Blue Planet Studio/iStock via Getty Images

Investment Strategy Outlook – International Equity

Global equities declined during the March quarter as Russia’s invasion of Ukraine left a dark cloud of uncertainty over financial markets. The FMI International portfolios were outperforming handily up until the eve of the war (February 24, 2022), ahead of the comparable MSCI EAFE indices by around 3%. Unfortunately, the tide turned after the onset of the invasion, as energy, commodity, and defense-related stocks – sectors where FMI has minimal exposure given our focus on business quality – soared. Growth stocks also rebounded strongly in the latter part of the period, amounting to an even tougher comparison.

For the quarter, the FMI International portfolios fell by approximately 5.3% (gross)/5.4% (NET) on a currency hedged basis and 7.4% (gross)/7.6% (NET) currency unhedged, respectively, compared with an MSCI EAFE Index down 3.73% in local currency (LOC) and 5.91% in U.S. Dollars (USD). The MSCI EAFE Value Index gained 2.68% in LOC and 0.33% in USD. The MSCI EAFE Value Index gained 2.68% in LOC and 0.33% in USD.

Industrial Services, Producer Manufacturing, and Finance contributed to FMI’s performance, while Distribution Services, Energy, and Non- Energy Minerals all hurt on a relative basis.

Schlumberger Ltd. (SLB), CK Hutchison Holdings Ltd. (OTCPK:CKHUF) (OTCPK:CKHUY), and Chubb Ltd. (CB) were the strongest individual performers, while Ferguson PLC (FERG), Samsung Electronics Co., and Akzo Nobel N.V. (OTCQX:AKZOY) each lagged.

A strong USD boosted FMI’s currency-hedged performance.

State of War

Russia’s large-scale invasion of Ukraine has quickly proven to be a humanitarian catastrophe. Thousands of innocent lives have been lost, over 4 million refugees have fled the country,1 homes have been destroyed, and infrastructure obliterated. Our hearts go out to those who are suffering through this needless tragedy. From where we stand today, the path of the war remains unknown, as Russian President Vladimir Putin is far from predictable or rational. Much has been written about the conflict, potential outcomes, and global ramifications; our discussion will center on the economic impact and what it could mean for our portfolios.

The FMI International portfolios’ exposure to Russia and Ukraine is quite limited, with no direct investments in either country, and around 1% of our aggregate revenue there. Both economies are expected to contract by over 30% this year.2 Unfortunately, the economic impact of the war is also far broader, spanning the globe. Energy and commodity prices have skyrocketed as Western nations have imposed the most sweeping economic sanctions against a major country in decades, with the United States banning the import of Russian oil, gas, and coal.

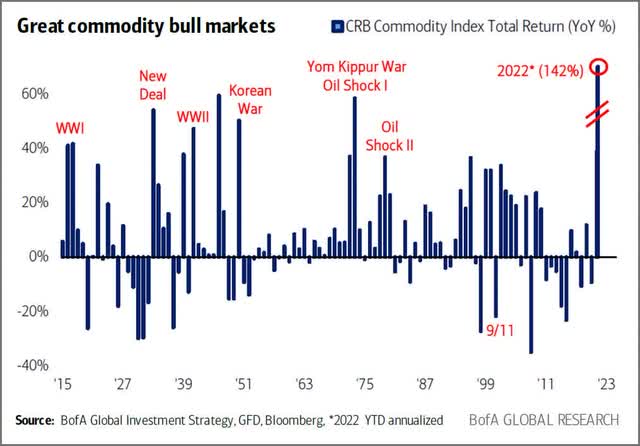

We witnessed the largest one-week price increase in commodities ever,3 with heavy Russia/Ukraine exports including Wheat (80%+ from January average price), Fertilizer (70%+), Nickel (60%+), Maize (40%+), and Palladium (30%+) on the move, in addition to the aforementioned fossil fuels. Russia supplies around 19% of the world’s natural gas and 11% of its oil, with Europe being highly dependent on Russian energy imports. The European Union gets around 40% of its gas from Russia and 27% of its oil.4 Shockingly, gas spot prices in Europe are ten times higher than they were a year ago, while the price for oil has nearly doubled.5 If elevated prices hold, we’d expect to see a supply response. As they say in commodity markets: “The cure for high prices is high prices.” Long-term, we also expect to see Europe diversify away from Russian fossil fuels. Unfortunately, the near-term pain appears unavoidable.

