Seiya Tabuchi/iStock via Getty Images

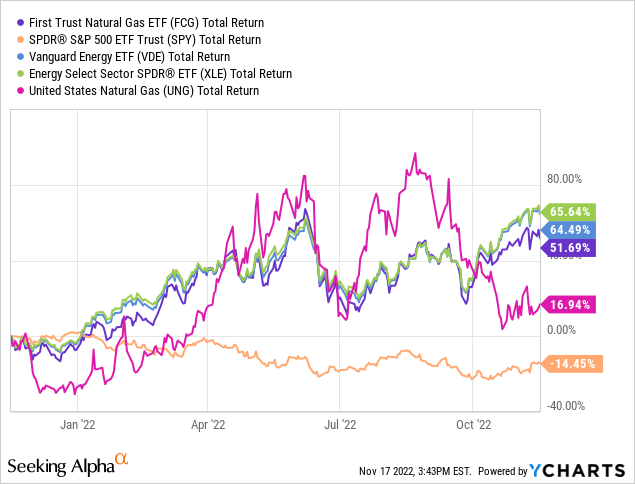

Back in April I suggested investors buy shares in the First Trust Natural Gas ETF (NYSEARCA:FCG) in order to gain exposure to the bullish natural gas futures strip (see FCG Is Still Attractive (Bullish Nat Gas Strip Pricing). Since then, the fund has returned 8% and has outperformed the S&P 500 by 19%-plus (see graphic below). And while the ETF’s top 10 holdings have changed considerably since that article was published, the fund is still excellently positioned to benefit from a still strong natural gas (and oil) price outlook. With no end in sight to Russia’s horrific war-on-Ukraine, the EU will likely never trust natural gas supply from Russia again. Meantime, the bulk of that incremental global demand will likely be satisfied by growing U.S. LNG exports, which should effectively put a floor under natural gas prices. And the price of natural gas already is significantly above (~3x) U.S. domestic E&P companies’ breakeven point. That being the case, I reiterate my buy recommendation on FCG.

Investment Thesis

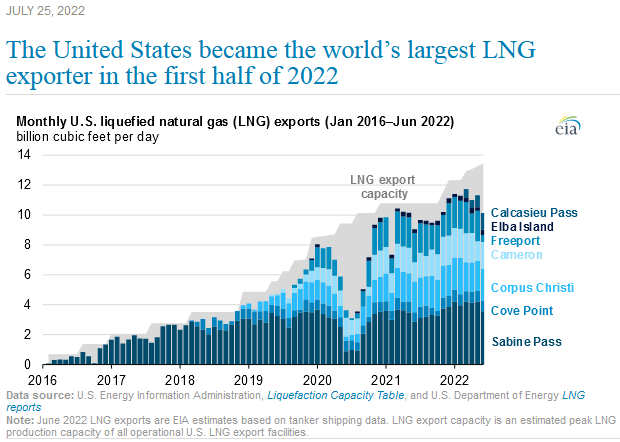

While some politicians inaccurately proclaim that U.S. oil and gas production is somehow being shut down by the Biden administration, the fact is this: In the first half of 2022, the U.S. became the largest LNG exporter on the planet:

EIA

Not only is the U.S. exporting greater volumes of natural gas, but the price of that natural gas (i.e. LNG feedstock) has increased significantly and is still considerably above the average price over the past five years:

tradingeconomics.com

Yet, as can be seen from the graphic, the price of natural gas is quite volatile and can be influenced by a number of global factors. The recent price decline was driven by news that the Freeport LNG terminal’s reopening would be delayed as well as forecasts for warmer than expected weather in Europe over November and December. However, that was recently countered by expectations of a cold snap in Europe starting Friday. While these type of short-term developments and gyrations are quite common in the global energy market, investors would be well advised to keep their eye on the mid to long term. And from that standpoint, it seems that Russian natural gas deliveries to Europe won’t likely return this winter. That means demand for natural gas from the U.S. will remain strong – and will likely put pep-in-the-step of domestic natural gas producers’ stock prices.

With that as background, let’s take a look at the FCG ETF to see how it has positioned investors to prosper going forward.

