wildpixel/iStock via Getty Images

So far, 2022 has been a year that only a mother could love if you are long equities. In the short timeframe of only two years, it would certainly seem that the Fed has cemented its status as always late to the party.

In this article, I would like to go over the current Fed cycle and why I believe we may be further along than many may think towards the end of Fed based selling pressure and present a list of stocks that may outperform coming out of the current tightening cycle.

Overview

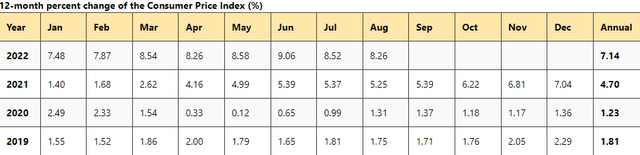

Can the Federal Reserve do anything right? They were certainly fashionably late to the current party. After it was crystal clear to literally everyone that the COVID pandemic was causing havoc in supply chains around the globe and leading to substantial inflationary pressures, the Fed seemingly did absolutely nothing at all for almost a year and a half, allowing inflation that, at the time, was limited to certain raw materials to sink in and work its way insidiously throughout the economy.

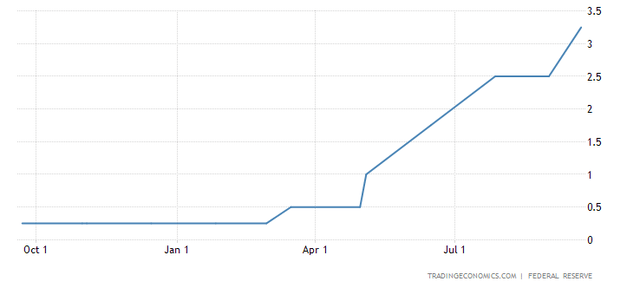

Only in March of 2022 did the Fed finally begin to act after inflation crested above 8%. The Fed acted slowly at first, only to bring out the wrecking ball during the summer and now into the Fall with three successive .75-point hikes.

Of course, this action is completely understandable given how late in the game it was. Now, however, the Fed is perhaps on the cusp of pushing too hard, as seems to be the trend of late.

Inflation appears to have peaked during the summer and commodity prices are showing signs of stabilization or decreasing, at least for the short-term given the wildcard of the Russian adventure in Ukraine. In addition, housing prices, both purchases and rentals, likewise appear to have peaked this summer.

www.corelogic.com

With the Fed indicating to markets that it will remain on the warpath and continue to raise rates as much as it takes, I am left to ponder just how much further it actually can take this fight given that we appear to be past peak inflation, along with increasingly clear signs of significant damage accumulating throughout the economy.

FedEx (FDX) thoroughly spooked the markets on September 15th with its shocking revenue miss along with forward guidance that was well below expectations. Company executives plainly stated that economies around the world dramatically weakened during the summer, leading to significantly lower volume expectations for the remainder of the year.

Global volumes declined as macroeconomic trends significantly worsened later in the quarter, both internationally and in the U.S. We are swiftly addressing these headwinds, but given the speed at which conditions shifted, Q1 results are below our expectations,” CEO Raj Subramaniam said.

The FedEx warning would be unwise to take lightly given that the company has a rather unique insight around the world into changing economic situations. The Federal Reserve clearly wants to inflict some pain on the economy in order to “shock and awe” its way to a 2-3% steady state inflation rate, however, I would argue that most of this work has already been done at this point and the end numbers simply need to catch up.

The way that the stock market generally works is inverse to how you would imagine, once it is clear that the Fed is beginning to take its foot off of the pedal regarding rate hikes, you are likely to have already missed the most opportune time to accumulate equities.

Likewise, when everyone is screaming doom and gloom, that is generally time to start buying. As the majority of investors currently are decidedly pessimistic and as I believe we are already in a recession, I have begun to put some cash to work in the market. Yes, I fully expect plenty of pushback on some of these picks and I may still be early, however, dipping your toes in during times of panic, historically has been a wise move.

