Chris Hondros/Getty Images News

A few months ago, I wrote a positive article on EZCORP Inc. (NASDAQ:EZPW), highlighting that the company’s countercyclical pawn business should benefit from a weakening economy.

EZCORP’s recent Q4 earnings report confirms my bullish thesis and management’s comments on consumers trading down highlight the tailwinds from a weakening economy. I expect EZPW to continue to perform well in the coming quarters.

Brief Company Overview

First, a brief review of the company for those not familiar. EZCORP is a leading operator of pawn stores in the U.S. and Latin America, with close to 1,200 retail stores.

Pawn loans have very low credit risk, as they are fully collateralized by the pawned item at a fraction of the market value. This is in stark contrast to other forms of consumer lending such as payday loans which have high loss ratios.

Historically, utilization of pawn services tends to be countercyclical, as financially stretched consumers seek out alternative credit solutions like pawn loans during tough economic times.

Strong Q4/F22 Results Confirm Thesis

In the recently reported Q4 earnings, EZCORP recorded $233.9 million in revenues (+21.6% YoY) and $0.15 in adj. EPS. Both figures beat analyst estimates, confirming our bullish thesis.

Importantly, pawn loans outstanding (“PLO”) increased 19% to $210 million, reflecting strong demand for pawn services. The company commented that on a same-store basis, PLO have increased to the highest levels over.

Financial Model Shows Strong Operating Leverage

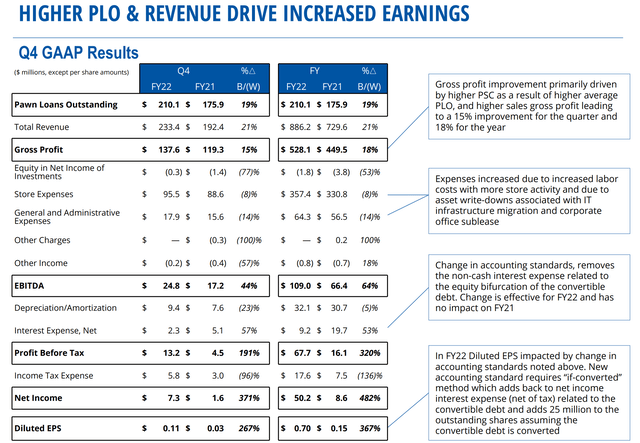

Analyzing EZCORP’s full year financials, we can see the company’s business model has a lot of embedded operating leverage. While total gross profit (pawn service charges plus merchandise gross profit) only recorded an 18% YoY increase, EZCORP’s net income grew 482% YoY to $50.2 million, as operating expenses only grew 8% (Figure 1)

Figure 1 – EZPW has a lot of operational leverage (EZPW investor presentation)

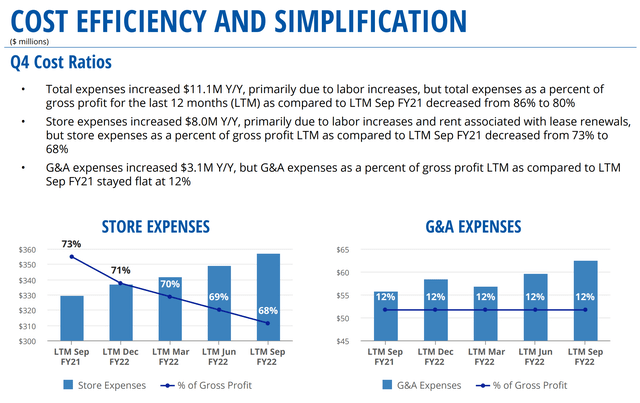

In fact, as a percent of gross profits, store expenses improved 5% YoY from 73% to 68% (Figure 2). This reflects management’s focus on cost efficiencies as well as the operating leverage from running a large number of physical stores.

Figure 2 – EZPW benefited from cost efficiencies (EZPW investor presentation)

Consumers Trading Down Due To Macroeconomic Factors

An interesting tidbit from EZCORP’s earnings call was the following exchange: (Author highlighted important passages)

John Hecht

Okay. And then there’s — we’ve seen some of the bigger retailers domestically announced that they’ve seen customers changing their kind of purchasing behavior, you talked about bargain shopping driving some of your results. I mean, any comments there, are you seeing changes in either the borrower or the retailer behavior, the customers’ behavior at this point either for macro trends or certain things you’re doing from an execution perspective.

Lachlan Given

Look, we’re seeing the same — all of the same commentary from the big retailers that they’re really seeing a shift in demand from their customers. Our sales continue to be quite robust. It’s — I think more people are coming to buy secondhand because it’s tough out there and our margins holding up really nicely. So while we’re seeing the big box retailers every week announcing downgrades and difficult conditions. We’re just seeing particularly down Latin America as well, we’re seeing really robust sales and maintaining our margins in that target rate.