Top 10 Holdings

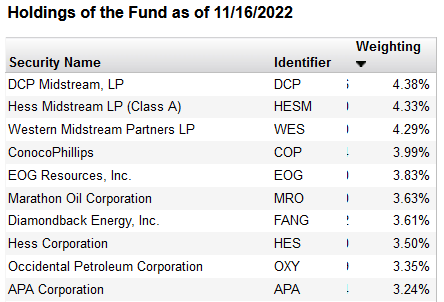

The top 10 holdings in the First Trust Natural Gas ETF were found on the FCG homepage and are shown below. The top-10 equate to what I consider to be a relatively well-diversified 38.2% of the entire 51-company portfolio:

First Trust

The No. 1 holding is DCP Midstream (DCP) with a 4.4% weight. DCP is one of the largest natural gas and NGLs processors in the U.S. The company is currently evaluating an offer by Phillips 66 (PSX) to buy the remaining outstanding units in DCP for $34.75. After a recent restructuring of the 50/50 JV between Enbridge (ENB) and PSX left PSX owning the majority of DCP (56.51%), the general consensus is that PSX will have to raise its bid to complete the transaction, and likely will do so. Note that DCP is currently trading at $38.38/unit, or roughly 10% above PSX’s initial offer. DCP yields 4.45%.

ConocoPhillips (COP) is the No. 4 holding in the fund with a 4% weight. ConocoPhillips is a large gas producer in the Eagle Ford and Permian shale plays, and has the largest natural gas marketing business in the country. COP also has significant LNG production in Australia and Qatar (see my July Seeking Alpha Editor’s Pick: COP Shifts Focus To LNG, Stock On Sale). Note the stock is up 47.5% since that BUY article was published and that COP is up a whopping 85% this year.

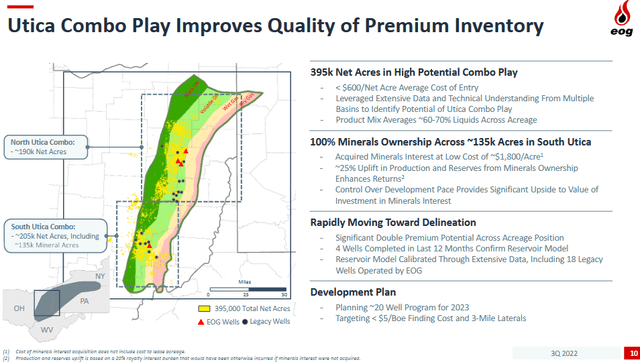

The No. 5 holding with a 3.8% weight is top-shale operator EOG Resources (EOG). Somewhat under-the-radar, EOG has recently cobbled together a significant acreage position in what is being called the “Utica Combo” play in Eastern Ohio. The slide below, taken from the company’s Q3 presentation, summarizes EOG’s 395,000 net acreage leasehold in this emerging play:

EOG Resources

As I reported in my recent article on EOG, the company says it expect Utica Combo wells will deliver a 30% internal rate of return (“IRR”) at $40/bbl WTI and $2.50 MMcf nat gas. Note that WTI is currently trading at ~$82/bbl and NYMEX gas at $6.38/MMBtu. EOG plans a 20-well drilling program in the play next year. For more information on the company, including its $8.80/share in (base+variable) dividend payments this year, consider reading my recent Seeking Alpha article EOG Resources: Premium Driller, Premium Income. EOG is up 68% this year.

Occidental Petroleum (OXY) is the #9 holding with a 3.4% weight. Berkshire’s Hathaway’s (BRK.A) recent SEC 13-F filing showed that the Warren Buffett run company continues to buy more shares in OXY. CNBC reports Berkshire currently holds a 21.4% stake in OXY worth $13.8 billion. As a side note, and despite all the media attention the Buffett and OXY combination receives, many investors would be surprised to know that Berkshire’s position in Chevron (CVX), at $30+ billion, is significantly higher.

OXY is one of the best performing stocks in the S&P 500 this year, and as I reported recently, it has totally repaired its balance sheet after taking on a huge debt load to buy Anadarko. That being the case, OXY is well positioned to start returning more free-cash-flow to its shareholders. However, OXY management doesn’t seem to be that interested in matching the big dividend payments that other shale companies are delivering to shareholders, and has signaled that its return-of-capital will be primarily through stock buybacks.

Performance

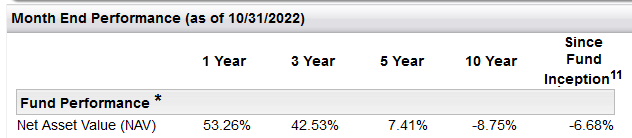

The total returns performance of the First Trust Natural Gas ETF relative to the broad S&P 500 and its energy fund peers, such as the Vanguard Energy ETF (VDE), the Energy Select SPDR ETF (XLE), and the United States Natural Gas ETF (UNG), is shown below:

While it’s no surprise that all the energy-related ETFs have significantly outperformed the S&P 500 (as measured by the (SPY) ETF) this year, it’s interesting to note that both natural gas focused ETFs have significantly lagged the broad energy sector ETFs (i.e. VDE and XLE) that are more exposed to oil production.

