Torsten Asmus/iStock via Getty Images

Nitrogen, Natural Gas & European Fuel Crisis

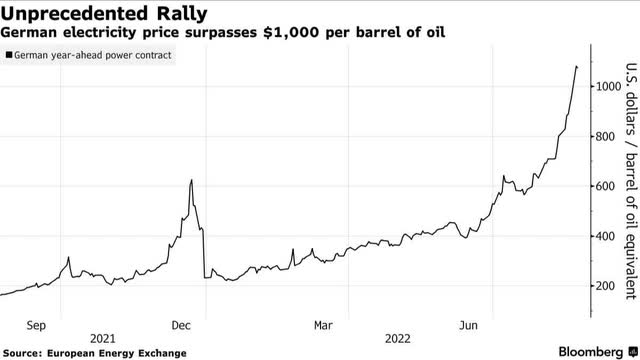

Russia’s invasion of Ukraine has created panic throughout the Eurozone, as nations scramble to find alternative fuel sources, rationing while seeking alternative supplies. Despite unusually higher temperatures this summer, Europe targets a 15% reduction in gas use this winter, including banning outdoor building lights and lowering indoor heating temperatures. Commodities are considered defensive investment instruments that have benefitted amid the European fuel crisis, +22% YTD. European gas prices have soared to more than $1,000 per barrel in Germany, prompting EU nations to resort back to fossil fuels as alternatives to their sustainable energy, including the reopening of several coal plants.

Germany Power Prices (Bloomberg – European Energy Exchange)

Soaring natural gas prices have prompted companies like Yara International (OTCPK:YARIY) and chemical company Azoty, large producers of nitrogen and ammonia mineral fertilizers in the EU, to reduce output. Nitrogen is one of the most common non-hydrocarbons in natural gas, whereas ammonia is produced from natural gas. U.S. ammonia production accounts for nearly 1.5 Bcf/d, 6.5% of all industrial natural gas consumption in 2020, according to the U.S. Energy Information Administration (EIA).

Although European natural gas and power prices have been on a bullish trend, they’ve started to decline as EU nations fill targets using alternate fossil fuels. Gas supplies are being replenished, and Energy Scan’s market analysis unit says, “The closer we get to the total filling of gas stocks — on 27 August, EU stocks were 79% full — the more the bullish momentum will be challenged.”

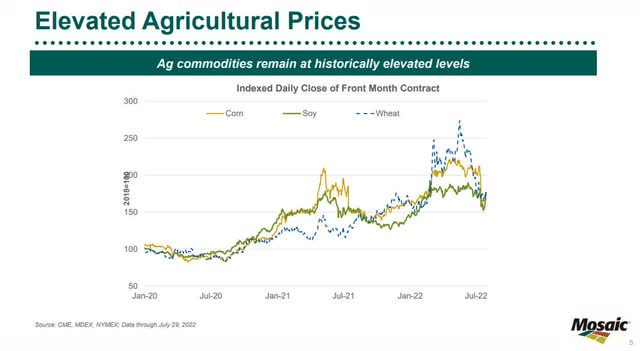

As fossil fuels are being more heavily relied upon in Europe, U.S. natural gas soared to 14-year highs amid Europe’s energy crisis. Despite a fall in second-quarter commodity prices compared to Q1, I believe that although inflation shows signs of cooling, raw materials may experience some flattening, with agricultural sentiment remaining bullish. The need for agricultural chemicals will allow prices to stay elevated, posting tailwinds for the future, which is why our quant ratings indicate our two stocks are Buys.

Agricultural Sentiment Remains Bullish

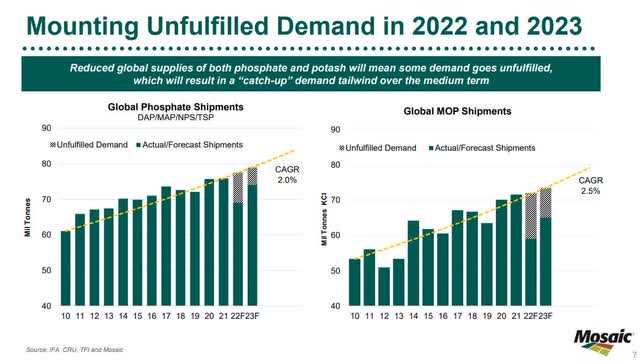

Commodities continue to run hot as many are in short supply. With increased need, an excellent hedge against inflation and unfulfilled demand should serve as tailwinds for my two stock picks going into the remainder of 2022 through 2023.

