jjgervasi/iStock via Getty Images

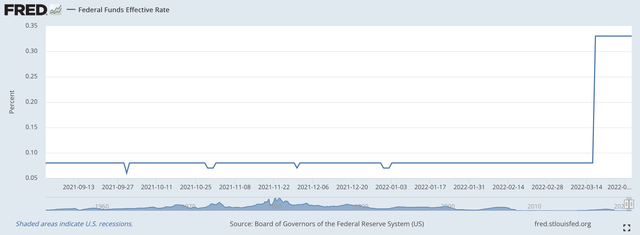

The Federal Reserve kept the effective Federal Funds rate constant last week at 0.33 percent.

Federal Reserve officials continued to talk about the future increases coming in its policy rate of interest with a few of the members of the Federal Open Market Committee talking about some “half-point” increases during the year.

The Federal Reserve kept its policy rate of interest constant at 0.08 percent from September 1, 2021, until it raised the policy range at its last meeting of the FOMC.

Since then, the Fed has maintained the effective Federal Funds rate at 0.33 percent.

effective Federal Funds rate (Federal Reserve)

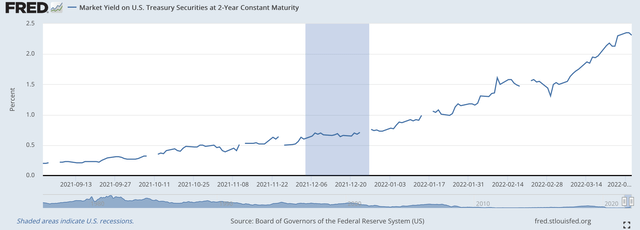

As Federal Reserve officials talked more and more about raising its policy rate of interest in March and then following up on this with several more increases this year, longer-term interest rates began to rise.

Take a look at what the yield on the 2-year U.S. Treasury note did during this period of time.

yield on 2-year Treasury note (Federal Reserve)

On September 1, 2021, when the Fed started holding the effective Federal Funds rate constant at 0.08 percent, the yield on the 2-year Treasury was 0.20 percent.

On March 17, the date when the Fed raised its policy rate of interest, the yield on the 2-year note was 1.94 percent.

On March 31, the 2-year Treasury note closed to yield 2.32 percent.

It should be noted that this rise in the yield on the short-term Treasury note was not accompanied by the same increases that took place in the yield on the 10-year Treasury note.

That is, the term structure of interest rates flattened out during this period of time as the yield on the 2-year note rose more rapidly than did the yield on the 10-year Treasury note.

On September 1, the spread between the yield on the 10-year Treasury note and the yield on the 2-year Treasury note was right around 110 basis points.

On March 17, 2020, the spread had dropped to around 25 basis points.

On March 31, the spread was only about one basis point.

The U.S. Treasury yield curve had roughly flattened out.

To many analysts, this is a market signal that a recession is on the way.

But, investors still are expecting that the Federal Reserve will continue to raise its policy rate of interest throughout the rest of 2022 and maybe halfway into the year 2023.

But, What About Inflationary Expectations?

Many analysts do not agree with this picture.

The reason for the disagreement is that these analysts do not believe that the level of the longer-term yields fully reflects the underlying economic situation.

These analysts believe that the inflationary expectations built into the longer-term interest rates are too low.

For example, right now, the inflationary expectations built into the nominal yield of the 5-year U.S. Treasury note is around 3.5 percent.

The inflationary expectations built into the nominal yield of the 10-year U.S. Treasury note is around 3.00 percent.

Yesterday, it was announced that the current rate of inflation, using the Fed’s favorite measure of Consumer prices was 6.4 percent. Even the core PCE inflation, which removes volatile food and energy prices, jumped to 5.4 percent in February,

In other words, many analysts feel that the inflation rates built into the current market yields do not fully take into account the actual inflation that the U.S. is going to face.

These analysts believe that the Federal Reserve needs to increase its policy rate of interest quite a few more times and make at least some of the increases one-half of a percentage point.

If this is the case, then the current term structure should not be flat or threatening to become negative and we should not be expecting a recession right away.

The Value Of The Dollar

The world situation might be keeping the nominal interest rates as low as they are.

The value of the U.S. dollar has risen during this particular time period. Two reasons are seen as the reasons for the stronger dollar.

First, starting last fall the Federal Reserve seemed to be further ahead of the advanced nations in moving toward a less accommodative monetary policy, one that would produce relatively higher rates of interest than these other countries.

Second, with the start of the Russian invasion of Ukraine, more risk-averse monies began to flow into the United States, resulting in the value of the U.S. dollar rising.

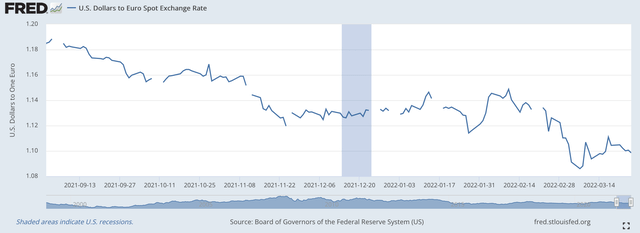

Here we see the price of the U.S. dollar relative to the Euro. Remember, the curve goes down when the dollar is becoming stronger relative to the Euro.

Dollar/Euro price (Federal Reserve)

On September 1, 2021, it cost $1.1840 to purchase one Euro.

On March 17, 2022, it costs around $1.1000 to buy one Euro, and the price has remained around this value, since.

So, the rest of the world seems to think that the Federal Reserve is doing OK as investors move money into the U.S. dollar, rather than away from it.

Federal Reserve Actions

All this year, the Federal Reserve has reduced the monthly amount of securities it has purchased, outright, for its balance sheet.

Before the start of the year, the Fed was acquiring $120.0 billion in securities per month.

Since the end of last year, since December 29, 2021, to be exact, the Fed has added only $207.5 billion of securities to its portfolio.

Since, the beginning of March, since March 2, 2022, to be exact, the Fed has acquired only $34.8 billion in securities. This latter number includes two weeks in which the amount of securities on the Fed’s balance sheet actually declined. In the past banking week, the one ending March 30, 2022, the Fed saw its securities portfolio actually decline by $22.7 billion.

Ever since the end of the year, the Fed has seen the Reserve Balances with Federal Reserve banks, a proxy for excess reserves in the banking system, decline by $266.4 billion.

One presumes that this decline was needed in order to prepare the banking system for the rise in the Fed’s policy rate of interest.

Now it is going to be interesting to see what the Fed does to manage its securities portfolio and continue to raise its policy rate of interest.

This is supposed to be the policy intent of the Fed, going forward. The interesting thing for investors will be to see the strategy the Fed uses in order to keep the policy rate of interest rising. Just how the Fed is going to accomplish this is the big question investors will be asking.

Be the first to comment