Hector Vivas/Getty Images News

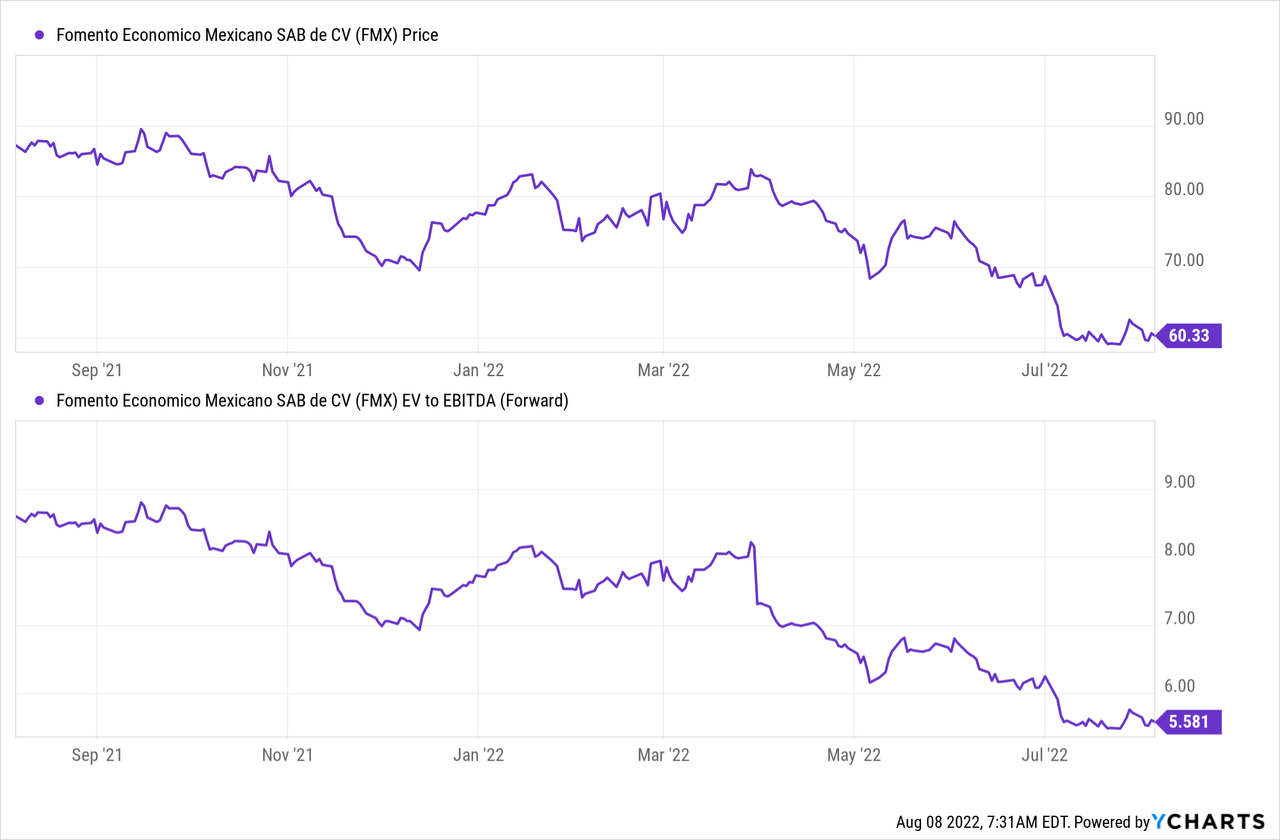

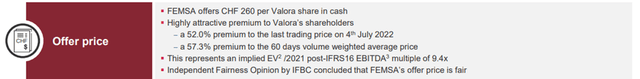

Fomento Económico Mexicano (NYSE:FMX), also known as FEMSA, recently announced its proposed all-cash tender offer to acquire 100% of the publicly held shares of Valora Holding AG (OTCPK:MKRMF), a European food convenience operator, for CHF260/share. The offer price implies a $1.2bn equity valuation for the company and a sizeable >57% premium to the 30-day volume-weighted average price. Strategically, the addition of Valora is a timely return to the convenience store basics for FEMSA, accelerating its shift toward becoming more of a retailer and less of a beverage player at a time when many had questioned management’s deviation from its core competencies. Yet, the negative stock price reaction post-announcement highlights the market’s dim view of the acquisition, along with the perception issues that continue to plague the stock. With the stock also trading at an excess discount to its publicly-listed holdings, FEMSA offers investors compelling value at these levels. The pending outcome of its strategic portfolio review later this year could catalyze a re-rating of the stock.