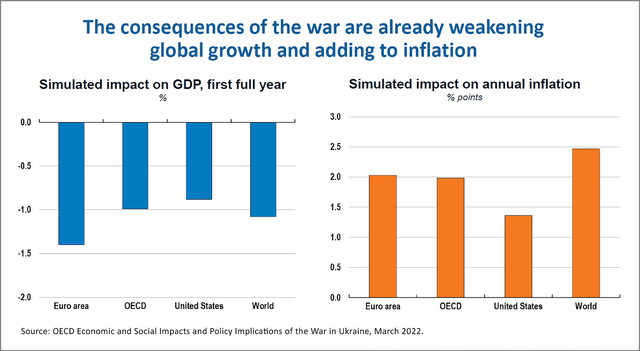

Rising energy and food prices are coming at a time when Europe and the U.S. (prior to the war) had already been facing the highest level of inflation in decades. After $30 trillion of global fiscal and monetary stimulus since 2020,6 and years of aggressive money printing and quantitative easing, the European Central Bank (ECB) and the Fed were well behind the curve in terms of raising interest rates (neither had even started). The commodity spike, in addition to another round of supply chain disruptions and increasing transportation costs, will add more fuel to the inflation fire. In Germany, for example, consumer prices rose 7.6% in March,7 the highest level in more than 40 years, after producer prices had risen by 25.9% in February.8 Europe’s economy, given its proximity to the war and reliance on Russian energy, is likely to be the hardest hit. The OECD9 estimated the potential impact to economic growth and inflation from the war in the chart above. Tough times may lie ahead for the global consumer, as companies look to maintain profits by continuing to raise prices to offset rising input costs. Unfortunately, given the composition of their income, assets, and consumption baskets, high inflation tends to have an outsized impact on low-income households, as they tend to spend disproportionately more on food and energy.10

Compared with the MSCI EAFE Index, the FMI International portfolio’s revenue exposure is over-indexed to the UK (13.6% vs. 6.1%), and under-indexed to the rest of Europe (20.2% vs. 25.8%). We believe we are well-positioned from a relative standpoint. The UK is much less dependent on Russian energy than the rest of the continent, importing only 4% of its gas and 8% of its oil from Russia.11 Furthermore, we have long argued that Brexit was the right move for the UK, as they have distanced themselves from the dysfunction of the EU, which has demonstrated an inability to reform, a lack of desire to address their own structural problems, and a propensity for high government debt levels that could once again become a problem.

Our domestic UK businesses are durable. B&M European Value Retail S.A. (OTCPK:BMRRY) (OTCPK:BMRPF) is a leading discount retailer that performs well in most economic environments, offering low prices on consumables and necessities. Greggs PLC is the UK’s top convenience food- to-go store operator, selling baked goods, food, and coffee at value prices, resulting in repeat consumption. Lloyds Banking Group PLC (LYG) (OTCPK:LLDTF), the UK’s largest bank, is predominantly a mortgage and credit card lender; it is well-capitalized, has a low-cost position, and de minimis exposure to Russia. The risk profile of the Eurozone banks (which we do not own) is far greater, as their Russian (and other counterparty) exposure is much less clear, and sovereign debt is being carried on their balance sheets with little- to-no capital requirements. Howden Joinery Group PLC (OTCPK:HWDJF) (OTCPK:HWDJY) is the UK’s largest supplier of fitted kitchens. Although we could certainly see an air pocket if discretionary spending falls, effectively all of their business is replacement, the company runs with no debt, and they have a history of taking market share during periods of dislocation.

