jetcityimage

What happened?

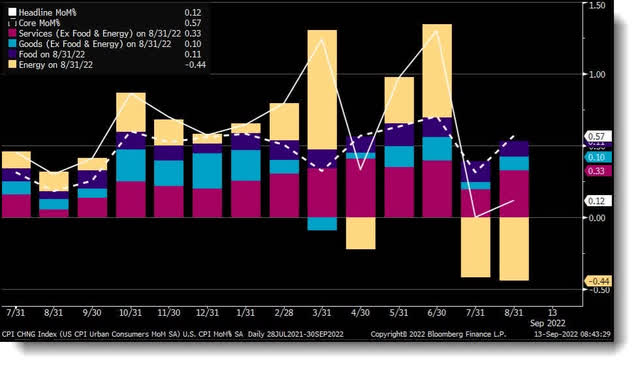

CPI came in above expectations on all fronts headline, core, year-over-year, and month over month.

CPI Breakout Chart

The headline number year-over-year came in at 8.3% versus 8.0% expected. Despite energy down big, Core CPI still came in hot at 6.3% versus 6.0% expected. The big miss was month-over-month coming in at +0.1% instead of -0.1% expected. This caused the treasury rate curve inversion to deepen.

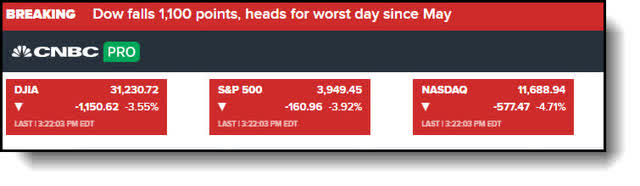

Furthermore, all three indices are getting pummeled beyond belief at the time of this writing.

Even so, Exxon Mobil Corporation’s (NYSE:NYSE:XOM) stock is holding up quite well on a relative basis.

Exxon Mobil Current Chart

The stock is only down slightly today at 1.3% while the overall markets are down substantially more. What’s more, this has been the case for the balance of the year.

Exxon Mobil versus S&P 500 Year-to-date

Year-to-date, Exxon Mobil’s stock is up 58% while the S&P 500 (SPY) is down 17%. This massive outperformance speaks to Exxon Mobil’s amazingly strong relative strength versus the market overall. This begs the question… Why? Why is Exxon Mobil’s stock price so resilient in the face of an inflationary environment coupled with a looming recession? Let me lay out the crude realties for your perusal.

The Crude Reality explained

Why is Exxon Mobil’s stock holding up so well in the face of the massive market selloff? I’ll tell you why – because it makes for the best possible inflation hedge available at present, a remarkable recession safe haven play. The stock is trading at a historic and relative low valuation, it is a cash flow machine, the company just reported a historically profitable quarter, it gave extremely positive guidance, and the Biden administration just announced it is considering buying oil to refill the Strategic Petroleum Reserve (“SPR”) per Bloomberg. In the following sections I lay out the bull case as to why Exxon Mobil’s stock makes for an excellent inflation hedge and recession safe haven play.

Let’s start by reviewing last quarter’s highlights and guidance.

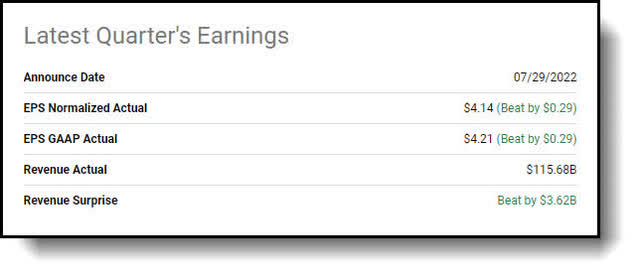

Exxon Mobil Q2 Earnings Highlights

Exxon Mobil recently reported its second quarter earnings results, and, frankly, knocked the ball out of the park. Exxon Mobil beat on EPS by $0.29 cents, coming in at $4.14, and beat on revenues by $3.62 billion. Exxon Mobil Corporation announced estimated second-quarter 2022 earnings of $17.9 billion, or $4.21 per share assuming dilution. Second-quarter results included a favorable identified item of nearly $300 million associated with the sale of the Barnett Shale Upstream assets. Capital and exploration expenditures were $4.6 billion in the second quarter and $9.5 billion for the first half of 2022.

