Robert Way/iStock Editorial via Getty Images

Investment Thesis:

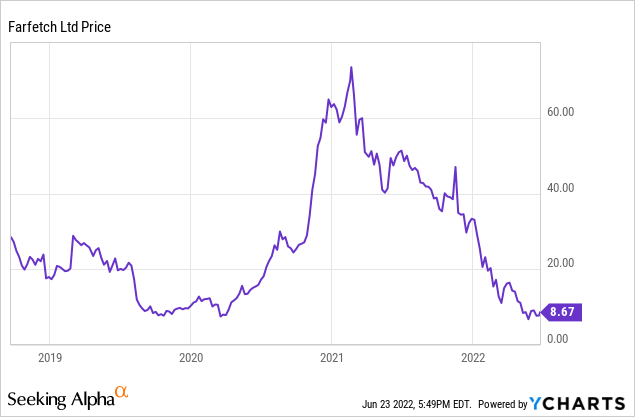

Farfetch’s investors have been on a wild ride in the last few years, with shares up 558% and down 89% within 2 years. The share price has bottomed somewhat after a recent fall (and downgrade) and so now feels like a good time to assess the attractiveness of the business.

Farfetch has innovated the way people buy luxuries in the modern day and has partnerships with several leading brands and marketplaces, who see cooperation as a means of modernizing their operations.

Everything is in place for success, but unfortunately, we see tough times ahead. Macro conditions are worsening and Farfetch’s financials look problematic.

This paper seeks to assess the attractiveness of Farfetch and consider what we believe the next 24 months will look like.

Company Description:

Farfetch (NYSE:FTCH) is a British online fashion marketplace, stocking a host of luxury fashion brands which it sells in over 190 countries. The platform currently has over 3.5M active consumers, 3,400 brands and 370K SKUs.

Historically, luxury fashion has been a market which focused on brick-and-mortar. There are multiple reasons for this, including the most obvious: that if a consumer is going to spend a large amount of money, they probably want to see and touch the item. Fashion brands also use this time in-store to provide an exceptional experience, to add to the attraction and justification of their prices. Farfetch has been innovative in this sense, bringing together lots of local sellers globally to market their goods online.

Farfetch has expanded beyond being just a 3rd party intermediary, purchasing a portfolio of brands called the New Guards Group. Brands within the group include, Off-White and Palm Angels. This diversifies Farfetch’s revenue streams, while also allowing the marketplace to heavily promote and sell the NGG brands.

Farfetch’s share price had a meteoric rise between 2020 and its ATH, gaining 558%. Since then, however, it has fallen 89%. The rise coincided with the general market rally we experienced post COVID-19, with demand remaining robust thanks to income support and lockdown-induced reduction in social spending.

The Luxury Fashion Industry:

The luxury fashion industry is valued at over $1.1TN and is expected to grow at mid-to-low double digits for the next 5 years. Bain believes that around 1/3 of luxury purchases will be digital by 2025. A part of this is the result of COVID-19, with businesses forced to bolster their online offering and begin marketing for online sales. Online sales rose 50% and 27% in 2020 and 2021, respectively. It could be argued however that COVID merely accelerated a shift in consumer spending habits. This goes beyond luxury and stems from the overarching shift from brick-and-mortar to online. Consumers enjoy the ease of shopping from their own home and being able to consider all of their potential options, rather than having to go to multiple stores. This is where Farfetch comes in, with all the brands on their platform and the ease of ordering and returning, they have been able to grow aggressively. With online sales expected to make up a greater percentage of total sales, the scope for growth in the market is certainly healthy.

The biggest drawback is that people cannot try on and see the item before purchasing. Given the price point, it does mean that online sales will not completely cannibalize the market. Farfetch’s counterpoint is that it finds the best prices and so has a good chance of beating an individual’s local vendor.

A risk Farfetch faces is that brands will take their products off the marketplace and go direct to consumers. We have seen this with Nike (NKE) dropping Foot locker (FL) and LVMH not allowing online sales of its products. Farfetch has taken steps to mitigate this, partnering closely with large conglomerates. Kering (OTCPK:PPRUF) and Richemont (OTCPK:CFRHF) have both taken ownership stakes in Farfetch and have their brands heavily promoted on the marketplace. This is a win-win for both parties. Farfetch gets some of the most popular brands in the world on their platform, specifically Balenciaga and Gucci, which rank No.1 and 2 on Lyst’s hottest luxury brands index. These brands alone will bring significant traffic to the marketplace. In exchange, Richemont and Kering can reach their target demographic, younger consumers, without having to build a new platform themselves and expend resources attracting clicks. YNAP, Richemont’s attempt at replicating Farfetch, has struggled in recent years. Deloitte’s research into this space has found the younger audience to be a key target for businesses in the medium term, and attribute their use of Farfetch as a key source of their success.

