Leon Neal

Fastly (NYSE:FSLY) recently reported a mixed quarter with revenue growing 21% yoy and coming in ahead of expectations, though gross margins remaining pressured due to true-up costs associated with revenue. This margin pressure ultimately led to an EPS miss during the quarter.

In addition, even though revenue guidance for the full-year was raised, management lowered their non-GAAP EPS loss guidance for the year, due to the ongoing margin pressures.

While the company recently announced their new CEO, I believe this stock remains a show-me story that could take several quarters to change the current negative sentiment bias.

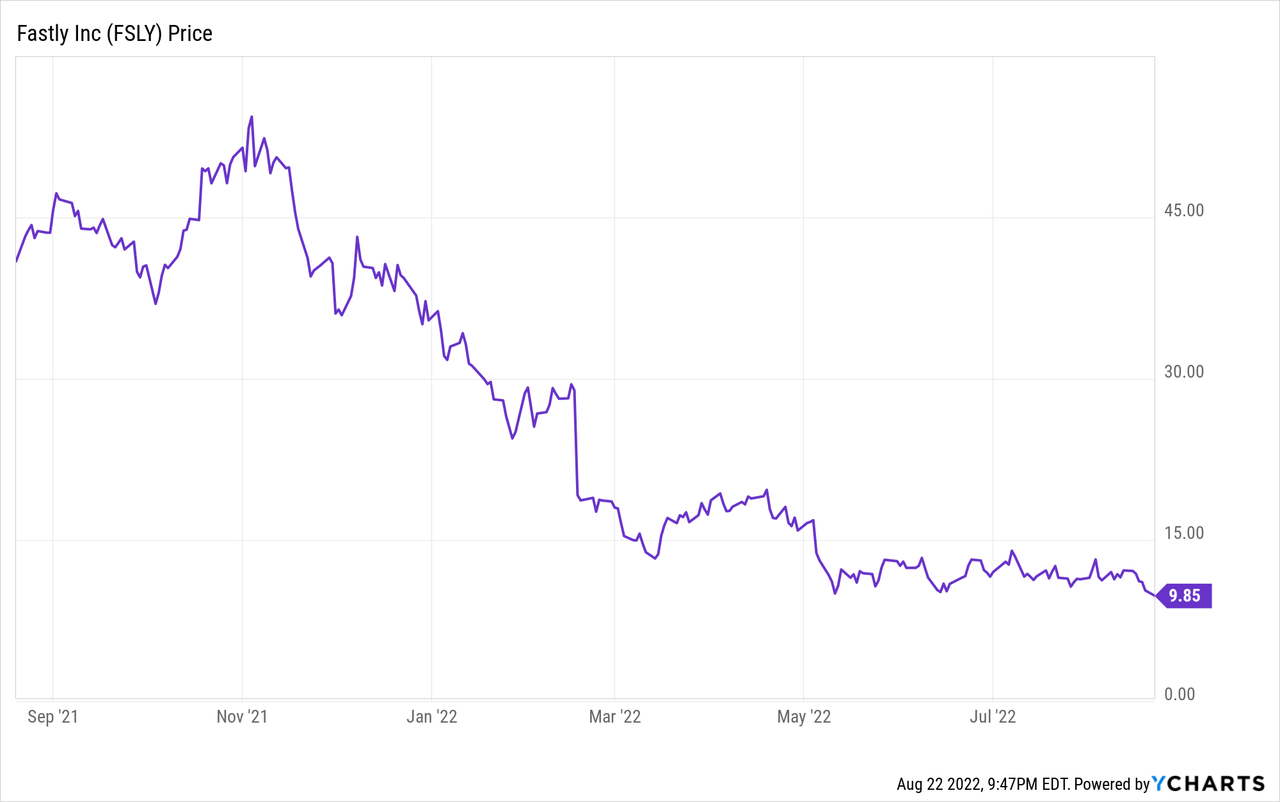

Even though the stock has pulled back over 70% year to date, I believe the stock may continue to be pressured in the near-term due to the lack of profitability. Revenue trends have remained healthy and the company continues to experience strength within their enterprise clients.

However, ongoing margin pressure and high free cash flow burn are concerning and something investors will likely pay close attention to over the coming quarters.