Mosaic Stock Unfulfilled Demand Chart (MOS 2022 Q2 Investor Presentation)

As European sanctions have altered trading patterns, investors are looking to companies with reliable supplies to capitalize on the demand and pricing competition. The cost of producing nitrogen and many mineral fertilizers has reached prices that have caused companies like those mentioned above to cut or halt production. Fertilizer stocks have outperformed the overall market and are an important agricultural industry, as food is essential. And as long as demand continues to exceed supplies, investors can see agricultural technology’s benefit to farmers, its benefits, and the potential benefit to portfolios. My two stock picks, Mosaic Company (NYSE:MOS) and CF Industries Holdings, Inc. (NYSE:CF), pose excellent hedges against inflation and have solid Buy ratings according to Seeking Alpha’s quant ratings.

2 Best Fertilizer Stocks To Buy Now

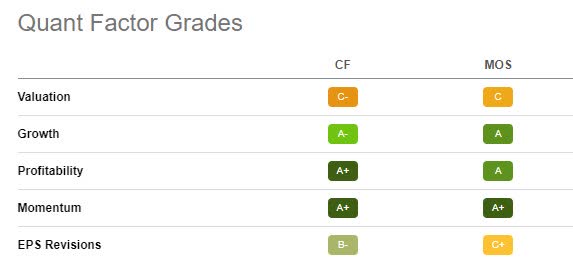

Agricultural chemical companies have seen a surge in price since February, on the heels of the war in Ukraine. On a continued bullish run, these businesses are centered around an essential need – food. And while relatively discounted valuations have prompted investors to buy shares of my two stock picks actively, tremendous growth and profitability grades make them even more attractive.

MOS vs CF Stock Quant Factor Grades (Seeking Alpha Premium)

As pricing competition allows both companies to pass along rising costs to consumers, let us dive into why these two stocks continue to be some of my favorites in their industry, supported by strong organic growth demand.

1. The Mosaic Company (MOS)

-

Market Capitalization: $21.33B

-

Quant Rating: Buy

-

Quant Sector Ranking (as of 8/29): 38 out of 280

-

Quant Industry Ranking (as of 8/29): 6 out of 12

Through its subsidiaries, the Mosaic Company markets agricultural fertilizers and nutrients globally and is one of the largest producers of phosphate and potash. With unusually high global temperatures, cyclically high prices due to the conflict between Russia and Ukraine, and supply chain shocks posed by sanctions imposed on Russian and Belarusian exports, Mosaic has been one of the companies able to benefit. After ramping up its production to meet demand, Mosaic and my other stock pick, CF Industries, is shattering records in the fertilizer industry. With substantial revenue growth, attractive free cash flow, and a discounted price, Mosaic is ripe for the picking. Seeking Alpha author, Michael Wiggins De Oliveira writes, “This stock offers investors a very positive risk-reward profile.”

Mosaic Stock Valuation & Momentum

Given the geopolitical tailwinds that Mosaic has faced, coupled with fluctuations in fertilizer prices, some risks are involved in investing in cyclical stocks. Up 89% over the last year, Mosaic still comes at a reasonable valuation, with a forward P/E ratio of 4.84x, 60% below its sector peers, and forward EV/Sales of 1.21x, more than 15% below the sector. Additionally, MOS has an excellent runway and great momentum.

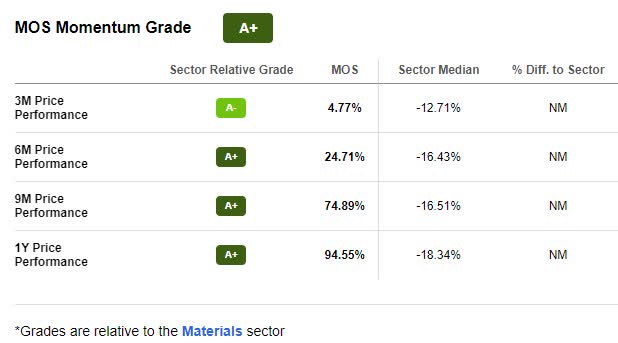

MOS is trading at $61.10 per share and has showcased stellar short-term price performance. Looking at the A+ Momentum grade below, this stock gradually outperforms its peers on a quarterly price-performance basis.

