skynesher/E+ via Getty Images

First Citizens BancShares, Inc. (NASDAQ:FCNCA) maneuvers its expanding operations with ease and prudence. In the last two years, it has stayed afloat amidst the pandemic disruptions. It capitalized on the near-zero interest rates to stabilize its loans and deposits, diversify its investments, and acquire more companies.

Today, the bank maintains its stellar fundamentals, allowing it to sustain its continued expansion. It remains sound amidst inflationary pressures. Its financial leverage is stable relative to its cash and investments even after the recent acquisition. Its current operating capacity appears sustainable while borrowings and dividends are well-covered. It is an ideal dividend stock with consistent payments over twenty years. Also, the stock price remains reasonable despite the still low yields. It already has skyrocketed from my first coverage of this company, but it remains attractive.

Company Performance

First Citizens BancShares sees more returns as its market visibility and capacity to cater to more clients increases. This year, the bank remains unperturbed despite the still-challenging market. There are some integration risks inherent to its most recent acquisition of CIT Group. But, there are also new opportunities it may enjoy. Also, it remains well-positioned to hedge the adverse impact of inflationary pressures. Its core deposits and loans continue to flourish with sustained reserves, making it very liquid. We will discuss this part further in the next section.

It is already established in retail and commercial lending. It is also a staple to many SMEs in the U.S., which appear to be one of its driving forces. With the addition of CIT Group, it now has a wider range in the middle market. Also, it has a larger capacity and market visibility, especially in North Carolina and Southern California. It is now almost twice as much as it was last year. Indeed, the transformative acquisition is a giant leap for its commercial lending, which also expands its real estate financing. Its lending capabilities also extend to other aspects, such as healthcare and aviation.

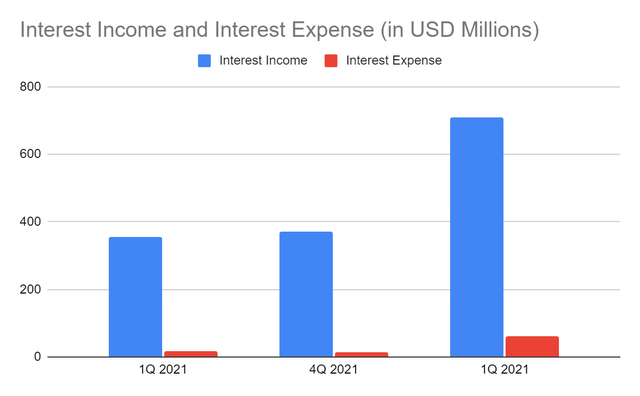

Today, its interest income amounts to $710 million, a 200% increase from $355 million in 1Q 2021. Its interest fees on loans comprise 88% of it, which is almost twice as much as in the same quarter. The increase was mainly due to the addition of CIT Group loans to its operations. As such, we can see that both companies have flourished in the last year. Another growth driver is its investment securities, which comprise 21% of its earning assets. These are also interest-sensitive, generating more yields. It amounts to $89 million, which is more than twice as much as in the comparative quarter.

Interest Income and Interest Expense (MarketWatch)

But of course, things may not be as smooth as before as the interest rate spikes. Most of these are mortgage-backed, so they may not be as attractive in the second half as in the last few quarters. In fact, the breakeven yield in June was 2.4% from its peak of 3% in April. 2Q 2022 yields may still be high, given its peak earlier this year. The higher interest rates may lead to higher unrealized losses. But note that these are cyclical so there may be more changes in the second half. The volatility of their actual value does not appear to go into a lull this quarter. It means that the actual value may rebound, leading to higher yields and sustained increases in investment income. It is logical since the continued increase in the interest rates may lead to savings skyrocketing.

There may be a larger need for spending, borrowings, and investments in the long run. That is why I still expect that these changes will offset capital impacts, leading to more payoffs. The rebound in the value and returns may coincide with the convergence between the book and market value of investment securities. Either way, the more interest-sensitive loans may generate higher interest income.