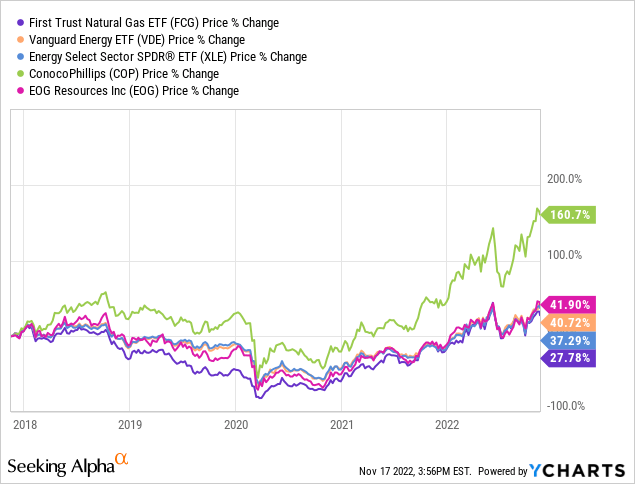

The graphic below shows FCG’s long-term performance:

First Trust

As you can see, with an average annual 10-year NAV return of -8.75%, the ETF has been, well, a lousy long-term investment. However, as you can also see, the fund has performed very well over the past year. This points out the very cyclical nature of the energy market, and that natural gas, in particular, is quite volatile and – over the long term – generally under performs investments and funds that focus more on oil:

Risks

The biggest risk to the FCG ETF at this time would be a cessation of the war in Ukraine and a resumption of Russian natural gas deliveries to the EU. I think that this is highly unlikely as it’s clear that Putin’s current objective is to try to freeze Ukraine and the EU over the winter in hopes that it will cause both to capitulate and give in to Russian demands. I doubt that too.

Longer term, and despite the false energy narratives being spun by many politicians and energy CEOs these days, we truly do live in an era of energy abundance. The fact is, U.S. shale producers have billions of bbls of proven oil and natural gas reserves that could be easily and very economically be brought to market in a matter of a couple months through existing pipelines simply by drilling and completing new wells. After all, the energy company CEOs who now say it will take a long time to bring on additional supply were the same CEOs that have been marketing shale oil and gas over the past decade as “short cycle” assets that can be scaled up (or down) relatively quickly, right? Well, they were absolutely correct – shale still is “short cycle.” But that assumes that we have energy company CEOs that actually want to produce more in order to tame inflation and help out the American economy during a time of war, as Democracies in the U.S. and the EU are suffering under high O&G prices – which are primarily the result of Russia’s aggression in Ukraine that broke the global energy (and food …) supply chains.

The point is, investors should consider that these current and relatively high O&G prices may not, and probably won’t, stick around forever.

Summary and Conclusion

I have reiterated my buy rating on the FCG ETF because I do think it will continue to perform well over the winter and will continue to beat the broad S&P 500 over that time frame. However, as you can tell by my commentary, investors would likely do even better by focusing on a broad energy ETF like the XLE that is more exposed to oil. Or, the other alternative is to simply choose one of the better oil and gas E&P companies (like COP or EOG) or a more diversified international integrated O&G company like Chevron.

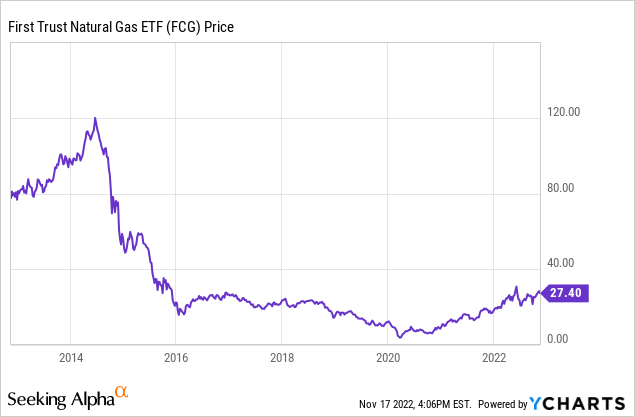

I’ll end with a 10-year price chart of the FCG, and, as they say, a picture is worth a thousand words:

Be the first to comment