The balance of our European exposure is well-diversified, though there are certainly some risk points we are monitoring. Leisure travel in Europe is a near-term concern for Booking Holdings, Inc. (BKNG) and Safran S.A. (OTCPK:SAFRY) (OTCPK:SAFRF), but demand should recover as time passes. Oil derivatives are a significant percentage of the raw material costs at Akzo Nobel N.V., with a pricing lag weighing on current profitability. However, price increases are coming and tend to be sticky, as paints and coating companies often see margin expansion after significant inflationary periods. Rexel S.A. (electrical distribution) faces the prospect of a slowdown in commercial construction, but 50-60% of their European commercial business is retrofit, which should prove more resilient. We are constantly monitoring the downside risks of our holdings. Collectively, given their business quality and balance sheet strength, we’d expect our companies to hold up well during challenging times.

The portfolio has very little exposure to Exploration & Production and commodity-related stocks, which were a big driver of returns in the quarter. Over long periods of time, most of the companies in these sectors have failed to earn their cost of capital, and are highly volatile. Commodities, by definition, lack differentiation. Poor discipline and bad actors can ruin the business economics. While these can be great trading stocks, like we are seeing today, they do not fit our eye in terms of business quality and long-term value creation.

Back to the Disco Era?

The risk of a global recession has undoubtedly increased due to the war. As penned by The Wall Street Journal, “Economists are increasingly warning of a possible bout of stagflation, particularly in Europe, a situation of high inflation and low growth that afflicted major economies during the 1970s. Back then, central banks responded to a surge in oil prices with easy-money policies that caused a wage-price spiral. Now, some central banks might give up on their plans to increase interest rates after keeping them down during the pandemic.”12 Herein lies the conundrum. If central banks stay accommodative and keep rates too low for too long, they could lose control of inflation (we think they already have). If they raise interest rates too aggressively, they risk choking off the growth of the economy. Years of profligate government spending and money printing have left central banks no choice but to try to “thread the needle.” We do not envy their position, but in many ways it has been self-made. The Fed and Bank of England are finally moving down the path of rate hikes (albeit slowly), while the ECB and Bank of Japan continue to drag their feet. Time is of the essence.

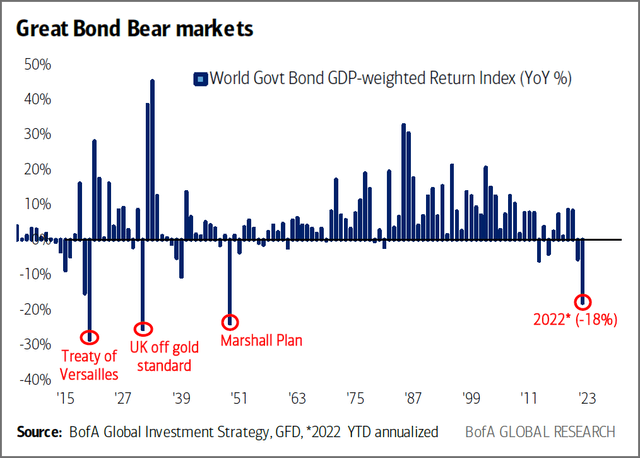

Fortunately, despite the disappointing reluctance of central banks to raise rates more decisively, market forces are starting to move interest rates higher on their own accord. Higher rates mean lower bond prices, so it appears that a global bond bear market is finally upon us, per the chart on the right.

To approach something that starts to resemble normalcy, we still have a very long way for rates to go. At the very least, it is encouraging to see negative yielding debt falling precipitously, from $18.3 trillion in late 2020 to under $3 trillion today.13 As we’ve said many times, money is not supposed to be free (or even worse, negative yielding). We welcome a day when price discovery determines the cost of capital, not manipulation by central banks.

If indeed the next economic cycle features higher interest rates and inflation, as it appears it will, we should be operating from a position of strength. Our quality businesses have pricing power given their advantaged competitive positions. Our companies’ solid balance sheets should allow for investment and market share gains during tough times, while their levered competitors are compromised. High valuation multiples may get knocked down off their perch, allowing for our valuation discipline and discount to the market to shine through. We remain optimistic, but discerningly cautious.

