 21.7% | 26.3% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $33.6, which implies an 11.7% downside from the current market price. Adding the forward dividend yield gives a total expected return of negative 9.7%. Hence, I’m adopting a hold rating on First Financial Bankshares.

Be the first to comment