JHVEPhoto

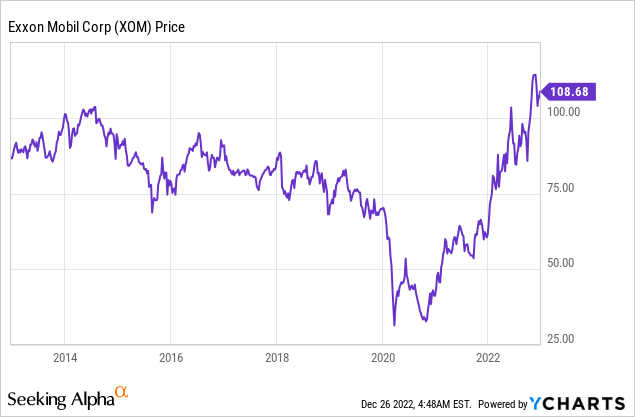

Exxon Mobil Corporation (NYSE:XOM) shares have seen renewed upward momentum in recent days after the appearance of a severe winter storm in the U.S. and Canada has increased supply fears in energy markets. Additionally, Exxon Mobil recently presented its capital plan for FY 2023, which included an aggressive increase in its share buybacks due to record free cash flow. Considering that at least some of Exxon Mobil’s share repurchases come a time of record profitability, cyclically high petroleum/natural gas prices and very high stock prices, I believe shareholders would get more value if Exxon Mobil raised its dividend instead!

Winter storm is propping up prices (temporarily)

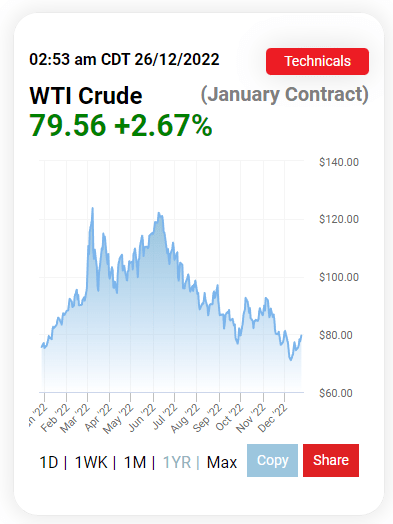

Petroleum prices have soared higher lately, largely because of a major winter storm that has begun to cause major damage in the U.S. and Canada. Severe weather events are typically good news for producers that get to sell their product for a higher price in the market. The price for WTI crude soared back to $80 a barrel yesterday, after dropping toward $70 a barrel earlier this month.

Source: Oilprice.com

The surge in petroleum and natural gas pricing in 2022, which has largely been related to Russia’s invasion of Ukraine, has led to record profits and free cash flow for Exxon Mobil.

Exxon Mobil’s free cash flow soared to $22.0B in Q3’22, showing an increase of 144% over the year-earlier period when the market didn’t price in major sanctions on the Russian energy sector as well as the disruption of natural gas supplies to Europe. For the fourth-quarter, Exxon Mobil is set to report strong free cash flow (“FCF”) as well (but likely not as strong as it was in Q3’22 due to lower average realized prices). I believe that the company could generate free cash flow of $16-18B in Q4’22.

Clearly, Exxon Mobil’s free cash flow is cyclically inflated right now, and I estimate that the firm will see much weaker FCF in FY 2023, especially if a recession hits the global economy.

|

FY 2022 |

FY 2021 |

||||

|

$B |

Quarter 3 |

Quarter 2 |

Quarter 1 |

Quarter 4 |

Quarter 3 |

|

Cash Flow from Operating Activities |

$24.4 |

$20.0 |

$14.8 |

$17.1 |

$12.1 |

|

Proceeds from Asset Sales |

$2.7 |

$0.9 |

$0.3 |

$2.6 |

$0.0 |

|

Cash Flow from Operations and Asset Sales |

$27.1 |

$20.9 |

$15.1 |

$19.7 |

$12.1 |

|

PP&E Adds / Investments & Advances |

($5.1) |

($4.0) |

($4.3) |

($4.6) |

($3.1) |

|

Free Cash Flow |

$22.0 |

$16.9 |

$10.8 |

$15.1 |

$9.0 |

(Source: Author)

New $50B stock buyback represents significant up-size

Earlier this month, Exxon Mobil announced a major increase in its stock buyback plan. According to the firm’s capital plan, Exxon Mobil plans to spend $50B over a three-year period on stock buybacks in order to distribute abnormally high free cash flow from the surge in petroleum and natural gas prices to investors. Exxon Mobil previously had a $30B stock buyback in place that was expected to be completed next year. The $50B stock buyback will last through FY 2024 and includes the $15B that Exxon Mobil is expected to spend on buybacks in 2022.

Given that the buybacks fall into a period of excess earnings and free cash flow, I believe investors would get a far better deal if Exxon Mobil raised its dividend payout instead. The $35B of shares expected to be bought back in FY 2023, and FY 2024 represent 8% of the firm’s current market cap.

Exxon Mobil’s valuation

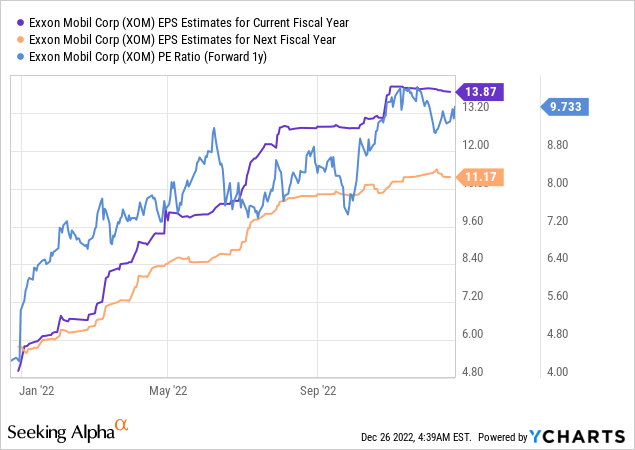

I made a good profit on Exxon Mobil in 2022, but given that the firm’s shares are trading at record prices, I sold my shares and moved some of my returned capital into midstream firms (like this one) which I believe offer investors better valuations, dividend prospects and risk profiles. Exxon Mobil’s shares currently trade at a P/E ratio of 9.7 X… which may look cheaper than it really is. Earnings estimates imply a big (20%) drop-off in earnings in FY 2023, indicating that the market believes that Exxon Mobil’s earnings (and free cash flow) have peaked. With earnings estimates decreasing, Exxon Mobil could see a much higher P/E ratio in FY 2023.

Risks with Exxon Mobil

Exxon Mobil’s free cash flow is at risk of a major cyclical adjustment in FY 2023, unless energy prices continue to remain way above the long term average… which I consider unlikely because economic risks are growing. The winter storm affecting the U.S. and Canada is doing its part in keeping petroleum prices high for now, but once the winter ends, Exxon Mobil is likely set to see lower free cash flow and earnings.

Final thoughts

I believe the $50B stock buyback plan that Exxon Mobil recently presented is wrong because Exxon Mobil’s shares are trading at 10-year highs and petroleum prices remain well above the longer term average. This means that at least some of the share repurchases are going to be executed at Exxon Mobil’s cyclically inflated prices, which, of course, implies that share buybacks don’t have as much value for shareholders as if they were executed at the bottom of the cycle. I would have liked to see Exxon Mobil make a stronger commitment to its dividend to distribute its free cash flow rather than buying back shares at record prices!

Be the first to comment