Vladimir Agapov

Despite Strong Headwinds, FibroGen, Inc. Has Achieved a High Market Valuation

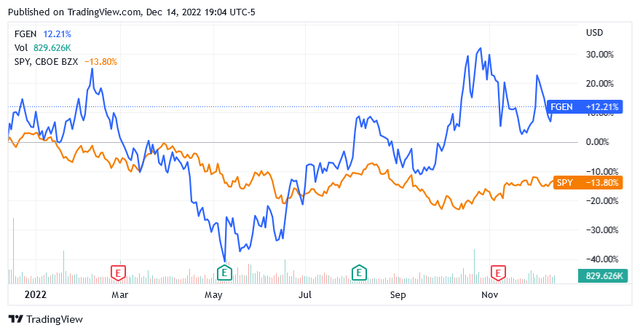

Compared to the US stock market represented by the benchmark index SPDR S&P 500 Trust ETF (SPY), shares of FibroGen, Inc. (NASDAQ:FGEN) have put in an amazing performance.

While high inflation, the risk of a recession and the war in Ukraine have led US-listed stocks to fall 13.80% so far, the share price of US biotech developer FibroGen, Inc. has gone up by more than 12%.

Due to growth over the past year, FibroGen, Inc.’s stock currently has a market valuation that seems disproportionate to its value. The latter is impacted by a treatment portfolio that seems to lack the prospects for strong long-term growth, while sales struggle with a worrying downtrend.

In addition, current funding may not be sufficient to support the development of treatments in the coming years. Shareholders should think about taking profits.

FibroGen, Inc. In The Biotechnology Industry

FibroGen, Inc. is a San Francisco, California-based biopharmaceutical developer and marketer of therapeutics to treat serious medical conditions in patients for whom adequate treatment options are either unavailable or no longer available.

The company continues to develop a therapy based on oral administration of a small molecule inhibitor for the treatment of anemia associated with chronic kidney disease and anemia associated with myelodysplastic syndromes.

The company also develops therapies for certain forms of pulmonary fibrosis, pancreatic cancer and muscular dystrophy.

The Pipeline of Treatments Under Development

The name of the treatment is Roxadustat, which has completed a Phase III clinical trial for anemia patients with myelodysplastic syndromes in the United States and Europe.

In addition, Roxadustat is in phase III of a trial aimed at helping chemotherapy-induced anemia patients in China.

FibroGen is also developing a human monoclonal antibody therapy called Pamrevlumab. The therapy is intended for the treatment of idiopathic pulmonary fibrosis, locally advanced unresectable pancreatic cancer, Duchenne muscular dystrophy and metastatic pancreatic cancer. The project is in Phase 3 of a clinical development process to develop a treatment for the first three conditions and in Phase 2/3 to develop a treatment for the last condition.

For the first three conditions, Pamrevlumab received orphan drug designation and fast-track designation from the US Food and Drug Administration.

Orphan drug status is granted to drugs intended to treat rare diseases.

In fact, orphan disease means that the disease or medical condition is fairly rare, affecting no more than 200,000 US citizens, or let’s say about 0.06% of the total US population of 332.4 million expected in 2022.

The Fast Track designation helps simplify development and speed up the review process for new medicines that have shown potential to treat conditions for which adequate treatment options are not available or no longer available.

Pamrevlumab was also awarded by the U.S. Food and Drug Administration a Rare Pediatric Disease Designation for the treatment of patients with Duchenne muscular dystrophy.

The Pediatric Rare Disease designation is awarded to accelerate the pipeline of products that have the potential to treat patients with severe or life-threatening diseases from birth to age 18. The purpose of this designation is to speed up the process to obtain marketing approval from the US watchdog. Thus, the developer of the treatment receives additional incentives beyond those provided under the orphan disease drug program.

While Pamrevlumab has been shown to be safe and tolerable, the product still needs regulatory approval before it can be marketed.

The company is partnered with Astellas Pharma Inc. (OTCPK:ALPMY) (OTCPK:ALPMF) and AstraZeneca PLC (AZN) under specific cooperation agreements.

The Conditions Targeted by The Treatments

Idiopathic pulmonary fibrosis [IPF] is a serious chronic condition that affects the patient’s lungs, causing the tissue around the air sacs to become thick and stiff.

Patients with idiopathic pulmonary fibrosis have a median survival time of two to five years. Pulmonary fibrosis tends to worsen throughout the years and there is no cure to prevent it from leading to death. It seems that people who have inhaled metal, wood dust, or other specific dust are at a higher risk of developing this condition. The condition can also be triggered by viral infections or because of family history.

Locally advanced unresectable pancreatic cancer [LAPC] refers to a cancer disease that has not spread from the pancreas, though it has progressed to the point of inoperability, i.e., it cannot be surgically removed.

Median survival for these types of unresectable pancreatic cancer patients ranges from 8 to 12 months, or less than 8 months for patients diagnosed with metastatic disease.

Duchenne muscular dystrophy [DMD] is characterized by progressive muscle wasting and has a genetic cause.

The disease is multisystemic, meaning it affects many parts of the body, which can be reflected in the deterioration of the skeletal and cardiovascular systems and pulmonary muscles.

Until not too long ago, children born with Duchenne muscular dystrophy did not survive puberty in most cases. However, thanks to improved heart and ventilation technology, the life expectancy of these patients increased significantly, and many of them can live into their 30s and some even into their 40s or 50s.

In metastatic pancreatic cancer, the infected cells multiply and invade other healthy organs or tissues, such as liver and lymph nodes, around the original tumor.

In terms of treatment, surgery is still an option. Otherwise, chemotherapy is recommended if the cancer disease has spread beyond the pancreas.