Taking Taiwan

At the outset of the Ukraine war, observers wondered whether Russia’s invasion would embolden China to attempt to annex Taiwan. This would be another extremely negative development with significant global economic implications. Taiwan is home to the world’s leading semiconductor company ( TSM – Taiwan Semiconductor Mfg. Co. Ltd.) and the most advanced semiconductor technology. China is significantly behind in this area, with little chance of quickly catching up through organic investment. In recent years, China has muscled its way into second place in the global economy and will remain a powerful force. However, China President Xi Jinping has been clear in his intentions to make China number one in economic, military, and geopolitical leadership over the next two decades. We hope Xi Jinping will learn some valuable lessons from the war, giving him some pause. Russia clearly miscalculated the military resolve of Ukraine, as their advancement has been much slower than originally anticipated. Furthermore, the swift and unprecedented sanctions from the West were bolder than many expected. Taiwan is of great strategic importance to the West and its invasion could elicit an even fiercer economic response, if not a military one as well. China’s reliance on approximately $1.3 trillion of exports to the U.S. and Europe14 may be an additional deterrent to a 21st Century Cold War. We hope that these factors will keep China from going too far, but recognize that anything is possible. With the U.S. and Europe keenly aware of Taiwan’s global significance, we hope there will be enough diplomatic pressure to forestall another war.

[As a reminder, FMI does not have any direct investments in China. China’s authoritarian government, rule of law, lack of disclosure, accounting practices, management distrust, and poor corporate governance have been roadblocks. When we cannot do our customary level of due diligence, we simply pass.]

While there is tremendous uncertainty in the world, with it comes new opportunities. Though some of our investments have been recently out-of-step with the market (the nature of contrarian investing), in the fullness of time we expect their positive attributes to prevail. As Ben Graham wisely said: “In the short run, the market is a voting machine, but in the long run, it is a weighing machine.” We remain focused on finding strong businesses that can weather the storm, are soundly financed, and trade below their intrinsic value.

Described on the next page are two holdings where we see an attractive risk/reward.

(Analyst: Dain Tofson)

Description

Sodexo is a leading global caterer, facilities manager, and benefits and rewards services provider. The company is headquartered in Paris, France, and controlled by the Bellon family. Sodexo reports two segments: On-site Services and Benefits & Rewards Services. On-site Services represented 96% of revenue and 79% of EBITA15 in fiscal year (FY) 2019. By service type, On-site Services revenue was split 66% food services and 34% facilities management services. By geography, On-Site Services revenue was split 45% North America, 39% Europe, and 16% rest of world. Benefits & Rewards Services represented 4% of revenue and 21% of EBITA in FY 2019. By activity, Benefits & Rewards Services revenue was split 77% Employee Benefits and 23% Services Diversification, which includes fuel passes and public benefits programs. By geography, Benefits & Rewards Services revenue was split 67% Europe, USA, and Asia and 33% Latin America.

Good Business

- Sodexo is one of the largest players in On-site Services and Benefits & Rewards Services. In On-site Services, the company’s scale gives them procurement advantages over smaller competitors. In Benefits & Rewards Services, Sodexo’s large, two-sided network constitutes a defensible moat.

- The On-Site Services industry is large and fragmented. The large players such as Sodexo have a long runway to take market share from smaller operators.

- The business is relatively stable and defensive in non-pandemic downturns, with client retention rates around 93-94%, new sales development around 7%, and consistent same site sales growth.

- Returns on capital employed have generally been mid-teens or higher.

- The company has a strong balance sheet with net debt-to-EBITDA of 1.7 times.

- This is an easily understandable business.

Valuation

- The stock trades at around 14 times FY 2023 earnings per share (EPS) versus 17-18 times historically, which is at a discount to the MSCI EAFE Index, despite being a much better-than-average business.

- The stock is trading at a discount to the company’s sum-of-the-parts value.

- We believe Sodexo can improve its EBITA16 margin more than consensus expectations. If the company can earn 6.25% EBITA margin on FY 2023 consensus revenue, then that implies €1.4 billion of EBITA and inexpensive valuation multiples of 8.4 times EV/EBITA17 and 11.9 times EV/NOPAT.18

Management

- Sophie Bellon is Chairwoman and CEO. The Bellon family is turning into a “self-activist,” having embarked on a plan to improve performance and unlock value in the business.

- Sodexo is a member of several Sustainability Indices and ranks amongst leaders in its sector for the sixteenth consecutive year.

