peshkov/iStock via Getty Images

(Note: This article was released to the newsletter on June 15, 2022.)

There is a whole lot of talk about the chart of Exxon Mobil (NYSE:XOM) not looking very good. For traders, that can certainly set up a potential short-term lucrative trade. But traders also have a mechanism to get out should a trade not work with a small loss. They make money by letting the winners run while limiting the losses. But that action often moves pretty fast. If you are a buy-and-hold investor, oftentimes, an unfavorable chart is the time to look at the fundamentals while allowing the selling caused by charts to run its course.

It is very well known that Mr. Market often goes to extremes. A bad chart combined with other ancillary news can build up a lot of selling pressure that takes the stock way past any reasonable fundamental value to a bargain price. Oftentimes, it is worth waiting for the selling pressure to abate because there is usually a period where the market “leaves the stock because it is dead”. Most great investors would tell you that you do not have to time things perfectly. All you have to do is get in at a bargain price and then hang on to the stock until the story changes.

Blast From The Past

History is loaded with examples of past excesses due to chart reading. Oftentimes that meant that the chart readers did make a profit. It also meant that they missed out on the beginning of a great rally that the buy-and-hold crowd was able to take advantage of.

Many times, the chart readers trade in and out all the way up unless there is that rare chart that has them staying in for a long, upward run. The buy-and-hold investor (in contrast) is far more likely to hang on through any volatility until that story that caused the upward stock price move changes.

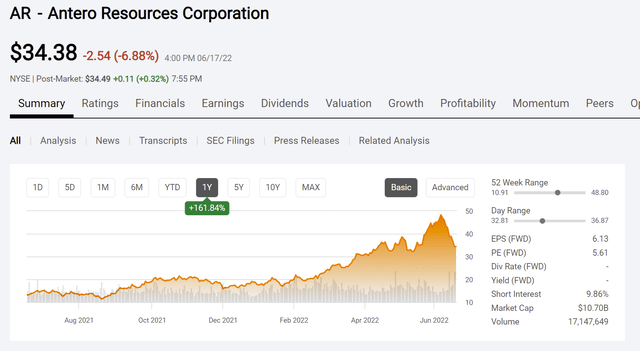

Antero Resources Common Stock Price History And Key Valuation Measures (Seeking Alpha Website June 20, 2022)

The extended natural gas pricing downturn combined with a warm winter or two towards the end of that cyclical downturn led to an absolute party for the bears. The Antero Resources (AR) downward spiral seemed to never end for quite a few years. Articles abounded about how the company would go broke. There was little to any mention of a future cyclical turnaround.

Ironically, even though the debt was at times on a watch for a downgrade, that downgrade never came. Instead, along came a freeze to get cash flow to a level not seen in years followed by an unexpectedly strong recovery that seems to happen in cyclical industries a fair amount of time. The result shown above was a big change in the chart from bearish to a far more favorable pattern. The financial upgrades have now continued to the present despite market worries a few years back.

What happened was the traders probably made a fair amount of profits and now the long-term holders are cashing in on their strategy. It is the old story of sometimes the bulls win and sometimes the bears win. But the pigs never win on Wall Street.

Exxon Mobil

So exactly what is happening now with Exxon Mobil common stock?

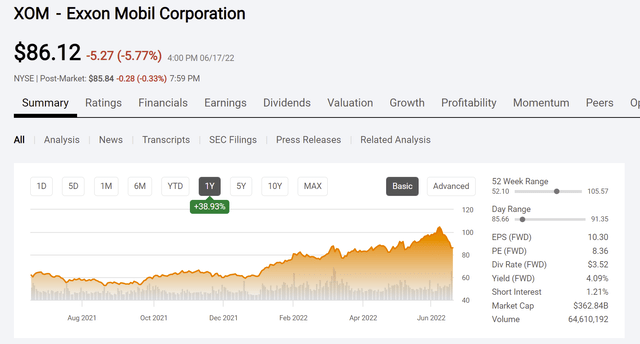

Exxon Mobil Common Stock Price History And Key Valuation Measures (Seeking Alpha Website June 20, 2022.)

Any investor looking at the Exxon Mobil common stock price chart knows that this stock has really not broken out of a range for a very long time (in fact, far longer than the time period shown above). Therefore, trades based upon chart reading, have been succeeding for quite some time. Traders could buy at the low end and sell at the high end. They may even succeed a while longer.

However, in the decades that I have followed this company, Exxon Mobil is a notoriously countercyclical company when it comes to strategies. All one has to do is go back to all the articles in the news and this website during the 2020 pandemic to see how many were critical of the additional debt and the capital budget during that time period to realize that this management has been busy beginning a new growth phase for some time.

The actual strategy change came a few years before that. It probably happened around the time of the change in CEOs. But a company the size of Exxon Mobil will not show a strategy change for several years because the large size of the company means those changes take a while to become significant to quarterly reports.