So I think what’s happening is people are buying second-hand and looking for a bargain and there are also particularly young people becoming really environmentally conscious. And so buying second-hand is not only value for money, they actually think it’s cool because you are doing what’s good for the environment. So we’re quite pleased with what we’re seeing from a sales perspective.

– Q4/2022 earnings call exchange between CEO Lachlan Given and Jefferies analyst John Hecht

Just as we’ve heard from Walmart’s earnings call that wealthy consumers are trading down to shop at Walmart, and increasingly some consumers are resorting to five-finger discounts at many retailers, EZCORP is also seeing increasing incidences of consumers trading down to secondhand goods.

While this is a good tailwind for EZCORP, it does give a sobering take on the precarious state of the U.S. consumer.

Is A Recession Imminent?

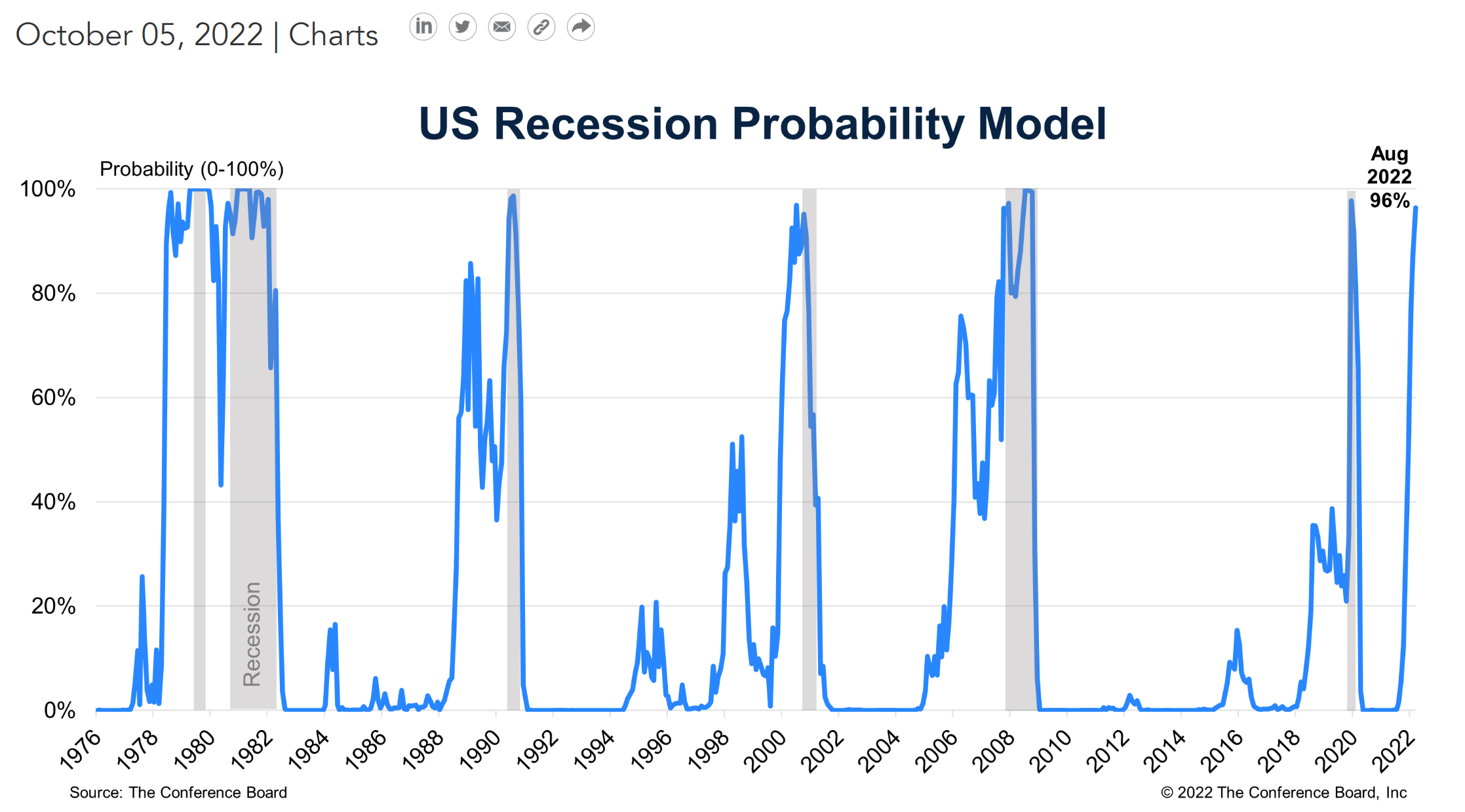

Since my last article, there have been a slew of economic data and projections suggesting a recession is imminent in the next few quarters. For example, a recent S&P Global Flash U.S. Composite PMI report of 46.3 was “consistent with the economy contracting at an annualized rate of 1%” and the ISM Manufacturing index also recently recorded its first contraction since May 2020. In October, the Conference Board predicted a 96% probability of a U.S. recession within the next twelve months (Figure 3). Historically, when the probability gets this high, a recession shortly followed.