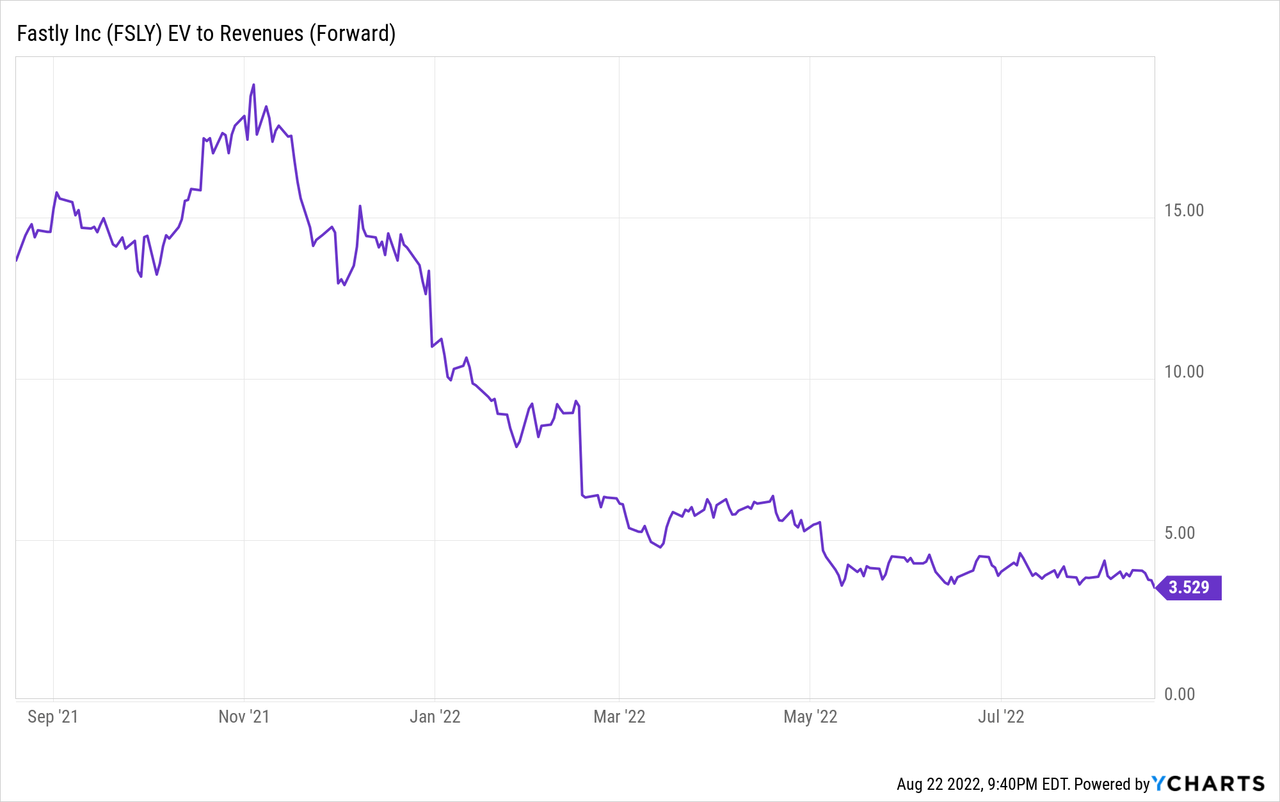

Valuation currently stands at ~2.3x 2023 revenue, though the combination of ~20% revenue growth and ongoing non-GAAP operating losses make it challenging to justify a much higher multiple in the current environment.

While there remains a lot of long-term growth opportunity left for the company to achieve, I continue to remain on the sidelines until the company can show profitability improvement, which is similar to my previous articles I have published related to the company.

FSLY is a content delivery network, which is known as CDN, and helps make it easier for consumers to have faster internet access by hosting a global network of services and data centers. Since their infrastructure is located closer to the end-user, this increases the internet response times and reduces latency, which often leads to a better internet experience.

Financial Review and Guidance

During Q2, the company reported revenue growth of 21% yoy to $102.5 million, which beat expectations by ~$1 million. In addition, revenue growth remained similar to last quarter’s 21% yoy growth, despite a more challenging macroeconomic environment.

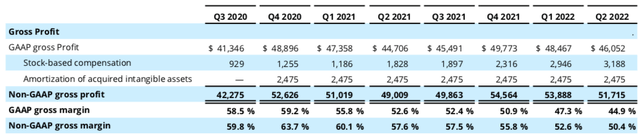

However, the disappointing metrics during the quarter fell within the company’s profitability, which came in below expectations. Non-GAAP gross margin during the quarter was 50.4%, which was down significantly from the 57.6% seen in the year-ago period. The company has previously talked about gross margins being pressured due to increased investments related to their servers, however during Q2 there was added pressure due to one-time cost true-ups and other smaller items.

Yes these costs are likely to be one-time and with management expecting gross margin to increase for the remainder of the year back towards low/mid-50s, these margins are still below the levels seen in prior years.

Lack of profitability continued during the quarter with the company reporting non-GAAP operating loss of $27 million, worse than the $17.5 million loss in the year-ago period and the $18 million loss last quarter.

The weaker than expected gross margin and ongoing operating loss led to non-GAAP EPS loss of $0.23, which was $0.06 lower than expectations.

