naphtalina/iStock via Getty Images

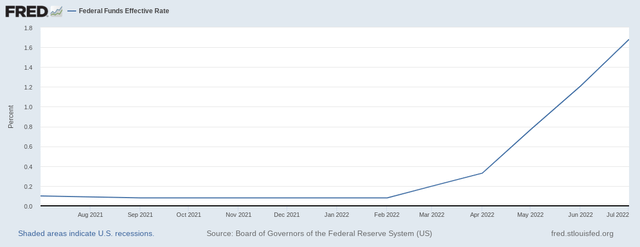

The banking sector continues to dominate the news. The Federal Reserve has increased interest rates at record rates in 2022 to combat sky-high inflation. Banks find themselves at the center of the madness due to their unique position in the global economy. Today’s article will talk about The First Bancorp, Inc. (NASDAQ:FNLC), one of our favorite bank stocks, to see if it is the PERFECT bank stock. We will review the company’s recent financial statements, earnings release, and run the bank through the Dividend Diplomats Dividend Stock Screener.

About The First Bancorp

This community bank is headquartered in Maine. The bank opened its doors since 1864 and has been serving the community ever since! The bank falls in the Diplomats’ sweet spot for community banks. As of June 30, 2022, First Bancorp has Total Assets were $2.63 Billion.

We love banks with Total Assets between $1 billion – $5 billion assets. This allows the institution to offer customers a full suite of products without the complex products used by the mega, Too Big To Fail banks. $1 billion – $5 billion banks are typically simple. Loans, deposits, investments, and typical non-interest income.

Interestingly, First Bancorp has realized significant growth over the last decade. Per the company’s website, First Bancorp has added over $1 billion in assets in the last 10 years. That is a 66% growth rate.

At a high level, this shows that the company knows how to responsibly grow the business (albeit aggressively over the last decade), while sticking to its historical roots of serving the Maine community and the area’s local businesses.

First Bancorp’s Recent Performance

The bank released earnings on July 20, 2022. The earnings release covered the second quarter. This section will review the highlights from the bank’s second quarter. A link to the Earnings Release on Seeking Alpha can be found here, as we will reference information from the linked page in this section.

Interest rates began to rise significantly in the second quarter, particularly, towards the end of the second quarter. Therefore, the true impact of rising interest rates won’t be fully reflected until the company’s third quarter earnings release. Trust us, though, like all banks, interest rate increases will be felt when reviewing next quarter’s earnings release.

Board of Governors of the Federal Reserve System (US)

How did First Bancorp perform in the second quarter? Very, very well. Net income was up 13.8% compared to the same period in the previous year. This was a record setting earnings performance according to management.

Reviewing the financials, there are several drivers for the strong earnings growth. First, the bank’s earning assets increased $175.9 million compared to the same period last year and $75.8 million compared to March 31, 2022 (Loans increased $200 million and $81 million during the two periods, respectively). Obviously, the bank’s net income is going to soar when the bank’s earning asset base increases significantly during the reporting periods.

The income statement is not the only area that saw strong growth in the quarter. Looking at the balance sheet, in particular, the loans section, the bank’s loan balances increased significantly. Of the $81 million in loan growth in the second quarter, the majority of the growth was focused on the commercial real estate and construction sectors ($61 million), while the rest of the bank’s loan growth was primarily residential loans ($23.7 million).

What we can’t see in the financial is when did this loan growth occur. I’d love to learn more about whether or not the growth occurred before interest rates increased or while the rates were rising. Both answers have pros and cons. If the loans were booked before interest rates were rising, the lower interest rate loans may provide interest income longer due to the fact that less companies and borrowers will refinance. Conversely, if booked at the beginning of the quarter, the bank may be locked into lower interest rates that the current market environment.

The bank’s deposit growth continues to remain very strong. Deposits have increased nearly 15% as of June 30, 2022, compared to the previous year. Per the earnings release, the recent growth was due to strong certificate of deposit growth.

Now, let’s talk loan quality. Sure, it is great to originate loans. How are the loans performing though? That’s the real question! From this standpoint, First Bancorp knocks it out of the park. Total Allowance for Loan Losses to Total Loans (.91%) and non-performing assets to assets remain exceptionally low (.18%). Net charge-offs (.03%) and past due loans (.18%) continue to remain low as well.

This tells me that the bank’s portfolio was very clean and still performing strongly at the beginning stages of the interest rate hike and potential recession. However, there is a catch that is important to highlight as we tout the strong numbers. The ratios cited above will lag what may actually be happening in the economy. Problem loans need time to become delinquent and become 90 days past due. It simply hasn’t been 90 days since the Federal Reserve and inflation really sent shock waves through the economy. Keep an eye on these ratios when reviewing the Q3 and Q4 Financial Statements.

