Michael Dodge

Introduction

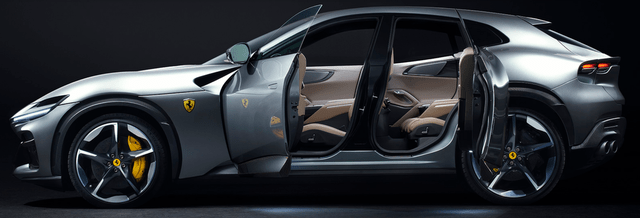

Ferrari (NYSE:RACE) launched a few months ago the long-expected Purosangue, the first four seater the company produces. There were many people eagerly awaiting for this release, though some fans were concerned that Ferrari would lose some of its evocative power because of this model. In this article I would like to update my research about the impact this model might have on the results the company will achieve in the next few years.

Previous coverage

In September, I published an article “Ferrari: What To Expect From Purosangue Sales“, where I tried to explain to my readers what kind of model we are dealing with and what kind of impact it might have on the whole company’s results. I felt it was best to read how Ferrari explains the car, which many thought would be an SUV, but though it was forecasted to be an SUV, it is actually a one-of-kind model that can’t be compared to modern GT archetypes. Here are the words Ferrari chose to describe the model:

To enable the company to achieve the ambitious goals set for this project and create a car worthy of a place in its range, a completely different layout and innovative proportions compared to modern GT archetypes (so-called crossovers and SUVs) were adopted. The average modern GT’s engine is mounted forwards in the car, almost straddling the front axle with the gearbox coupled directly to it; this results in less than optimal weight distribution that delivers driving dynamics and driving pleasure well short of the standards of excellence to which Prancing Horse clients and enthusiasts have become accustomed.

The Purosangue, on the other hand, has a mid-front-mounted engine with the gearbox at the rear to create a sporty transaxle layout. The Power Transfer Unit (PTU) is coupled in front of the engine to provide a unique 4×4 transmission. This delivers exactly the 49:51% weight distribution that Maranello’s engineers deem optimal for a mid-front-engined sports car.

For those interested in taking a look at the car, I suggest watching the official Ferrari trailer: Ferrari Purosangue: Come nessun’altra – Ferrari.com

I then took the data available from Lamborghini about the sales of its model Urus. I cross referenced this with the guidance Ferrari gave about sales of Purosangue and I reached the conclusion that next year this model would sell around 2,600 units adding an extra €221 million to the company’s revenue. Keep in mind that Ferrari has a business model where new models replace the older ones and sales are kept low on purpose to preserve exclusivity. So, the 2,600 Purosange that will be sold won’t be that accretive to total volumes, but will be revenue accretive because, compared to the average revenue per car of €315k that Ferrari achieves, the Purosange will be available from a starting price around €400k, that is 27% more than the average price. Clearly, this is not only revenue accretive, but also margin accretive.

My point was that, just through the Purosangue, Ferrari gets half the job done in relation to its growth guidance of 9% a year.

Updated forecast

Things seems to go better than expected. It has been reported that Ferrari paused its Purosangue orders due to very strong demand. Currently, some customers are on a waiting list that stretches as far as two years from now. This means that the order books for 2023 and 2024 are full. We also know that Ferrari has pledged it will not allow Purosangue to account for more than 20% of total sales, in order to preserve exclusivity. We know that in 2023 it should sell 2,600 Purosangue. We may expect that in 2024 this number can go up to 2,850. Given the strong demand, I expect that the average price of each Purosange sold will be quite a bit higher than the base price of $400k. Ferrari will favor highly customized orders and will have the power to push prices up for 2024. This is why I am raising the average price I expect Purosangues will be sold at from €420k to €440k for 2023 and €460k in 2025.

This will bring in a total revenue of €1.14 billion next year and a 2024 revenue of €1.31 billion.

Now, while back in the spring Ferrari offered a guidance for this year of €4.8 billion in revenue, it has recently ticked it up to €5 billion, after it reported its Q3 results. However, this was no surprise as I thought and wrote back in May that this was the real threshold Ferrari would reach in 2022.