The fashion industry was positioned perfectly for a business like Farfetch to come in and disrupt it, many of the large brands are now responding but it is likely too late. Naturally, this has left many choosing to partner with them, rather than attempting to compete.

China:

China’s share of luxury goods is a staggering 21%, according to Bain. As a result of this, brands have focused significant resources into marketing in China. Farfetch again is positioned perfectly here as they have managed to increase their popularity by hosting a large number of brands. Farfetch gives many brands who do not have the scale to “go it alone” in China the ability to sell through their platform, while also leveraging the popularity of the larger brands.

Not only this but Farfetch has secured the Chinese trifecta to propel its growth in China. Alibaba (BABA), JD.com (JD) and Tencent (OTCPK:TCEHY) have all announced investments in, and strategic partnerships with, Farfetch, to assist the business with its growth in China (JD partnership has come to an end, being replaced by Alibaba, although some ownership remains). They know the thirst Chinese people have for western goods and so will happily exchange their expertise for a cut of every transaction. These businesses wrote the playbook on growth in the Chinese e-commerce space and will allow Farfetch to penetrate into the market and bridge the gap between locals in China and western goods.

This being said, Chinese growth is looking shaky. Recent lockdowns have weakened short-term demand and Xi’s common prosperity speech hinted at a move away from Chinese consumption of western luxuries. Regardless, it is currently too early to tell, but relying purely on China would be a miscalculation.

Macro Headwinds:

Much has been made of the current economic conditions but the reality is, the future is still uncertain. Many are expecting a recession to come later this year, if not in 2024. This is highly problematic for Farfetch, as luxury goods are as the name suggests, a luxury. During recessionary times, people lose their jobs, wealth decreases and generally discretionary income falls. As a result of this, there is the risk that the coming 24 months could be incredibly difficult for Farfetch, with a reduction in revenue growth.

A layer of complexity here is the inflation, this is already deteriorating people’s discretionary income, with a cost of living crisis hitting many western economies. This means that the problems for Farfetch have likely already begun and the coming period will only be worse. We note that Farfetch missed earnings for the first time in over a year, while attempting to reset forward guidance.

Therefore, the coming 24 months could be the hardest in Farfetch’s history, with no real ability to mitigate or offset the impact of weakening demand.

Financials:

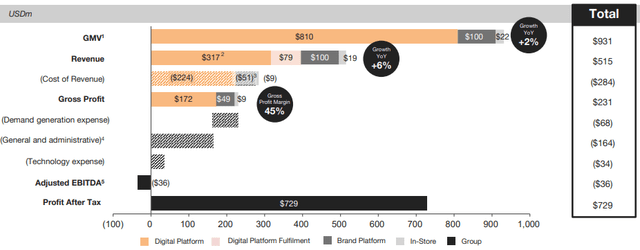

In the first quarter of 2022, Farfetch posted a slight uptick in Gross Merchandise Value (“GMV”) across its marketplace and brand platforms, with a dip in gross profit margins. Farfetch attributes the weak growth to ceasing operations in Russia and macro events in China. These issues will not ease quickly and in the case of Russia, the demand may be lost for a long time.

Farfetch’s Q1 performance breakdown (Farfetch)

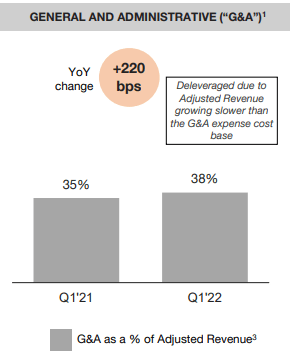

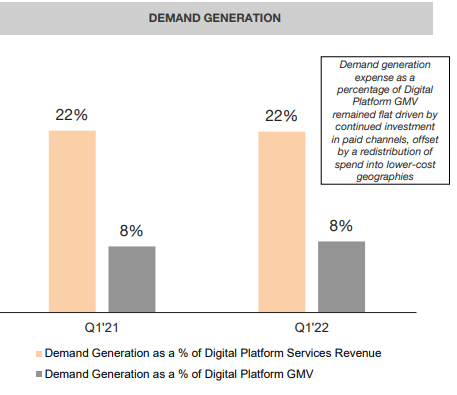

Furthermore, our real concern is Farfetch’s route to profitability. Currently, Farfetch’s G&A expense are 100% of gross profits and demand generation expenses are 30%. These expenses have grown in lockstep with revenue as the below shows, showing little signs of scale efficiencies.