MOS Momentum Grade (Seeking Alpha Premium)

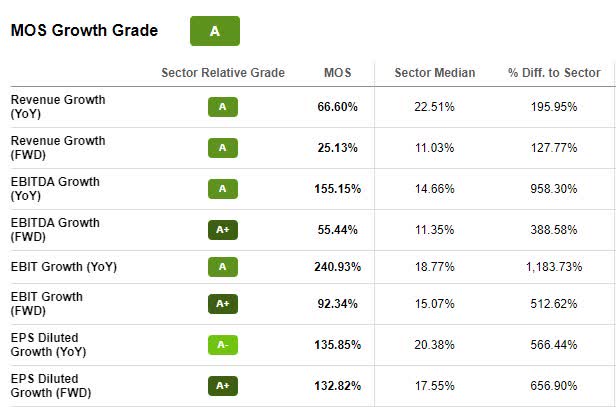

As fertilizer stocks continue to surge, with top European producers cutting output due to astronomical fuel prices, this proves beneficial for U.S. producers. I believe as we look to MOS’ future, the stock has considerable growth and profitability potential, as indicated by its growth and profitability grades, coupled with strong agricultural prices.

MOS Elevated Agricultural Prices (MOS 2022 Q2 Investor Presentation)

MOS Growth and Profitability

Despite lower-than-expected Q2 earnings, Mosaic expects agricultural prices to remain at multi-year highs with zero demand slowing. The war in Ukraine persists, and with European nations seeking alternative sources to account for crop shortages, I expect that current conditions in the fertilizer industry should continue, allowing stocks like MOS to advance.

MOS Stock Growth (Seeking Alpha Premium)

Year-over-year EBIT Growth trumps its median peers by 1,183.73%. Year-over-year revenue growth is 66.60% compared to 22.51% for the sector. Although Q2 EPS of $3.64 missed by $0.36 and revenue of $5.37B missed by $244.13M, Mosaic continues to deliver strong results through substantial cash flow and declared its $0.15 dividend. President & CEO Joc O’Rourke discussed some of the headwinds during the Q2 Earnings Presentation, as well as the future outlook:

“We continue to expect Belarusian exports to be down 8 million tonnes this year. Some of that will be mitigated by incremental supply from producers like Mosaic over the next 18 months. But that will not be enough to erase the deficit that we see lasting well into 2023 at least…Significant customer prepays, though, indicate farmer demand will ramp up as the softer season gets underway. In India, we’ve begun to see importers enter the market and take advantage of the recent price pullback in phosphate…Farmer demand for nutrients remains very strong, and the government continues to indicate it will ensure adequate supply for domestic consumption…Looking forward, Mosaic, Fertilizantes will continue to benefit from its market position as the country’s largest producer and second-largest distributor. We are seeing inflation in our cost structure but believe ongoing optimization should offset much of the impact.”

With $2.94B cash from operations, with $2.37B and continued demand, I see an upside in this stock as supply constraints maintain elevated nutrient prices, similar to my next stock pick, CF Industries Holdings, Inc.

2. CF Industries Holdings, Inc. (CF)

-

Market Capitalization: $23.58B

-

Quant Rating: Buy

-

Quant Sector Ranking (as of 8/29): 31 out of 280

-

Quant Industry Ranking (as of 8/29): 4 out of 12

Like Mosaic, CF Industries Holdings, Inc. manufactures and sells fertilizer products, specifically hydrogen and nitrogen-based products for energy and fertilizer companies. As one of the lowest-cost nitrogen fertilizer companies in the world, based in the U.S., CF is set to capitalize on the recent shift by big producers like Yara and Azoty based in Europe, whose energy costs have resulted in production cuts.

Evidenced by the tremendous price performance relative to its sector peers, it’s no wonder CF is a buy. On a notable upward trend since Q4 of 2021, CF has a one-year price increase of +156%. The stock is trading near its 52-week high of $119.59 with stellar momentum, including A grades over the last four quarters.

