The Good Brigade/DigitalVision via Getty Images

Introduction

Fidelity National Financial (NYSE:FNF) offers property insurance, mortgage and real estate services, and real estate technology services. The acquisition of FGL holdings in 2020 will also generate sales in annuities and life insurance, making consolidated sales more diversified.

Fidelity National Financial’s stock rose sharply from early 2020 to late 2021. The company has benefited greatly from strong demand in both housing transactions and the rise in house prices in the low interest rate environment. Interest rates are currently rising sharply. This year, however, the stock has fallen by 26%. Investors are concerned about the prospects for the housing market due to rising interest rates.

The acquisition of F&G by Fidelity National Financial is a strategic move to offset declining title segment revenues in times of high interest rates. Higher interest rates are detrimental to the title segment, but beneficial to F&G. It is therefore unclear what the growth in EPS will be for the coming years. Due to the lack of growth catalysts, I give the stock a hold rating.

The Housing Market Is In A Bubble

At the beginning of 2020, the FED drastically cut interest rates, making it very attractive to take out a new mortgage. According to the S&P CoreLogic Case-Shiller US National Home Price Index, house prices rose 10.4% in 2020 and 18.9% in 2021, the largest increase in 34 years. The housing price boom is still active today. The median listing price grew 15.7% in June compared to last year.

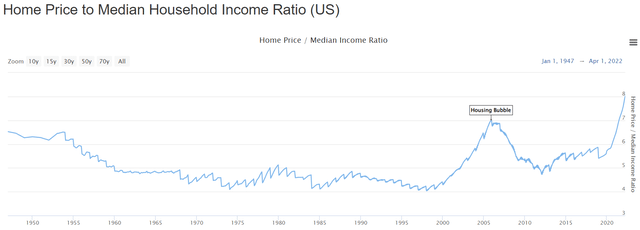

Historically, house prices have been expensive compared to median household income. The ratio between the house price and the median household income is 8, while the ratio was a maximum of 7 during the housing boom.

Home Price to Income Ratio (US) (Longtermtrends)

The same goes for the Case-Shiller Home Price to CPI Ratio. Currently, this ratio is 1.04 (all time high) compared to the maximum value of 0.92 during the housing boom. House prices are very expensive.

Monthly mortgage payments are up 55% year-over-year as a result of the rise in interest rates. The FED isn’t done raising interest rates yet; inflation rose by 8.6% in May compared to last year. Rising interest rates mean that potential homeowners can borrow less, which can cause home prices to fall.

Realtor expects growth to slow in H2 2022. New listings were up 5% compared to a year ago and active inventory rose 25% above one year ago.

Revenue And EPS Will Decline

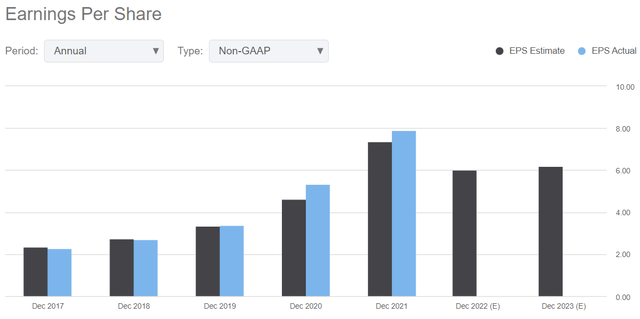

In the first quarter, title segment revenue declined to $2.4 billion from $2.5 billion a year ago. However, F&G revenue grew 57% from a year ago. Overall, total revenue increased 2% to $3.2 billion and net income attributable to common shareholders declined 34.3% to $397 million. The title segment received a strong boost from the commercial market and the increase in house prices in the residential market, offsetting the decline in refinancing volumes in the rising interest rate environment. F&G delivered strong sales and thrives in an environment of rising interest rates.

The title segment may experience a decline in revenue during a period of rising interest rates, while the F&G segment is growing in this environment. Despite this strategic mix, 6 analysts expect consolidated revenues to fall by 16% in 2022 compared to 2021. Earnings per share are expected to fall by 24%.

FNF has made a good strategic choice to acquire FGL in 2020 to cushion the coming headwinds in the housing market. However, this hinders consolidated growth in both segments. The stock is down 26% this year, but does that mean the market has already priced in the risk?

Stock Valuation Is Attractive

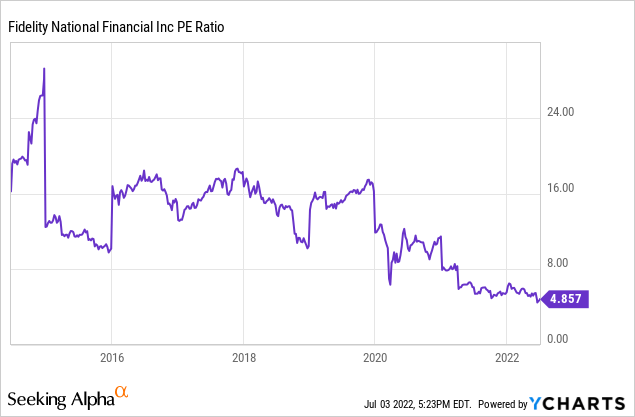

The drop in share price makes it interesting to investigate the valuation in more detail. The PE ratio is a commonly used tool to compare the current valuation with the past. Currently, the PE ratio is 4.9. At the end of 2022, the EPS is expected to fall to $6.02, the forward PE ratio is then 6.3.

The current PE of 4.9 and the forward PE of 6.3 are both historic lows and the stock valuation is therefore very attractive. However, analysts expect zero growth in EPS for the next few years. The stock valuation is therefore fairly valued, but still trades on the low side due to the absence of growth catalysts.

Conclusion

Interest rates are rising, causing real estate transactions and prices to fall, which is detrimental to the title segment. However, rising interest rates are beneficial for the annuity and life insurance segment. Due to this mix, it is unclear which direction EPS will go in the coming years. Because there are no growth catalysts, the current stock valuation is fair. When the EPS trend is positive, the stock has the potential to rise sharply. In this case, FNF is a hold.

Be the first to comment