Gaining a Foothold into Europe Through $1.2Bn Valora Acquisition

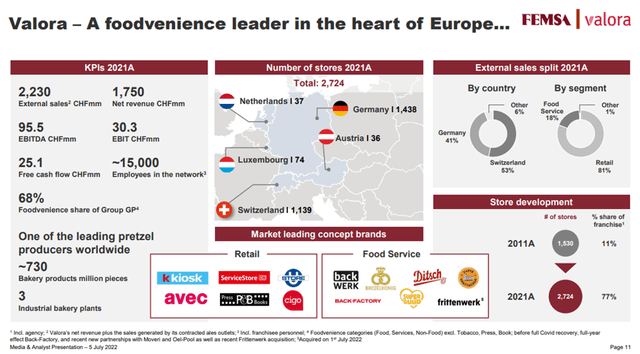

FEMSA has outlined the proposed acquisition of Valora Holding AG through an all-cash deal amounting to $1.2bn to expand its convenience store and food service footprint in Europe. For context, Switzerland-based Valora is in the “foodvenience” business and operates >2.7k convenience stores and foodservice operations in Switzerland and Germany (its key markets). Within its multi-format strategy (including an in-house pretzel production), retail accounts for >80% of the business, followed by food service at ~18%. While COVID has hit the P&L hard, the company is on the path to recovery toward its pre-COVID EBITDA margin in the mid to high single digits % (pre-IFRS 16). Of note, Valora also runs a similar franchise model to OXXO’s commission-based model, typically taking on investments in real estate, equipment, and inventory financing on-balance sheet.

The offer still has to go through several hurdles, including the acceptance by two-thirds of Valora shareholders (including the ~17% shares outstanding already subject to an agreement to tender). The offer period will run to September 2nd, after which an additional acceptance period will be available from September 9th to September 22nd. Settlement is then scheduled for end-September/early October. While the Valora transaction is far from a done deal, FEMSA has won the support of its largest shareholder (Ernst Peter Ditsch, owner of ~17% of the shares) and the Board, so it seems very likely that the delisting of Valora shares will go through as planned.

Net Favorable Deal Economics

Funding for FEMSA’s $1.2bn (~CHF1.1bn) all-cash offer for Valora should not be an issue – by comparison, FEMSA’s market cap stands at ~$26bn as of the announcement date. FEMSA plans to fund the acquisition price entirely with its cash on hand – a very manageable ask given the company closed its most recent quarter with ~$4.7bn in cash and a 1.8x leverage ratio (post-IFRS-16). As FEMSA will assume Valora’s net debt of ~CHF222m (adjusted for ~CHF3.0/share of dividends to be distributed in 2022), consolidated post-deal leverage should move modestly higher to >2x EBITDA on a post-IFRS 16 basis. This assumes no synergies, though, and that Valora’s EBITDA generation remains in line with last year, so there could be upside revisions from here. Based on pre-COVID numbers, FEMSA also paid a ~9x pre-IFRS EV/EBITDA multiple for Valora (slightly above where Femsa currently trades) – a very reasonable price for a leading convenience-store player in Europe, in my view.

Strategically Accelerating the Long-Term Expansion Strategy

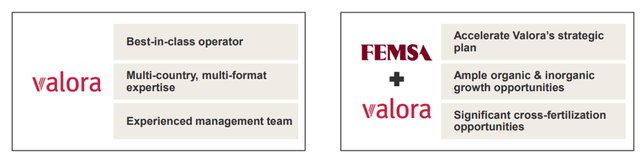

The acquisition should go a long way toward addressing investor concerns around the viability of the FEMSA growth story following recent capital allocation decisions outside of its core business (e.g., expanding into the specialized distribution business in the US). By refocusing the M&A debate on convenience stores, a business where FEMSA has a proven track record of execution through organically developed OXXO, FEMSA is going back to its bread and butter. Plus, Valora’s franchise model is very similar to OXXO’s commission model (recall, OXXO transitioned a decade ago to a ~77% franchise model to incentivize store owners and managers), so the company is well-positioned to unlock earnings growth post-integration.

Relative to the US convenience-store space, where the dependence on gas stations is a concern, along with the need for FEMSA to sell off its Heineken stake to offer beer in-store, the move into Europe makes good sense. In turn, Valora gets to accelerate growth by leveraging FEMSA’s sector capabilities, while operating under its own company name as the FEMSA Proximity division flagship brand in Europe. current expansion efforts in South America are also on track, with Brazil expected to add 250-300 new stores in 2022, and thus, the mid to long-term growth outlook looks bright for the company.

Going Back to Basics with Valora Acquisition

While the addition of Valora to the portfolio might not be game-changing for the company as a whole at ~5% of the FEMSA market cap, it marks a welcome return to the retailization theme. The entry EBITDA multiple also screens reasonably at ~9x EBITDA, while from a strategic perspective, FEMSA gains a solid foundation to build out its presence in Europe and diversify revenue streams into developed economies over the long term. At current market prices, the stock seems oversold – the combination of OXXO at ~$14bn (based on Walmex’s (OTCQX:WMMVY) fwd P/E) and the current market valuation for the Heineken and Coca-Cola FEMSA (KOF) stake net against its debt would imply the rest of Femsa’s assets are on offer for free. Going forward, key re-rating catalysts include Oxxo’s growth trajectory in LatAm as well as news from FEMSA’s strategic portfolio review (due sometime in H2 2022).

Be the first to comment