Chairman and Chief Executive Officer Darren Woods stated:

“Earnings and cash flow benefited from increased production, higher realizations, and tight cost control. Strong second-quarter results reflect our focus on the fundamentals and the investments we put in motion several years ago and sustained through the depths of the pandemic.”

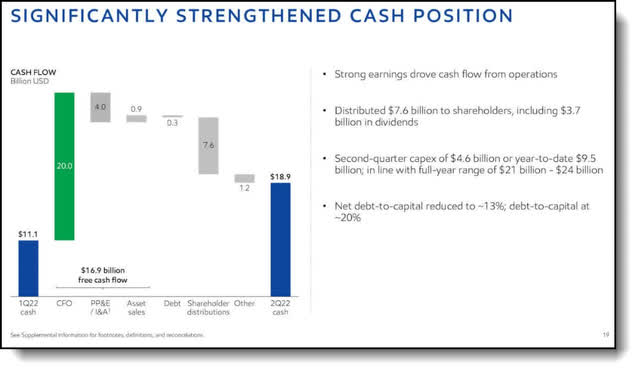

The Texas oil titan is a cash flow machine

Strong earnings drove increased cash flows from operations. Exxon Mobil returned $7.6 billion to shareholders, of which about half was in the form of dividends and the remainder in share repurchases, consistent with the oil giant’s previous program. Exxon Mobil stated during its Corporate Plan Update in December that the company expects to repurchase $10 billion shares. Just recently, Exxon actually announced a huge increase to the share buyback program, upping it to $30 billion shares in total through 2023. This move confirms the confidence Exxon Mobil has in the strength of its balance sheet and future prospects for profits.

Second quarter capex of $4.6 billion was in line with the full-year range of $21 billion. The fact of the matter is that this quarter’s results are important, but it will be the guidance given going forward that will should augur the stock price one way or the other. Let’s delve into what lies ahead at this time, shall we?

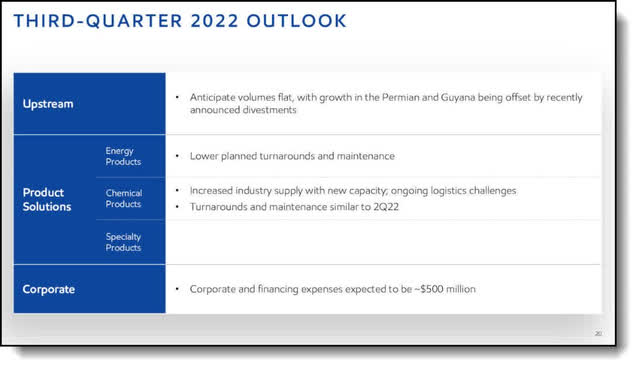

Positive Guidance based on production growth

As Chairman-CEO Woods said:

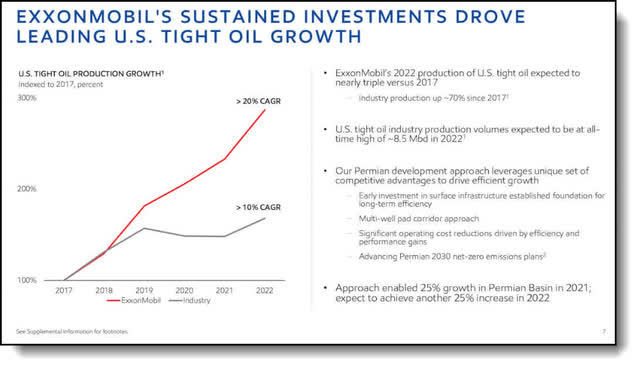

For the full year, in the Permian, we expect to achieve 25% production growth for the second consecutive year. In Guyana, our total capacity is now more than 340,000 oil-equivalent barrels per day.

The sizable investments Exxon’s been making over the past several years puts the company in a great position to deliver increased production at a time when the world needs it most. The Texas oil titan is continuing to increase production of low-cost barrels in Guyana and the Permian all while maximizing output of currently existing facilities as well. Exxon’s new Corpus Christi complex was cash and earnings positive in the first half of the year.