To summarize the financials. The results are currently great. Strong asset growth and strong earnings growth. In addition, the bank continues to show asset quality. That is why we love this rock solid community bank.

Dividend Diplomats Dividend Stock Screener

Let’s run First Bancorp through the Dividend Diplomats’ Dividend Stock Screener. We built our stock screener as a simple way to help us, and all of you, identify undervalued dividend stocks to research further and buy!

The Dividend Diplomats Dividend Stock Screener examines the following metrics and is what we use to determine whether a company is considered an undervalued dividend growth stock.

-

P/E Ratio (Valuation) and P/B Ratio for Banks

-

Dividend Payout Ratio (Safety)

-

Dividend Growth Rate and History (Longevity)

For this analysis, I will use the company’s 8/12/22 close price of $30.88/share, annualized EPS of $3.60/share, and an annual dividend of $1.36/share.

1.) Price-to-Earnings (P/E) and Price to Book Ratio (P/B) – This metric is used to see if the company is undervalued. According to my source, the S&P 500 P/E ratio is 21.63. FNLC’s P/E Ratio is 8.57X. That is much lower than the market!

For banks, we also look at the Price to Book Ratio (P/B). We love banks with a P/B between 1X – 1.15X. In that zone, we consider a bank truly undervalued. FNLC’s Price to Book Ratio is currently 1.50X. This is well above the range we typically look for in a community bank.

2.) Payout Ratio – We use a 60% target payout ratio in our analysis, as we believe 60% provides a strong blend of yield and ability to continue growing their dividend going forward. FNLC’s payout ratio is 37.78%. Boom. A nice check mark right there.

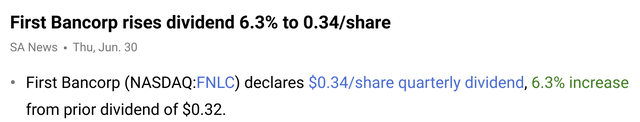

3.) Dividend Growth Rate – First Bancorp has increased its dividend annually since 2013. Now, the company has amassed an impressive 10 year dividend increase streak. The company’s five year average dividend growth rate is 6.93%. Pretty solid!

The last dividend increase was right in line with their historical mark. FNLC announced a 6.3% dividend increase at the end of June!

4.) Dividend Yield – The bank’s current dividend yield is 4.40%

Summary

After reviewing the stock metrics, the bank has a strong dividend growth history, excellent dividend yield, and a great dividend payout ratio that will allow the company to grow its dividend for years to come. The one con from our dividend stock screener is that the company is not exactly cheap. From a P/E Ratio perspective, the company performs well. However, when looking at the industry preferred metric of P/B, First Bancorp’s expensive.

The company has performed very well historically. There probably is a good reason why the company’s valuation isn’t cheap. Strong financial results, great loan and deposit growth, and excellent asset quality should command a premium in this market.

From a quality perspective, First Bancorp is a great dividend stock. Especially with a 4.4% dividend yield.

Now here is another question. How will this bank perform during a potential recession and rising interest rate environment? Can the company’s past results and current strong balance sheet give any signals about how the stock may perform if the economy continues to worsen?

While you cannot predict the future (if you could, we would all be sipping drinks on a beach somewhere), you can look at the company’s long term history to determine banks that may hold up well. I believe First Bancorp is one of those banks that can withstand the shocks to the economic system that have been coming our way.

The bank may see slower loan growth in future months and an uptick in problem loans. However, the bank’s prepayments will slow down and their current loan portfolio will season for a longer period of time. This will provide the bank with a strong base of interest income to help offset revenue growth from a potential decrease in new loans.

From an asset quality and problem loan perspective, the bank’s current metrics are very strong. This will allow the bank to absorb large increases without cause significant asset quality concerns that would cause alarm bells to ring and their stock price to sink. Even if net charge-offs increase 10X, they would still have a historically low net charge off rate (from .03% to .3%). Similarly, their .18% Past Due loan total today is a very low number. A bump up with this metric won’t send me running for the hills.

At the company’s current valuation, I’ll be closely watching the stock and they’ve earned a spot on my dividend stock watch list. If the price falls, I’ll be adding this dividend stock, as I think they are well positioned to perform well in the long term regardless of the economic environment. That day just isn’t today.

What do you think about First Bancorp? Are you buying at the bank’s current valuation, or are you just watching like me? Do you think this is a perfect bank stock?

-The Dividend Diplomats

Be the first to comment