Benito Vega

Akero Therapeutics (NASDAQ:NASDAQ:AKRO) is a biotechnology company focused on therapies for NASH (non-alcoholic steatohepatitis). NASH is a bit of a grail for the biotech industry as many therapies have been tested for it and failed. On September 13 Akero announced positive Phase 2 results for efruxifermin for NASH. Usually, positive Phase 3 clinical trial results are needed to get regulatory approval for a therapy, so further work will be needed. This article will focus on the trial results and the coincident raising of funds with a stock offering. In conclusion I will consider the stock price and market capitalization of Akero to determine whether it is still a good investment at the current price.

Akero Therapeutics’ Phase 2 NASH Trial Results

The Phase 2b study, HARMONY, of efruxifermin (or EFX) tested two doses, 50 mg and 28 mg. Within the NASH spectrum the patients were in fibrosis stage 2 or 3. Note this is not a very large study: there were 38 patients receiving 28 mg doses, 34 receiving 50 mg doses, and 41 receiving a placebo. For the primary endpoint, reaching an at least one-stage improvement in liver fibrosis with no worsening of NASH, 39% in the 28 mg group and 41% in the 50 mg patient group met the target. Only 20% of the placebo group met that goal. The p value for this goal for both active groups was p<0.05.

For the secondary endpoint, resolution of NASH without worsening of fibrosis, 76% in the 50 mg group, 47% in the 28 mg group, and 15% in the placebo group met the goal. For the other secondary endpoint, NASH resolution plus one stage or more fibrosis improvement, 41% in the 50 mg group, 29% in the 28 mg group, and only 5% in the placebo group met the goal.

Akero reported that EFX-treated patients also experienced statistically significant improvements in liver fat, liver enzymes, noninvasive fibrosis markers, glycemic control, lipoproteins, and body weight. Akero engineered EFX to mimic the biological activity profile of native FGF21, fibroblast growth factor 21, a hormone secreted by the liver that regulates simple sugar uptake.

The company believes the results in the HARMONY study and the earlier Phase 2a study increase the probability of success in a Phase 3 trial and position EFX to be a foundational monotherapy for NASH. I agree the results appear strong but emphasize the trial group was quite small.

New Stock Offering

On September 13, 2022 Akero Therapeutics announced a proposed public stock offering. The headline amount sought is $175 million, with a possible additional $26.25 million. Small biotech companies have had trouble raising cash this last two years, but with the new trial results Akero should have no trouble with this raise. It will dilute current stockholders. If the price is $30 per share, that would mean issuing about 6.7 million shares. The share count at the end of Q2 was about 35.4 million shares. Since Akero had a cash and equivalents balance of $186 million at the end of Q2, this cash raise can be seen as opportunistic. It should be enough to conduct a Phase 3 trial and commercialize efruxifermin if all else goes well.

Akero Q2 2022 Earnings Highlights

Akero is a clinical-stage company. In Q2 2022 Akero generated no income. It spent about $21.4 million on research and development and $6.2 million on general and administrative expenses in the quarter. The resulting net loss was $27.4 million, about typical for the company. Net loss per share was $0.77. Cash and equivalents ended at $186 million.