Stanley Black & Decker (SWK)

Speaking of a year that only a mother could love… Whew, what a terrible year 2022 has been for one of the most celebrated and iconic tool and outdoor companies on the planet.

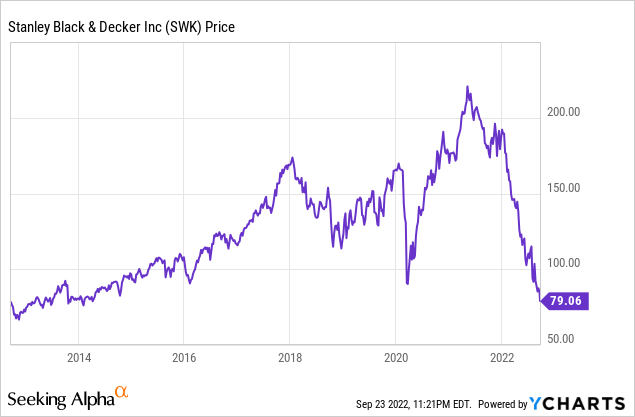

To me, this chart resembles a crime scene photo as investors in Stanley Black & Decker have been thoroughly assaulted in the name since mid-2021, with shares falling basically straight down from a high of $220 to the current $78.98, a full 65% loss.

So, what happened, was the CEO indicted in a Bernie Madoff level scheme? No, the company got its teeth kicked in by way of supply chain issues, pandemic demand pull ahead during 2020, inflation and the prospects of a worsening economy.

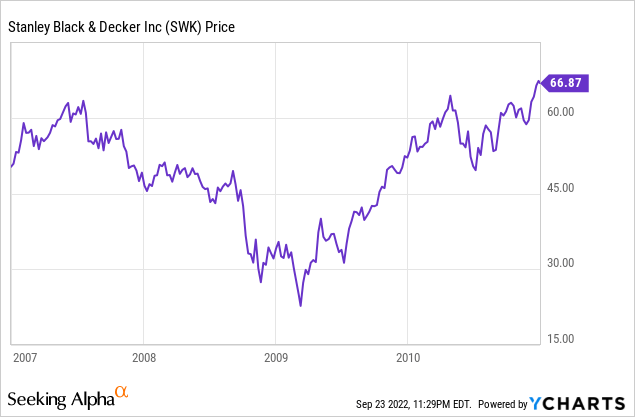

For long-term investors in the company, you have seen this play out before to a certain extent during the 2007-09 period.

The company’s shares are extremely sensitive to the overall economy and specifically to the housing market. What is puzzling to me is that during the financial crisis of 2007 to 2009, the company lost roughly 58% of its value which is less than the current drop in shares.

One could certainly argue that shares had been bid up artificially during COVID-19, thus giving the company a greater height from which to fall, however, the company currently sells for a decidedly reasonable price, even after taking a woodchipper to earnings guidance after the prior quarter.

The company currently sells for a 2022 estimated PE of 14.61 along with holding solidly investment grade credit ratings with no debt maturities of note until 2026. The company also provides a well-covered, 4% dividend with a storied history of dividend growth.

Historically, Stanley Black and Decker has been one of the first stocks to recover following a recession and I am betting that this trend continues here.

Salesforce, Inc. (CRM)

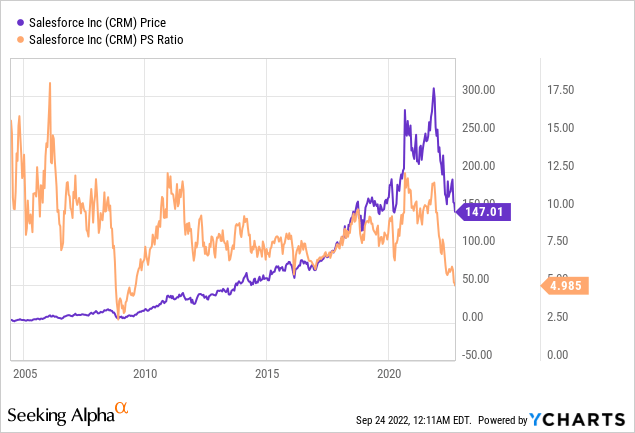

Shifting to the world of technology, Salesforce has been hit with a double whammy as the tech crash of early 2022 morphed into the current sell everything mindset. This beatdown in shares has taken the company all the way down to valuation levels not seen since the financial crisis.

