The Good Brigade

A Capital Markets Day that lost a lot of capital

Shares of online luxury platform Farfetch Limited (NYSE:FTCH) have suffered a 35% decline since the company held its Capital Markets Day on 12/1. At the event, Farfetch management laid out its plan for 2023 and 2025. For FY23, GMV is expected to increase 20-22% YoY to $4.9 billion, driven by an 8-10% growth of the underlying business as well as a ~$500 million contribution from signed partnerships. However, adj. EBITDA margin is guided to 1-3%. While the margin outlook represents an improvement from negative 3-5% in 2022, investors were unimpressed.

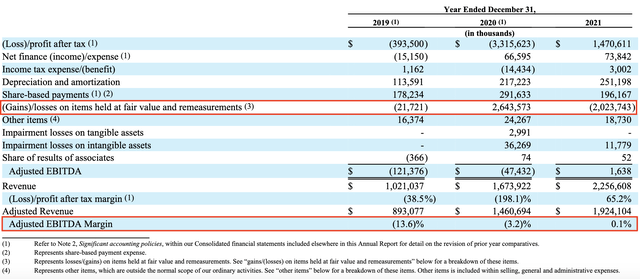

Taking a look at Farfetch’s earnings history, we can quickly observe that: (1) the business can’t quite achieve profitability even on an adj. EBITDA basis; and (2) adj. EBITDA margin barely reached positive territory during the pandemic, when revenue jumped 64% in 2020 and 35% in 2021.

Unlike other SaaS (software as a service) companies where stock-based compensation (“SBC”) easily makes up 20% of revenue, the largest component of Farfetch’s adj. EBITDA is the change in the fair values of numerous financial instruments on the balance sheet. In 2020, the negative adj. EBITDA margin of 3.2% was a result of adding back a $2.6 million loss from fair value remeasurements of put/call options and embedded derivatives within convertible notes.

Even though Farfetch did have a profitable year in 2021 with a net income of $1.47 billion, it was driven by a $1.64 billion gain from embedded derivatives (within convertible notes), a $156 million gain from Chalhoub put option, and a $246 million gain from Alibaba (BABA) and Richemont (OTCPK:CFRHF) put options. If I never knew what Farfetch does in the first place, I’d have easily mistaken the fashion company for a derivatives trading house.

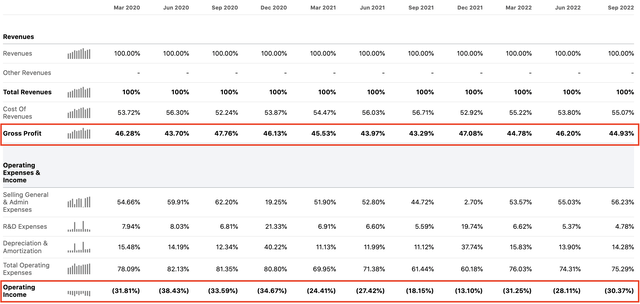

Looking past all the non-core financial items, we can again see that the idea of profitability seems incredibly farfetched given Farfetch has never been able to deliver a positive operating margin and given total SG&A has a strong tendency of surpassing gross profit. With revenue growth decelerating from +90% YoY in 1Q20 to less than 2% in 3Q22, it’s difficult to imagine how Farfetch will ever achieve positive operating income. Considering EBIT has never reached positive territory since 2015 (in fact very negative), there’s clearly something wrong with the business model: it doesn’t work.

Could this be a turnaround story?

Markets are forward-looking, so it’s important to put yesterday’s results aside and focus on what could happen for Farfetch tomorrow. Despite a very tough macro, Farfetch management was able to provide a 3-year outlook that many companies could not confidently discuss. Nevertheless, the 2025 GMV guidance of $10 billion (+32% 3-yr CAGR) was not good enough to convince investors, given adj. EBITDA margin was guided to just 10%.

Unpacking the $10 billion GMV target, Marketplaces GMV is expected to be $3.8 billion as management sees an annual growth of 8-10%. Platform Solutions GMV is guided to $4.3 billion thanks to signed partnerships (e.g., Bergdorf Goodman, Ferragamo, and Yoox Net-A-Porter). Brand Platform GMV of $1.5 billion will become a less meaningful driver, with an annual growth of 5-10%. Lastly, Fulfillment revenue is expected to be $0.9 billion.

While it’s important to note that the FY25 GMV guidance assumes no GMV growth from new partnerships (e.g., Richemont) and no new deals for FPS (Farfetch Platform Solutions – the Shopify (SHOP) equivalent for luxury brands), investors appear to be focusing on the profitability side of the story vs. how much upside there is on the top-line. Though Marketplaces will account for a meaningful 38% of FY25 GMV, adj. EBITDA margin is guided to just 5% vs. Platform Solutions (43% of GMV) at 20% and Brand Platform (15% of GMV) at 20%. Profitability aside, I see the $10 billion GMV target as ambitious, with a recession being the base case for 2023 where luxury will not be immune to a downturn.

What to do with Farfetch stock?

Farfetch is a structurally unprofitable business that cannot deliver operating income even when demand skyrocketed during the pandemic. Now that Covid is behind us, it’s even more difficult to believe that the company can achieve sustainable profitability when revenue growth has significantly decelerated. With an FY25 adj. EBITDA margin of 10% (which indicates a very minimal operating margin), markets now understand that the idea of generating operating profits just seems too farfetched.

As a result, I would suggest avoiding bottom-picking the stock on theses such as “expectations are low” or “the stock is cheap at <0.6x FY25 revenue” unless you’re a technical trader. Equally, I would advise against shorting Farfetch stock, as shorts have every reason to cover following such a violent decline in the share price.

From a top-down perspective, Farfetch is another case in point that investors are done with unprofitable growth stories that just don’t have a viable business model. I would therefore treat any bounce of Farfetch Limited stock amongst similar names as a selling opportunity to reduce exposure to the speculative pocket of the market.

Be the first to comment