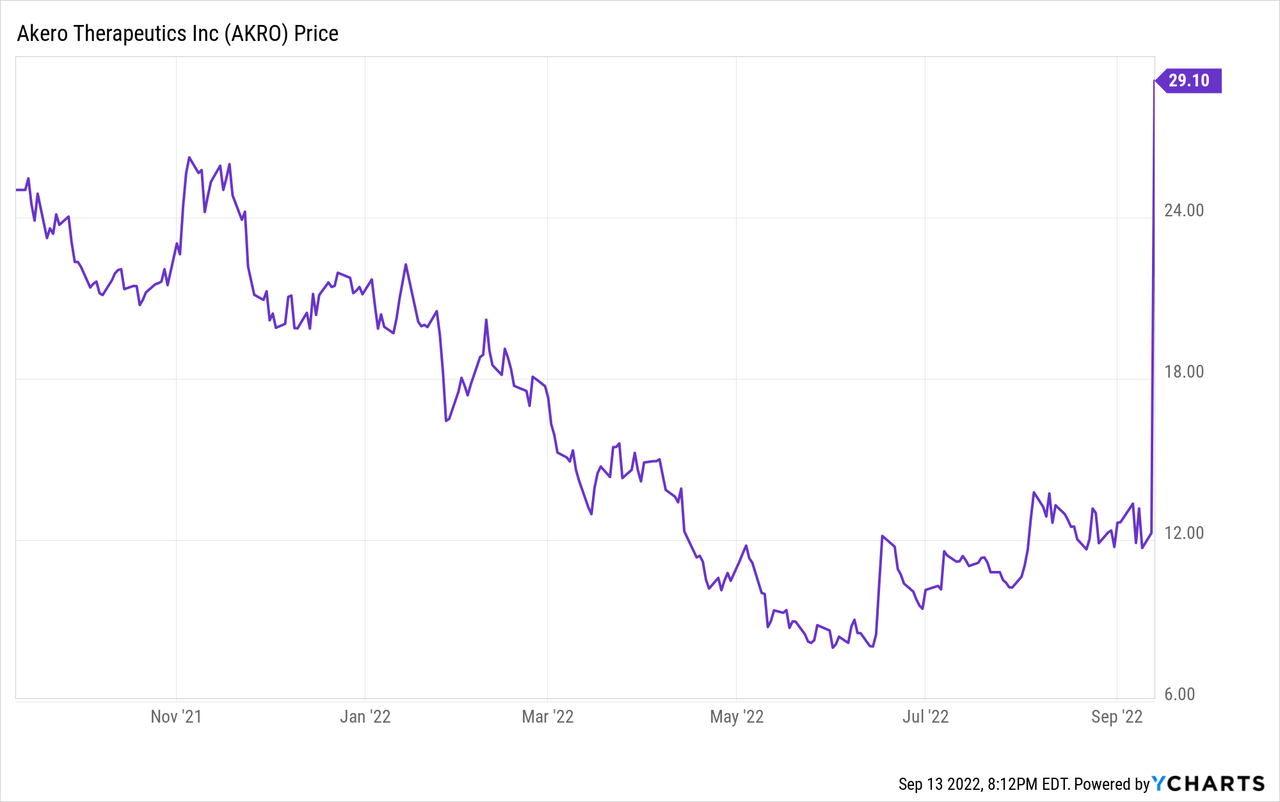

AKRO Stock Valuation and Conclusion

It is exciting to see positive Phase 2b results for efruxifermin. An effective therapy for NASH could bring relief to a large number of patients and billions of dollars in annual sales. NASH seems to be chiefly caused by poor diets and obesity, but the destruction of the liver it sometimes causes is not easily reversible and can lead to death. There are no currently approved medications that specifically treat NASH. NASH prevalence estimates are that about 3% to 10% of the population of adults in the United States have the condition, which is often undiagnosed. If efruxifermin can get the same level of results in Phase 3 trials as those that were just reported, Akero is going to be an extremely valuable company. The main caveat to investors is that in a larger trial the results may trend back towards placebo results, or a new side effect may emerge. Another possibility is that some competitor will complete a successful Phase 3 trial before Akero can or will report even better results. I would put a ballpark market capitalization of about $1 billion on Akero Therapeutics, based more on the small size of the reported trial than on the large size of the potential patient population. Another possibility is that Gilead (GILD) or another large pharma company interested in the NASH space will scoop Akero up in hopes of a future Phase 3 success. For now, at the closing price of $29.05 on September 13, 2022, or a market cap of $461 million, clearly Akero Therapeutics is a Buy, both for short-term and long-term investors.

Be the first to comment