FedEx shares took off today after a surprise announcement covering a dividend increase, new appointments to the Board of Directors, changes to the Executive Compensation Program and changes to the company’s long-term CapEx spending plans. Grzegorz Malec/iStock Unreleased via Getty Images

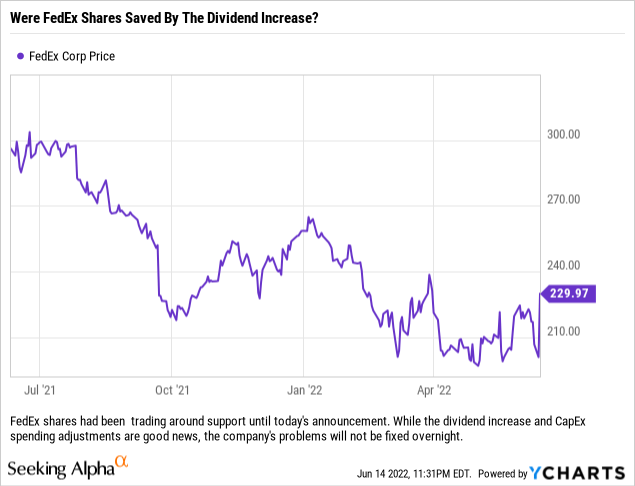

Finding stocks that are up on good news in down markets is a good way to find some hidden gems from time to time. The big news today, at least among big-caps, was the deal that FedEx Corporation (NYSE:FDX) struck with activist investor D.E. Shaw & Co. which was well received by both investors and analysts. FedEx shares finished the day at $229.95/share, up $28.97/share or 14.41%, on the news.

It all started this morning when FedEx announced via a press release that they would be taking steps to enhance shareholder value and make some changes to the company’s Board of Directors.

Big Dividend Increase

FedEx is increasing its quarterly dividend to $1.15/share from $0.75/share, which is a 53% increase. This is a welcomed move for shareholders as the dividend had been stuck at $0.65/share per quarter for three years before spending the last year at $0.75/share per quarter. With this move, we think it might be likely that FedEx will revert back to its old policy of revisiting the dividend each year for a potential increase (in fact, from 2012 to 2018 the company did raise the dividend annually before it stalled out at $0.65/share).

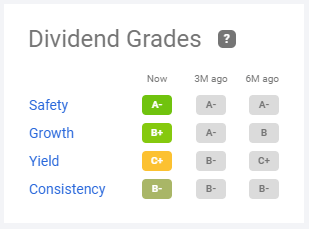

Seeking Alpha’s Quant Dividend Grade for FedEx was respectable across the board, with the one average grade consistently being for ‘Yield’. The company did a lot to address this issue with the dividend increase. (Seeking Alpha)

Investors will have to wait until the end of the month at the company’s investor day to get more color on management’s (as well as the board’s) thinking on the dividend and how important they think it is when compared to other ways of returning capital to shareholders. Hopefully, they also provide some insight into their thoughts on growing the dividend moving forward and where that falls within their priorities.

New Board Directors

Investors already knew that there would be some turnover on the board due to the mandatory retirement provision which would prevent Dr. Shirley Ann Jackson from serving another term as Director, but as part of the agreement, FedEx is appointing two of D. E. Shaw’s directors (Amy Lane and Jim Vena) and will appoint at a later date another independent director which is mutually agreed on by the Company and D. E. Shaw.

Ms. Lane has prior board experience and years spent working in the finance industry, most of her experience relates to retail. Mr. Vena has experience which could benefit FedEx, as he has over 40 years spent in the railroad business at both Union Pacific (UNP) and Canadian National Railway Company (CNI) – having held the Chief Operating Officer role at both companies. While at Union Pacific, Mr. Vena helped the company improve efficiency to catch up with peers.

These current appointments will take the board up to 14 members, and we suspect that the board will remain at that number as the director to be appointed at a later date might replace Dr. Jackson when her term expires.

Overhauled Executive Pay Package And CapEx Spending Plans

FedEx also made changes to its executive compensation program which will now have additional metrics to measure performance with a focus on “total shareholder return and long-term value creation,” according to the press release. Tucked into this portion of the press release, the company unveiled that they would be cutting back on CapEx spending plans, especially after 2025.

Our Take

FedEx made this announcement today and was pretty light on the details. The company is holding its first investor day in roughly a decade on June 28th, and we suspect that the company’s CEO, Raj Subramaniam, will give investors more detailed information then.

Cutting back on CapEx spending and the new dividend rate are good stories for FedEx, but those moves can only go so far. Investors should be pleased to have more cash distributed to them each year, but FedEx is going to have to make their spending more efficient in future years and make sure that they do not fall behind competitors such as Amazon (AMZN) and United Parcel Service (UPS). We hope that management has a plan to unveil in two weeks at the investor day event that focuses on how the company will increase its margins to at least match UPS’s and how it will adjust to changing market dynamics which include changes in how retailers ship product as well as the number of competitors.

While we think that this news is good for those who already own FedEx shares, and were able to participate in today’s rally, we believe that investors looking to enter into ownership of FedEx shares might be better served by sitting on the sidelines for now. This was the low-hanging fruit that FedEx had, and other than the dividend increase, it is hard to imagine any further moves that the company could announce that would have an immediate impact on shares because everything else are “show me” items (meaning goals that the company announces that have execution/implementation risks). If you own shares, the stock is a ‘Hold’ but if you currently have no position, we think it might be best to sit on the sidelines and wait for either a pullback or the investor day to pass, which could provide more clarity on the company’s plans moving forward.

Remember, there is a new CEO who was hand-picked by founder Fred Smith, but Mr. Smith is still the Chairman of the Board and is still the largest shareholder in FedEx owning roughly 7.50% of the company’s shares.

Be the first to comment