Aum racha/iStock via Getty Images

Introduction

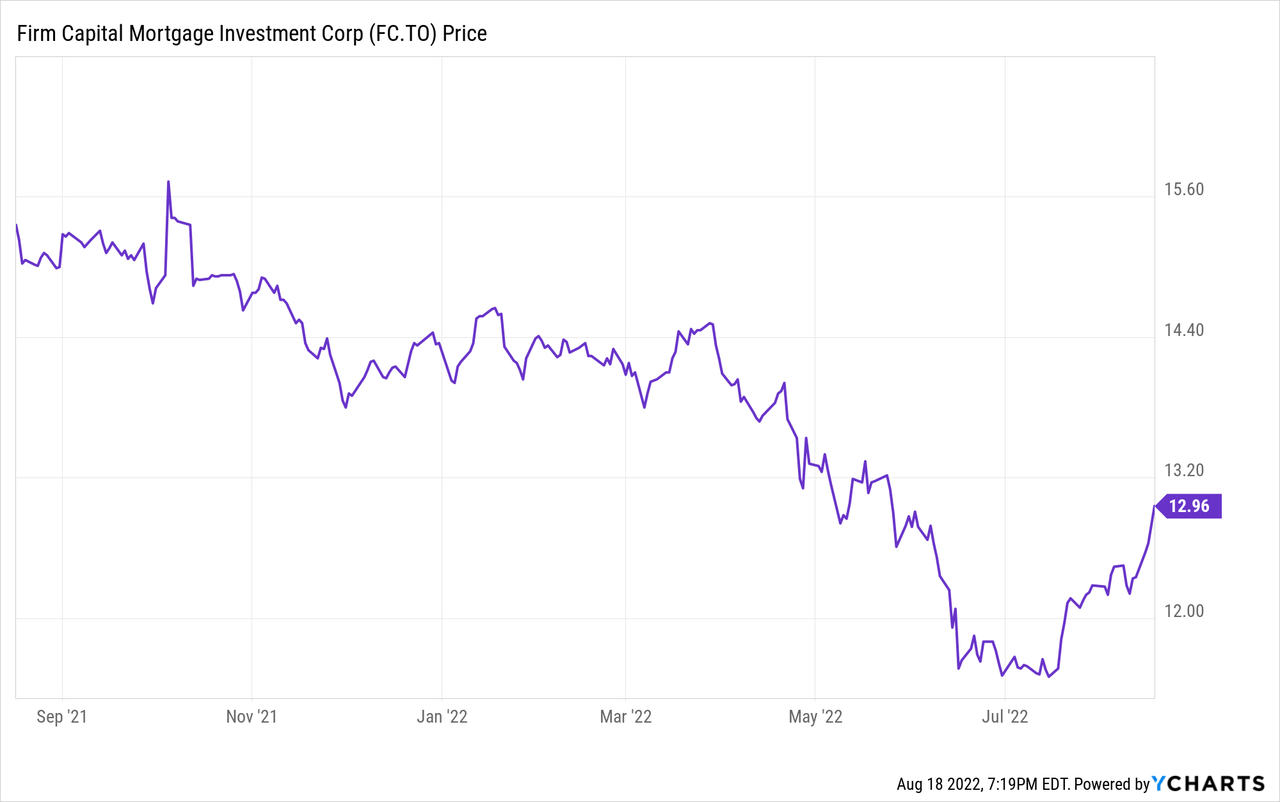

About two years ago, I discussed Firm Capital Mortgage Investment Corporation (OTCPK:FCMGF) (TSX:FC:CA) as the debentures were offering a yield of 5-6% which I thought was a good deal to park some cash during the COVID crisis. Fast-forward to the summer of 2022 and the yields are increasing again as higher interest rates on the market are pushing the bond prices lower. I believe these debentures now once again offer an excellent

As Firm Capital Mortgage Investment Corporation is a Canadian company, its Canadian listing is more liquid than its US listing. The ticker symbol in Canada is FC and the average daily volume exceeds 34,000 shares for a monetary value of approximately C$400,000 per day. As there are 34.5M shares outstanding, the current market capitalization is approximately C$450M. I will use the Canadian Dollar as the base currency throughout this article.

Firm Capital: A non-conventional lender in Canada

To get a better understanding of the business model, I’d like to refer you to my July 2020 article. But just to make sure you get the gist, Firm Capital is a Mortgage Investment Corporation. And as explained in the previous article:

In Canada, the Mortgage Investment Corporations invest in mortgages originated by mortgage brokers for clients that either don’t really have access to funding from commercial banks or only need to get their hands on bridge loans during the development stage. The Mortgage Investment Corporations fulfil an unique role in the Canadian landscape as they serve a specific niche of customers allowing them to charge higher interest rates (6-8% is quite common).