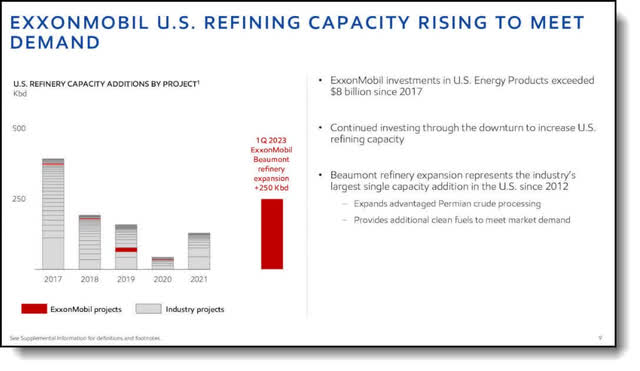

According to the company, the U.S. Gulf Coast refining capacity is poised to increase by about 250,000 barrels per day with the start-up of the Beaumont refinery expansion project in the first quarter of 2023. Two new LNG projects are also advancing. Coral LNG and Mozambique is set to deliver its first cargo in the second half of this year. The Golden Pass LNG project, which will provide 18 million tons per year of new LNG supplies, remains on schedule to start up in 2024. Once completed, Golden Pass will increase LNG from the Gulf Coast by 20%.

In addition, Exxon continues to divest nonstrategic assets at an opportune point in the cycle. It has delivered strong safety and reliability while controlling costs. These moves are improving the asset mix by lowering break-evens and boosting resiliency. The Low Carbon Solutions business continues to grow its portfolio of opportunities with four newly announced carbon capture and storage opportunities in Australia, China, Indonesia and the Netherlands. As you can see, the company is well-positioned for the coming years.

Now let’s take a closer look at the current market backdrop to see what they will be facing.

Tight supply/demand is expected to persist

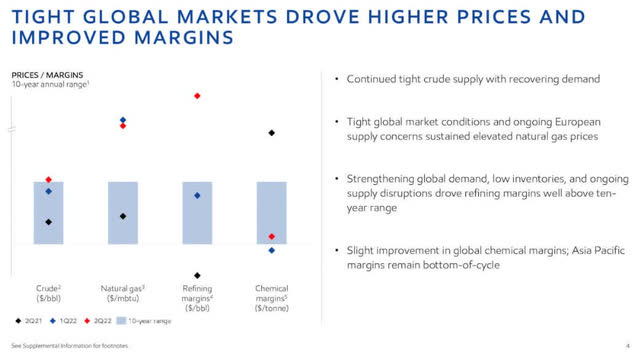

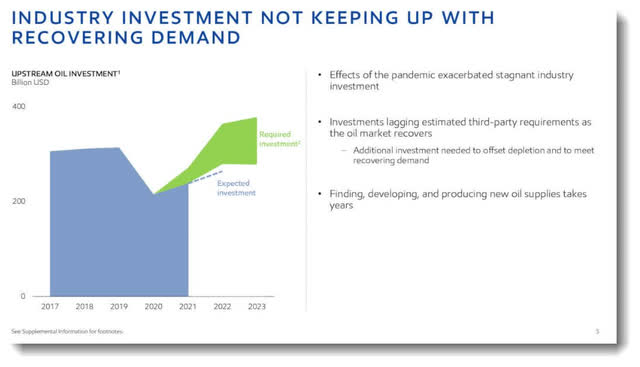

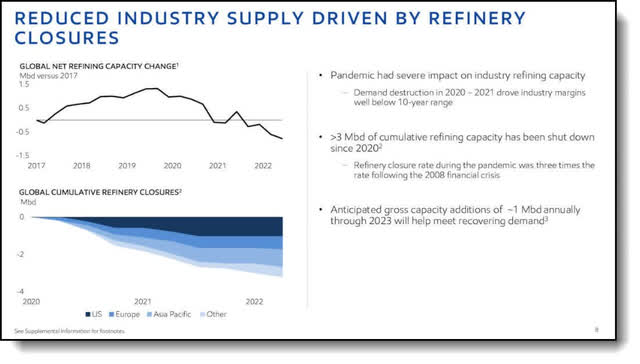

A tight supply/demand environment has developed primarily due to low investment levels during the pandemic. The low supply, coupled with a substantial increase in demand as the pandemic faded, contributed greatly to the rapid increases in prices for crude, natural gas, and refined products.