Moreover, FCNCA maintains its efficient and prudent loan and investment portfolio management. It is no wonder that its revenues continue to go up. But, its efficiency and prudence also extend to how it handles and diversifies its resources. Prudent deposit management remains one of its cornerstones. Even better, FCNCA appears to capitalize on its low-cost deposit base to lower the costs and funds associated with CIT. Its current setup may help it balance the costs between it and CIT. Note that its cost of funds and deposits are 0.2% and 0.06%, respectively. It is way lower than in CIT with 1% and 0.46%, respectively. It may be a downside to its cost and expense side in the short run. It is already visible since interest expense has already quadrupled. But, I believe it may use its low-cost-deposit base to manage its now larger funds and deposits.

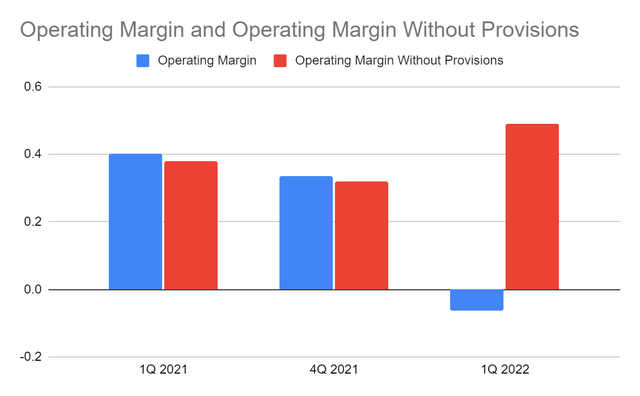

Even so, the company remains profitable. Its efficiency also extends to how it manages its non-interest resources. It manages its larger labor and capital base to generate income while keeping its expenses reasonable. Also, the acquisition appears to have more gains than expenses as we have seen its non-interest income and expenses. Despite its larger capacity and sustained efficiency, the company remains conservative. Its provisions on credit losses have a massive difference than before the completion of integration. It is still logical since the M&A brings it more loans, which may increase the chances of defaults and delinquency.

If we check in the balance sheet, the allowance is four times larger than in 1Q 2021 or 1.31% of the net loans vs 0.7%. The operating margin of the company is -0.064 vs 0.41. But if we exclude the provisions for credit losses, the operating margin will be 0.49 vs 0.38. Also, its bottom line income is way better than in the previous year. With or without the acquisition, the company manages both its core and non-operations very well.

Operating Margin (MarketWatch)

Macroeconomic Pressures

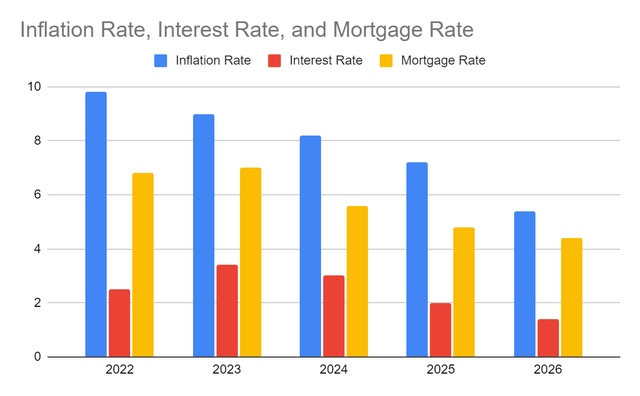

FCNCA faces more macroeconomic pressures today. Prices have sustained increases a new all-time high inflation rate of 9.1%. So, the price upsurge may continue in 3Q and 4Q. The geopolitical disturbance brought upon by Ukraine vs Russia drives it further. Note that Russia is a primary source of energy commodities. These are vital to create and transport goods globally. But of course, there are more alternatives as seaborne oil explorers and transporters increase in the U.S.

It is safe to say that the increase in prices is more of the pent-up demand across various industries. The pent-up demand for leisure and business travel has spillovers on energy commodities, automobiles, and accommodation industries. Also, the housing and automobile boom remains high even after the slight cooldown in house sales in May. It remains higher than pre-pandemic levels as housing and car shortages remain high. Recent statistics also show that many Americans are still confident about their capacity to buy houses. The vast majority of Americans believe that now is the perfect time to buy houses. With the still high demand for houses, home furnishings and consumer discretionaries may also expect more market demand. So, I expect the inflation rate to rise further to 9.8%. In 2023, the economy may start to stabilize but it may remain high at 8-9%. But in the following years, it may hush down to 7-8% before landing at 5.2%.