It’s important to note these mortgage investment corporations mainly work with equity and the debt(liabilities)/assets ratio is usually relatively low (and just a fraction of the bank’s leverage ratios). This makes this type of companies attractive as these high-margin loans are generally secured by mortgages on real estate assets and have acceptable LTV ratios. As I will show in this article, the relatively conservative balance sheet structure makes MICs sometimes more interesting than banks but more importantly, the listed debentures that are trading at or slightly below par appear to be extremely interesting in the current low-interest climate.

As a Mortgage Investment Corporation, Firm makes its money on the interest spread: as long as its cost of capital (mainly equity and some debentures yielding 5-5.5%) is lower than the interest it charges its clients, Firm Capital will generate a positive net interest income.

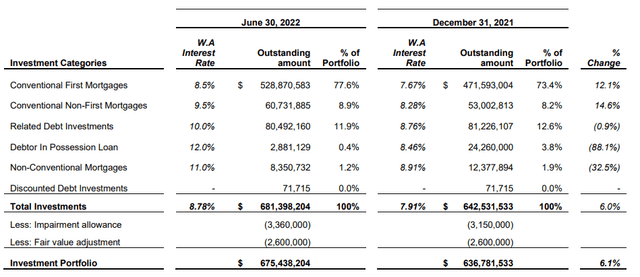

The majority of the loans are conventional first lien mortgages, although about 22.4% of the total loan portfolio isn’t the first mortgage. The higher risk of those other loans is mitigated by charging higher interest rates. And as you can see below, the higher benchmark interest rates have resulted in a positive evolution of the weighted average interest rate in Firm Capital’s portfolio as it jumped from 7.91% to 8.78% in just six months thanks to the floating nature of the vast majority of the loans.

Firm Capital Investor Relations

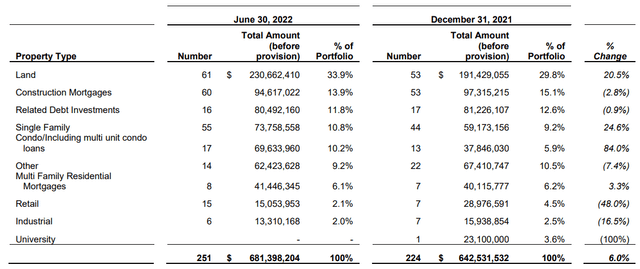

About a third of the loan book consists of land loans, followed by construction mortgages.

Firm Capital Investor Relations

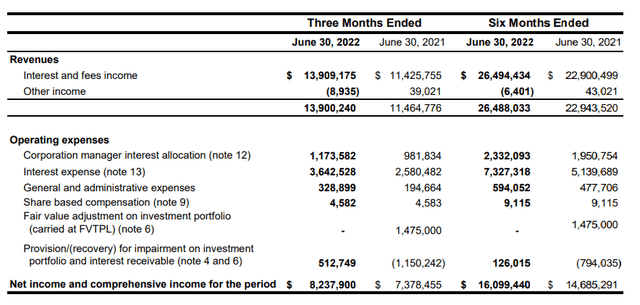

In the second quarter, the total interest income came in at C$13.9M thanks to the combination of an expanded loan book and the aforementioned higher average interest rate. The operating expenses were just around C$5.7M (including a C$0.5M loan loss provision) which meant the reported net income was C$8.2M, resulting in an EPS of just under C$0.24.

Firm Capital Investor Relations

Looking at the half-year results, Firm Capital recorded an EPS of C$0.47 including a C$0.1M loan loss provision. If we would calculate the net interest income for Q2, we end up with in excess of C$10M as Firm Capital’s net interest margin is expanding.

The company has a bunch of convertible debentures

The purpose of this article is to look at the (listed) debentures of Firm Capital.

Firm Capital Investor Relations

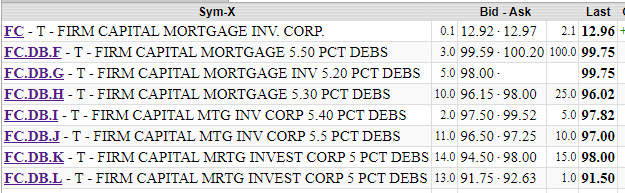

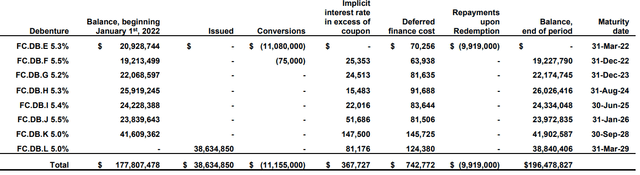

All these debentures have different yields and maturity dates, and I own a bunch of them. The image below shows the size of the respective issues as well as the maturity dates.