Brent crude price rose by about $22 per barrel, or 27%, versus the fourth quarter of 2021. Today, natural gas prices remain well above the 10-year historical ranges, driven by tight global market conditions and ongoing European supply concerns. Moreover, tight supplies to manufacturers have pushed refining margins to the top of the range.

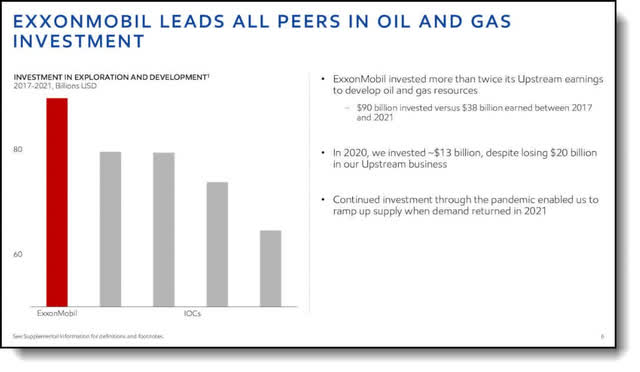

Large annual investments in oil and gas production are required to offset normal depletion, but even more is required to grow net production. Prior to the pandemic, industry investments were below historical levels.

The economy-wide shutdowns during the pandemic exacerbated the problem. The industry is currently experiencing tight markets across most types of distillates as supply lags demand recovery.

Given the long investment cycle times, growing supply will not happen overnight. Exxon Mobil has actually been leading the way when it comes to increased production due to the fact they have continued to invest throughout the cycle. CEO Woods stated:

At Exxon Mobil, throughout this period, we stayed focused on the fundamentals and led our IOC peers in oil and gas investment. We leaned in when others leaned out, including investments in U.S. refining capacity, notably with our Beaumont refinery expansion.”

Exxon Mobil’s refining advantage

What’s more, there is a clear tightness in refining. The closure rate during the pandemic was three times the rate of the 2008 financial crisis.

XOM has the largest refining footprint of all the Big Oil companies at a time of rising margins and increasing demand for gasoline and diesel.

Thus, the benefits of a continuing tight supply/demand environment bode extremely well for Exxon Mobil’s refining business. Exxon Mobil is a cornerstone holding in my sleep well at night (“SWAN”) retirement income portfolio. Therefore, let’s now review the state of affairs as it relates to the dividend safety and growth prospects.

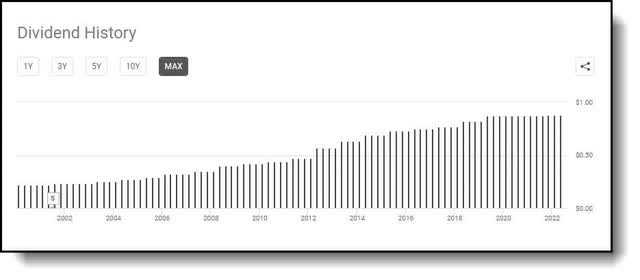

Dividend review

Exxon Mobil is a dividend aristocrat with 40 years of consecutive dividend payments.

As a former Texas oil man myself, I have a certain affinity for the Texas oil titan. I can say without doubt the company is dedicated to paying the dividend come hell or high water.

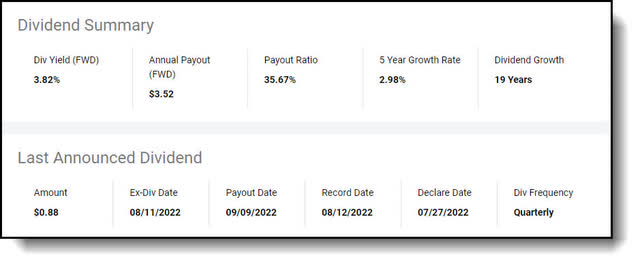

Dividend summary

In fact, it has been overtly expressed by management that the company’s top priority at this time is return of capital to shareholders as well as long-term capital investments in production to keep the cash flowing in for years to come. The following slide details analyst dividend growth estimates for the coming two years.

Consensus Dividend Estimates

What’s more, the company is vastly undervalued at present. Let me explain.