G&A as a % of revenue (Farfetch) Demand generation expense as a % of revenue (Farfetch)

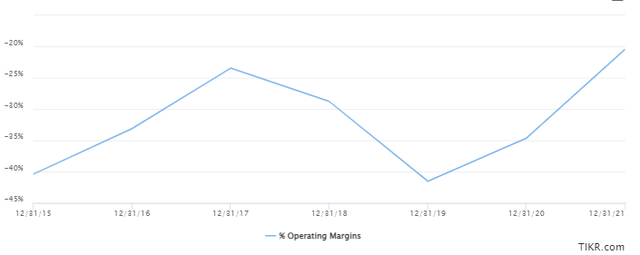

The net impact of this is a negative operating margin of fluctuating between -40% and -20%.

Farfetch’s operating margin 2015-2021 (Tikr Terminal)

Our expectation is for economic conditions to worsen, with Farfetch hit by falling demand and discretionary income falls. Given this, Farfetch will likely incur greater losses and move further from profitability. Margins may also decline, as Farfetch invests a greater amount in order to attract sales. Therefore, we must consider the liquidity of the business.

Currently, debt to equity sits at 71%. Given Farfetch’s negative EBITDA, the business is currently funding its c.$69M in interest payments through cash. With a cash balance of c.$1BN and $310M in cash outflows during the LTM (Source: Tikr Terminal), Farfetch will likely need to raise cash in the coming 24 months. With interest rates on the rise, there is no good choice for investors between debt or equity.

Unfortunately, Farfetch’s financials do not look good. The business is in a growth trap, with costs moving in line with revenue growth. If they cut costs, revenue will likely fall also. On the balance sheet side, the business will likely need additional financing in the near future, investors will need to pay for this in one way or another.

M&A Upside:

One way Farfetch could improve its financials is to conduct more profitable operations. We note that Farfetch acquired Violet Grey in January 2022, ahead of its launch of Farfetch beauty. Beauty is a high margin business, which has the potential to improve Farfetch’s margins.

Additionally, Farfetch acquired Luxclusif, a luxury reselling platform. This gives Farfetch exposure to a competing industry. Here, Farfetch will be able to leverage its marketplace growth expertise to help Luxclusif compete against those taking business from Farfetch.

Valuation:

With growth in question and losses likely increasing, it is very difficult to calculate a fair value.

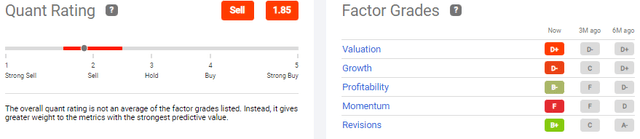

Seeking Alpha’s current quant rating is extremely poor, rating this stock a sell. Further, Farfetch currently has a D+ valuation grade, even after the sharp fall in recent months.

Seeking Alpha Quant Rating (Seeking Alpha)

It is clear that purely from a financial perspective, this is an incredibly expensive investment.

Potential Upside:

We never like to write a paper with only negativity and so have considered what may cause bullish price action. The business achieved adjusted EBITDA positivity in 2021, on the back of the post-COVID spending binge. The share price was up 40% on the news. Assuming economic conditions do not worsen, or at least pick up in 2023, Farfetch could return back to EBITDA positivity and a similar outcome could occur. Interested investors should follow Farfetch’s quarterly profitability for signs of spending picking up.

Final Thoughts:

Farfetch has quite the list of notable investors. This is the clearest evidence of what they have achieved so far, shaking up an industry which in theory does not work online. That said, the coming 24 months will likely be incredibly tough, economic headwinds are very close in an inevitability in our view and China will not be available to bail them out. Looking more long-term, we currently do not see a clear route to profitability and so struggle to see where alpha can be generated.

We thus rate this stock a sell.

Be the first to comment