Firm Capital Investor Relations

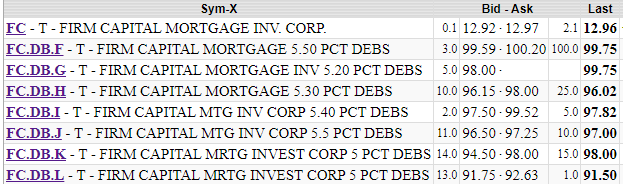

I wanted to single out the K-Series of the convertible debenture (TSX:FC.DB.K:CA) as I have a decent-sized position in that one, and I just can’t understand why the L-debentures are trading so much cheaper as the only difference between both appears to be a six-month difference in maturity. As you can see below, the K-series showed weakness in July but has bounced back to levels we haven’t seen since early May.

This strength is perhaps a bit surprising as the Bank of Canada has hiked interest rates since.

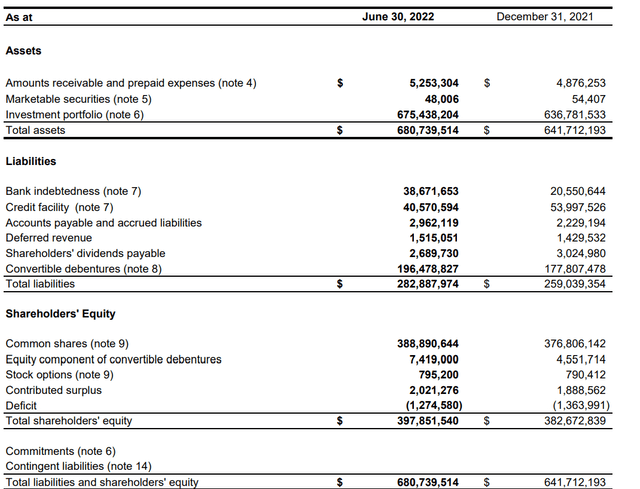

Before discussing whether the K-series or the L-series makes the most sense, I would like to bring up one important element of why I am confident the credit risk on all debentures is pretty low. The image below shows the balance sheet of Firm Capital as of June 30th.

Firm Capital Investor Relations

Debt only makes up a small portion of the total balance sheet. Of the C$681M in assets, almost C$400M is covered by equity. And with almost C$200M in convertible debentures outstanding, this effectively means there’s less than C$80M in debt ranking senior to these debentures.

So going back to the specifics of the K-series: the interest rate is 5.0% and the debentures are maturing in September 2028, almost 6 years from now. The bid is 94.5 and the ask is 98 cents on the dollar with the most recent trade being conducted at 98. Using the last price to calculate the YTM, you end up with a YTM of approximately 5.3%. If you’d put in a bid at 95 cents on the dollar (higher than the current bid), the YTM would increase to 5.83%.

A decent yield compared to the relatively low risk, but that doesn’t mean the K-series is the best possible purchase. Let’s pull up the debenture prices again.

Firm Capital Investor Relations

The H-series looks pretty interesting as well. You can buy those at the same 98 cents on the dollar but these come with a 5.30% coupon and mature in August 2024, which means the yield to maturity for this two-year bond is approximately 6.3%.

That may sound crazy, but it actually makes sense in this current era of inverse yields. The Canadian government bond yield is, for instance, just under 3.4% for a two-year period while a six-year bond has an interest rate of less than 3%. So a longer duration actually means a lower yield.

But for investors looking to lock in the longer duration anyway, the L-series appears to be the best purchase. Available for 92.63 cents on the dollar, the yield to maturity for this 6.5-year bond is approximately 6.4%. Which means that, in my case, it would actually make sense to sell my current K-series at 94.5 and use the proceeds to purchase the L-series at a lower price and a much higher yield to maturity. There is no good reason to explain this discrepancy as the conversion price of the L-series (C$17.00) is even lower than the K-series (C$17.75).

Investment thesis

Although the debentures are convertible, I am considering them as a normal fixed income security and I will cross the bridge of potential conversion when I get there. I own several of the Firm Capital debenture issues as I like the risk/reward ratio with virtually no other debt more senior to the debentures and thanks to a very decent cushion of equity ranking junior to these debentures.

I do own the K-series of the Firm Capital debentures but seeing how the L-series have the same interest rate but are trading materially cheaper, I should make the switch. The debentures are a very useful tool in my income portfolio, but as shown in this article, it makes sense to continuously compare the different issues with each other.

Be the first to comment