imaginima

Investment Thesis

Fabrinet (NYSE:FN) is a global optical communication components and services provider headquartered in Grand Cayman, Cayman Islands. In this thesis, I will mainly analyze FN’s Q1 2023 results and its future growth prospects. I will also be examining the company’s valuation at current price levels. I believe FN is an excellent investment opportunity for investors looking for a growth company at a cheap valuation.

About FN

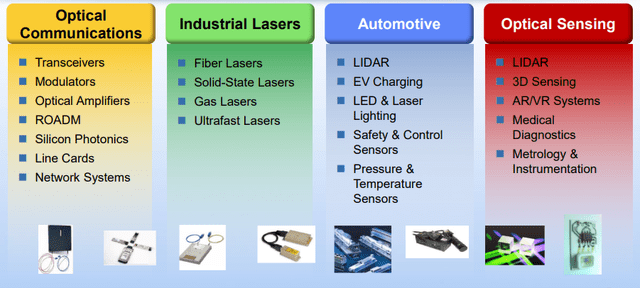

FN is a leading provider of electro-mechanical, electronic manufacturing services and optical packaging solutions to original equipment manufacturers. FN’s business can be segregated into two segments; optical communications and non-optical communications. The optical communications segment accounts for 76% of the total revenue, followed by non-optical communications at 24%. FN has the majority of its operations in North America, Europe, and Asia Pacific. FN has a diversified product and service portfolio, including products designed and manufactured for multiple industries globally. Following is the list of products manufactured by FN.

Q1 FY23 Results

FN recently reported Q1 FY23 results beating the market EPS estimates by a significant 13.5% and revenue estimates by 4%. The company reported impressive quarterly results with improved gross and operating profit margins. One of the biggest positives for the company was improving supply chain management. The supply chain issues in the past affected the company’s ability to manage and deliver on the piled-up orders, but Q1 FY23 saw a comparatively smooth supply chain functioning, especially in the Asia Pacific region.

FN reported total revenue of $655.4 million, up 21% compared to $543.3 million in the same quarter last year. As per my analysis, strong demand coupled with improved supply chain conditions were the main contributor to this increase. The optical communications segment revenue was reported at $497.6 million, up 16.3% compared to $427.3 million in the corresponding quarter last year. I believe the strong demand for telecom products was the primary revenue driver for FN in the optical communication segment. The non-optical communications segment reported revenue at $157.9 million, up a solid 36% compared to $116 million in the same quarter last year. As per my analysis, automotive products were the primary contributor to this increase. The automotive product revenue increased by 80% to $86.8 million y-o-y. The non-optical communication segment proved to be an outperformer for FN in Q1 FY23. The company reported a gross profit of $82.75 million, an increase of 30% compared to $63.6 million in the same quarter last year. The gross margin for the quarter stood at 12.6%, compared to 11.7% in the corresponding quarter last year. The company managed to control its operating expenses, and the operating income increased 44% from $43 million in Q1 FY22 to $62.2 in Q1 FY23. The operating margins improved from 7.9% to 9.5% y-o-y. I believe the company did a good job keeping the operating expenses in control despite the inflationary headwind that it faced in Q1 2023. FN reported diluted EPS of $1.76, up 46.5% compared to $1.20 in the same quarter last year.

One of the most impressive things about FN is that it has only $21 million in long-term borrowings, including the current and non-current portion against the cash and cash equivalent of $225 million. Low debt liability helped FN in keeping the interest expenses in control, especially in the current economic environment with high-interest rates. I believe low debt and high cash reserves will help FN in boosting future growth, and it will help in raising funds in the future to support organic growth.

Overall, the results were quite impressive both in terms of revenue growth and profit margins. I believe FN will continue this growth rate in the coming quarter, given the solid consumer demand and easing supply chain constraints. The company has provided optimistic revenue and EPS estimates for Q2 FY23. The revenue is estimated to be in the range of $640-$660 million, and the diluted EPS is estimated to be in the range of $1.67-$1.74. I believe the company will achieve these targets and even exceed them on the basis of consistently strong demand and FN’s recent partnership with DZS. DZS is a global access networking infrastructure and consumer experience software solutions provider, and this partnership is expected to solve FN’s sourcing, procurement, and fulfillment issues.

Key Risk Factor

High dependency on few customers: FN has a high dependency on a limited number of customers for a large portion of its revenues. The top three customers of FN each contributed 10% or more of the total revenues. The top three customers together accounted for 48% of the total revenues. High dependency on a limited number of customers exposes any organization to a high level of risk. Any volatility in the customer’s business could negatively impact FN’s performance. Also, when a limited number of customers account for a large chunk of the revenue, they have higher leverage in contract negotiations. FN is consistently expanding its customer base, but this risk cannot be ignored, and investors should consider this risk before investing in FN.

Quant Rating and Valuation

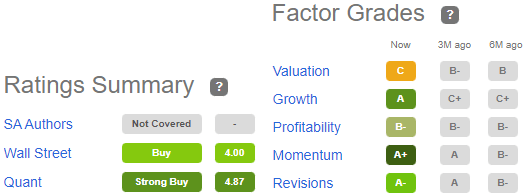

Seeking Alpha

FN has a Quant rating of strong buy, which reflects the company’s growth potential on multiple parameters. FN has a C grade in valuation, which I believe is not a fair representation of the company’s valuation at current price levels, and I think it should witness a significant improvement in the coming quarters. Apart from that, the company has A, A+, and A- grade for growth, momentum, and revision respectively. This reflects that FN is growing at a significant pace and consistently exceeding market expectations. The Wall Street rating of buy reflects that the analysts in the market have an optimistic view towards FN, which further strengthens my thesis.

FN is currently trading at a share price of $133, a YTD increase of 9.5%. The company has a market cap of $4.7 billion. FN is trading a forward Non-GAAP P/E multiple of 17.5x compared to the industry standard of 19.7x. This reflects that the company is undervalued compared to the industry average. However, I believe that PEG ratio analysis is more suitable for the growth companies like FN. The company has a forward non-GAAP PEG ratio of 0.59x against the industry standard of 1.6x with an annual EPS growth rate estimate of 30%. A PEG multiple below 1x is considered good for growth companies, and it reflects that FN is undervalued at current price levels. I believe FN is a great investment opportunity, and the investors can initiate a buy position at current share price levels.

Conclusion

FN is growing at a significant pace and simultaneously experiencing improving profit margins. I believe solid demand and easing supply chain constraints are expected to boost revenues in the coming quarters. The partnership with DZS is expected to solve the company’s sourcing and procurement issues which will further enable smooth business functioning. I believe FN is undervalued at current price levels with a PEG ratio of 0.59x. The company faces the risk of high dependency on a limited customer base, but I think the overall risk-reward profile is quite favorable. Considering all these growth and risk factors, I assign a buy rating for FN.

Be the first to comment