- Long-term incentive compensation is based on revenue, margin, total shareholder return versus peers, and corporate responsibility.

Investment Thesis

Sodexo is a very FMI-like business – it has solid growth prospects in structurally attractive industries, relatively defensive performance, mid-teens or higher return on capital employed, a solid balance sheet, and is easy to understand. However, despite the company’s attractive intrinsic qualities, the business and stock have been through a multiyear period of underperformance. The underperformance began in 2018 due to management issues in On-site Services North America Healthcare and On-site Services Education sectors, and was followed by pandemic-induced lockdowns in 2020 and 2021 that significantly impacted the overall business. However, there are signs that the future looks brighter than the past. Trends are improving in these two sectors, and the acute phase of the pandemic looks to be coming to an end. In our opinion, Sodexo is posed for a strong recovery, but the market hasn’t recognized this yet.

(Analyst: Jordan Teschendorf)

Description:

Greggs is the UK’s leading convenience food-to-go store operator, offering fresh prepared baked items, food, coffee, other drinks, and snacks from convenient locations at value prices. It operates a unique vertically integrated model, manufacturing and distributing the majority of the products it sells. Greggs serves over 6.5 million customers each week from its shop network (2,181 at year-end 2021) and estimates it has around 5% market share in the UK “food-on-the-go” sector (sized at £24 billion in 2019; growing mid-single digits). As of 12/31/21, approximately 17% of Greggs shops were franchised.

Good Business:

- Greggs has historically grown strongly in good economic periods, and has been resilient in recessions. Prior to COVID the company grew sales for >35 consecutive years, including +7%/+5% in 2008/2009.

- Greggs sells products that are low-ticket (£3 estimated average transaction value), consumed immediately, and often need to be replenished during the day. The company’s vertically integrated model, large scale, and network density enable it to deliver fresh-baked foods and ingredients for on-site preparation multiple times daily to each shop in its network, control and assure food quality, flex its range to meet changing tastes/preferences, and drive economies of scale across the value chain.

- Consistent operational delivery in the industry creates habitual purchasing behavior. Greggs operational model within stores is built on speed-of-service, with efficient layouts, teams, and the latest technologies. As Greggs expands its network, its convenience and value to the customer improves while fixed cost and overhead per store declines, justifying further expansion.

- The industry has proven to be rational, with pricing offsetting inflation over time.

- Return on invested capital is 21%, fully burdened for leases. Greggs recently outlined a significant investment program over the next several years, supporting an acceleration in its growth rate. With strong execution, the business is capable of growing its shop base around 7% annually with strong unit economics.

- The company is conservatively financed, with net financial cash on the balance sheet. Net cash has averaged around 15% of the invested capital base over the last two decades.

- Since the 1980s, Greggs has shared 10% of annual profits with employees.

Valuation:

- The stock trades at 10.6 times trailing EV/EBITDA, a discount to its long-term historical average, despite improved growth prospects.

- It trades at approximately 20 times trailing EPS ex-cash, which is below its five-year average leading up to the pandemic of 23.5 times.

- The multiple appears reasonable based on normalized potential growth of high-single to low-double-digit revenue (slightly faster EPS), high-teens or better incremental returns, and a net cash balance sheet.

Management:

- Roger Whiteside has been CEO since February 2013 and on the board since March 2008. He has driven a significant investment program, deepening existing competitive advantages for the company.

- In early February, the board named Roisin Curry successor to long-time CEO Roger Whiteside, effective May 2022. She served as retail and property director, having been with Greggs since 2010. Mr. Whiteside will remain on the board and support Ms. Curry through January 5, 2023.

- Richard Hutton has been CFO since March 2006, having joined the company from Proctor & Gamble Co. in 1998.

- Long-term compensation is paid in the form of performance shares and linked to return on capital employed (ROCE), while annual incentives are linked to profit before tax, sales growth, and cost savings. All investments in shops and infrastructure are evaluated based on ROCE and discounted cash flow analysis.