More Data on Treatments Is on The Way

In 2023, FibroGen expects top-line data from 3 pivotal studies evaluating Pamrevlumab in DMD and IPF patients. The data may include primary survival endpoints and additional safety data.

After that, the company should receive further top-line data from the phase 3 study evaluating Pamrevlumab in LAPC and IPF. These should be available sometime in the first half of 2024.

Additional topline data on Roxadustat, which is being evaluated through a phase 3 trial in patients with MDS anemia and chemotherapy-induced anemia, is also on the way. This data should be available before the second half of 2023.

Anemia associated with myelodysplastic syndromes [MDS] occurs when anemia (a lower number of red blood cells) is caused by the inability of blood stem cells to mature into healthy blood cells. Anemia can lead to several complications, such as fatigue or blood not clotting normally and recurrent infections. MDS generally has no genetic cause, and people with MDS have a 50 percent chance of developing acute myeloid leukemia [AML], a type of cancer. Treated MDS patients can live longer than 5 years, but when MDS has progressed to AML, their lifespan is shortened.

Although it is a common form of blood cancer, the incidence of MDS in the general US adult population is very low, say 0.02-0.06% of the total US adult population, with risk increasing with age.

Chemotherapy-induced anemia is a form of anemia that results from cancer treatments, such as chemotherapy and radiation therapy. The anemia resolves a few weeks after the end of chemotherapy and radiation therapy, as the body has time to restore normal blood cell counts.

Declining Sales and Deterioration in Income

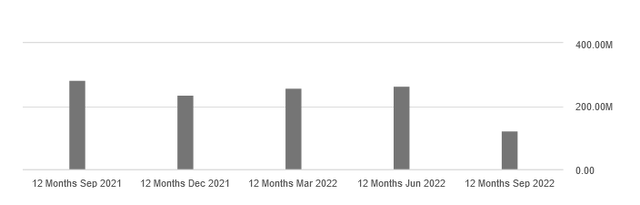

On a 12-month basis, total revenue of $123 million as of September 30, 2022, decreased 53.2% sequentially and 57% year-on-year.

Both declines were due to the recognition of a $120 million milestone payment in Q3 2021 that FibroGen received from Astellas Pharma Inc. following the approval of Roxadustat in the EU.

In addition to Europe, where Roxadustat is approved for the treatment of anemia in patients with chronic kidney disease, the product has been approved in China and Japan for the treatment of the same condition.

However, 12-month revenue is significantly lower on a quarterly and annual basis, even when milestone payments are not included. And this negative trend occurred despite the strong development of Roxadustat sales volume in the third quarter of 2022 in the Chinese market.

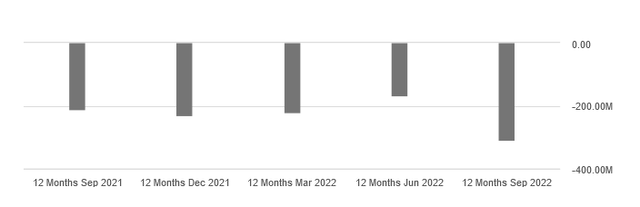

Roxadustat’s excellent performance in China is not enough to support the company’s operating income, which on a 12-month basis is significantly deteriorating quarter-on-quarter and year-on-year.

Net income isn’t doing well either, as the chart below shows.

For the third quarter of 2022, the company suffered a net loss of $91.7 million, or about $0.98 per share, versus a net loss of $49.8 million, or about $0.54 per share.

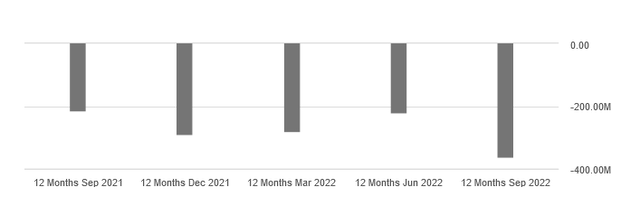

In the Q3 earnings report, the company expects cash on hand to fluctuate between $380 million and $410 million at the end of 2022.

These are the financial resources to support the development of treatments in the portfolio. While the business implies a 12-month cost of sales of $308 million and 12-month total operating expenses of $126 million.

In addition, the company has total debt of $108 million and an Altman Z-score of -3.24 which indicates that the balance sheet is in areas of financial distress posing a potential high risk of bankruptcy within a few years.

The Stock Valuation

Shares of FibroGen are up 12% over the past year, trading well above the long-term trend of the 200-day moving average line of $12.69 and above the midpoint of $13.06 of the 52-week range of $7.81 to $18.31.

As of this writing, shares were trading at $15.16 apiece for a market cap of $1.42 billion.

Compared to the portfolio of treatments in development, this market valuation of the stock seems overstated. Other therapies will probably come onto the market, but they will continue to relate to rare diseases. Also, once they are on the market, there will be competition for the treatments.

The stock price might get some jolt from top-line data expected from the various pivotal studies in 2023 and 2024, but rallies will still be short-lived in my view. Until then, there is no reason for a further significant increase in the share price.

Rather, it is likely to pull back from these levels under strong pressure from known market headwinds and a discouraging sales performance.

Investors should therefore consider taking profits on their investments as long as the returns do not fall short of their goals.

Conclusion

FibroGen, Inc. develops treatments to address health issues in patients affected by very rare diseases. With no prospect of strong and sustained sales growth, the market’s current valuation of the stock appears objectively out of place.

There will likely be some increases consistent with the release of toplines from some pivotal clinical trials, but these should not be happening any time soon.

In the future, it may be worth taking advantage of these expected price jumps, but that means buying the stock at prices well below current levels.

For now, investors holding positions in this stock should consider taking profits.

Be the first to comment