Vitezslav Vylicil

By Rob Isbitts

Summary

First Trust Dow Jones Internet ETF (NYSEARCA:FDN) is a “who’s who” of contemporary tech/internet icons. It is not a FAANG ETF per se, but it tends to track that group well, since it does own many of the stocks in that group, as well as other FAANG-like names. FDN was a great place to be and might be again one day. But that’s not likely until the current bear market cycle plays out.

Strategy

FDN tracks the Dow Jones Internet Composite Index. That index has two different but complementary sub-sections. One is Internet Commerce businesses, and the other is Internet Services businesses. The index, and thus the ETF, holds about 40-45 stocks. To qualify for potential inclusion in the index, more than half of a company’s revenue needs to come from the internet.

Proprietary ETF Grades

-

Offense/Defense: Offense

-

Segment: Aggressive

-

Sub-Segment: Internet

-

Correlation (vs. S&P 500): Moderate

-

Expected Volatility (vs. S&P 500): High

Holding Analysis

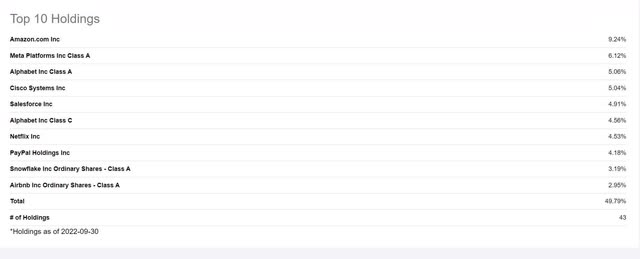

A glance at the top 10 holdings as of 9/30/22 tells us a lot about both the past success and current troubles for FDN. Note that this was before, shall we say, Amazon (AMZN) went south, and Meta Platforms (META) did a “Facebook face-plant.” Other top holdings have also been squarely in the sights of bears, as earnings and sentiment toward this market segment have reversed course sharply.

FDN holdings as of 9/30/22 (Seeking Alpha)

Strengths

FDN could be considered the “grandfather” of internet stock ETFs. It debuted way back in 2006, and First Trust, the fund’s owner, is one of the more established players in the ETF field. While the fund has bled assets this year, it still has about $4 Billion under management, and trading volume check in at around $90mm a day. FDN even has an options market that attracts a small, but consistent level of engagement. So, it’s the real deal as far as an ETF that targets this sector. And, with a reasonably small number of holdings, and only 10 of those making up about half of FDN’s assets, it actually possesses the type of targeted exposure and “look-through” ability we like in equity ETFs.

Weaknesses

The obvious weakness with FDN is not in its construction, but rather the extreme cyclicality of what it invests in. As the past decade has rolled on, the big have gotten bigger. And some smaller companies became much, much bigger. The problem with this is when the music stops, and the bull market ends. That’s when companies that were once thought of as world-changers are re-classified as grossly overvalued. The word “bubble” enters the dialogue, and before you know it, securities like FDN become the last place investors want to be.

Opportunities

FDN is clearly a “risk-on” ETF, currently suffering in a largely “risk-off” market climate. Tactical investors can consider this ETF a “role player” to rent for the ongoing series of bear market rallies. But they should be careful, since those rallies may get shorter in duration and magnitude. Either way, FDN is what it is, and until the market truly goes from range-bound bear to full-on panic, this one is on our possible rental list. But “owning” it for months or years? No way at this point.

Threats

I could probably just leave this section of the report blank, given that FDN is down nearly 50% this year. The threat has already been realized. But as with any high-risk, high-return market segment, remember that just because it has been cut in half, that doesn’t mean it can’t get cut in half again, and again, and again. That’s how investment loss math works. FDN has had a maximum drawdown (decline from a top to a bottom) of more than 61%. That dubious record appears to be in play as we proceed into year-end 2022 and the start of 2023.

While technically speaking, the chart shows potential support around $107 (about 9-10% below the price when I wrote this article), the broad market’s trend makes that a very tentative, optimistic view. Furthermore, the next support level below $107 is probably in the low $80s. Thus, the reward here is dwarfed by the risk of a major loss.

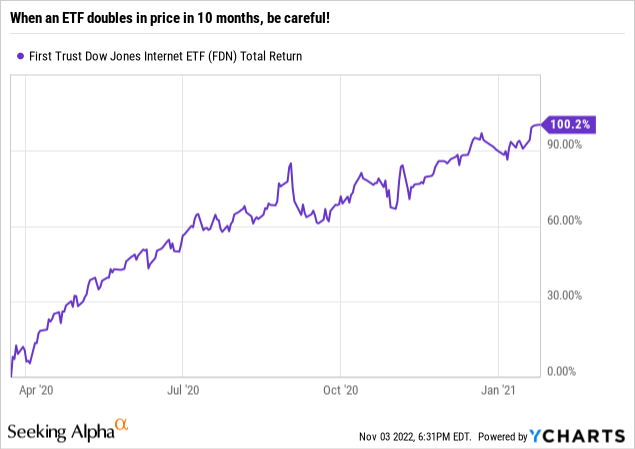

Here’s a chart of what likely drew many investors in. Back in March 2020, when the pandemic crash ended, FDN went on a tear. It doubled in price in about 10 months. This type of story has played out across the tech and internet space, just as it did during the last big “internet boom” from 2000-2003.

Proprietary Technical Ratings

-

Short-Term Rating (next 3 months): Sell

-

Long-Term Rating (next 12 months): Strong Sell

Conclusions

ETF Quality Opinion

FDN is an ETF that has been successful in delivering the best and worst of what it invests in. It has ridden the wave of investor obsession with FAANG and similar stocks. More recently, its price has collapsed right along with that changing sentiment. FDN is a classic case of a solidly-constructed ETF you can include in a watchlist of securities that could be owned “at a price.”

ETF Investment Opinion

However, there’s a good chance that price is significantly south of where it trades now. Even if what I just wrote turns out to be completely wrong, unless you are a big-time risk seeker, it’s probably best to leave this one on the bench for now. We rate it a Sell.

Be the first to comment