Investment thesis:

Greggs is a strong franchise we have admired for some time, gaining appreciation for the company and the food-to-go industry through previous UK portfolio companies. The stock’s high valuation and light liquidity had historically been constraints on potential ownership, although the pandemic provided an opening. Preventative coronavirus measures and social distancing restrictions led Greggs to temporarily close shops for nearly fifteen weeks, which led to the first loss in company history during 2020. While disruptive, our thesis was that this would ultimately prove manageable given the company’s strong financial position, the business would eventually return to its strong pre-COVID growth trajectory, and its competitive position could be enhanced. We established our initial position at a significant discount to long-term average valuation levels and the broader market. Greggs’ recent results and fundamental outlook are supportive of our thesis. Considering the combination of its business model resilience, growth prospects, returns on capital, and strong balance sheet, we believe the valuation remains reasonable on an absolute basis and attractive on a relative basis.

Thank you for your continued support of Fiduciary Management, Inc.

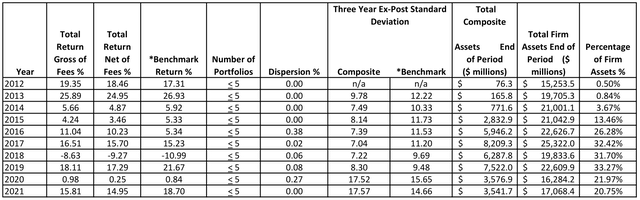

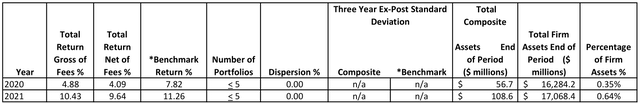

Fiduciary Management Inc. International Equity Hedged Composite 12/31/2010 ‐ 12/31/2021

*MSCI EAFE Net Local Index®

Returns reflect the reinvestment of dividends and other earnings.

The above table reflects past performance. Past performance does not guarantee future results. A client’s investment return may be lower or higher than the performance shown above. Clients may suffer an investment loss.

Fiduciary Management Inc. International Equity Unhedged Composite 12/31/2019 ‐ 12/31/2021

*MSCI EAFE Net Index (USD)®

Returns reflect the reinvestment of dividends and other earnings.

The above table reflects past performance. Past performance does not guarantee future results. A client’s investmentreturn may be lower or higher than the performance shown above. Clients may suffer an investment loss.

Footnotes

¹Jon Henley. “More than 4 million have fled Russia’s ‘senseless’ war on Ukraine, says UN.” The Guardian, March 30, 2022.

²Mohamed A. El-Erian. “The Ukraine War’s Multifaceted Economic Fallout.” March 7, 2022. https://www.project-syndicate.org/

³Bloomberg Commodity Index (BCOM)

⁴Rowena Mason, Heather Stewart, Julia Kollewe. “UK to phase out Russian oil imports by 2023 and explore ending gas imports.” The Guardian,

⁵”Economic and Social Impacts and Policy Implications of the War in Ukraine.” OECD Economic Outlook, March 17, 2022. https://www.oecd.org/ economic-outlook/

⁶Michael Hartnett, David Jones, Shirley Wu, and Myung-Jee Jung. “The Flow Show: Buy Signal.” BofA Global Research. March 24, 2022.

⁷Zuzanna Szymanska and Miranda Murray. “‘Welcome back to the 1970s’: Oil, gas prices push German inflation above 7%.” Reuters, March 30, 2022.

⁸”German producer prices jump by record 25.9%.” Reuters, March 21, 2022.

⁹Organisation for Economic Co-operation and Development.

10Indermit Gill and Peter Nagle. “Inflation could wreak vengeance on the world’s poor.” Brookings Institute, March 18, 2022.

11Rowena Mason, Heather Stewart, Julia Kollewe. “UK to phase out Russian oil imports by 2023 and explore ending gas imports.” The Guardian,

12Tom Fairless. “Global Economy Braces for Impact of Russia’s War on Ukraine.” The Wall Street Journal, March 7, 2022.

13Bloomberg.

14Bloomberg.

15Earnings before interest, taxes, depreciation, and amortization.

16Earnings before interest, taxes, and amortization.

17Enterprise value-to-EBITA.

18Enterprise value-to-net operating profit after tax.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment