Vitalii Petrushenko/iStock via Getty Images

On Wednesday afternoon, the Federal Reserve announced it would raise interest rates by 0.75%, bringing the Fed funds rate to a target range of 3.75%–4%.

The move, which was the Fed’s fourth 0.75% hike in a row, was expected. The question is whether the central bank will, as some market watchers expect, moderate its hawkish stance going forward. As the Fed has long maintained, it intends to base its decisions on hard data—most importantly, clear signals that inflation is finally on a downward path.

Wednesday’s announcement came after the stock market closed out one of its strongest months in nearly two years, amid an earnings season that, while mixed, has so far outperformed many analysts’ expectations.

It remains to be seen whether earnings guidance is still too optimistic. Morgan Stanley & Co., for example, has described the recent rebound as a bear market rally (albeit one that could send the S&P 500 as high as 4,150), arguing the correction is unlikely to reach its bottom until companies lower their earnings guidance for 2023—something it suspects may occur within the next few months.

US equities

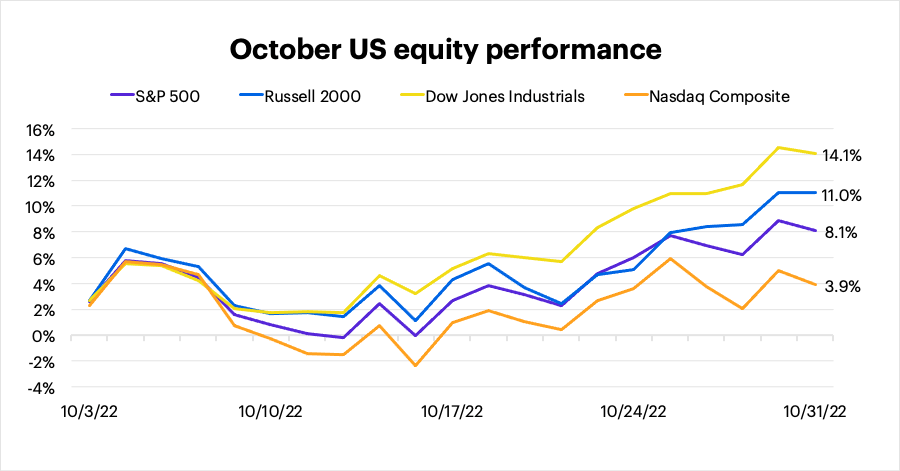

Even though the market fell to new lows for the year less than three weeks ago, October turned out to be the second-strongest month for US stocks since November 2020. In addition to the Dow Jones Industrial Average logging its biggest monthly gain since 1976, the small-cap Russell 2000 was notably strong (+11%). The tech-centric Nasdaq Composite trailed the field, while the S&P 500 gained 8.1%:

FactSet Research Systems

Sectors

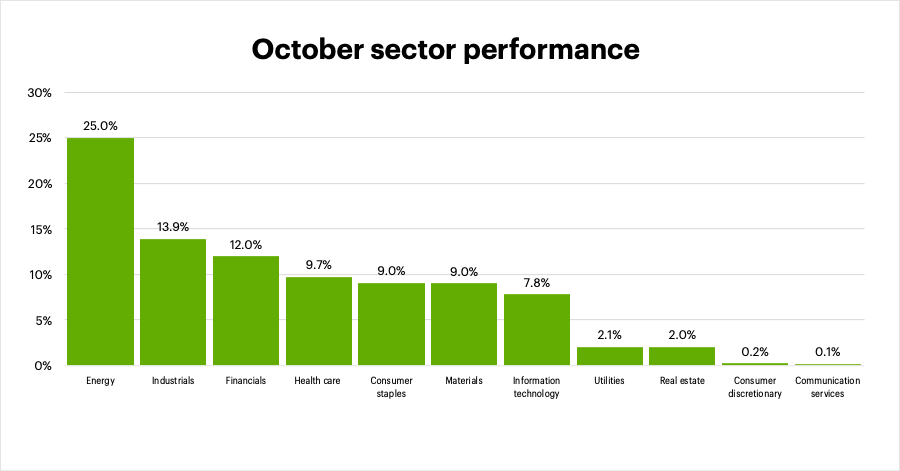

All S&P 500 sectors were positive last month, but energy outpaced the rest of the market by a wide margin. Four sectors—utilities, real estate, communication services, and consumer discretionary—were clear laggards:

FactSet Research Systems

International equities

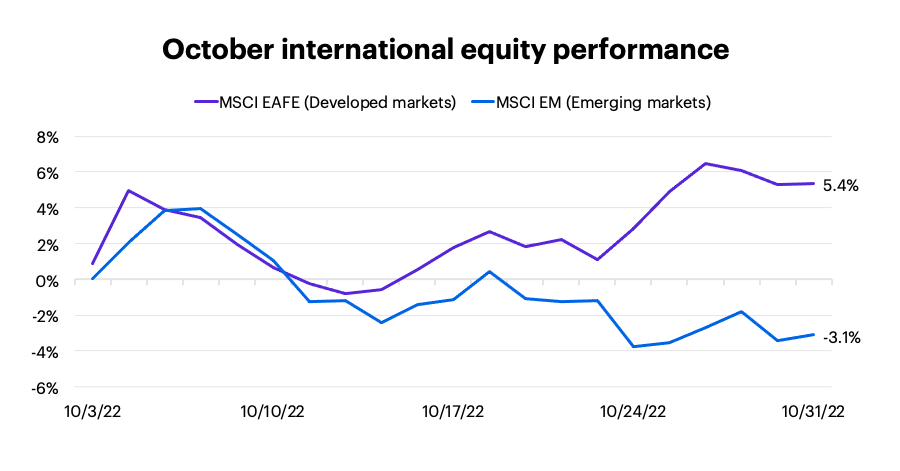

Global markets underperformed the US in October, but while developed markets rallied, emerging markets lost ground, thanks in part to a sharp sell-off in Chinese stocks amid President Xi Jinping’s unexpected power consolidation. The MSCI EAFE Index of developed markets gained 5.4%, while the MSCI Emerging Markets Index fell 3.1%:

FactSet Research Systems

Fixed income

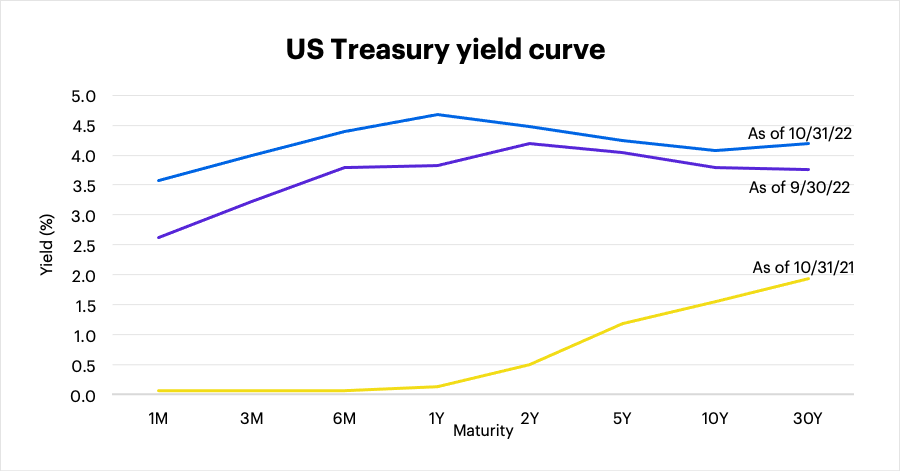

Interest rates continued to climb in October, but the biggest increases occurred in shorter maturities—both the 6-month and 1-year US Treasury yields climbed above 4% in October. That shift exaggerated the ongoing yield curve inversion, which occurs when short-term rates are above long-term rates, signaling decreased confidence in the longer-term economic picture. The benchmark 10-year T-note yield closed October at 4.07%—only slightly above the 3-month yield of 3.99%, and below the 6-month, 1-year, 2-year, and 5-year yields:

FactSet Research Systems

Looking ahead

We’re down to two months—and just one more Fed meeting—for the year. Here are a few things to keep in mind:

- “Income” has returned to fixed income. As we’ve noted in the past, the rising-rate environment has had an upside—better bond returns. Yields have increased dramatically, but the jump in shorter-term rates has been especially notable. For example, the 1-year US T-note yield ended October at 4.7%—that’s a meaningful return, and a dramatic turnaround from a year ago, when it stood at 0.12%.

- China replacing Russia–Ukraine? Europe has been the focus of geopolitical concerns for most of 2022, but attention may be shifting to China. The sell-off in Chinese equities that occurred as Xi Jinping extended his control over the country and its economy at the 20th Communist Party Congress highlighted a sense of uncertainty: Some analysts believe Jinping’s move could further dampen the country’s economic growth (a development that could weigh on emerging markets as a whole) and complicate relations with the US.

- Continue to play the long game. Unlike most of the market setbacks over the past dozen years, the current correction has dragged on—and the longer it persists, the more psychological pressure it will exert on investors. Don’t get exasperated—stay the course.

As always, the way to do that is through diversification and patient rebalancing of your portfolio.

Be the first to comment