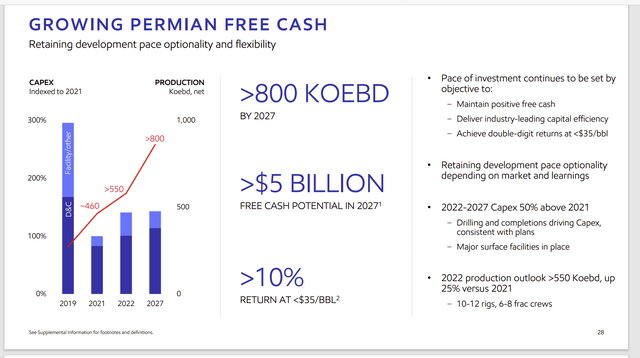

Exxon Mobil Permian Strategy And Financial Performance Guidance (Exxon Mobil Fiscal Year 2022 Investor Day Presentation)

For some years, Exxon Mobil has been investing in the Permian. There will be major production growth complete with adequate takeaway capacity because this management planned ahead. The production already online has the advantage of being sold for some fantastic prices in the current industry environment. Management likely grew that production in past years just for that reason as well as to take advantage of some very low costs. The very low breakeven cost of this project will likely make it very profitable even during industry downturns.

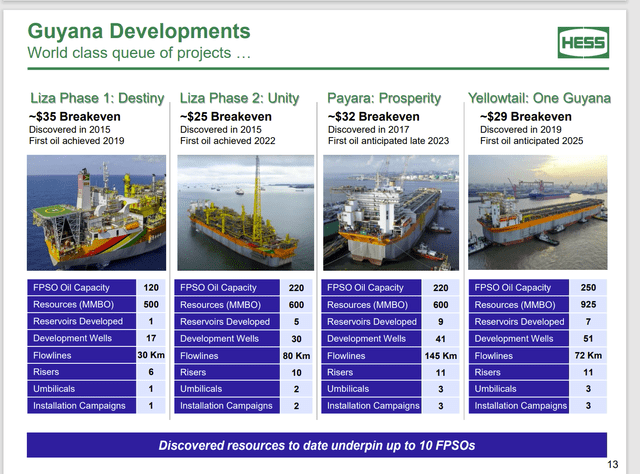

Hess Corporation Guidance Of FPSO Startups For Guyana Project (Hess Corporation May 2022, Corporate Presentation)

Probably the major project that will change the future Exxon Mobil chart is shown above. Hess (HES) is the partner that usually presents the project details because it is far more significant to Hess than it is to Exxon Mobil (and it is likely to remain that way as Hess is the smallest partner of the partnership).

The third FPSO is very likely to begin production in 2023 which is considerably ahead of the original guidance. The market expects one FPSO per year. But the pace of discoveries in this project probably indicates a move toward 2 FPSOs a year in the not-to-distant future now that cash flow from this giant project is rapidly building. The discovered resources are significant even to a company like Exxon Mobil. The “cashing-in” of those reserves is far less risky than discovering them in the first place. Therefore, the cash flow build from increasing production will likely affect the stock price of even a large company like Exxon Mobil at some point.

More to the point, even if there were no more discoveries starting tomorrow (which is very unlikely), the progress made so far ensures growth through the end of the decade at least. That is one very large project.

An FPSO that produces 200 thousand BOD is worth $20 million when they sell the oil for $100 a barrel. That amounts to revenue of nearly $2 billion every quarter. That kind of revenue (partner’s share) will be significant even to Exxon Mobil and it will be growing by that $2 billion every time another FPSO begins production. If everything goes as planned, this project alone could be as much as one-third to one-half of total company production by the end of the decade.

The nice thing is that even if oil prices drop substantially in the future, the continuing arrival of more FPSOs ensures a revenue build that will still make this project significant for Exxon Mobil in the future.

Exxon Mobil also completed an offer for Interoil to add a very large natural gas field to its plant in Papua, New Guinea. That sizable project has not gotten a lot of attention as natural gas prices have continued to slide. That may change now that natural gas prices have climbed considerably.

The Future

The main point of this discussion is that different investing types “have their day in the sun”. What is now coming though, is a time for long-term buy-and-hold investors to consider an investment in Exxon Mobil as the company embarks once again on its periodic growth spurts.

The capital budgets from prior years, particularly fiscal year 2020, have provided a considerable cost advantage that will prove to be a competitive moat. The first two FPSOs, for example, were purchased and put online during a time of particularly offshore depressed prices. Those two are likely to pay back in record time. That is highly unusual for a big project like Guyana. But that fast payback will enable those two FPSOs to be unusually profitable for a long time to come. Saving years of interest costs by increasing the upfront cash flow (because the beginning of production was timed to catch high prices) is a huge plus.

Exxon Mobil now has significant growth projects that will change the history of the last decade going forward. Management is not done growing yet as there are still more possible offshore and onshore growth projects in different stages of evaluation and implementation.

Traders are often satisfied with a set short-term profit. Long-term buy-and-hold strategies usually will not sell until the growth story changes. In this case, the growth story is in place until at least the end of the decade and maybe longer. That should lead to a higher stock price as the decade unfolds no matter the short-term chart picture.

Be the first to comment