KathrynHatashitaLee/iStock Unreleased via Getty Images

Fairfax Financial Holdings (OTCPK:FRFHF) is a global insurance and reinsurance conglomerate based in Toronto, Canada which currently writes net premiums of more than $21 billion annually. Among Fairfax’s insurance subsidiaries are Allied World, Odyssey Group, Crum & Forster, and Northbridge Financial.

Investors today are valuing Fairfax at 71% of book value adjusted for three transactions which should close by the end of the year. That is absurdly cheap for a property casualty insurer that is consistently underwriting profitably and does not currently hold a long-duration bond portfolio. With a conservative fair value of about $750 (representing roughly 1.2x adjusted book value), investors today are being offered shares at a 40% discount.

Disillusionment

For many years after current management took over in 1985, the company and its CEO Prem Watsa were seen as value investing icons. Between 1985 and 1998, the company’s book value per share compounded at an astonishing 43% per year. Watsa was often heralded as the “Canadian Warren Buffett” and the stock sold for nearly four times its book value in 1998.

I wrote about the company’s challenges following that period in 2018. The first period of poor performance for the company was nearly twenty-five years ago when Fairfax purchased two insurers for less than book value, but whose reserves were badly understated and tough catastrophe years that followed forced a capital raise. Later, Watsa and the Fairfax investment team remained extremely bearish after the financial crisis and hedged away potential gains for several years.

The result has been that the company is often seen as overly complex, esoteric, and its managers as out of touch.

What’s Changed?

People often ask for a catalyst after it is pointed out that a particular company is trading cheaply. What is the catalyst for Fairfax? If the company’s shares are being held back by lingering poor perceptions of management, then it is hard to say precisely when that perception will change. But it can be said that performance is what will change it. The news on that front is good.

After Fairfax’s torrid growth in book value per share of 43% between 1985 and 1998, book value per share grew by only about 9% per year from 1998 through 2018. In the three years since then (2019-2021) book value per share grew at 16% per year. (All figures are adjusted for a dividend in the years when one was paid.)

The company no longer hedges its equity book and eschews the more complicated strategies from its past. Importantly, the company has kept its fixed income portfolio at an incredibly short duration. At the end of the second quarter of this year, about a third of the company’s $35.3 billion in cash, short-term investments, and fixed maturities were either cash or short-term investments and an incredible 91% of the remaining amount matures in three years or less, giving the entire portfolio a duration of 1.2 years. This positioning has immediately increased Fairfax’s investment income, as net interest and dividend income is likely to be roughly $800 million this year compared to $640 million in 2021. Additionally, the limited capital losses suffered from higher interest rates cushions against near-term book value declines and makes the company’s underwriting operations more competitive.

The poor underwriting problems that the company suffered two decades ago have long been fixed. The consolidated combined ratio has averaged 95% over the last decade, a period in which 2017 was the only year that produced an underwriting loss. The company learned its lessons and has acquired much higher quality insurance operations over the last twenty years and developed and hired exceptional managers to run them.

Valuing Fairfax Based on Book Value

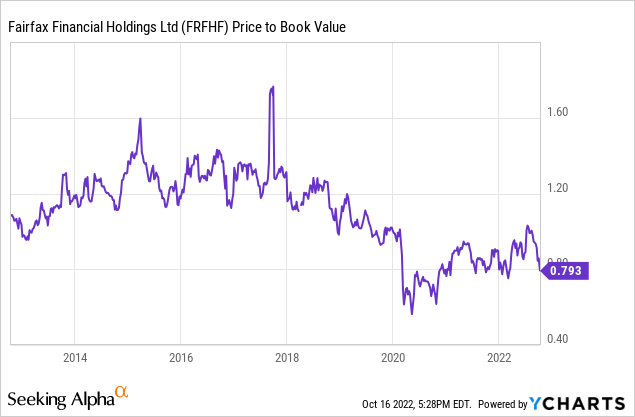

Fairfax has been valued at a discount to book value since 2020’s Covid-induced sell-off. Prior to that time, shares tended to trade for about 1.2x book value and when recent valuations are accounted for, the ten-year average price-to-book ratio declines to about 1.1x.

