RyanJLane/E+ via Getty Images

It’s been about six months since I wrote my cautious piece about Games Workshop Group PLC (OTCPK:GMWKF), and in that time the shares have returned a loss of about 20% against a loss of ~4.9% for the S&P 500. A stock trading at $85 is a definitionally less-risky investment than the same stock when it’s trading at $108.50, so I thought I’d review the name again. Additionally, the company has posted financial results since, so I want to comment on those as well. I’ll determine whether or not it makes sense to buy after reviewing these financials and by looking at the stock as a thing quite distinct from the underlying business.

Welcome to the “thesis statement” portion of the article. It’s at this point where you get the highlights of my argument. I write the thesis statement paragraph, so you can get the highlights of my thinking and then get out in order to avoid my writing, which can be tedious. Anyway, I’ve changed my views on Games Workshop. Although I only conducted primary research myself, it was extensive, and I concluded that Warhammer isn’t going anywhere anytime soon. After reviewing the financial history here, I’ve concluded that the dividend is reasonably well covered in spite of the high payout ratio. Finally, the stock and the dividend yield are attractive to me at the moment. I won’t take a full position just yet, but will buy some this afternoon and will continue to do so opportunistically over the next few months.

Some Primary Research

I’ve bragged about being a nerd a few times on this forum. For example, I belong to a very large Dungeons & Dragons community, and there are, unsurprisingly, many Warhammer players among these people. I’ve conducted a straw poll of about 1,200 people and have concluded that the popularity of this system is still quite robust. In addition, I’ve talked to various retail store managers who sell a significant percentage of the Canadian market for these products, and these people too talk about the ongoing popularity of the Warhammer game system. They also acknowledge that there are more or less expensive ways to access the hobby, but that it remains quite popular. Thus, I’ve tempered the “running out of nerds” views that I expressed in my previous missive somewhat.

Financial Snapshot

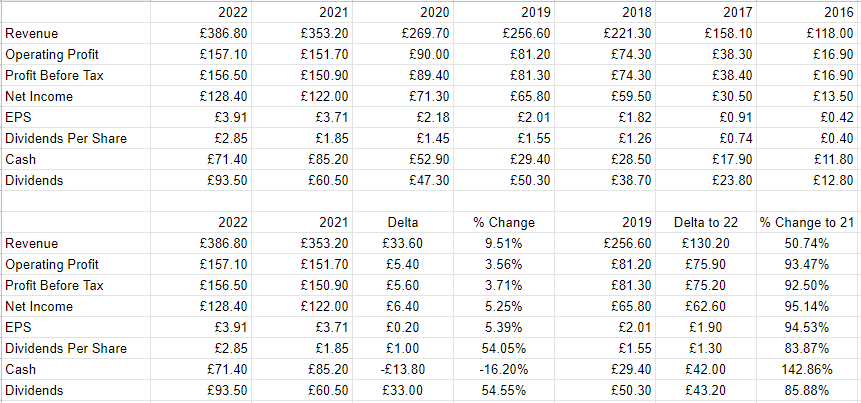

The following figures are reported in Pound Stirling. The most recent financial year was in many ways quite strong in my view. All of the revenue, operating profit, and net income were up a respectable 9.5%, 3.5%, and 5.25% respectively. Recent performance looks even better when compared to the pre-pandemic period. Specifically, revenue and net income were 50.75% and 95% higher in 2022 when compared to 2019. Management saw fit to reward shareholders with a 54.5% uptick in dividends from the prior period.

Although this is a huge increase, the dividend is reasonably well covered in my view, with the payout ratio sitting just under 73%. Although this may seem high, the company has had higher payouts in 2016, 2017, and 2019.

Given all of this, I’d be happy to buy the shares at the right price.

Games Workshop Financials (Games Workshop investor relations)

The Stock

One of the reasons I write on this forum is to try to dispel myths that I’ve come upon over the years. One of these seems to be that a stock is a good investment if it can grow revenue and net income. This was certainly a view that was generally expressed in the comments section of my Games Workshop article. A stock is not necessarily a good investment just because it’s growing profits. The only way that it is a good investment is if there’s a disconnect between those growing profits and expectations about them. Back in February, the market had excessively optimistic expectations, and that drove the shares lower in price.

The fact is that a “stock” and a “business” are two very different things, and we need to analyse them in isolation before doing a more “holistic” analysis. I’m of the view that a reasonably strong company can be a terrible investment at the wrong price, while a struggling company can be a decent investment if you pick it up at a sufficient discount to intrinsic value.

