Noam Galai/Getty Images Entertainment

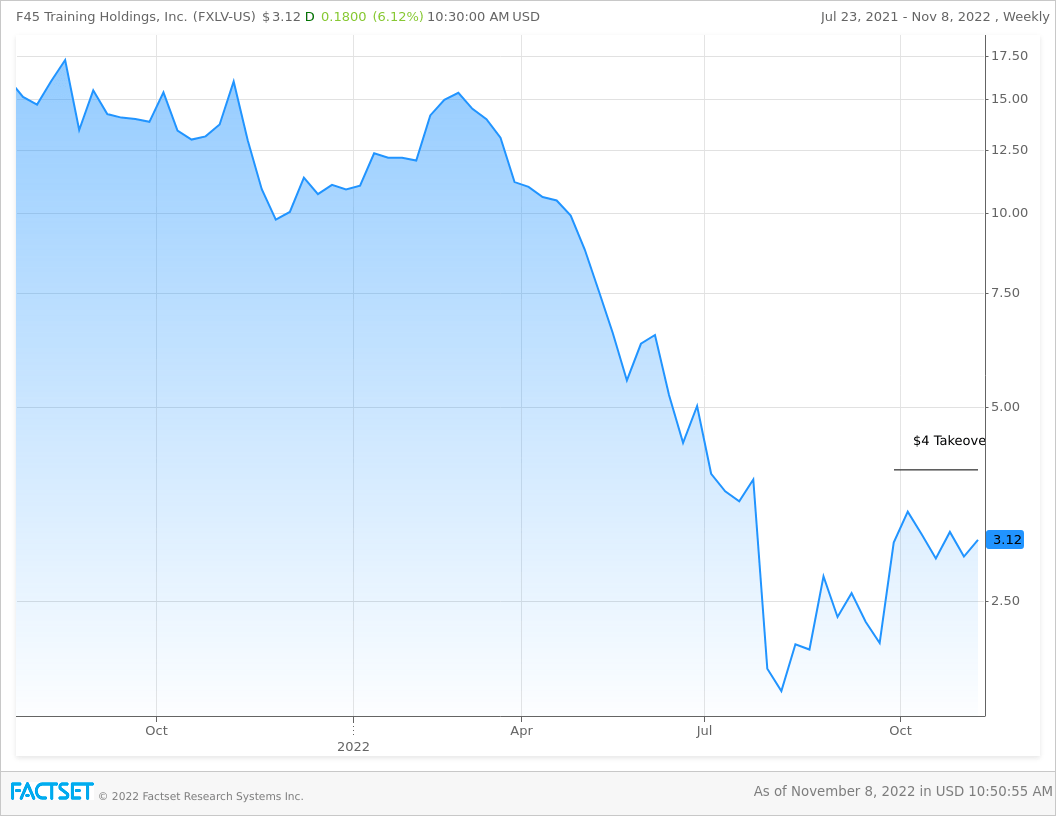

F45 (NYSE:FXLV) is a boutique training center that facilitates growth through a franchise model. The company’s main offering is a 45 minute workout that is run by a trainer in a class-like environment. The company recently received a takeover bid at $4 a share from an activist investor. Given the nature of the business and the significant discount present, I believe that there is a significant possibility that the merger closes at $4.

Company Background

F45 was formed in 2013 in Sydney, Australia with the intention of franchising technologically-based exercises. The company’s main office is located in Austin, Texas. In recent years, boutique training centers have come to dominate the entire fitness industry. This tendency is anticipated to persist.

Adam Gilchrist, the company’s former President and CEO, recently resigned owing to the company’s poor financial performance and diminished future prospects. Since then, Ben Coates has assumed the role of the company’s top executive. As a consequence of the worrying growth in the number of persons growing more obese, health care practitioners and government authorities are emphasizing the necessity for their clients to engage in regular physical exercise.

Alternative market participants and major rivals include full-service health clubs, alternative studio concepts, alternative sports clubs and activities, as well as at-home and digital fitness solutions.

A Content distribution platform, a library of training routines, and a Fitness programming engine are the company’s key services.

The company is entirely committed to functioning as a franchise and utilizing a revenue model based on franchising in order to provide favorable economic conditions for franchisees. In addition, the health and fitness facility market in North America is anticipated to continue growing in the future years.

The company’s leadership believes that its 45-minute exercise program is both effective and enjoyable, making it the company’s main product despite the wide range of services offered. Typically, in order to give the maximum potential benefit to the client, exercises of this sort incorporate features such as high-intensity interval training, circuit training, and functional training. The organization has developed a technologically-enabled infrastructure that allows it to design and deliver exercises to its international franchisee base. The majority of the company’s exercises are disseminated via this studio network. F45 Training Holdings prioritizes technology above traditional gym amenities such as wide floor space and exercise machines. Since opening its first club in 2013, the firm has focused on discovering unique methods to employ technology to provide members and franchisees with a one-of-a-kind experience. Total Franchises refers to both the total number of franchise agreements sold by the firm and the total number of active franchises. Total Studios, on the other hand, is an acronym for the aggregate of all studio openings reported by the firm as of the given date. The organization’s senior executives are certain that by the end of this decade, the firm will have expanded to more than 23,000 studios worldwide, almost all of which will be franchisees.