The company itself appears to be executing at a high level of late and recently issued guidance for 17% compound organic revenue growth out to 2026. In addition, the company is continuing to pull levers to improve its profitability as the market has clearly asked the company to shift from growth mode to profit mode.

Salesforce has always been a bit of an enigma to many investors given it pioneered the highly sticky and unique SaaS model and is a bit notorious for high levels of stock-based compensation muddying the waters with regard to GAAP profitability.

The non-GAAP earnings the company consistently generates are substantial and on a trailing 12-month basis, the company has generated nearly $10 billion in free cash flow, certainly not a small amount. I firmly believe that profitability at the company is only scratching the surface of its potential and the company deserves a premium valuation, not a reversion to 2009 levels.

Anheuser-Busch InBev (BUD)

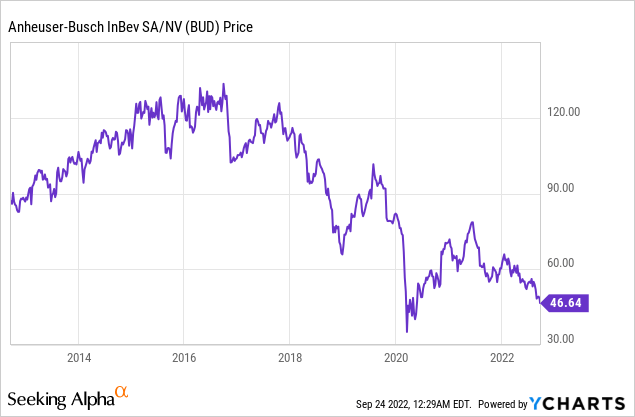

One would assume that alcohol companies would flourish given the current strife and crises around the world. Well, in a Lee Corso inspired “not so fast my friend” moment, AB InBev has certainly proved this theory wrong so far in 2022.

After a nice recovery during 2021 to nearly $79 a share, the company has reverted to its “ski slope from hell” epic run, currently landing at a miserable $46.64 a share.

Much of the investing public is focused on the massive debt pile that the company accumulated during the acquisition of SABMiller in 2016. This debt pile started the slide that continues to this day as the perception is that the company is in distress.

