Paola Giannoni/iStock via Getty Images

It seems as if very little was done at the Federal Reserve in the banking week ending August 24, 2022.

The reason?

Jerome Powell, Fed Chair, is going to make a speech at Jackson Hole, Wyoming this Friday that will be the focus of all Fed watchers into next week and beyond.

People want to know where the Federal Reserve is and what it is going to be doing in the upcoming months.

All comments coming out before Friday are from the past.

Mr. Powell’s comments on Friday, are the future.

The Fed’s Balance Sheet

If one looks at the Fed’s balance sheet for the banking week ending August 24, one sees that very little happened in the past banking week.

Reserve balances with Federal Reserve Banks, a proxy for excess reserves in the commercial banking system, dropped by $62.8 billion, but this decline came from the movement of U.S. monies from the banking system into Federal Reserve deposits and from a small increase in reverse repurchase agreements.

Quantities seemed to be insignificant.

The effective Federal Funds rate remained constant all week at 2.33 percent.

The next meeting of the Federal Open Market Committee is scheduled to take place on September 20 and 21.

The Fed is expected to raise its policy rate again. The discussion right now is whether or not the Fed will aggressively raise the range by another 75 basis points. The alternative, raising the range by another 50 basis points.

Whatever choice is made, the top of the policy range will be 3.00 percent, a figure not seen for a long time.

Jackson Hole

For now, however, the focus is going to be on the words that will spill out of Mr. Powell’s mouth at Jackson Hole.

Most feel that Mr. Powell has some credibility to regain.

Under his leadership this year, confidence in the Fed had diminished.

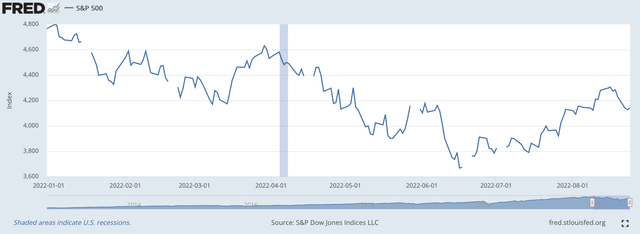

The primary evidence of this has been the performance of the stock market.

The S&P 500 stock index reached a historical high on January 3, 2022.

S&P 500 Stock Index (Federal Reserve)

The Federal Reserve made its first increase in its policy rate of interest on March 16.

As can be seen from this chart, the S&P 500 had been declining since January 3rd. Investors seemed to take this rise in stride and the market recovered up until the end of the month.

The market declined in a relatively steady manner until the middle of June.

In May, May 5th to be exact, the Fed raised the policy rate again. Then it did not raise the rate again until the middle of June and the Fed shocked the market by raising the policy range by a large 75 basis points.

And, what did stock prices do?

They jumped up!

And, again, on July 28th, the Fed raised its policy range by another 75 basis points.

And, the market went up.

The market went up until the middle of August.

Then the market began to drop off a little.

What was making the market so volatile?

Investors were trying to discern what was really happening in the marketplace and what exactly was the Fed’s position on dealing with these movements.

People were uncertain about the Federal Reserve leadership.

Mr. Powell and his team had lost some of the trust of the investment community and, as a consequence, stock prices bounced up and down.

Now, it appears that Mr. Powell is very cognizant of this lack of trust and is focusing upon the Jackson Hole speech to turn market sentiment around.

This speech is what Mr. Powell wants people to concentrate upon.

Thus, it was a quiet week at the Fed. Nothing happening that will draw people’s attention away from the speech.

So, let us hear what Mr. Powell has to say.

Be the first to comment