Next year, I expect Ferrari to reach a revenue of €5.5 billion and to break the €6 billion barrier in 2024. This means that I expect Purosangue sales to generate 20.7% of total revenues in 2023 and 21.8% in 2024. However, I think we will see a greater impact as we move towards the bottom line.

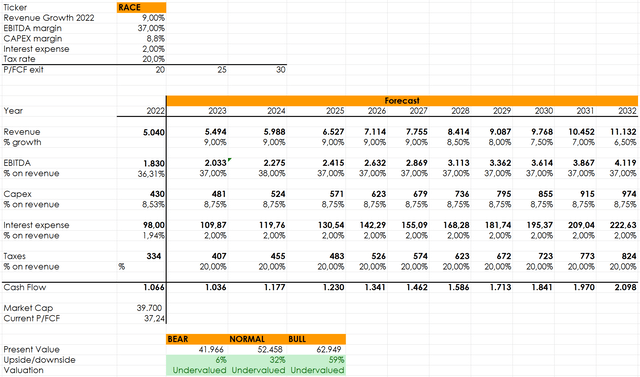

In fact, I expect Ferrari to be able to reach an EBITDA margin of 37% in 2023 and a 38% in 2024. This means that the 2023 EBITDA will be above €2 billion and €2.28 billion in 2024. EBIT margin will move up too: I forecast that it will be at 26.5% in 2023 and 28% in 2024. This means that the 2023 EBIT will amount to € 1.33 billion and that in 2024 it will reach €1.68 billion.

Net income margin will be easily above 20% (it is now at 19.7%) in 2023, reaching €1 billion and it will be at 22% in 2024, €1.32 billion in 2024.

Let’s consider that Ferrari has a €2 billion buyback program that just started and that will reduce the total share count. Together with the improved profitability, this could help drive upwards the EPS for 2023 and 2024, with a beneficial impact on the stock price.

Last, let’s consider that higher profitability should also lead to higher free cash flow, as this is calculated starting from net income. I think it is reasonable to expect €1 billion in free cash flow by 2024.

Raising my target price

In this model I try to project the future cash flow of the company for the next decade. Then, in order to get an idea of what the valuation may be I use three possible price/free cash flow exit multiples. In this model I don’t discount the free cash flow because I am using a forward multiple strategy. I wanted to share this model now because I have already shared a different discounted cash model on Ferrari that gave me an upside of more than 20%, as I showed in my previous articles.

This time, based on what exit multiple we feel more comfortable with, there is still some upside left. In my view, the 25 fwd price/free cash flow can be appropriate, given the fact that we are talking about a clear industry leader that should be looked at as part not only of the automotive industry but also (and most importantly) as belonging to the luxury industry, where multiples are usually quite high.

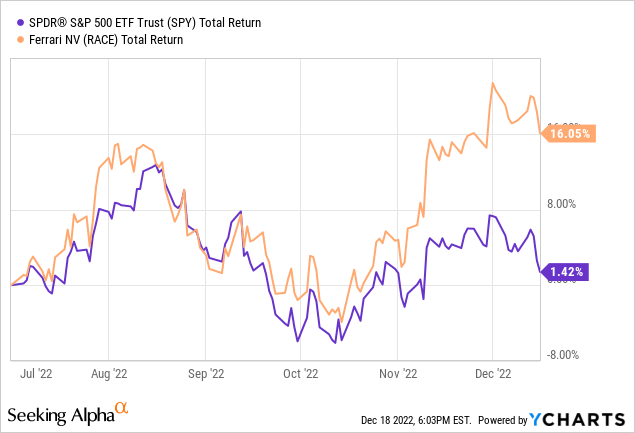

I previously said my target price for the stock was $260. Now, given the recent news we discussed and what it means for Ferrari’s financials, I am now increasing it to $280. So far, this year Ferrari, though it has sometimes trades south, has been a stock that didn’t disappoint me as it has overperformed by 14.5 percentage points the S&P500 in the second part of this year.

As I have repeatedly pointed out, Ferrari is one of the most predictable businesses on earth and this allows investors who study the company to guess fairly well its future earnings. I think this time too it is reasonable to push up my guidance a bit thanks to the news about strong Purosangue sales.

Be the first to comment