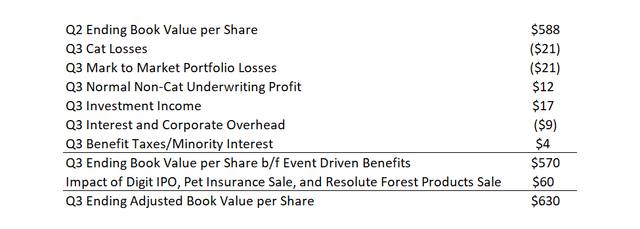

Book value at the end of the second quarter was $588.36 per share. Quite a few adjustments, both positive and negative, need to be accounted for when considering underlying book value today.

The third quarter will include catastrophe losses for Hurricane Ian and some mark-to-market losses from rising interest rates and stock market declines. As a rule of thumb, Fairfax will share in approximately 0.75% of the losses from many global catastrophes. Of course, in some cases the number could be higher and lower in others, but using that rule of thumb and using industry estimates for Ian losses of $65 billion to $75 billion would mean that Fairfax would be on the hook for roughly $500 million to $550 million. A recent Royal Bank of Canada report also estimated Q3 catastrophe losses at $500 million for Fairfax. The same RBC report also pegged Q3 mark-to-market losses at $500 million. Adding in normal underwriting profits, investment income, and other items produce a Q3 ending book value of $570 per share.

Fairfax is also waiting for three additional items to feed into stated book value. Among the most impactful has been the sale of the pet health insurance business, which should close at the end of October. The sale is for $1.4 billion for a business that was bought for $100 million in 2014. The after-tax gain will be $975 million.

Secondly, Resolute Forest Products (RFP) is being sold to Domtar for $2.7 billion. Fairfax’s current stake is 32% and the pre-tax benefit to the company will be $180 million before any value is assigned to contingent value rights that are also a part of the consideration.

Finally, the company is likely to see a benefit (likely in Q4) as Digit goes public, a company that the company holds a 74% interest.

Fairfax said in its Q2 report that those three items are likely to add $1.4 billion, or $60 per share, to book value.

Fairfax Financial Holdings Adjusted Book Value Per Share (Estimated by author based on financial filings and Royal Bank of Canada research)

Those adjustments imply an adjusted book value of $630 per share, although much of the $60 gain will not get booked until Q4. At a fair value of 1.1x to 1.2x book, shares are worth between close to $700 and $750 per share.

Valuing Fairfax Based on Income Potential

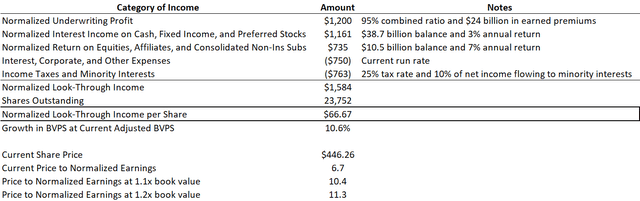

Fairfax tends to be valued on book value and presumptively will still be in the future. However, it is also enlightening to compare fair value estimates with expected normalized income levels, which today are approximately $1.6 billion.

Fairfax Financial Holdings Estimated Normalized Net Income (Author’s estimate)

The assumptions in the above chart are not heroic. They assume Fairfax underwrites at a similar combined ratio as its ten-year average and that investments on cash and fixed income will be no more than 3% pre-tax annually and equity investments will generate 7% returns over the long-term. Those non-heroic assumptions imply that book value growth should tend towards 10.6% per year. This is reasonable growth. Remember, growth averaged 9% per year from 1998 until 2018, before moving up to 16% per year on the back of a strong equity market (although combined with still low interest rates).