Figure 3 – U.S. recession probability (Conference Board)

Technical Breakout

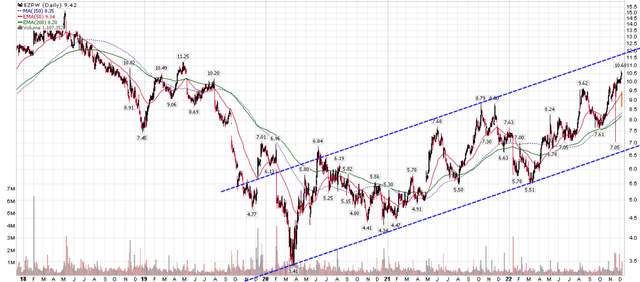

Technically, EZPW’s chart continues to show strong momentum within a well-defined uptrend (Figure 4). The stock reaction on December 7th (explained below) is likely technical and not reflective of a change in the business fundamentals.

Figure 4 – EZPW still in uptrend (Author created with price chart from stockcharts.com)

Valuation Remains Reasonable

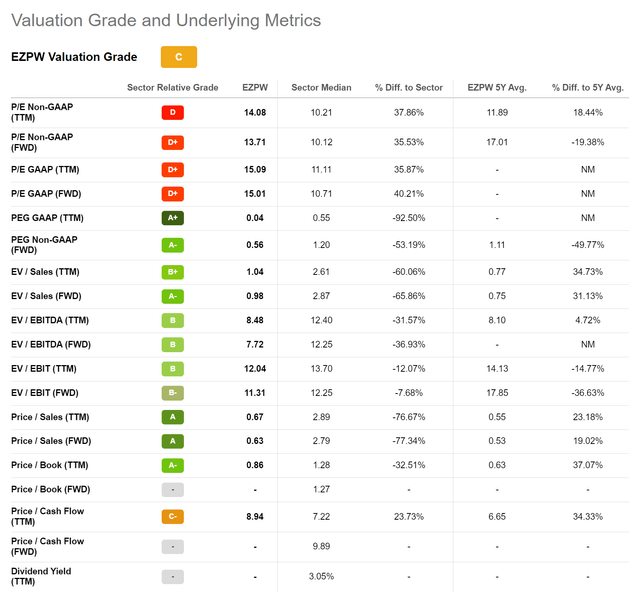

Even though EZPW’s stock has rallied 20% since my initial article, the company’s valuation is still reasonable at 13.7x Fwd P/E (vs. 11.9x previously) as analysts have increased their estimates (Figure 5).

Figure 5 – EZPW valuation (Seeking Alpha)

With a continuing tailwind from a weak economy, EZPW’s revenue and earnings should continue to grow in the coming quarters, supporting further positive revisions.

Convertible Bond Issuance Could Be Nice Entry

On December 7, 2022, the company issued $175 million in senior convertible notes, causing the stock to drop more than 10% intraday. I believe this could be a nice entry point for investors on the sidelines.

Convertible bonds are bonds that can be converted into equity at some future point in time at a stated conversion ratio. When institutional investors like hedge funds buy convertible bonds, they often ‘short’ the common equity of the issuer in the amount of the conversion ratio. This allows them to be market neutral while earning a high yield. Investopedia explains the strategy as:

The rationale for the convertible hedge strategy is as follows: if the stock trades flat or if little has changed, the investor receives interest from the convertible. If the stock falls, the short position gains while the bond will likely fall, but the investor still receives interest from the bond. If the stock rises, the bond gains, the short stock position loses, but the investor still receives the bond interest.

The stock reaction on December 7th likely reflects the convertible bond investors putting on the hedge, and should not be viewed as reflective of the underlying business fundamentals. In fact, EZCORP likely issued the convertible bond in anticipation of making more pawn loans in the next few quarters.

Conclusion

EZCORP’s stellar Q4 earnings report confirmed my bullish thesis on the company. As the U.S. economy likely heads into recession in 2023, I expect EZCORP’s pawn business to continue to benefit.

Be the first to comment