JuSun

Screening for high yield is easy for any investor to do, and is often times a front line screen for investment opportunities. This can be tricky, however, with stocks that pay supplemental dividends, as with many in the BDC sector. Top stocks that come to mind may be Main Street Capital (MAIN) and Hercules Capital (HGTC), both of which pay meaningful supplemental dividends.

This brings me to Fidus Investment (NASDAQ:FDUS), which appears to be among one of the lower yielders in the BDC space based on its regular dividend alone, but is actually more attractive than meets the eye. This article highlights why the recent dip in price presents a good buying opportunity on this high yield.

Why FDUS?

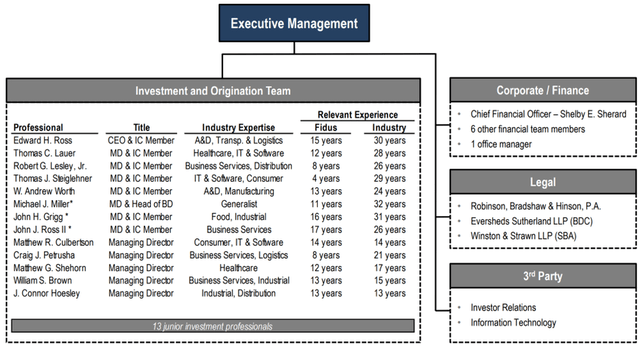

Fidus Investment is an externally-managed BDC that invests primarily in lower middle-market, as defined by U.S. companies with annual revenues between $10 to $150 million, and annual EBITDA from $5 to $30 million. It was founded in 2007 as a Small Business Investment Company and went IPO as a BDC in 2011. FDUS also enjoys the benefit of a rather stable management team, led by the CEO who has been with the company for 15 years, with 30 years of industry experience.

FDUS Executive Team (Investor Presentation)

Given the smaller nature of FDUS, it doesn’t have to compete with much larger BDCs like Ares Capital (ARCC) in the middle market and upper middle market space for deals. Its focus on the LMM space results in less competition, given than this segment is highly fragmented with over 100K companies.

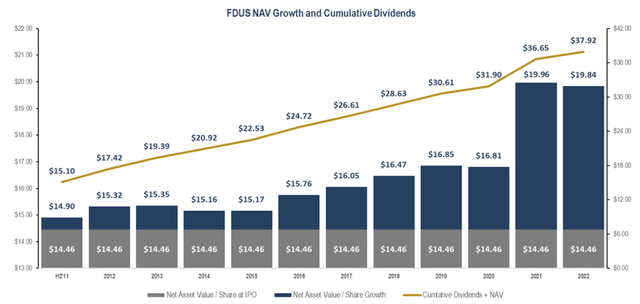

This strategy has worked well for FDUS, as it has grown its net asset value per share substantially since IPO, all while delivering a high amount of cumulative dividends. As shown below, investors at IPO have realized more than double their initial value through a combination of NAV/share appreciation and cumulative dividends.

FDUS NAV and Dividend Record (Investor Presentation)

Moreover, management employs a rather rigorous investment selection process, reviewing an average of 620 deals per year, screening just 6.6% of those deals for further review, and closing on just 2% of the total amount. FDUS also focuses on direct sourced deals rather than broadly syndicated loans, resulting in a closer relationship with the borrower, which can lead to repeat business through follow-on financing rounds.

At present, the investment portfolio is comprised of 75 portfolio companies with a fair value of $857 million and a high weighted average debt yield of 13%. A large portion of investments (83%) are in the form of secured debt (59% first lien, 24% second lien) with the remainder comprised of subordinated debt (10%), for higher yield, and equity (7%), for more capital appreciation potential. Its portfolio companies have a strong weighted average interest coverage of 3.9x.

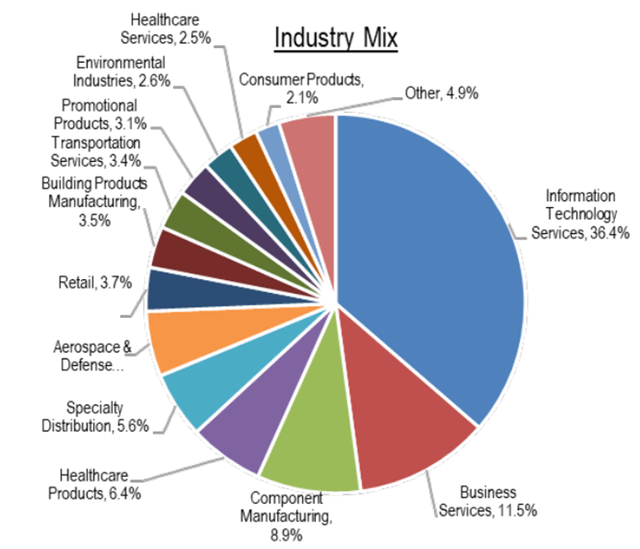

Also encouraging, FDUS currently has unrealized gains on its portfolio, with a fair value to cost ratio of 104%, and investments on non-accrual are low, representing just 0.5% of the portfolio fair value. The portfolio also is well diversified in defensive industries, with little to no exposure cyclical sectors.

FDUS Portfolio Mix (Investor Presentation)

Importantly, FDUS generated NII per share of $0.52 during the third quarter, more than covering its $0.36 regular dividend, enabling it to declare $0.25 in supplemental dividends this quarter. FDUS also saw its NAV per share grow by $0.47 per share.

Looking forward, FDUS is well positioned to continue with supplemental and special dividends, considering its substantial buffer between the regular dividend and earnings as well as $2.86 in spillover income per share. Notably, it also has potential to fund add-on investments with its strong balance sheet. This is reflected by its regulatory debt to equity ratio of just 0.6x, sitting far below the 2.0x statutory limit. This may be especially helpful in the current environment of high interest rates.

Lastly, find FDUS to be appealing after the recent drop in price from the $20 level to $18.88 at present. This translates to an 11% earnings yield, based on NII per share of $0.52 during Q3. I believe this serves as a better gauge of FDUS’s dividend potential, considering that many BDCs pay out the majority of their earnings, as was the case for FDUS over the past 3 months.

FDUS is also now trading at a 3% discount to NAV at the current price. I believe a premium to NAV is warranted considering the strong track record and balance sheet. Analysts have a consensus Buy rating on FDUS with an average price target of $20.42, translating to total return potential in the mid to high teens over the next year.

Investor Takeaway

Fidus Investment is a small business development company that has employed a successful strategy of investing in the lower middle market space. This has resulted in attractive returns for investors, both through NAV appreciation and cumulative dividends. The recent dip in share price presents an attractive 11% earnings yield with potential for capital appreciation.

Be the first to comment