CF Momentum Grade (Seeking Alpha Premium)

Although CF possesses a C- valuation grade, underlying metrics showcase its discount relative to sector peers. In addition to strong free cash flow, CF’s forward P/E of 6.65x is a -45.45% difference to the sector, and the company’s forward PEG is -14.38%.

CF Valuation Grade (Seeking Alpha Premium)

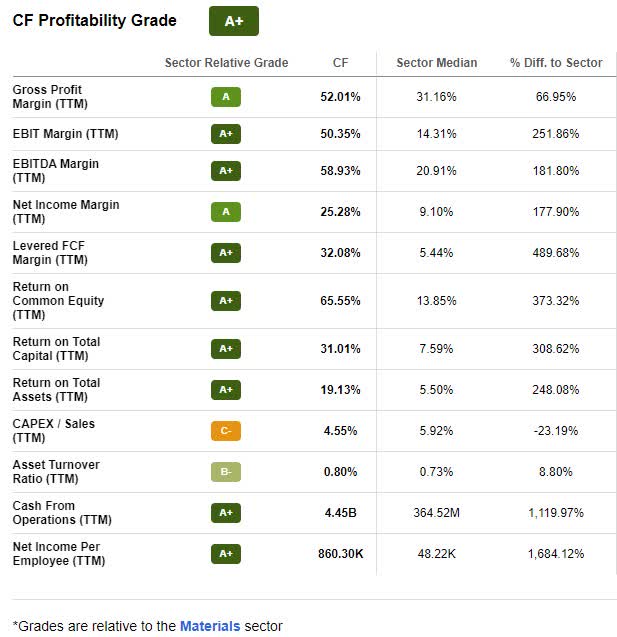

CF’s momentum and continued tailwinds are supported by demand. Strong pricing fundamentals for fertilizers backed by substantial growth and profitability metrics highlight why CF is a buy based on the quant ratings.

CF Growth & Profitability

CF Industries continues to outperform the market, +62% YTD, despite a fall in Q2 value as investors weigh potential headwinds for fertilizer stocks and price fluctuations. With an EPS of $6.15 beating by $0.36 and revenue that missed by $108.01M in Q2, CF still benefits from the favor of natural gas, which produces both ammonia and nitric acid used in its UAN fertilizers. As CF Industries previously wrote:

“Natural gas is the principal raw material and primary fuel source used in the ammonia production process at our nitrogen manufacturing facilities. In 2021, natural gas accounted for approximately 40% of our total production costs for nitrogen products. Our nitrogen manufacturing facilities have access to abundant, competitively-priced natural gas through a reliable network of pipelines that are connected to major natural gas trading hubs.”

CF has strong overall growth and profitability metrics. As I previously wrote in The Hunt For Quality: Best Profitable Stocks to Invest In, “CF reached its long-term gross debt target of $3B in 2022 and plans to maintain its CAPEX range of $500M to $550M per year, including expenses around maintenance and clean energy initiatives,” and plans to return more than $1B to shareholders on an annualized basis. Despite market volatility, CF exceeds adjusted EBITDA expectations and hit a record free cash flow for Q2.

CF Profitability Grade (Seeking Alpha Premium)

The commodity sector continues to be the top performer year-to-date. With the short supply and 28% of nitrogen-based fertilizers originally coming from Russia and Ukraine and no end to the war in sight, Mosaic and CF pose excellent hedges against rising inflation that are also fundamentally sound.

Conclusion

Despite earnings misses for MOS and CF, both stocks have substantial gains and tailwinds that will likely carry them through the rest of 2022 and 2023. The war in Ukraine appears to have no end, and the need for food, agricultural fertilizers, and chemicals persists. This poses a moat for Mosaic and CF Industries, which also possess extraordinary growth and profitability outlooks based on our quant ratings.

Mosaic and CF’s forward revenue growth of 25.13% and 31.57%, respectively, significantly outperform their sector peers. In addition, fertilizers and agricultural chemicals are defensive in the current inflationary environment, especially amid global shortages. As costs continue to be passed onto customers, despite some flattening, these commodities are likely to maintain their bullish trend for the foreseeable future.

Our investment research tools help to ensure you’re furnished with the best resources to make informed investment decisions. Check out our list of other Top Materials Stocks, or you can create your own Stock Screen to help you achieve diversification into desired sectors you like.

Be the first to comment