It is hard to dispute that the majority of current revenue originates from American customers. This segment accounts for 65.8 percent of the corporation’s overall revenue. Australia is the second-largest market for the corporation, contributing 14.6% of its overall sales last year. When analyzing the company’s revenue structure, it is instantly clear that franchise agreements account for around 55 percent of overall revenues. The remaining 45 percent of income is generated through the sale of items and the financing of equipment directly related to these sales.

The Takeover

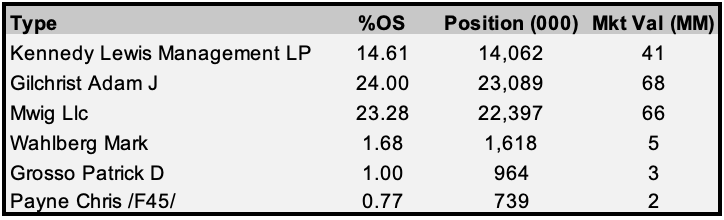

The company received a $4 per share takeover offer from “Kennedy Lewis Management”. I believe this is an intriguing merger opportunity, since there is a substantial 20% upside on the closure of the acquisition. Although nothing has been mentioned by management regarding their acceptance of the conditions of the takeover, I consider this to be a merger strategy that might be advantageous. The takeover offer must be approved by the company’s founder, who still controls a large proportion of outstanding shares. This may be the sole drawback of the bid.

FactSet, Author’s Work

The current price implies that the market values in a significant chance that the bid will lose value or that the purchase would fail. Given the company’s significant losses and lack of future development prospects, as seen by founder Adam Gilchrist’s resignation, I believe that this offer will be accepted, since it represents a significant improvement above the $2.20 share price bottom in 2022.

FactSet

Financial State Of The Company

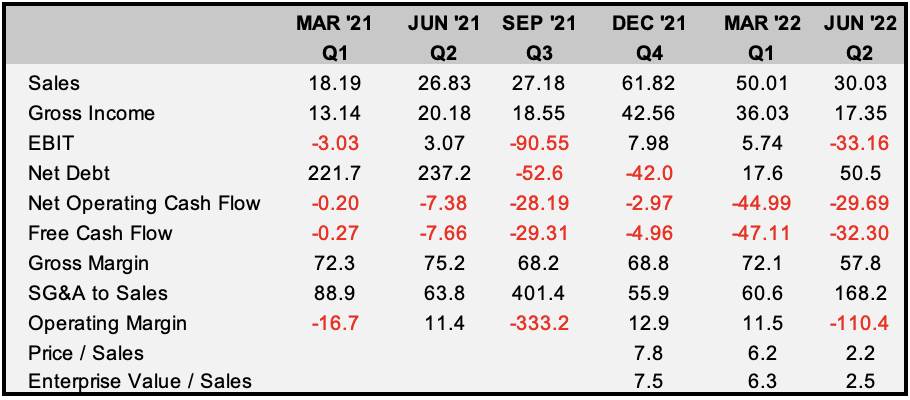

The nature of the firm requires seasonal changes in sales growth; nonetheless, according to management’s predictions, growth prospects do not sustain any demand increases. This may be owing to the nature of the firm’s management, and as a result, the takeover proposal may modify the company’s going concern prospects to allow private management to facilitate growth.

As you are aware, we had negative free cash flow during the first half of the year. The primary reason for the negative free cash flow during this period was due to significant investments in inventories and global headcount to support our previous new initial studio opening strategy, where we connected our best franchisees with readily accessible capital and real estate. Our decision to make these investments was partially due to the $250 million of committed capital from 2 financing facilities we announced earlier this year. However, recent market conditions and share price performance meant that we could not make this facility available to our franchisees.

Ben Coates, CEO

FactSet, Author’s Work

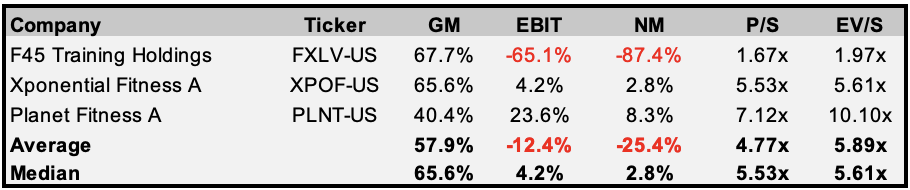

I attribute F45’s difficult position relative to its competitors to the immaturity of its IPO. Even though the company has been handled effectively in Australia since 2013, the inability to employ the same playbook has hampered its development in the United States. Before expanding effectively in the United States, FXLV needed some breathing room on the market. Investors should understand that, despite the company’s low multiples, this is justified by the company’s financial health and future outlook.

FactSet, Author’s Work

Final Thoughts

Despite the fact that management has not provided a definitive verdict on the takeover offer, I believe this is an intriguing merger play. That is owing to the fact this is a very highly accepted product, that is hugely popular and enables the lack of time in many people’s life but is a poorly handled business. As evidenced by the recent takeover, this is a great example of how an activist investor might seek to enter the business and seize control. A $4 per share offer places the P/S ratio at 2.27x, which I believe to be a fair price, despite the fact that there are very few historical examples to compare relative acquisition multiples. This is significantly lower than both the next closest competitor and FXLV’s historical trading range.

The merger arb opportunity must be taken into account that there is significant risk that the takeover bid does not follow through, and in that case I believe you will be holding a company that will not be able to continually grow within the public markets. I view this as a high risk play that holds a significantly smaller position within my portfolio.

Be the first to comment