In response, interest and mortgage rate hikes are taking place. Recently, the Fed raised the Federal Funds rate by 75 basis points. So, the expected interest rate is already higher at 3.4%. It is a huge increase from the initial estimations of 1.7-2% and 3-3.25% in 1Q 2022. Likewise, the mortgage rate shows high-flying values at 5.7%. It is also higher than the initial estimation of 5.1-5.3%. With that, it has a possibility to increase further to 7%. But in 2024-2026, they may also become more manageable as the economy becomes more stable.

Inflation Rate, Interest Rate, and Mortgage Rate (Author Estimation, Barron’s, and Forbes)

Why First Citizens BancShares, Inc. May Stay Afloat

The market environment is still stormy contrary to our initial expectations. The rising inflation, interest, and mortgage rates were already expected in line with the upsurge in spending and investments. Yet, their peaks have already stretched further than anticipated. As such, market volatility, including loan and investment security portfolios remain evident. It does not appear to go into a lull anytime soon. So, First Citizens BancShares, Inc. must be more watchful amidst these inflationary pressures.

In its recent transformative acquisition, FCNCA has become larger and more diverse. As discussed earlier, the inclusion of CIT Group is a giant leap into its CI Lending segment. It expanded its customer base and the capacity to cater to more clients and borrowers. Mortgage and leasing are now part of its core revenue streams. But of course, there are risks inherent to the integration of these entities. Despite being both banks, they have a huge difference, especially in underwriting. The people who control both companies are different, which may lead to culture risks.

Thankfully, FCNCA appears well-positioned against the potential disruptions of these factors. It has already converted and integrated its payroll and HR system. Employees from CIT have been migrated to its systems. Its integration phase is on track and may be completed. Even better, FCNCA continues to capitalize on technology, which may be vital to drive its growth further. Digital banking is now a favorite both in mature and emerging economies. In the U.S., only 22% have used cash in the last two years, a massive decrease from 51% in 2010. The same goes for some countries in Europe where only 10% are using cash.

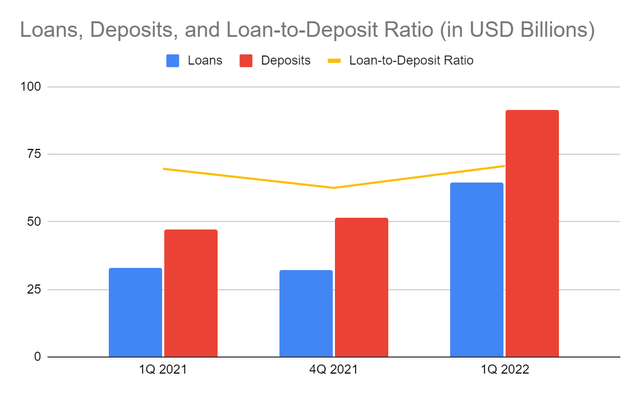

Moreover, the efficient and prudent management of its earning assets remains its cornerstone. It keeps its loans and deposits balanced to generate returns and maintain liquidity. It is vital, given that it has a larger loan and deposit base today. FCNCA has an asset-sensitive Balance Sheet. So, integrating it with CIT may offer more opportunities, given the much larger CI lending segment. Also, this integration may work to improve the funding costs of CIT to adapt to FCNCA. It may not be quick, but given the impressive financial position of both companies, this goal is possible.

