mppriv/iStock via Getty Images

By Rob Isbitts

Summary

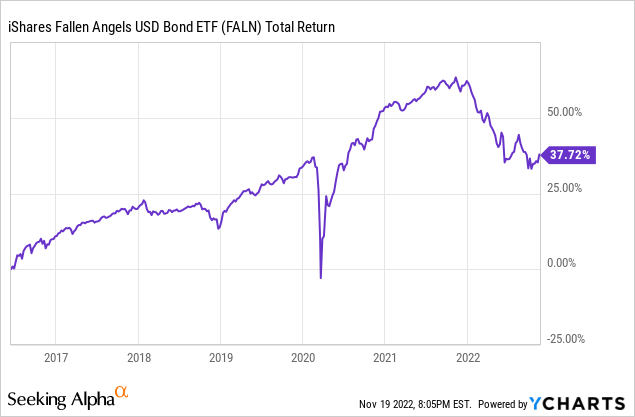

The iShares Fallen Angels USD Bond ETF (NASDAQ:FALN) represents a segment of the bond market that certainly reminds me of the iconic TV commercial known to Baby Boomers and probably many others: “I’ve fallen, and I can’t get up.” At a time when rising interest rates and a questionable corporate environment have combined to wreak havoc on the prices of all bonds, Fallen Angels are particularly vulnerable. Why? Because this is not a time to expect the mighty that have fallen to regain their attractiveness. There is too still too much pushing against them. There will be a point where this niche within the high yield category may be intriguing. For now, however, FALN gets a Sell rating from us.

Strategy

The iShares Fallen Angels USD Bond ETF tracks the Bloomberg US High Yield Fallen Angel 3% Capped Index. It holds corporate bonds that at one time were rated investment grade (BBB or higher) but have since been downgraded to BB or below, a.k.a. “junk” bonds.

Proprietary ETF Grades

-

Offense/Defense: Offense

-

Segment: Bonds/Cash

-

Sub-Segment: High Yield Bonds

-

Correlation (vs. S&P 500): High

-

Expected Volatility (vs. S&P 500): Moderate

Holding Analysis

FALN owns more than 250 different bonds, so it is quite diversified in a market area where being too concentrated can create major headaches. More than half of its holdings mature in 7 years or less, so that adds an element of relative risk-reduction. It is one thing to own junk bonds, but adding longevity risk in the form of bonds maturing in 20-30 years, is something that only applies to about 10% of FALN’s current portfolio. Non-U.S. issuers account for about 18% of the current portfolio’s holdings.

Strengths

87% of this ETF’s assets are invested in BB, the highest junk rating category. So, you might say this is higher-end junk. Furthermore, we are talking about bonds from businesses that in some cases are temporarily suffering. They were downgraded, but FALN’s selection process is angled toward sorting through to try steer clear of downgraded issues that still have proverbial shoes to drop.

Weaknesses

Corporate bonds of nearly every company size, industry and rating are potentially toxic, due to the potential for continued upward pressure on interest rates. This is junk, so we can only sugar-coat the nature of this ETF so much. The Fed supported this market in recent years, buying up bonds of weaker companies to avoid a corporate bond disaster. This market suffers from a lack of liquidity, the likes of which we have not seen in at least 14 years, and perhaps ever.

Opportunities

There will be a turning point for high yield, and when that happens, ETFs like FALN may represent excellent reward/risk tradeoff. But while I’ll look forward to writing about that one day, this is not that day.

Threats

That brings FALN back down to the pack, and placing it under the broader label of “credit bond funds are dangerous for now.” That is reflected in the ETF’s average price of its holdings of just under $90, versus the $100 ultimate maturity value. While at some point, that accretion toward maturity for many bonds in the portfolio could have a beneficial headwind, for now, the bigger issue is that those bonds continue to get marked down. Note that FALN has fallen by as much as 29% from its high in the past.

Proprietary Technical Ratings

-

Short-Term Rating (next 3 months): Sell

-

Long-Term Rating (next 12 months): Sell

Conclusions

ETF Quality Opinion

FALN has yet to get up, and let’s not rush to help it. The bond market is going through a long-awaited reckoning, one I’ve been warning about in my writings for many years. The good news: when the dust finally settles, this one will be worth a look.

ETF Investment Opinion

FALN gets a Sell for now, but it is on my radar for a potential role player when high income funds are being given away. For now, they are just “buy the dip” possibilities that continue to come with plenty of risk. We rate it a Sell.

Be the first to comment