recep-bg/E+ via Getty Images

FARO Technologies (NASDAQ:FARO) is considered a paradigm for commercializing the emerging 3D Measurement and Imaging business. We were bullish long-term. We recommend holding shares you own. Buying now is only for those with a high-risk tolerance and patience.

FARO stock dived in November ’21 from $82 to $30.65 in June ’22. The share price is down 60.27% over the past 52 weeks.

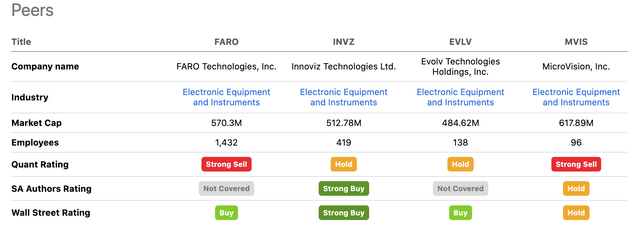

Seeking Alpha’s Quant Ranking screams a strong sell. SA justifies its severe warning because FARO demonstrates “characteristics which have been historically associated with poor future stock performance.”

Fantasy Into Reality

Software-driven, three-dimensional (3D) measurement, imaging, and realization solutions are designed and developed for metrology, architecture, engineering, new construction, maintenance, and public safety markets including crime and fire scenes.

FARO Technologies operates on the cutting-edge of a relatively young industry. The company is plowing its way into the application of 4D digital reality solutions. Products can capture large amounts of visual information with instant access on-the-job using technology allowing 360 degrees photos of a room or site. The photos and data are stored in the cloud. The system complements FARO’s 3D high-accuracy laser technology.

Bleak Images

The CEO attributes the weak Q4 ’21 revenue to China’s COVID extensive lockdown of Shanghai. Logistics disruptions are a nightmare. Additionally, the resurgence of pandemic cases in the US and the slowing economy could all “last into the second half of 2022,” the CEO told investors.

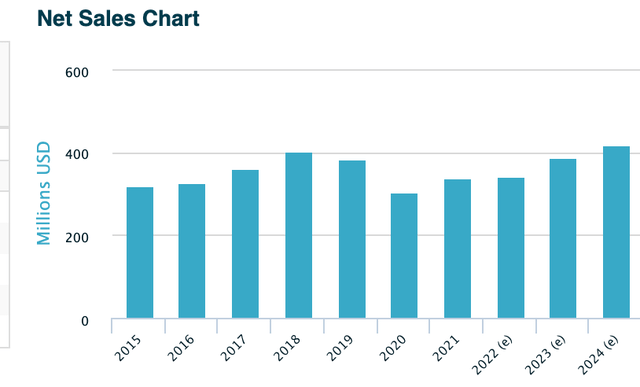

Faro Revenue (infrontanalytics.com/fe-EN/35496NU/FARO-Technologies-Inc-/Beta)

FARO is outsourcing manufacturing to reduce costs. “We have stopped manufacturing activities in both of our U S sites as of the end of Q1.” The popular ScanArm and Laser Tracker product lines are being made in Thailand and shipped through FARO’s lone Chinese logistics center in Shanghai. News reports are that Shanghai and Beijing are back on lockdown under China’s dynamic zero-COVID policy. The business climate in China and for FARO is not healthy.

Q4 ’21 was not a woeful report: revenue was +27% compared to the previous quarter. Revenue in Q1 ’22 rose 8% Y/Y to $100M and $337.8M for the year. The gross margin was up but so too the net loss to $31.7M over $27.4M previously. The CEO sounded an encouraging note by touting customer demand for vanguard products designed to help “digitize the physical world” in the markets they address.

We don’t like that 99.26% of FARO shares are owned by institutions. Less than 1% are held by corporate insiders. The next earnings report date is tentatively July 26th for Q2. We see no let-up in the extrinsic factors putting downward pressures on FARO. Last year’s Q2 earnings per share were 12 cents; we do not foresee the EPS coming in over zero, perhaps it will be nearer to -10 cents.

FARO was slicing away at its debt. It ended FY ’21 in December owing just over $240K. Debt skyrocketed to $381K by the end of the first quarter in 2022. Interest rate hikes and inflation are going to hit corporate earnings harder this year than anyone is forecasting. We see the average price target for the next 12 months somewhere in the $27 to $30 range.

Below $30 presents a potential opportunity to moderately acquire some shares. In my experience, patience is not a virtue of institutions holding stocks with poor profitability and little momentum. One might expect to hear rumblings about M&A activity if the next quarter yields a poor report. Contributing to our musing is that the P/E ratio is -12.17. The P/B is a mere 1.72; below 3 suggests the company is already reasonably valued.

Q1 ’22 performance was a bit better compared Y/Y:

- Total sales in Q1 were $76.7 million; software sales were $10.3M (13% of revenue).

- Recurring revenue was $16.5M (21.5% of sales) or +6.5% over the prior-year period.

- The gross margin was 53.5% in Q1, higher than 52.9% in the prior year but lower than the previous quarter.

- Operating expenses were $48.2 million compared to $46.8 million in the prior year.

- The net loss in Q1 was $9.7 million, or ($0.53) per share compared to $3.2 million, or ($0.18) per share in the prior year.

- Cash and short-term investments are $107.2 million compared to $122M as of December 31, 2021.

On a more positive note, the Beta rating of 0.93 measuring the volatility of FARO is below that of the stock market which is making analysts jittery and fills investors with consternation. We are somewhat surprised the short interest on FARO is only at 3.2%. Seeking Alpha grades the valuation a B-, growth at A, but holding the shares back are profitability, momentum, and revisions (all get D’s). Hedge funds were moving out of FARO every quarter since May 2020 but increased their holdings (158K shares) last quarter.

Here is how FARO compares to others in the industry and a snapshot from SA:

FARO Peers Comparison (seekingalpha.com/symbol/FARO)

Window to the Future

We do not need a high-tech artificial intelligent window to see there are too many ominous portents for FARO’s earnings to be in the black next quarter. The share price collapse changed sentiment about the stock. Rising debt combined with poor returns on equity and investment makes a dispiriting stewpot. This is not just a case of stock being oversold.

The three best things going for FARO are its vibrant commitment to developing unique applications for new tech. That is its fountainhead of revenue in a growing industry. Second, hedge funds buying shares again sounds a positive note. Third, we hope the new Chairperson and relatively new CEO are able to effect new plans and strategies that return FARO to profitability.

Management’s foremost task is to overcome fate, frustration and fatigue among investors. We do not advise selling shares; for retail value investors to risk cash betting on FARO’s potential in this jittery stock market and economic environment is asking too much right now.

Be the first to comment