Those non-heroic assumptions also imply that Fairfax is currently trading at less than 7x earnings and that fair value estimates using 1.1x to 1.2x book value would put fair value at between 10x and 11x earnings.

Where could Fairfax meaningfully exceed the model? The assumption is that cash and fixed income returns will only be 3% per year. Three-month treasury bills and two-year treasury bonds are presently yielding 3.64% and 4.48% respectively and one could argue that 4% is a much more reasonable estimate of fixed income returns. Leaving them at 3% is a hedge against interest rates moderating from recent highs, but it should be clear that given Fairfax’s portfolio duration, higher interest rates are very good for the company. Should a 4% return on cash and fixed income investments be assumed, forward growth and book value would be above 12% per year and the current price to normalized net income would be less than 6x. Quite a bargain.

The Bear Case

The bear case is likely the reason why shares trade so cheaply, which is the worry that management will once again introduce unnecessary complexity to portfolio management or allow underwriting to deteriorate. Those risks seem unlikely given the history and the lessons learned, but they should be considered.

One comforting fact that can mitigate the above facts is that Fairfax’s management team does not need to be aggressive or overly ambitious. Sustaining current underwriting momentum and earning market rate or near market rate investment returns will allow shareholders to win in a big way.

The bigger risks to monitor are the ones management cannot control. Interest rates falling next year due to a recession would crimp forward income levels. It will be important to monitor how management will be managing the fixed income portfolio for the remainder of the year and it would probably be wise to extend the duration of the portfolio out to two to three years and lock in today’s higher interest rates for at least a modest period of time.

Volatile equity markets present another clear risk for the company, as a 20% decline in equities could take $2 billion off book value.

The Next Era for Fairfax

Fairfax’s valuation is so exceedingly cheap that I think any risks to the company are more than priced into the stock.

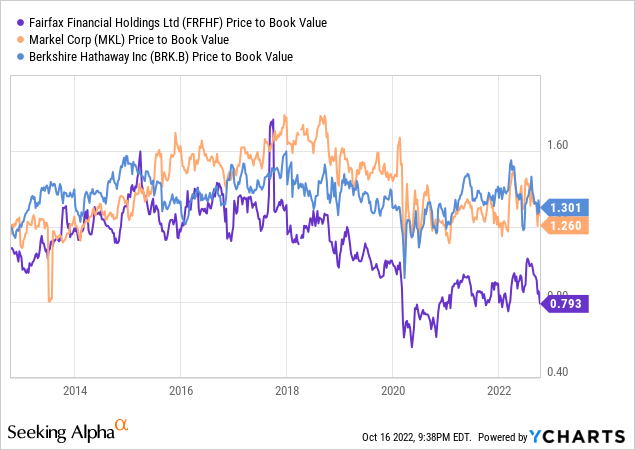

Another piece of context on Fairfax’s current valuation is the above comparison to two companies it is often measured against: Berkshire Hathaway (BRK.B) (BRK.A) and Markel (MKL). Fairfax historically was valued somewhat similarly to these two value investing and insurance giants. Perhaps some discount is warranted, but not at the amazing 40% where it currently stands.

A few points are also noteworthy about that 40% figure. The first is that neither Berkshire or Markel are particularly expensive at the moment at around 1.3x book value. Secondly, while Berkshire does have basically no fixed income portfolio to speak of, Markel does and the company matches insurance liabilities to fixed income duration, which is about three years right now. Thirdly, while the book value considered in the above comparison does not include cat losses (or Q3 mark to market losses for any of the three companies), it also does not include Fairfax’s pipeline of positive developments including the sale of its pet health insurance business.

Whether viewed from the positive business momentum that has been building for many years now, relative valuations to traditional comparisons, or the absolute cheapness of a company that now trades at 6.7x normalized earnings and 71% of adjusted book value, Fairfax shares are a steal for investors willing to look past a company whose reputation was previously tarnished.

Be the first to comment