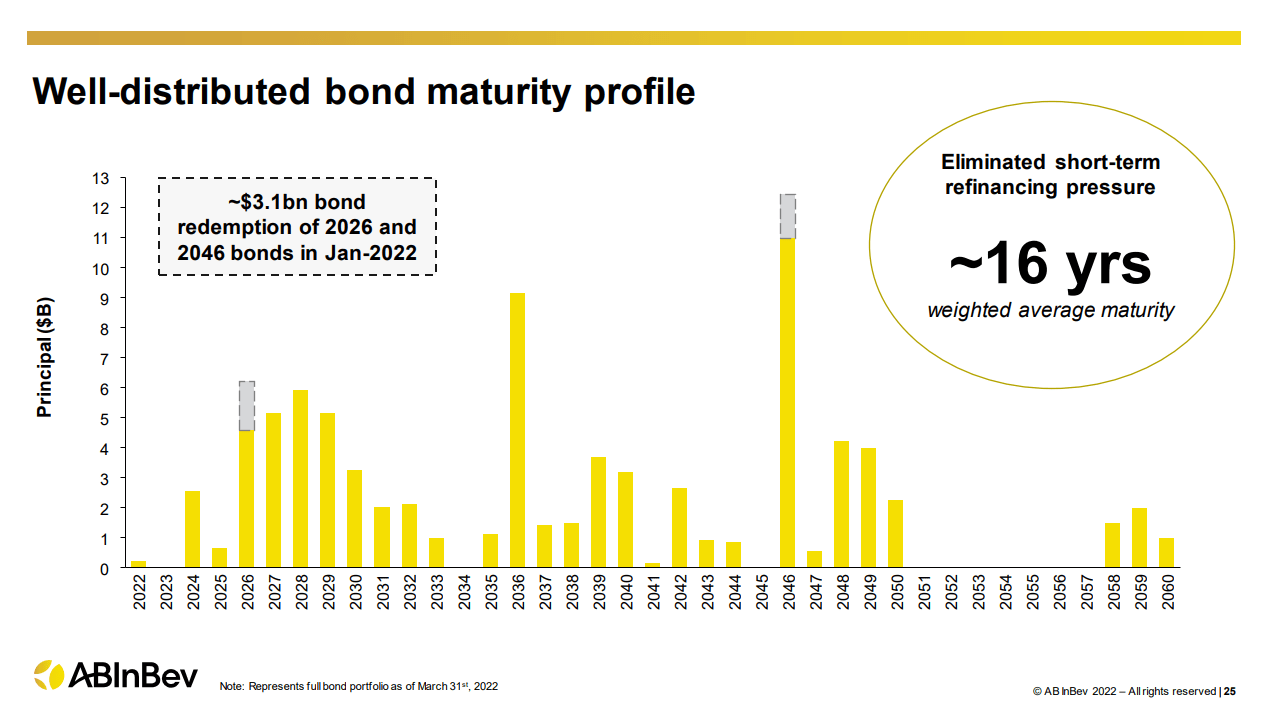

AB InBev

In my opinion, this assumption is dead wrong and the company has done an admirable job in restructuring its balance sheet, particularly over the last few years by pushing out key debt maturity dates and locking in rather absurdly low interest rates for decades to come.

As you can see, the company does not have significant maturities until around the 2026-time frame, in fact, Fitch this summer raised its outlook to positive on the company and reiterated BBB status, likewise, Moody’s and S&P have AB InBev as investment grade with Baa1 and BBB+ ratings respectively.

This is a company that I believe is not given the respect that it deserves given its wide moat status and improving financial profile.

Intel Corp (INTC)

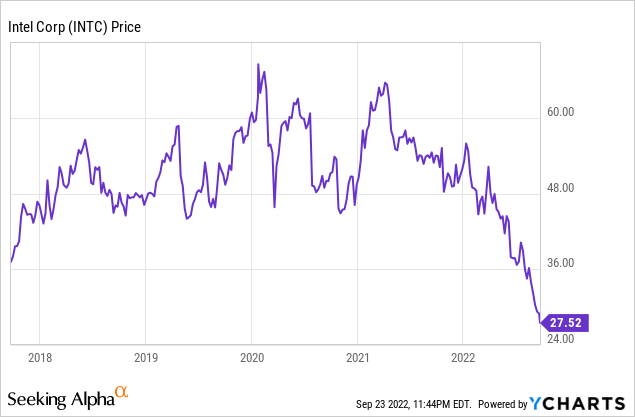

To continue my attempt to herd black sheep, Intel is thoroughly unloved by a huge majority of investors and analysts alike. The semiconductor sector has been one of the hardest hit so far this year after a stellar run in 2020 and 2021. Intel, for the most part, missed the hype of the pandemic run and was battered by the recent Fed and economic news.

Shares have travelled from $67 in 2021 to just over $27 today for a Bill Buckner like 60% decline in value. Do not get me wrong, Intel does have issues. They have been behind the 8-ball in chip design and have, over the last decade, given up substantial market share to both AMD (AMD) in the data center and NVIDIA (NVDA) in the GPU markets respectively. These issues will take some time and substantial investment by the company if it hopes to level the playing field going forward.

The saving grace for Intel, in my opinion, is in the nascent foundry business that CEO Pat Gelsinger is building. This division has the potential to become a monster given the geopolitics involved with the chip supply chain currently as it exists in the world.