Currently, loans are $65 million while deposits amount to $92 million. Both accounts are now higher as they are the combined value of FCNCA and CIT. The year-over-year growth of loans is 96% vs deposits at 93%. It shows a higher increase in loan demand, especially in the commercial and industrial segment. It is no surprise that interest income remains impressive amidst the rising interest and mortgage rates. Thanks to the enticing fund cost of FCNCA, which may also help CIT. But, the best thing about it is its loan-to-deposit ratio of 70% vs 69% in 1Q 2021. It proves that the bank keeps its loans and deposits stable amidst integration and economic fluctuation. It is very liquid, so it has more reserves should there be defaults and delinquencies. Also, its provisions for credit losses of 1.31% of the total loans are more than twice as much as in 1Q 2021 of only 0.64%. It can even increase its loans to generate more returns while remaining liquid. The higher interests can provide more interest income. Given these figures, the bank is viable while remaining liquid and conservative.

Loans, Deposits, and Loan-to-Deposit Ratio (MarketWatch)

Cash and investments are other earning assets. They comprise almost 30% of the total assets, proving the high liquidity of the bank. Also, they yield income, which has been rebounding and staying in an uptrend in the last few quarters. Their combined value is about seven times higher than borrowings.

With its integration efforts and financial transactions remaining on track, I expect its increased focus on CI lending segment. As such, it must enhance its treasury services. Also, its efficiency may improve as the focus shifts to it once the integration is complete. It may drive its viability, allowing it to generate more returns. It may also help sustain its expansion in a more stable economy.

Stock Price Assessment

The stock price of First Citizens BancShares, Inc. has been rebounding in the last month from its dip. But, it remains far lower than its peak. At $700.72, it is already 17% higher than its most recent dip but 19% lower than the starting price. It is already 20% higher than the stock price from my previous coverage, which is a testament to its commitment to growth and expansion. Its M&As in the last two years can also prove it. It still appears cheap and reasonable, given its P/E Ratio of 12.5. Its P/B Ratio of 1.06 shows that the price is just fairly valued.

Meanwhile, dividend payments are still consistent and sustainable. It has a low Dividend Payout Ratio at only 2.8% so it means that it has more means to raise it. But of course, it may not be simple since its focus is on integration. Plus, it has over 20,000 preferred shares, which may be having more yields. Its dividend yield is only 0.26%, which is way lower than the average of S&P 400 and NASDAQ components of 2.06% and 1.51%. It may become a concern for CIT shareholders since dividends are higher for them.

Personally, this stock is not a real dividend champion. But, investors must consider it a tool for capital appreciation. Aside from the consistent and sustainable dividend payments, it has an excellent approach for growth by capitalizing on prudent acquisitions. It has also made share repurchases whenever the stocks are undervalued. Its share buybacks in 2020 for over $300 million is an example. We can assess the stock price better using the discounted cash flow (“DCF”) Model and the Dividend Discount Model.

DCF Model

FCFF $484,000,000

Cash $523,000,000

Outstanding Borrowings $1,910,000,000

Perpetual Growth Rate 4.8%

WACC 9%

Common Shares Outstanding 16,002,000

Stock Price $700.72

Derived Value $737.37

Dividend Discount Model

Stock Price $700.72.

Average Dividend Growth 0.0949226891

Estimated Dividends Per Share $1.88

Cost of Capital Equity 0.0976998378

Derived Value $748.36.

Both models show that the stock price is reasonable. There may be an upside of 5-7% in the next 12-24 months. If I adjust my DCF Model values based on my projection for 2Q results, the derived value will decrease to $717.32. I adjusted the interest income and expense, non-interest income and expense, and tax rate based on the company estimation. These accounts will affect NOPAT, a component of FCFF. I also adjusted the outstanding borrowings in line with the interest rate hikes. Either way, there is still potential undervaluation.

Bottom Line

First Citizens BancShares, Inc. is committed to growth and expansion through its prudent M&As. Its prudence and effort are paying off amidst macroeconomic pressures. It is well-positioned that can cushion the impact of market fluctuations. Also, dividends, borrowings, and acquisition-related expenses are well-covered, making it a stock for capital appreciation. The stock price is still reasonable with a potential undervaluation. Even if I adjust it to my projected 2Q fundamentals, the current stock price is still lower than my estimation. Although I still advise investors to wait for the release of the 2Q report, expected before the market on July 28, before making a position, the trend adheres to its fundamentals. The recommendation is that First Citizens BancShares, Inc. is a buy.

Be the first to comment