Another way to conceive of this idea is that a business is an organization that buys a number of inputs, performs value-adding activities to those, and sells the results at a profit. The stock, on the other hand, is a traded instrument that reflects the crowd’s aggregate belief about the long-term prospects for a given company. If you’ve invested in stocks previously, you may have noticed that the crowd can be capricious and has a tendency to drive prices up and down relatively frequently. Added to that is the volatility induced by the crowd’s views about a given sector. Hasbro and Games Workshop may go up and down together, for instance, after an analyst offers commentary on only one of these, though these businesses are quite different. Additionally, a company’s stock can be buffeted by our collective view about “stocks” as an asset class, and we see that the stock is often a poor proxy for what’s going on at the firm. This is frustrating in some ways, but it also represents an opportunity for us. If we can spot discrepancies between the price and likely future results, we’ll do well over time. It’s typically the case that the lower the price paid for a given stock, the greater the investor’s future returns. In order to buy at these cheap prices, you need to buy when the crowd is feeling particularly down in the dumps about a given name. In my world, “down in the dumps” means “cheap.” In this case, I would want to see the market start to fret about 3-D printing, because I’m of the view that fears about this are overdone.

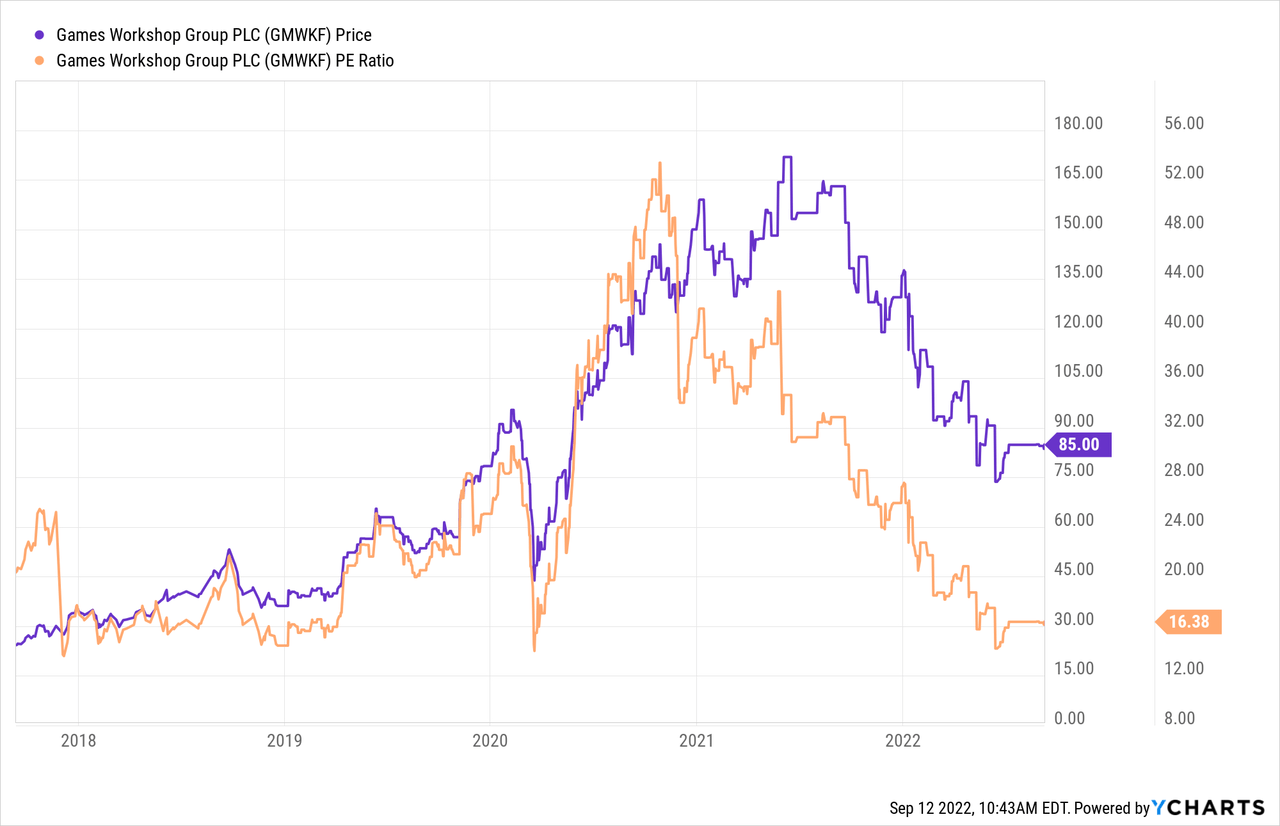

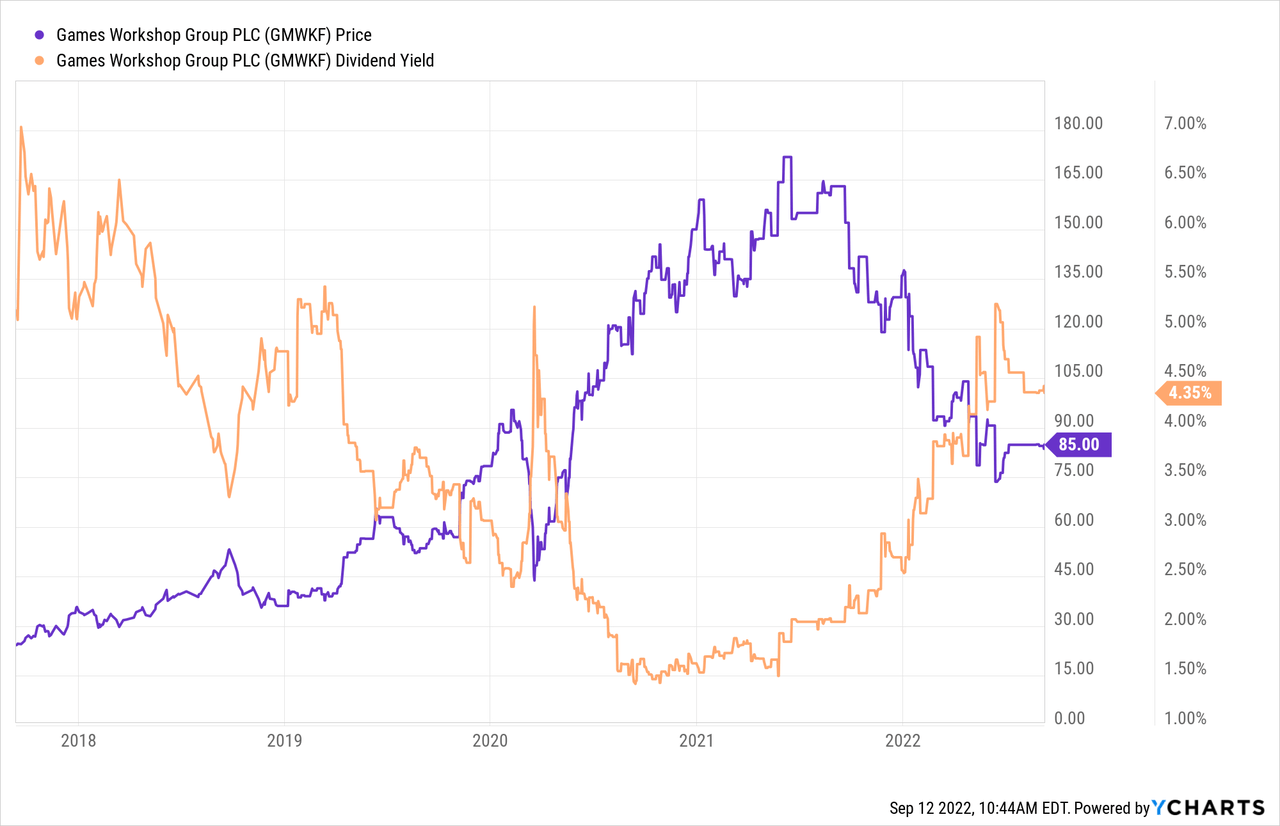

Those who read my stuff regularly know that I measure the cheapness of a stock in a few ways, ranging from the simple to the more complicated. On the simple side, I track multiples of price to some measure of economic value, like earnings, free cash flow, book value, and the like. Ideally, I want to see a company trading at a discount to both the overall market and its own history. When I last reviewed Games Workshop, I complained about the fact that the stock was trading at a price-to-earnings ratio of about 21.75, and sported a dividend yield of about 3.3%, which was low by historical standards. Fast-forward to the present and things are about 24% cheaper, per the following:

Although the dividend hasn’t reached its previous heights, it is quite good when compared to the past few years. I like a situation where investors end up paying less for earnings, and getting more of this sustainable dividend.

Conclusion

All of this is compelling to me, and for these reasons, I’ll be buying some shares this morning, and will continue to acquire shares between now and the gift-giving season opportunistically. The price is reasonably attractive at the moment, the well-covered dividend yield is decent, and I think there’s room for growth here. I may suffer a bit of capital loss if the overall market is taken down, but the dividend will insulate me from some of this pain.

Be the first to comment