Both the United States and all of Europe have, at last, recognized the risks of entrusting critical supply chains to China’s direct sphere of influence. This is not to say that suppliers such as Taiwan Semiconductor Manufacturing Company (TSM) nor Samsung (OTCPK:SSNNF) will fade quietly into the night as both have likewise embarked on geographically diversifying manufacturing plants, however, it is abundantly clear that Intel has a growing and marquee list of clients ready and willing to diversify their own sources of chips going forward.

UMH Properties (UMH)

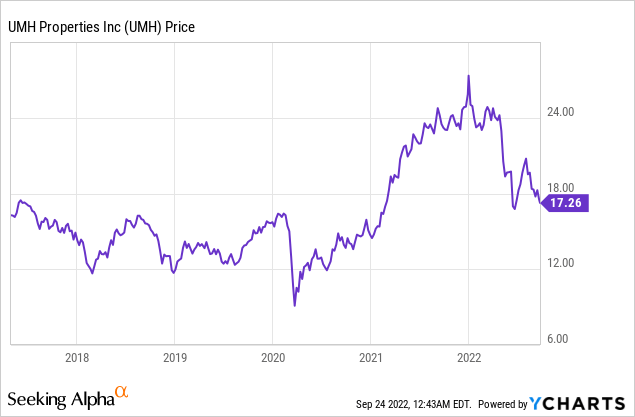

Last, but certainly not least, is a rather under-the-radar manufactured housing REIT. Why, you ask? Because UMH is a company with multiple catalysts whose product is in extreme need in the current environment. Also, add in the fact that the shares have essentially gone nowhere over the past 5 years whilst results have improved dramatically.

UMH had a rather remarkable run during the COVID pandemic given the obvious benefits that landlords capitalized on with soaring rents and a snug security blanket provided by the federal government with COVID relief funds. However, so far in 2022, the company has lost nearly 35% of its value under the mild misconception that UMH is likely to be punished disproportionately in a recession.

Here is a little secret that I will let out, lot rents for manufactured homes basically never go down, they only go up more slowly in hard times. In addition, while recessions are certainly not pain free by any stretch, manufactured housing communities are well positioned for those downsizing or looking to get back on their feet. These are not the days of old trailer parks; these homes are seriously appealing.

UMH Properties

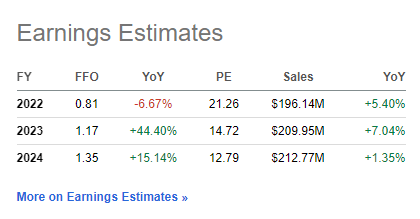

The market also seems to be missing an important catalyst of the preferred share redemption that occurred this summer, which is slated to have a dramatic effect on earnings owing to greatly reduced interest costs going forward.

Seeking Alpha

As you can see, earnings for the company are projected to jump nearly 45% next year, thanks to roughly $.30 per share in interest costs savings by redeeming the 6.75% preferred shares in addition to continued growth.

The market appears to be valuing UMH as if the last 5 years of operations and significant growth simply did not happen or that the company is likely going to head into reverse. I don’t buy it. UMH, in my opinion, has turned a corner and is likely to significantly grow FFO in the coming years, even in a recession.

In addition, one of the main drags on the company during the pandemic has been the housing supply crunch by manufacturers of the homes that UMH sells and rents. This supply crunch appears to be easing significantly with normal operations on the horizon.

Recession or not, UMH, I believe, is likely to generate above-market returns for the foreseeable future and I am happy to grab a chunk at what I view as a discount.

Bottom Line

The Fed is currently getting exactly what it wanted out of the equity markets, fear and even a bit of despair. In my opinion, this is a good thing as it means that the current tightening cycle may be nearer to an end than many think. I can basically guarantee to you that this is not the bottom. Anyone who says that they know for sure one way or another, is flat out lying to you.

What I do know for certain is that in my investing lifetime, I have been greatly rewarded for swallowing hard and buying during times that felt like this. I am not going all in here, but incremental buys at current levels are likely to be rewarded in the long run.

Let me know your shopping list below in the comments. Thank you for reading and good luck to all!

Be the first to comment