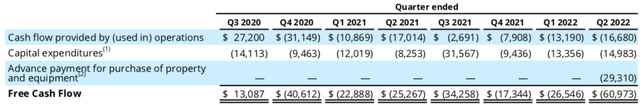

What continues to disappoint is the company’s free cash flow. During Q2, free cash flow loss was $61 million, which was lower than the $25 million loss in the year-ago period, despite revenue growing over 20% yoy.

The company only has $63 million of cash with an additional $705 million of marketable securities. If free cash flow burn continues to remain at these elevated levels, the company may only have a few quarters left before a capital raise may become a serious consideration. While I do believe free cash flow will improve during the remainder of the year, the ongoing losses remain concerning.

Fastly

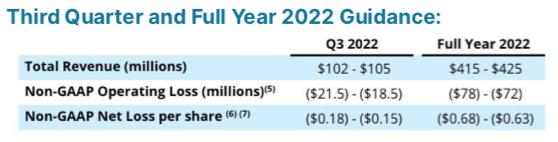

For Q3, the company is expecting revenue of $102-105 million, which was above expectations for $101 million. Non-GAAP operating loss is expected to be around $18.5-21.5 million, leading to non-GAAP EPS loss of $0.15-0.18, lower than expectations for a loss of $0.14.

For the full-year, the company raised their revenue guidance to $415-425 million, up $10 million at the midpoint and above expectations for $412 million. However, the company widened their adjusted loss guidance, now expecting a non-GAAP EPS loss of $0.63-0.68, lower than their previous guidance of $0.50-0.60. This wider loss is largely due to the combination of lower gross margins and higher operating expenses, despite revenue being stronger than anticipated.

Recent News and Customer Metrics

In conjunction with the company’s earnings release, they announced that Todd Nightingale will become their new CEO, succeeding Joshua Bixby. Now that the company has announced the finalization of their leadership changes, I believe investors will start to expect a heightened focus on profitability improvement.

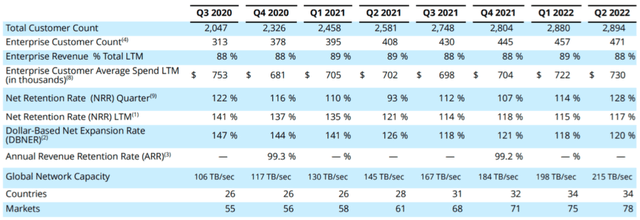

Also during Q2, the company added only 14 customers compared to last quarter, which was much lower than their historical net adds, with management noting that the macro environment had an impact.

Our total customer count was impacted by higher churn at the low end of our customer base, which we believe was impacted by the uncertain macro environment impacting smaller customers and the dynamics we have described before in which small customers opt for our more robust developer-friendly trials. We continue to focus on landing new enterprise and large customers

In addition, enterprise revenue remained nearly 90% of total revenue, which tends to be a little stickier than smaller-sized businesses. Fastly also continues to experience churn of less than 1%.

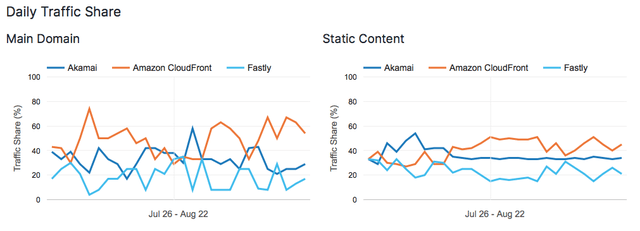

According to CDN Traffic, Fastly continues to remain below both Akamai and Amazon CloudFront when it comes to traffic share. While this can move around quite a bit on a daily basis, Fastly tends to remain the smaller player of the group.

Valuation

Given the ongoing profitability challenges, it is no surprise to see the stock pullback over 25% since reporting earnings, bringing the year to date pullback to over 70%. Revenue growth and sustainability no longer seem to be in question. Rather, it’s the company’s path toward profitability which is being put under pressure.

During more challenging economic times, investors look for sustainably profitable companies, something that Fastly is not able to check the box on. As the macro environment remains challenged, investors may continue to focus on profitability metrics, which could remain an ongoing sentiment headwind for the company over the coming quarters.

Fastly has a current market cap around $1.2 billion and with ~$60 million of net cash, the company has a current enterprise value around $1.14 billion. Guidance for the full year was recently raised to $415-425 million, which implies a 2022 revenue multiple of ~2.7x.

Revenue trends have proven to be resilient and with ongoing strength from enterprise clients, it’s reasonable to assume that revenue growth remains strong over the coming years. Even if we were to assume 2023 revenue grows 20% to $500 million, valuation would stand at ~2.3x 2023 revenue.

Admittedly, valuation has become pretty attractive given the recent pullback. However, with no clear sight of profitability and high free cash flow burn, I continue to remain on the sidelines.

This stock has turned into a significant show-me story, with the company likely needed to execute on both revenue and profitability over the coming quarters in order to change the current negative sentiment.

Be the first to comment