Stock fundamentally undervalued

Finviz

Exxon Mobil is extremely unvalued at the present valuation. Exxon’s forward P/E of 9.03 is approximately half of the current S&P 500 forward P/E of 18. The stock, incredibly, is trading for a PEG ratio of 0.43; anything less than 1 is considered to be vastly undervalued. Finally, the Texas oil titan is a free cash flow machine, with $20 billion in cash flow from operations last quarter. It is currently trading for approximately 11.66 times free cash flow, where anything less than 15 times is considered cheap.

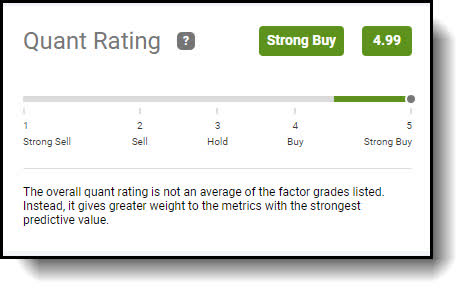

Moreover, Seeking Alpha’s Quant analysis rates Exxon Mobil as a Strong Buy with A scores for growth and profitability.

Seeking Alpha Strong Buy Quant rating

Seeking Alpha’s Quant Ratings are an objective, unemotional evaluation of each stock based on data, such as the company’s financial statements, the stock’s price performance, and analysts’ estimates of the company’s future revenue and earnings.

According to Seeking Alpha’s objective quantitative evaluation of the data, Exxon Mobil is a STRONG BUY. The strong buy rating is based on positive valuation, growth, profitability, momentum, and revisions data.

Seeking Alpha

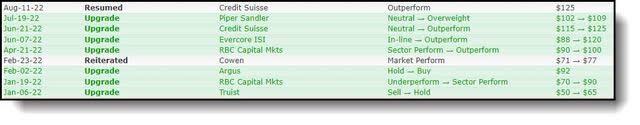

I am a data-driven investor at heart, with a little intuition sprinkled in, along with a love for the Texas oil titan’s pledge to return as much capital as possible to shareholders Moreover, I am not alone. The stock has received numerous upgrades the entire year of 2022.

2022 Analyst upgrades

These are not cherrypicked either, just FYI. Every analyst this year has either upgraded the stock or reiterated their buy or outperform rating while upping their price targets. The most recent upgrade was by Credit Suisse last month with a $125 price target. This implies 31.5% upside is in the cards over the next 12 months.

Now, let me wrap this up.

Key investor takeaways

Exxon’s management is evolving the organization from a holding company to an operating company in an attempt to better serve its customers’ evolving needs as well as to continue to grow long-term shareholder value. I see the stock eclipsing its all-time high as the supply/demand imbalance begins to tighten even more so over the coming months. I feel confident oil prices will increase or at least maintain this level for the foreseeable future based on the under-investment in production, China coming back on line, the already tight supply/demand imbalance, and the SPR release ending and now needing to be refilled, providing a proverbial “put” under oil prices.

One thing many have not considered is the fact that Exxon Mobil makes for the perfect inflation hedge. The key factor influencing inflation across all sectors is energy prices. It takes energy for any sector of the economy to operate. The food has to be delivered by trucks, the crops have to be cultivated with massive combines, it goes on and on. So, if inflation persists, so will oil’s price and therefore Exxon Mobil’s results. Additionally, the immense supply/demand imbalance that has built up over the years will take a long, long time to dissipate.

Finally, Exxon Mobil has stated its primary focus right now is to return capital to shareholders. I like that. I see now as an excellent opportunity to get in at the recent lows. With 31.5% upside to Credit Suisse’s target of $125 and a 4% dividend yield, a solid 35% total return opportunity over the next 12 months presents itself. That is the crude reality, my friends.

Final Note

Nevertheless, if I was a prospective buyer, I would definitely layer into any new position over time to reduce risk. There’s a fine art to investing during highly volatile markets such as these. It entails layering into new positions over time to reduce risk. As a Veteran Winter Warrior of the US Army’s 10th Mountain Division, the attributes of patience and perseverance were instilled in me, hence the investing motto of my marketplace service The Winter Warrior Investor, “Patience Equals Profits.” Here’s a picture of me during “Green Hell” jungle warfare school at Ft. Sherman, Panama, circa 1989.

Those are my thoughts on the matter! I look forward to reading yours! The real value of my articles is derived from the prescient insights provided by Seeking Alpha members in the comments section! Do you believe now is the time to buy Exxon Mobil? Do you believe it is an inflationary hedge? Why or why not?

Be the first to comment